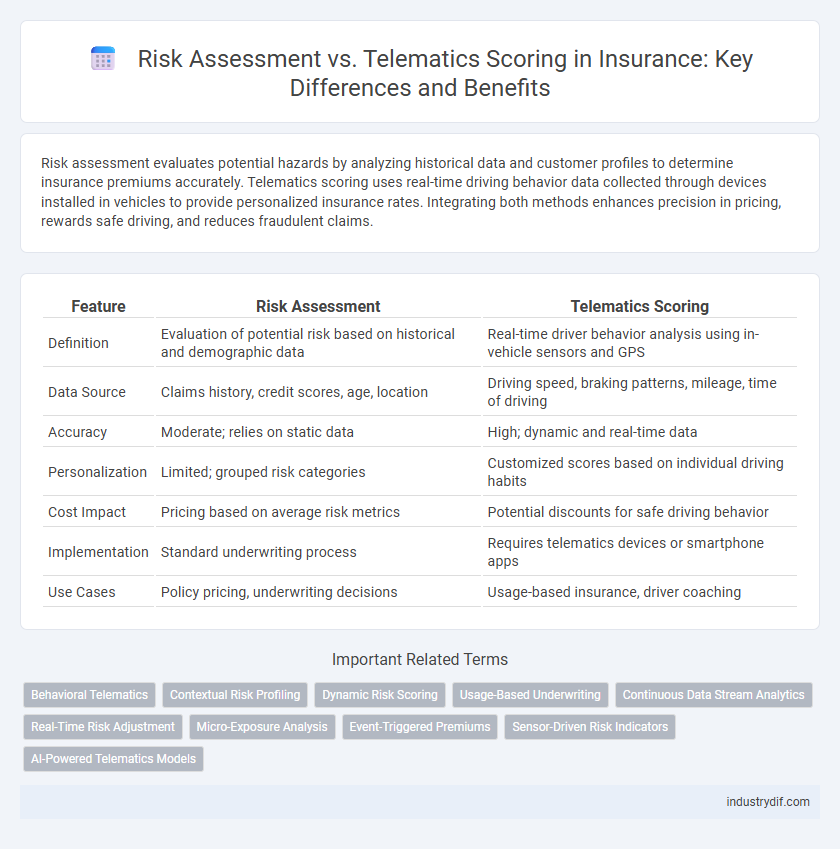

Risk assessment evaluates potential hazards by analyzing historical data and customer profiles to determine insurance premiums accurately. Telematics scoring uses real-time driving behavior data collected through devices installed in vehicles to provide personalized insurance rates. Integrating both methods enhances precision in pricing, rewards safe driving, and reduces fraudulent claims.

Table of Comparison

| Feature | Risk Assessment | Telematics Scoring |

|---|---|---|

| Definition | Evaluation of potential risk based on historical and demographic data | Real-time driver behavior analysis using in-vehicle sensors and GPS |

| Data Source | Claims history, credit scores, age, location | Driving speed, braking patterns, mileage, time of driving |

| Accuracy | Moderate; relies on static data | High; dynamic and real-time data |

| Personalization | Limited; grouped risk categories | Customized scores based on individual driving habits |

| Cost Impact | Pricing based on average risk metrics | Potential discounts for safe driving behavior |

| Implementation | Standard underwriting process | Requires telematics devices or smartphone apps |

| Use Cases | Policy pricing, underwriting decisions | Usage-based insurance, driver coaching |

Introduction to Risk Assessment in Insurance

Risk assessment in insurance involves evaluating the likelihood and potential severity of a claim by analyzing various factors such as an individual's age, driving history, and location. Telematics scoring enhances this process by utilizing real-time data collected from devices installed in vehicles, providing precise insights into driving behavior. This combination allows insurers to more accurately price premiums and tailor coverage based on personalized risk profiles.

Understanding Telematics Scoring

Telematics scoring leverages real-time data collected from devices installed in vehicles, such as GPS and accelerometers, to evaluate driving behavior more accurately than traditional risk assessment methods. This dynamic approach measures variables like speed, braking patterns, and mileage, enabling insurers to personalize premiums based on actual usage and risk exposure. Integrating telematics data enhances risk prediction models, reducing claims costs and encouraging safer driving habits.

Key Differences Between Risk Assessment and Telematics Scoring

Risk assessment in insurance evaluates potential policyholder risks using historical data, demographic factors, and behavioral trends to estimate likelihood of claims. Telematics scoring relies on real-time driving data collected via devices or apps, analyzing metrics such as speed, braking, and mileage to personalize premiums. The key difference lies in risk assessment's static, retrospective approach versus telematics scoring's dynamic, data-driven evaluation based on actual driving behavior.

Traditional Risk Assessment Models

Traditional risk assessment models in insurance primarily rely on historical data, demographic factors, and credit scores to evaluate policyholders' risk levels. These models use static indicators such as age, gender, driving history, and claims records to predict the likelihood of future claims, often resulting in generalized risk profiles. Unlike telematics scoring, traditional assessments lack real-time driving behavior insights, which can limit the precision and personalization of insurance premiums.

How Telematics Scoring Works

Telematics scoring leverages real-time data collected from devices installed in vehicles, such as GPS trackers and accelerometers, to monitor and analyze driving behaviors including speed, braking patterns, and mileage. This continuous data feed allows insurers to create personalized risk profiles that reflect actual driving habits rather than relying solely on historical claims or demographic information. By integrating telematics scoring, insurance companies enhance accuracy in risk assessment, leading to more tailored premiums and improved fraud detection.

Advantages of Telematics Scoring for Insurers

Telematics scoring enables insurers to collect real-time driving data, resulting in more accurate risk assessment compared to traditional methods that rely on historical data and demographics. This technology enhances risk segmentation, allowing insurers to tailor premiums effectively and reduce claims frequency by encouraging safer driving behaviors. The integration of telematics scoring improves customer retention through personalized policies and promotes operational efficiency by streamlining underwriting and claims processes.

Challenges of Implementing Telematics Scoring

Implementing telematics scoring in insurance faces challenges such as privacy concerns, which require robust data protection measures to gain customer trust. The integration of vast amounts of real-time driving data demands advanced analytics and seamless compatibility with existing underwriting systems. Additionally, regulatory compliance across different jurisdictions complicates standardized telematics use, slowing widespread adoption.

Impact on Premium Pricing: Risk Assessment vs Telematics

Traditional risk assessment relies on historical data and demographic factors to estimate insurance premiums, often leading to generalized pricing models. Telematics scoring, by utilizing real-time driving behavior data such as speed, braking patterns, and mileage, enables more personalized and dynamic premium adjustments. This shift towards data-driven risk evaluation enhances pricing accuracy, rewarding safe drivers with lower premiums while better identifying high-risk individuals.

Data Privacy Concerns in Telematics Scoring

Telematics scoring captures real-time driving behavior, providing insurers with detailed data but raising significant data privacy concerns due to continuous monitoring and location tracking. Policyholders face risks of unauthorized data access, potential misuse, and insufficient transparency regarding data storage and sharing practices. Robust data protection frameworks and clear consent mechanisms are essential to balance accurate risk assessment with consumer privacy rights.

Future Trends: Integrating Risk Assessment with Telematics

Future trends in insurance emphasize integrating traditional risk assessment methods with telematics scoring to enhance precision and personalization in underwriting. Combining real-time driving behavior data from telematics devices with historical risk profiles enables insurers to dynamically adjust premiums and predict claim likelihood with greater accuracy. This integration fosters proactive risk management, encouraging safer driving habits while optimizing policy pricing through advanced data analytics and machine learning models.

Related Important Terms

Behavioral Telematics

Behavioral telematics enhances risk assessment by analyzing real-time driving patterns such as speed, acceleration, and braking to provide personalized insurance scoring. This data-driven approach enables insurers to more accurately predict risk and tailor premiums based on individual driving behaviors rather than traditional demographic factors.

Contextual Risk Profiling

Contextual risk profiling leverages diverse data sources like driving behavior, environmental conditions, and demographic information to create a comprehensive risk assessment beyond traditional metrics. Telematics scoring enhances this by utilizing real-time GPS and sensor data to dynamically adjust insurance premiums based on actual driving patterns and context-specific risk factors.

Dynamic Risk Scoring

Dynamic risk scoring in insurance leverages telematics data such as driving behavior, speed, and braking patterns to provide real-time, individualized risk assessments that adjust continuously. This method contrasts with traditional static risk assessment by offering more precise premium calculations and fostering safer driving habits through immediate feedback.

Usage-Based Underwriting

Risk assessment in insurance traditionally relies on historical data and demographic factors, while telematics scoring enhances usage-based underwriting by analyzing real-time driving behavior such as speed, acceleration, and braking patterns. Usage-based underwriting leverages telematics data to provide personalized premiums and improve risk prediction accuracy, optimizing policy pricing and customer segmentation.

Continuous Data Stream Analytics

Risk assessment traditionally relies on historical data and static criteria, while telematics scoring leverages continuous data stream analytics to monitor real-time driving behavior and environmental conditions. This dynamic approach enhances accuracy in predicting risk profiles by analyzing granular metrics such as speed patterns, harsh braking, and route variability.

Real-Time Risk Adjustment

Real-time risk adjustment in insurance leverages telematics scoring by continuously analyzing driver behavior data such as speed, braking patterns, and mileage, enabling more precise and dynamic risk assessment compared to traditional methods. This approach reduces underwriting uncertainty, improves premium accuracy, and incentivizes safer driving habits through immediate feedback and personalized scoring.

Micro-Exposure Analysis

Micro-exposure analysis in risk assessment evaluates individual risk factors in granular detail, enabling insurers to identify subtle patterns of driver behavior traditionally obscured in aggregate data. Telematics scoring enhances this approach by leveraging real-time data from telematics devices, providing dynamic insights that improve precision in risk profiling and premium calculation.

Event-Triggered Premiums

Event-triggered premiums leverage telematics data to dynamically adjust insurance costs based on specific driving behaviors such as harsh braking, acceleration, or speeding incidents, offering more personalized and accurate risk assessment compared to traditional static models. This method enables insurers to reward safe driving habits in real time while promptly identifying high-risk events that could lead to claims, enhancing both customer engagement and loss prevention.

Sensor-Driven Risk Indicators

Sensor-driven risk indicators in telematics scoring leverage real-time data from vehicle sensors to provide more precise assessments of driving behavior and environmental conditions, enhancing accuracy beyond traditional risk assessment methods that rely primarily on historical claims and demographic data. This dynamic approach enables insurers to tailor premiums and coverage more effectively, improving risk prediction and encouraging safer driving habits through continuous monitoring.

AI-Powered Telematics Models

AI-powered telematics models utilize real-time data from connected devices to deliver precise risk assessment in insurance, surpassing traditional methods by analyzing driving behavior, vehicle usage, and environmental factors with advanced machine learning algorithms. These models enhance underwriting accuracy and enable personalized policy pricing by continuously adapting to evolving risk patterns.

Risk Assessment vs Telematics Scoring Infographic

industrydif.com

industrydif.com