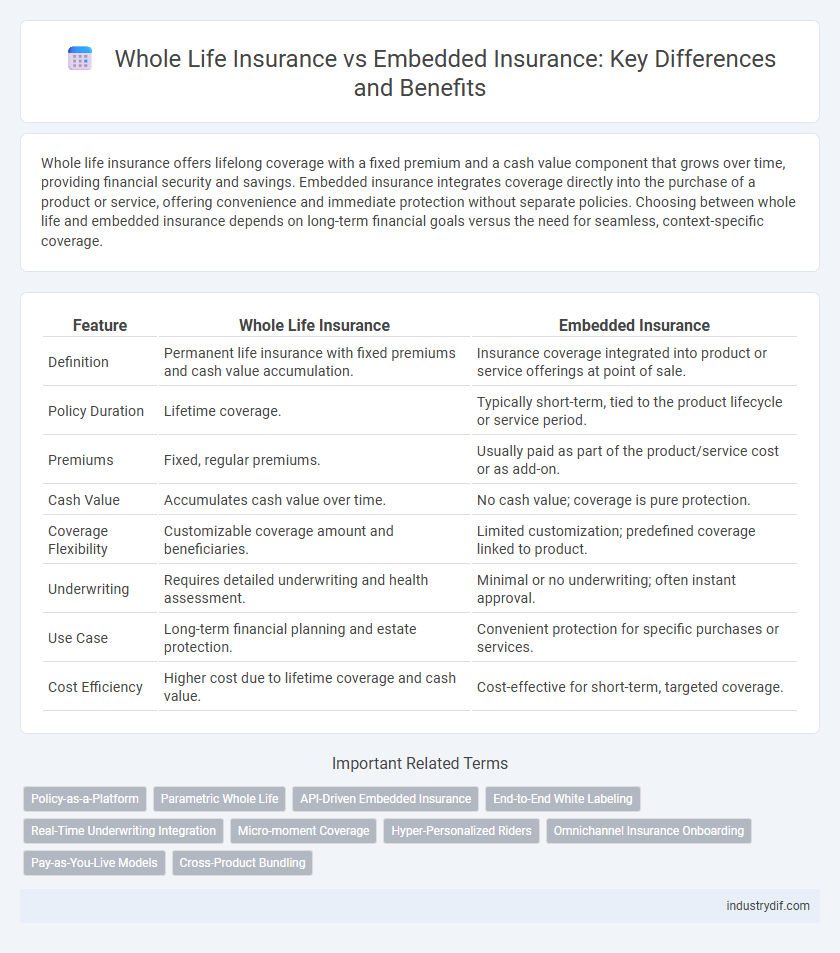

Whole life insurance offers lifelong coverage with a fixed premium and a cash value component that grows over time, providing financial security and savings. Embedded insurance integrates coverage directly into the purchase of a product or service, offering convenience and immediate protection without separate policies. Choosing between whole life and embedded insurance depends on long-term financial goals versus the need for seamless, context-specific coverage.

Table of Comparison

| Feature | Whole Life Insurance | Embedded Insurance |

|---|---|---|

| Definition | Permanent life insurance with fixed premiums and cash value accumulation. | Insurance coverage integrated into product or service offerings at point of sale. |

| Policy Duration | Lifetime coverage. | Typically short-term, tied to the product lifecycle or service period. |

| Premiums | Fixed, regular premiums. | Usually paid as part of the product/service cost or as add-on. |

| Cash Value | Accumulates cash value over time. | No cash value; coverage is pure protection. |

| Coverage Flexibility | Customizable coverage amount and beneficiaries. | Limited customization; predefined coverage linked to product. |

| Underwriting | Requires detailed underwriting and health assessment. | Minimal or no underwriting; often instant approval. |

| Use Case | Long-term financial planning and estate protection. | Convenient protection for specific purchases or services. |

| Cost Efficiency | Higher cost due to lifetime coverage and cash value. | Cost-effective for short-term, targeted coverage. |

Defining Whole Life Insurance: Core Concepts

Whole life insurance provides lifelong coverage with a fixed premium and a cash value component that grows tax-deferred over time. Policyholders benefit from guaranteed death benefits and the ability to borrow against the accumulated cash value. This type of insurance contrasts with embedded insurance, which integrates coverage into other products rather than existing as standalone policies.

Understanding Embedded Insurance: A Modern Shift

Embedded insurance integrates coverage directly into the purchase of products or services, streamlining customer experience by reducing the need for separate insurance transactions. This modern shift contrasts with Whole Life insurance, which offers lifelong protection with a cash value component but requires ongoing premiums and individual policy management. By embedding insurance within everyday purchases, businesses enhance convenience and accessibility while expanding risk coverage opportunities for consumers.

Key Features: Whole Life Insurance Explained

Whole Life Insurance provides lifelong coverage with fixed premiums and a guaranteed death benefit, accumulating cash value that policyholders can borrow against or withdraw. Embedded Insurance integrates coverage within a primary product, offering convenience but typically lacking the cash value growth and flexibility of Whole Life policies. Whole Life's key features include stable premiums, a savings component, and financial protection that lasts a lifetime, making it distinct from more limited embedded insurance options.

Embedded Insurance: Integration and Applications

Embedded insurance seamlessly integrates coverage within the purchase of products or services, offering real-time protection without requiring separate policy purchases. This integration leverages digital platforms and APIs to provide tailored insurance solutions directly at the point of sale, enhancing customer convenience and engagement. Applications span industries such as automotive, travel, and electronics, where embedded insurance mitigates risks instantly, improving overall user experience and reducing friction in claims processing.

Coverage Comparison: Whole Life vs Embedded Insurance

Whole Life insurance provides lifelong coverage with fixed premiums and a cash value component that grows over time, offering financial security and savings benefits. Embedded insurance integrates coverage directly within the purchase of products or services, offering limited, event-specific protection without long-term benefits or cash value accumulation. Coverage under Whole Life is comprehensive and continuous, while Embedded Insurance is typically narrow in scope and duration, tailored to the associated product or service lifecycle.

Policyholder Benefits: Lifetime vs Embedded Protection

Whole Life insurance offers policyholders lifelong coverage with guaranteed premiums and cash value accumulation, ensuring financial security and estate planning benefits. Embedded insurance provides protection that is built into products or services, offering convenience and often lower costs but limited to the duration or terms of the primary purchase. Policyholders choosing Whole Life gain continuous, comprehensive benefits, whereas Embedded Insurance delivers cost-effective, situational coverage without lifetime guarantees.

Pricing Models: Traditional vs Embedded Insurance

Whole Life insurance uses traditional pricing models based on fixed premiums and actuarial risk assessments, ensuring stable, long-term coverage with predictable costs. Embedded insurance integrates pricing dynamically within a product or service, leveraging real-time data and usage patterns to offer flexible, usage-based premiums. This approach enhances affordability and personalization, contrasting with the rigid, one-size-fits-all pricing of traditional whole life policies.

Consumer Experience: Enrollment and Accessibility

Whole Life insurance typically requires a detailed underwriting process, which can result in longer enrollment times and more complex accessibility for consumers. Embedded insurance, integrated directly into products or services like electronics or travel bookings, offers seamless enrollment with minimal effort and instant coverage confirmation. This streamlined accessibility enhances the consumer experience by reducing barriers and simplifying the decision-making process.

Industry Trends: Digitalization and Embedded Solutions

The insurance industry is rapidly evolving with a significant shift towards digitalization, enhancing customer experience and operational efficiency for whole life policies. Embedded insurance is gaining traction as it integrates coverage seamlessly into everyday purchases and services, leveraging APIs and data analytics to offer personalized protection. This trend accelerates market growth by simplifying access and enabling insurers to tap into new distribution channels beyond traditional frameworks.

Choosing the Right Option: Factors to Consider

Whole life insurance offers lifelong coverage with a fixed premium and cash value accumulation, making it suitable for long-term financial planning and estate preservation. Embedded insurance, integrated within products like credit cards or travel services, provides convenience and cost-effectiveness for specific, short-term needs but often lacks comprehensive coverage. Key factors to consider include coverage duration, premium stability, cash value benefits, policy flexibility, and your individual financial goals.

Related Important Terms

Policy-as-a-Platform

Whole Life insurance offers lifelong coverage with fixed premiums and cash value accumulation, while Embedded Insurance integrates coverage seamlessly within products or services through a Policy-as-a-Platform model, enabling real-time customization and streamlined claims processing. Leveraging Policy-as-a-Platform technology enhances customer experience by providing flexible, on-demand insurance solutions embedded directly into everyday transactions.

Parametric Whole Life

Parametric Whole Life insurance combines lifelong coverage with pre-defined payout triggers based on specific event parameters, offering faster claims settlement compared to traditional Whole Life policies. Embedded insurance integrates coverage within another product or service, but Parametric Whole Life emphasizes automatic, transparent payouts tied to measurable events, enhancing policyholder certainty and efficiency.

API-Driven Embedded Insurance

API-driven embedded insurance seamlessly integrates whole life insurance products into digital platforms, enabling real-time underwriting, policy management, and claims processing within a single user experience. This approach enhances customer engagement and operational efficiency by leveraging automated data exchange and tailored policy offerings embedded directly into e-commerce, financial apps, or IoT ecosystems.

End-to-End White Labeling

Whole Life insurance offers lifelong coverage with fixed premiums and cash value accumulation, while Embedded Insurance integrates protection seamlessly into third-party products through End-to-End White Labeling, enhancing customer experience and brand loyalty. End-to-End White Labeling enables insurers to fully customize policy design, underwriting, and claims processes under the partner's brand, streamlining distribution and operational efficiency.

Real-Time Underwriting Integration

Whole Life insurance offers lifetime coverage with fixed premiums, but Embedded Insurance integrated via APIs enables real-time underwriting within purchase journeys, enhancing customer experience and reducing policy issuance time. Real-time underwriting integration leverages data analytics and AI to assess risk instantly, providing immediate coverage decisions that streamline operations compared to traditional Whole Life underwriting processes.

Micro-moment Coverage

Whole Life insurance offers lifetime coverage with fixed premiums and cash value accumulation, providing long-term financial security, while Embedded Insurance integrates coverage seamlessly into everyday purchases, delivering instant, context-specific protection during micro-moments such as travel bookings or retail transactions. Micro-moment coverage maximizes convenience and relevance by triggering insurance benefits precisely at the point of need, enhancing customer experience and risk management in dynamic environments.

Hyper-Personalized Riders

Whole Life insurance offers stable coverage with guaranteed cash value growth, while Embedded Insurance integrates customizable protection seamlessly into products or services. Hyper-personalized riders enhance both by tailoring benefits to individual needs, optimizing policy flexibility and customer satisfaction.

Omnichannel Insurance Onboarding

Whole Life insurance offers lifelong coverage with fixed premiums, while Embedded Insurance integrates policies seamlessly into everyday purchases, enhancing customer convenience through omnichannel insurance onboarding. Omnichannel onboarding leverages digital platforms, mobile apps, and in-person interactions to create a streamlined, consistent customer experience, improving engagement and retention in both Whole Life and Embedded Insurance products.

Pay-as-You-Live Models

Whole Life insurance offers lifelong coverage with fixed premiums and a cash value component, providing long-term financial security. Embedded insurance integrates pay-as-you-live models within everyday purchases, delivering flexible, usage-based protection that aligns premiums with actual risk exposure.

Cross-Product Bundling

Whole Life insurance offers lifetime coverage with guaranteed premiums and cash value accumulation, while Embedded Insurance integrates coverage seamlessly within products or services, enhancing customer experience through convenience. Cross-product bundling leverages the strengths of both by combining comprehensive life protection with embedded policies, increasing customer retention and optimizing risk management across multiple insurance offerings.

Whole Life vs Embedded Insurance Infographic

industrydif.com

industrydif.com