Physical inspections provide a hands-on evaluation of property conditions, uncovering risks that may be missed through remote assessments. Remote risk assessments leverage technology such as satellite imagery and drones to analyze risks efficiently, offering faster data collection with reduced costs. Balancing both methods enhances accuracy in underwriting and claims processing while optimizing resource allocation.

Table of Comparison

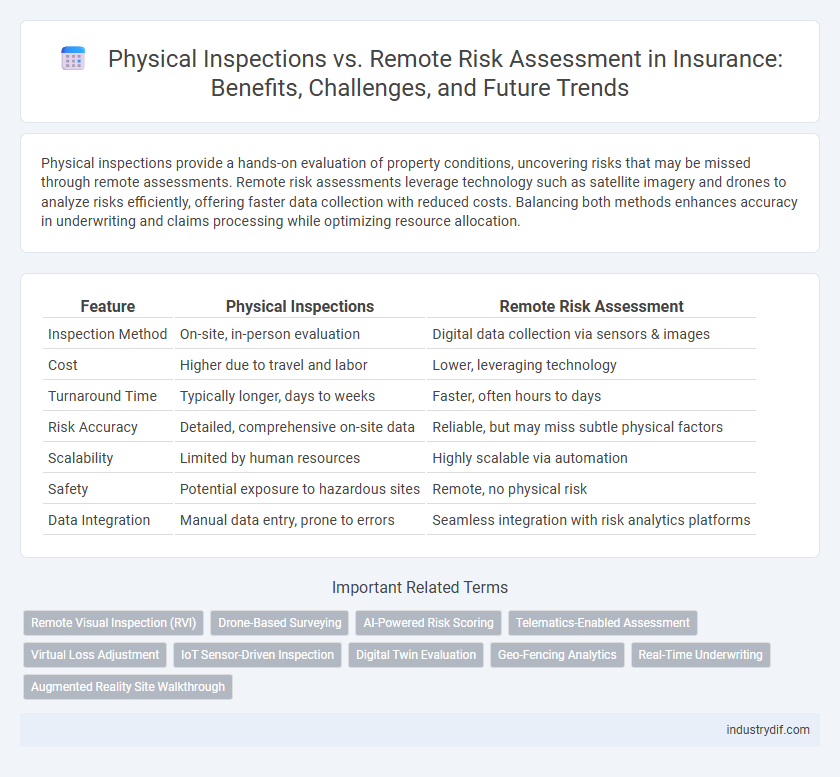

| Feature | Physical Inspections | Remote Risk Assessment |

|---|---|---|

| Inspection Method | On-site, in-person evaluation | Digital data collection via sensors & images |

| Cost | Higher due to travel and labor | Lower, leveraging technology |

| Turnaround Time | Typically longer, days to weeks | Faster, often hours to days |

| Risk Accuracy | Detailed, comprehensive on-site data | Reliable, but may miss subtle physical factors |

| Scalability | Limited by human resources | Highly scalable via automation |

| Safety | Potential exposure to hazardous sites | Remote, no physical risk |

| Data Integration | Manual data entry, prone to errors | Seamless integration with risk analytics platforms |

Introduction to Physical Inspections and Remote Risk Assessment

Physical inspections involve on-site evaluations where insurance professionals assess property conditions, verify compliance, and identify potential hazards through direct observation. Remote risk assessment utilizes digital tools such as drones, satellite imagery, and IoT sensors to analyze risks without physical presence, enabling faster data collection and broader coverage. Both methods enhance risk analysis accuracy, with physical inspections providing detailed, tactile insights and remote assessments offering scalable, real-time monitoring capabilities.

Key Differences Between Physical and Remote Assessments

Physical inspections involve on-site evaluations by insurance professionals, allowing for direct observation and interaction with the insured property, which leads to detailed risk analysis and accurate policy pricing. Remote risk assessments rely on digital technologies such as satellite imagery, drones, and data analytics to evaluate risks from a distance, offering faster, cost-effective evaluations but potentially less granular detail. Key differences include the level of detail, immediacy of data collection, cost implications, and the technological dependency inherent to remote assessments versus the tactile, human-driven approach in physical inspections.

Advantages of Physical Inspections in Insurance

Physical inspections in insurance provide a comprehensive and accurate evaluation of the insured property, allowing underwriters to detect risks that may be overlooked in remote assessments. Direct on-site evaluations enable the identification of structural issues, asset conditions, and compliance with safety regulations, leading to more precise risk pricing and reduced claim disputes. Insurance companies benefit from enhanced fraud detection and improved customer trust through transparent and thorough physical inspections.

Benefits of Remote Risk Assessment for Insurers

Remote risk assessment enables insurers to evaluate properties and assets efficiently without the need for on-site visits, significantly reducing time and operational costs. Leveraging advanced technologies such as drones, satellite imagery, and AI-driven analytics enhances accuracy and allows continuous monitoring of risk factors in real-time. This approach improves customer satisfaction by providing faster policy decisions and claims processing while minimizing exposure to hazardous inspection environments.

Limitations of Physical Inspections

Physical inspections often face limitations such as restricted site access, time constraints, and human error, which can lead to incomplete risk evaluations. These inspections may miss hidden hazards or evolving risks due to their periodic nature and reliance on visible cues. Consequently, they offer less flexibility in real-time monitoring compared to remote risk assessment technologies.

Challenges in Remote Risk Assessment

Remote risk assessment in insurance faces challenges such as limited visual data, making it difficult to accurately evaluate property conditions compared to physical inspections. Technological constraints, including poor image quality and connectivity issues, can hinder thorough risk analysis. Additionally, the absence of on-site observations reduces the ability to identify hidden damages or contextual risks, impacting underwriting precision.

Technology Tools Used in Remote Risk Assessment

Remote risk assessment in insurance leverages advanced technology tools such as drones, satellite imagery, and IoT sensors to gather real-time data on properties and assets without requiring physical site visits. AI-powered analytics and machine learning algorithms process this data to predict risk factors, assess damage, and monitor ongoing conditions with higher accuracy and efficiency. These technologies enable insurers to enhance underwriting precision, reduce inspection costs, and accelerate claim settlements while maintaining rigorous risk evaluation standards.

Cost Comparison: Physical vs Remote Methods

Physical inspections typically incur higher costs due to travel, labor, and time expenses associated with on-site evaluations, whereas remote risk assessment significantly reduces these overheads by utilizing digital tools such as drones, satellite imagery, and artificial intelligence analytics. Remote methods offer scalable, real-time data collection, decreasing operational costs while maintaining or enhancing the accuracy of risk evaluations. Insurers adopting remote risk assessment report cost savings of up to 40% compared to traditional physical inspections, improving financial efficiency in underwriting processes.

Impact on Underwriting and Claims Processes

Physical inspections provide detailed, on-site evaluations critical for accurate underwriting by identifying risks that may be overlooked remotely. Remote risk assessments leverage technology such as drones and IoT sensors, enabling faster data collection and continuous monitoring, which enhances claims accuracy and reduces fraud. Combining both methods optimizes risk evaluation, improves decision-making efficiency, and accelerates claims processing in the insurance industry.

Future Trends in Insurance Risk Assessment Methods

Future trends in insurance risk assessment methods emphasize the integration of advanced technologies such as drones, AI-powered analytics, and IoT sensors to enhance remote risk assessment accuracy. Physical inspections are increasingly supplemented or replaced by real-time data collection and automated image recognition, reducing costs and improving efficiency. Insurers leverage machine learning models to predict risks with higher precision, facilitating faster underwriting and personalized policy offerings.

Related Important Terms

Remote Visual Inspection (RVI)

Remote Visual Inspection (RVI) leverages high-resolution cameras and real-time video streaming to accurately assess property conditions without physical presence, significantly reducing inspection time and costs. This technology enhances risk evaluation by providing detailed imagery and data analytics, enabling insurers to make informed decisions while minimizing health and safety risks associated with onsite visits.

Drone-Based Surveying

Drone-based surveying in insurance physical inspections enhances accuracy and efficiency by capturing high-resolution aerial imagery and detailed data from inaccessible or hazardous locations, minimizing human risk and inspection time. Remote risk assessment through drones provides insurers with rapid, real-time property evaluations, improving claim accuracy and enabling proactive risk management while reducing costs associated with traditional on-site inspections.

AI-Powered Risk Scoring

AI-powered risk scoring transforms physical inspections by enabling remote risk assessments with higher accuracy and real-time data analysis, reducing the need for onsite visits while enhancing fraud detection and underwriting efficiency. Leveraging machine learning algorithms, insurers can assess property risks, detect anomalies, and predict claim probabilities faster, leading to more precise premium calculations and improved customer experience.

Telematics-Enabled Assessment

Telematics-enabled assessments enhance remote risk evaluation by providing real-time driving data, reducing the need for costly and time-consuming physical inspections. This technology leverages GPS, accelerometers, and onboard diagnostics to deliver accurate, continuous monitoring of policyholders' behavior, improving risk prediction and underwriting precision.

Virtual Loss Adjustment

Virtual loss adjustment leverages advanced technologies such as drones, AI-powered image analysis, and real-time video streaming to conduct remote risk assessments, significantly reducing the need for physical inspections. This approach enhances efficiency, accuracy, and safety by enabling insurance adjusters to evaluate damages and verify claims promptly without on-site visits.

IoT Sensor-Driven Inspection

IoT sensor-driven inspections enable continuous monitoring of insured assets, providing real-time data that enhances risk analysis accuracy compared to traditional physical inspections. Remote risk assessment powered by IoT sensors minimizes on-site visits, reduces operational costs, and accelerates claim processing by delivering precise, instant insights into asset conditions.

Digital Twin Evaluation

Digital Twin Evaluation leverages real-time data and 3D modeling to enhance risk accuracy in insurance physical inspections, minimizing the need for on-site visits. This technology enables remote risk assessment by creating precise virtual replicas of insured assets, improving claim validations and underwriting processes.

Geo-Fencing Analytics

Geo-fencing analytics revolutionizes risk assessment by enabling insurers to monitor insured properties' geographic boundaries in real-time, reducing reliance on costly physical inspections. By integrating geo-fencing with remote risk assessment tools, insurers can detect anomalous activities or risks, leading to faster claim validation and improved underwriting accuracy.

Real-Time Underwriting

Real-time underwriting leverages remote risk assessment technologies, utilizing AI-driven data analytics, geospatial imagery, and IoT sensors to evaluate policy risks instantly without physical inspections. This approach accelerates decision-making, reduces operational costs, and enhances accuracy by continuously integrating real-world data streams for dynamic risk profiling.

Augmented Reality Site Walkthrough

Augmented Reality (AR) site walkthroughs enhance insurance risk assessments by providing real-time, immersive views of insured properties, enabling detailed inspections without the need for physical presence. This technology increases accuracy in identifying hazards, reduces inspection time, and improves communication between insurers and clients compared to traditional physical inspections.

Physical Inspections vs Remote Risk Assessment Infographic

industrydif.com

industrydif.com