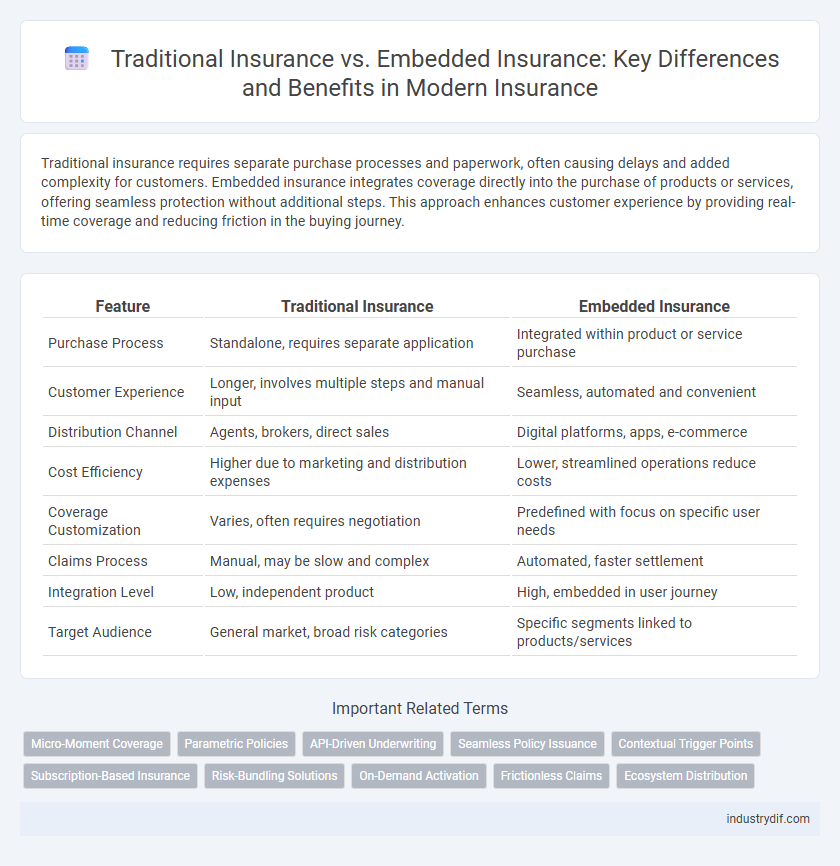

Traditional insurance requires separate purchase processes and paperwork, often causing delays and added complexity for customers. Embedded insurance integrates coverage directly into the purchase of products or services, offering seamless protection without additional steps. This approach enhances customer experience by providing real-time coverage and reducing friction in the buying journey.

Table of Comparison

| Feature | Traditional Insurance | Embedded Insurance |

|---|---|---|

| Purchase Process | Standalone, requires separate application | Integrated within product or service purchase |

| Customer Experience | Longer, involves multiple steps and manual input | Seamless, automated and convenient |

| Distribution Channel | Agents, brokers, direct sales | Digital platforms, apps, e-commerce |

| Cost Efficiency | Higher due to marketing and distribution expenses | Lower, streamlined operations reduce costs |

| Coverage Customization | Varies, often requires negotiation | Predefined with focus on specific user needs |

| Claims Process | Manual, may be slow and complex | Automated, faster settlement |

| Integration Level | Low, independent product | High, embedded in user journey |

| Target Audience | General market, broad risk categories | Specific segments linked to products/services |

Understanding Traditional Insurance: Definitions and Models

Traditional insurance operates through standalone policies offered by insurers, requiring customers to actively seek coverage, complete underwriting, and manage claims independently. This model emphasizes risk pooling, premium payments, and contractual agreements between insurers and policyholders, often involving brokers and agents. The rigid structure and separate transaction process differentiate traditional insurance from more integrated models like embedded insurance.

What is Embedded Insurance?

Embedded insurance integrates coverage directly into the purchase of products or services, allowing customers to obtain protection seamlessly without separate transactions. Unlike traditional insurance, which requires standalone policies and independent buying processes, embedded insurance leverages digital platforms and APIs to offer instant, contextual coverage at the point of sale. This innovation enhances customer convenience, accelerates claims processing, and drives higher adoption rates by embedding policies within everyday purchasing experiences.

Key Differences Between Traditional and Embedded Insurance

Traditional insurance requires customers to seek out policies separately, often involving standalone purchases through agents or brokers, whereas embedded insurance integrates coverage seamlessly into the purchase of a product or service, enhancing convenience and user experience. Traditional insurance policies typically involve longer processes with underwriting and claims management handled separately, while embedded insurance leverages digital platforms for instant coverage activation and streamlined claims. Embedded insurance uses real-time data and APIs to customize offerings dynamically, contrasting with the fixed, less flexible nature of traditional insurance products.

Customer Experience in Traditional vs Embedded Insurance

Traditional insurance often involves complex processes and prolonged waiting times, leading to a fragmented customer experience with multiple touchpoints and paperwork. Embedded insurance integrates coverage seamlessly into the customer journey through digital platforms, offering real-time, personalized protection with minimal friction. This streamlined approach enhances convenience, reduces friction, and increases overall customer satisfaction compared to conventional insurance methods.

Distribution Channels: Agency vs API Integration

Traditional insurance relies heavily on agency distribution channels where agents build personal relationships and guide customers through complex policy options, resulting in higher acquisition costs and slower onboarding. Embedded insurance utilizes API integration to seamlessly incorporate coverage into digital platforms or products, enabling instant policy issuance and improved customer experience with reduced operational expenses. This shift towards API-driven distribution accelerates market reach and enhances scalability compared to conventional agency models.

Personalization and Product Flexibility

Traditional insurance often offers standardized policies with limited personalization, restricting customers to predefined coverage options that may not fully address individual needs. Embedded insurance integrates seamlessly into relevant platforms and services, enabling tailored product flexibility that adapts to real-time customer behavior and situational demands. This approach enhances user experience by providing context-specific coverage, improving both relevance and convenience for policyholders.

The Role of Technology in Insurance Evolution

Technology drives the transformation of insurance by enabling seamless integration of embedded insurance within everyday products and services, offering real-time data analytics and personalized risk assessment. Traditional insurance relies heavily on manual underwriting and delayed claims processing, whereas embedded insurance leverages APIs and IoT devices to enhance automation and customer experience. Advanced technologies such as AI, machine learning, and blockchain optimize risk management, fraud detection, and policy administration, accelerating the shift towards more dynamic and accessible insurance solutions.

Regulatory Considerations and Compliance

Traditional insurance operates under established regulatory frameworks demanding separate licensing, strict solvency requirements, and comprehensive disclosures, ensuring consumer protection and market stability. Embedded insurance integrates coverage seamlessly within non-insurance products or services, often prompting regulators to adapt compliance rules to address the hybrid distribution models and consumer consent mechanisms. Both models face evolving data privacy laws, anti-money laundering standards, and risk management protocols tailored to their distinct operational structures.

Market Adoption and Industry Trends

Traditional insurance relies on standalone policies sold directly by insurers or through brokers, with slower market adoption due to complex purchase processes and limited digital integration. Embedded insurance integrates coverage seamlessly into products or services, accelerating adoption by offering instant protection at the point of sale within ecosystems like e-commerce, automotive, or travel industries. Industry trends indicate rapid growth in embedded insurance driven by digital transformation, customer demand for convenience, and partnerships between insurers and technology providers.

Future Outlook: Traditional vs Embedded Insurance

The future outlook for traditional insurance versus embedded insurance highlights a shift towards seamless integration of insurance products within everyday purchases and digital platforms, driven by consumer demand for convenience and personalization. Embedded insurance leverages advanced data analytics and APIs to offer real-time, context-specific coverage, enhancing customer experience and operational efficiency. Traditional insurance models must innovate by adopting digital transformation strategies to remain competitive amid the growing popularity of embedded insurance solutions.

Related Important Terms

Micro-Moment Coverage

Traditional insurance often involves lengthy processes and predefined policies, whereas embedded insurance delivers micro-moment coverage by seamlessly integrating protection directly into products or services at the point of need. This approach enhances customer experience by offering instant, context-specific insurance, improving accessibility and personalization during critical micro-moments.

Parametric Policies

Parametric insurance policies, often integrated within embedded insurance models, automate claim payouts based on predefined triggers such as weather events or flight delays, reducing the need for traditional claim assessments. Traditional insurance typically requires extensive documentation and loss verification, while parametric policies streamline processes, offering faster, transparent compensation linked directly to measurable parameters.

API-Driven Underwriting

API-driven underwriting in embedded insurance streamlines risk assessment by integrating real-time data from multiple sources directly into the insurance platform, enhancing accuracy and speed compared to traditional insurance methods that rely on manual data collection and processing. This technological advancement reduces underwriting costs and improves customer experience by enabling personalized policy offerings and instant coverage decisions.

Seamless Policy Issuance

Traditional insurance often involves lengthy policy issuance processes with multiple touchpoints and manual documentation, causing delays and customer frustration. Embedded insurance streamlines policy issuance by integrating coverage directly within product purchases, enabling instant activation and enhanced customer convenience.

Contextual Trigger Points

Traditional insurance relies on separate purchase processes often initiated by consumer need or periodic renewal cycles, whereas embedded insurance integrates contextually triggered coverage directly within the purchase journey of related goods or services, enhancing convenience and relevance at critical decision points. This approach leverages data-driven insights to activate insurance offers precisely when customers are most receptive, such as during online transactions or app-based engagements, increasing uptake and customer satisfaction.

Subscription-Based Insurance

Subscription-based insurance offers flexible payment models and continuous coverage by integrating insurance services directly into digital platforms, contrasting with traditional insurance's fixed-term policies and separate purchasing process. Embedded insurance enhances customer experience by providing on-demand protection tailored to user behavior, driving higher engagement and retention compared to conventional insurance models.

Risk-Bundling Solutions

Traditional insurance relies on standalone policies with fixed terms and premiums, often leading to fragmented coverage and delayed claims processing. Embedded insurance integrates risk-bundling solutions directly into products or services, enabling seamless coverage, real-time risk assessment, and dynamic pricing tailored to customer needs.

On-Demand Activation

On-demand activation in embedded insurance allows customers to instantly enable coverage through digital platforms at the point of need, enhancing convenience and reducing wait times compared to traditional insurance processes that often require lengthy applications and underwriting. This seamless integration enables real-time risk management and tailored protection, driving higher customer engagement and satisfaction.

Frictionless Claims

Traditional insurance often involves complex, time-consuming claims processes requiring extensive paperwork and manual verification, leading to customer frustration and delayed payouts. Embedded insurance integrates seamless, automated claim handling within everyday transactions using APIs and AI, enabling frictionless claims resolution with faster approvals and improved customer satisfaction.

Ecosystem Distribution

Traditional insurance relies on direct sales channels and broker networks, often limiting reach and increasing acquisition costs, while embedded insurance integrates coverage seamlessly within digital ecosystems such as e-commerce platforms, travel booking sites, or automotive services, enhancing customer convenience and driving higher conversion rates. Embedded insurance leverages real-time data and contextual triggers within these ecosystems, enabling personalized offerings and streamlined claim processes that improve overall customer experience and operational efficiency.

Traditional Insurance vs Embedded Insurance Infographic

industrydif.com

industrydif.com