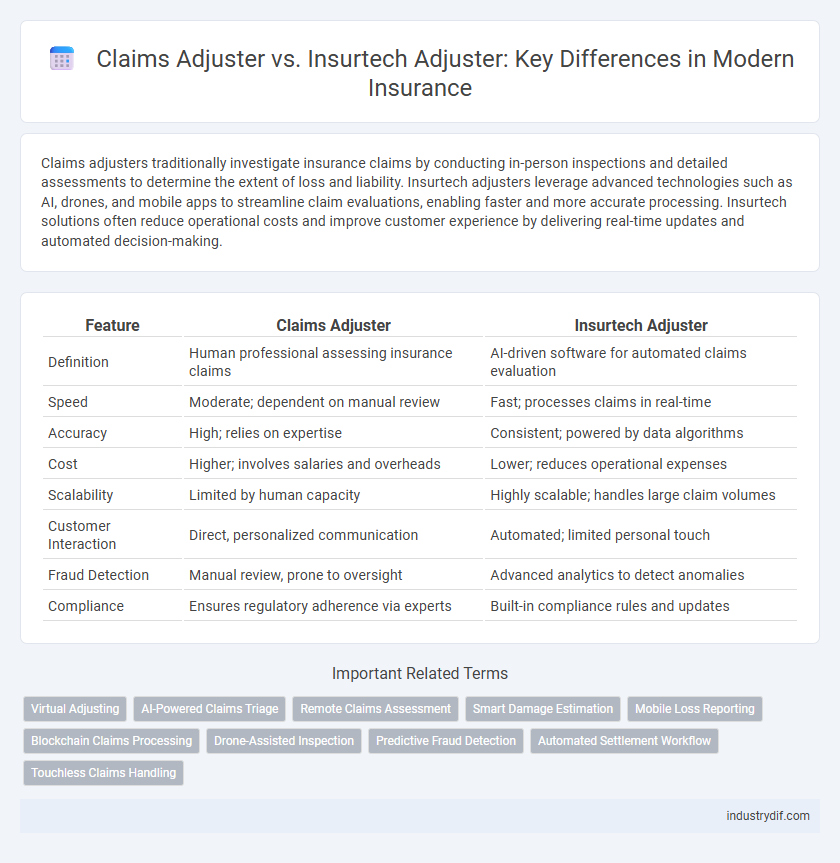

Claims adjusters traditionally investigate insurance claims by conducting in-person inspections and detailed assessments to determine the extent of loss and liability. Insurtech adjusters leverage advanced technologies such as AI, drones, and mobile apps to streamline claim evaluations, enabling faster and more accurate processing. Insurtech solutions often reduce operational costs and improve customer experience by delivering real-time updates and automated decision-making.

Table of Comparison

| Feature | Claims Adjuster | Insurtech Adjuster |

|---|---|---|

| Definition | Human professional assessing insurance claims | AI-driven software for automated claims evaluation |

| Speed | Moderate; dependent on manual review | Fast; processes claims in real-time |

| Accuracy | High; relies on expertise | Consistent; powered by data algorithms |

| Cost | Higher; involves salaries and overheads | Lower; reduces operational expenses |

| Scalability | Limited by human capacity | Highly scalable; handles large claim volumes |

| Customer Interaction | Direct, personalized communication | Automated; limited personal touch |

| Fraud Detection | Manual review, prone to oversight | Advanced analytics to detect anomalies |

| Compliance | Ensures regulatory adherence via experts | Built-in compliance rules and updates |

Overview of Claims Adjuster Roles

Claims adjusters investigate insurance claims by evaluating damages, interviewing stakeholders, and determining claim legitimacy to process payments accurately. Insurtech adjusters leverage advanced technologies like AI, machine learning, and data analytics to expedite claim assessments and enhance accuracy. Traditional claims adjusters rely heavily on manual procedures, while insurtech adjusters integrate digital tools to streamline workflows and improve customer experience.

Introduction to Insurtech Adjusters

Insurtech adjusters leverage advanced technologies such as AI, machine learning, and data analytics to streamline the claims assessment process, significantly reducing appraisal time and increasing accuracy. Unlike traditional claims adjusters who conduct manual evaluations and on-site inspections, insurtech adjusters utilize automated tools and real-time data to expedite decision-making and improve customer experience. This integration of technology in claims adjustment transforms the insurance industry by enhancing efficiency, reducing operational costs, and delivering faster settlements.

Key Differences Between Traditional and Insurtech Adjusters

Traditional claims adjusters conduct on-site inspections, relying heavily on manual processes and personal judgment to assess damages and determine claim payouts. Insurtech adjusters utilize advanced technologies such as AI, drones, and data analytics to expedite evaluations, increase accuracy, and enhance client communication. The key differences lie in efficiency, automation levels, and the integration of digital tools that streamline claim settlements in insurtech models.

Core Responsibilities Explained

Claims adjusters investigate insurance claims by assessing damage, interviewing claimants, and determining policy coverage to ensure fair settlements. Insurtech adjusters leverage advanced technology such as AI, drones, and data analytics to expedite claim evaluations, increase accuracy, and improve customer experience. Core responsibilities of both roles include damage assessment and fraud detection, but insurtech adjusters emphasize automation and digital tools to streamline the claims process.

Traditional Claims Process vs. Digital Claims Process

Traditional claims adjusters conduct in-person inspections and manually verify documentation, often leading to longer processing times and increased operational costs. In contrast, insurtech adjusters leverage digital tools such as AI-driven damage assessments and automated communication platforms to streamline claims handling, reducing delays and enhancing accuracy. The digital claims process improves customer experience by enabling faster settlements and real-time status updates, transforming the efficiency of insurance workflows.

Technology Integration in Adjusting

Claims adjusters rely on traditional methods such as on-site inspections and manual paperwork to evaluate insurance claims, which can be time-consuming and prone to errors. Insurtech adjusters leverage advanced technologies like AI-driven analytics, drone assessments, and mobile apps to streamline claim processing and improve accuracy. This integration of technology accelerates claim resolutions, enhances data accuracy, and reduces operational costs in the insurance industry.

Efficiency and Accuracy Comparison

Claims adjusters rely on manual assessment processes, which can lead to longer claim resolution times and higher potential for human error. Insurtech adjusters leverage AI-driven automation and real-time data analytics to enhance both efficiency and accuracy, significantly reducing claim processing time and improving decision consistency. The integration of advanced technologies in insurtech platforms ensures faster fraud detection and more precise damage evaluation compared to traditional claims adjusters.

Customer Experience: Old vs. New Approach

Traditional claims adjusters typically handle claims through manual processes involving in-person inspections and phone communications, which can result in longer resolution times and limited real-time updates for customers. Insurtech adjusters leverage digital platforms, AI-driven assessments, and real-time data analytics to streamline claims processing, offering faster responses and more transparent communication. This new approach significantly enhances customer experience by providing convenience, quicker settlements, and increased satisfaction through technology-enabled interactions.

Challenges and Opportunities in Adjuster Evolution

Claims adjusters face challenges such as managing increasing claim volumes and complex fraud detection, which insurtech adjusters address through advanced data analytics and automation. Opportunities arise from leveraging AI-driven tools to enhance accuracy and speed in claim settlements, reducing operational costs and improving customer satisfaction. The evolution from traditional claims adjusters to insurtech adjusters transforms the insurance landscape by integrating technology for more efficient and transparent claim processing.

Future Trends in Claims Adjustment

Claims adjusters are increasingly integrating insurtech solutions like AI-driven analytics and remote inspection technologies to enhance accuracy and efficiency in claims processing. Future trends indicate a growing reliance on automated systems, blockchain for transparent records, and mobile platforms enabling faster claim settlements. These advancements are reshaping the role of traditional adjusters by emphasizing data-driven decision-making and customer-centric approaches.

Related Important Terms

Virtual Adjusting

Virtual adjusting leverages advanced insurtech solutions such as AI, machine learning, and mobile apps to expedite claims processing, reduce turnaround times, and enhance accuracy compared to traditional claims adjusters. Insurtech adjusters use remote inspections and digital documentation to streamline claim assessments, improving customer experience and operational efficiency in the insurance industry.

AI-Powered Claims Triage

AI-powered claims triage enhances the efficiency of insurtech adjusters by rapidly analyzing vast datasets to prioritize and route claims with precision, reducing manual workload and accelerating settlement timelines. Traditional claims adjusters rely on manual processes, whereas insurtech adjusters leverage machine learning algorithms to improve accuracy in fraud detection and optimize resource allocation.

Remote Claims Assessment

Claims adjusters traditionally perform on-site inspections to assess damages, while insurtech adjusters leverage advanced remote claims assessment technologies such as AI-driven photo analysis and virtual inspections to expedite claim resolutions. Remote claims assessment reduces operational costs, enhances accuracy in damage evaluation, and accelerates settlement processes, improving customer satisfaction and efficiency in the insurance industry.

Smart Damage Estimation

Claims adjusters rely on traditional methods and manual inspections to assess damages, often leading to longer processing times and subjective evaluations. Insurtech adjusters utilize smart damage estimation technologies, such as AI-powered image analysis and IoT sensors, to deliver faster, more accurate, and objective claims settlements.

Mobile Loss Reporting

Claims adjusters perform on-site inspections and manual assessments to evaluate insurance losses, often resulting in longer claim processing times. Insurtech adjusters utilize mobile loss reporting platforms that enable instant damage documentation and real-time data sharing, accelerating claim resolution and improving customer experience.

Blockchain Claims Processing

Claims adjusters utilize traditional methods involving manual verification and documentation review, which can be time-consuming and prone to errors. Insurtech adjusters leverage blockchain claims processing to ensure transparent, tamper-proof records and faster claim settlements through automated smart contracts.

Drone-Assisted Inspection

Claims adjusters traditionally rely on manual inspections for damage assessment, while insurtech adjusters utilize drone-assisted inspections to enhance accuracy and efficiency in evaluating claims. Drone technology enables rapid data collection and high-resolution imagery, reducing claim processing times and minimizing human error in damage evaluation.

Predictive Fraud Detection

Claims adjusters rely on traditional investigation methods to evaluate insurance claims, whereas insurtech adjusters leverage advanced predictive fraud detection algorithms powered by artificial intelligence and machine learning to identify suspicious patterns and reduce fraudulent payouts. The integration of big data analytics and real-time risk assessment tools enables insurtech adjusters to enhance claim accuracy and streamline processing times significantly.

Automated Settlement Workflow

Claims adjusters traditionally handle insurance claims through manual processes, involving on-site inspections and paperwork, which can delay settlements. Insurtech adjusters leverage automated settlement workflows with AI and machine learning algorithms to accelerate claim processing, improve accuracy, and enhance customer satisfaction by reducing turnaround times.

Touchless Claims Handling

Claims adjusters manually investigate and evaluate insurance claims, often requiring in-person inspections and customer interviews, whereas insurtech adjusters leverage AI-driven touchless claims handling to automate damage assessments and expedite claim settlements digitally. Touchless claims technology reduces processing time, minimizes human error, and enhances customer satisfaction by enabling instant claim approvals through data analytics, machine learning, and mobile app integration.

Claims Adjuster vs Insurtech Adjuster Infographic

industrydif.com

industrydif.com