Manual processing in insurance involves human intervention to handle tasks such as claims, underwriting, and policy management, often leading to slower turnaround times and higher error rates. Robotic Process Automation (RPA) streamlines these operations by automating repetitive, rule-based tasks, resulting in increased efficiency, reduced costs, and improved accuracy. Implementing RPA transforms traditional workflows, enabling insurers to focus on complex decision-making and enhancing overall customer experience.

Table of Comparison

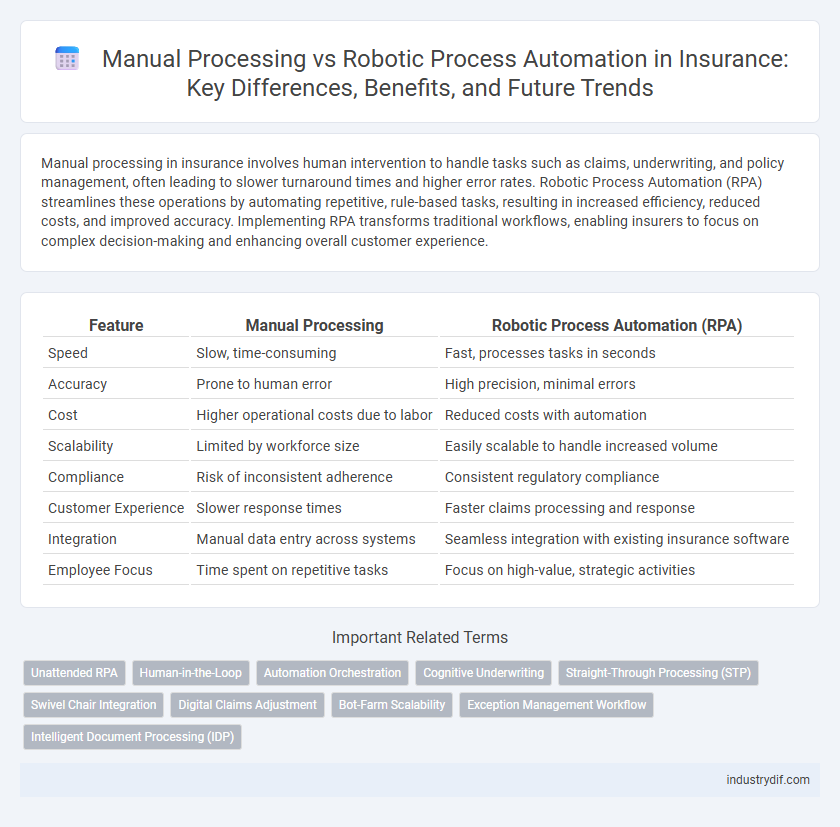

| Feature | Manual Processing | Robotic Process Automation (RPA) |

|---|---|---|

| Speed | Slow, time-consuming | Fast, processes tasks in seconds |

| Accuracy | Prone to human error | High precision, minimal errors |

| Cost | Higher operational costs due to labor | Reduced costs with automation |

| Scalability | Limited by workforce size | Easily scalable to handle increased volume |

| Compliance | Risk of inconsistent adherence | Consistent regulatory compliance |

| Customer Experience | Slower response times | Faster claims processing and response |

| Integration | Manual data entry across systems | Seamless integration with existing insurance software |

| Employee Focus | Time spent on repetitive tasks | Focus on high-value, strategic activities |

Introduction to Manual Processing in Insurance

Manual processing in insurance involves human intervention to handle tasks such as data entry, claims assessment, and policy administration, often leading to slower turnaround times and higher error rates. This traditional approach relies heavily on paper-based documentation and manual verification, increasing operational costs and limiting scalability. Despite advances in technology, many insurers continue to use manual processing for complex cases requiring human judgment and personalized customer interaction.

What is Robotic Process Automation (RPA) in Insurance?

Robotic Process Automation (RPA) in insurance involves using software robots to automate repetitive, rule-based tasks such as claims processing, policy administration, and customer data management. RPA enhances accuracy, reduces processing time, and minimizes human error compared to manual processing methods. Insurance companies leverage RPA to improve operational efficiency, streamline workflows, and accelerate service delivery while maintaining regulatory compliance.

Key Differences Between Manual Processing and RPA

Manual processing in insurance involves human intervention to handle tasks such as data entry, claims assessment, and policy management, which often leads to higher error rates and longer processing times. Robotic Process Automation (RPA) leverages software bots to perform repetitive, rule-based tasks with greater speed, accuracy, and consistency, significantly reducing operational costs and improving customer satisfaction. Key differences include RPA's ability to operate 24/7 without fatigue and its scalability to manage large volumes, contrasting with the limitations of manual labor in terms of efficiency and error susceptibility.

Common Insurance Processes Handled Manually

Common insurance processes handled manually include claims processing, policy administration, and underwriting assessments, which often involve extensive data entry, verification, and customer communication. Manual processing increases the risk of errors, delays, and higher operational costs due to repetitive tasks and human dependency. Robotic Process Automation (RPA) streamlines these functions by automating data extraction, validation, and rule-based decision-making, enhancing efficiency and accuracy in insurance operations.

RPA Use Cases in the Insurance Industry

Robotic Process Automation (RPA) significantly streamlines insurance claims processing by automatically extracting data from forms, validating policy details, and updating records, reducing manual errors and handling time. RPA also enhances underwriting by rapidly gathering and analyzing applicant information from multiple sources, enabling quicker and more accurate risk assessments. Policy administration benefits from RPA through automated renewals, endorsements, and billing workflows, improving operational efficiency and customer satisfaction.

Benefits of Shifting from Manual to RPA

Shifting from manual processing to Robotic Process Automation (RPA) in insurance significantly enhances operational efficiency by automating repetitive tasks like claims processing and policy management, reducing errors and processing time. RPA improves regulatory compliance through consistent data handling and audit trails, minimizing risks associated with manual data entry. This transition allows insurers to allocate human resources to strategic decision-making, driving innovation and improving overall customer experience.

Challenges and Limitations of Manual Processing

Manual processing in insurance claims handling often results in higher error rates due to human fatigue and oversight, prolonging claim settlement times and decreasing customer satisfaction. The reliance on manual labor increases operational costs and limits scalability, making it difficult for insurers to manage large volumes of claims efficiently. Compliance risks also escalate as manual workflows struggle to maintain consistent documentation and audit trails in rapidly evolving regulatory environments.

Overcoming RPA Implementation Barriers in Insurance

Overcoming RPA implementation barriers in insurance requires addressing data integration challenges, employee resistance, and regulatory compliance complexities. Seamless integration with legacy systems and ensuring data accuracy through automated validation enhance operational efficiency. Comprehensive training and change management strategies foster employee adoption, while robust compliance frameworks guarantee adherence to insurance regulations during automation deployment.

Impact on Compliance and Data Security

Manual processing in insurance often increases the risk of human error, leading to potential compliance breaches and data security vulnerabilities. Robotic Process Automation (RPA) enhances regulatory adherence by automating data handling with consistent accuracy and maintaining robust encryption protocols. Insurance firms that implement RPA experience improved audit trails, reduced insider threats, and strengthened protection of sensitive client information.

Future Trends: Automation and Digital Transformation in Insurance

Robotic Process Automation (RPA) is revolutionizing the insurance industry by significantly reducing manual processing times and minimizing human errors through intelligent automation. Future trends indicate a growing integration of AI-driven RPA with advanced analytics, enabling real-time risk assessment and personalized policy management. Digital transformation in insurance leverages these technologies to enhance customer experience, optimize operational efficiency, and accelerate claims processing workflows.

Related Important Terms

Unattended RPA

Unattended Robotic Process Automation (RPA) in insurance accelerates claims processing by autonomously handling repetitive tasks without human intervention, significantly reducing errors and operational costs compared to manual processing. This technology enhances efficiency through 24/7 system availability, seamless data integration, and rapid scalability, driving faster policy administration and improving customer satisfaction.

Human-in-the-Loop

Human-in-the-Loop (HITL) in insurance claims processing combines manual intervention with Robotic Process Automation (RPA) to enhance accuracy and decision-making in complex cases. This hybrid approach reduces errors while maintaining human oversight, ensuring regulatory compliance and improved customer satisfaction.

Automation Orchestration

Automation orchestration in insurance integrates manual processing with robotic process automation (RPA) to streamline complex workflows, reduce errors, and improve claim processing efficiency. Combining human judgment with AI-driven bots enables scalable, end-to-end automation that enhances policy administration and accelerates customer service response times.

Cognitive Underwriting

Manual processing in cognitive underwriting relies heavily on human expertise to evaluate complex insurance applications, often resulting in slower decisions and higher error rates. Robotic Process Automation (RPA) enhances cognitive underwriting by automating data extraction and initial risk assessments, improving accuracy and accelerating policy issuance in the insurance industry.

Straight-Through Processing (STP)

Manual processing in insurance claims often results in lower Straight-Through Processing (STP) rates due to human error and slower data handling, while Robotic Process Automation (RPA) significantly boosts STP by automating repetitive tasks and ensuring consistent data accuracy. Implementing RPA enhances operational efficiency, reduces claim cycle times, and increases customer satisfaction through faster, error-free claim settlements.

Swivel Chair Integration

Manual processing in insurance claims often involves swivel chair integration, where employees switch between multiple systems to gather and input data, slowing efficiency and increasing human error. Robotic Process Automation (RPA) eliminates this inefficiency by automating data transfers across platforms, enhancing accuracy and accelerating claim processing times.

Digital Claims Adjustment

Robotic Process Automation streamlines Digital Claims Adjustment by automating repetitive tasks, reducing human error, and accelerating claims resolution compared to manual processing. Leveraging AI-driven RPA tools enhances data accuracy, optimizes workflow efficiency, and improves customer satisfaction within insurance claims management.

Bot-Farm Scalability

Robotic Process Automation (RPA) enables scalable bot farms that can manage high volumes of insurance claims with consistent accuracy and reduced turnaround times, outpacing manual processing workflows. Manual processing lacks the flexibility and scalability to handle fluctuating workloads efficiently, often leading to bottlenecks and increased operational costs in insurance claim settlements.

Exception Management Workflow

Exception management workflow in insurance benefits from Robotic Process Automation (RPA) by drastically reducing manual intervention and accelerating claim resolution times. While manual processing often leads to increased error rates and slower exception handling, RPA enhances accuracy and consistency, enabling insurers to efficiently manage complex exceptions and improve overall operational efficiency.

Intelligent Document Processing (IDP)

Intelligent Document Processing (IDP) enhances insurance workflows by automating data extraction from complex documents, significantly reducing manual processing errors and improving claim turnaround times. Integrating IDP within Robotic Process Automation (RPA) frameworks accelerates underwriting and policy administration by enabling accurate, real-time document analysis and decision-making.

Manual Processing vs Robotic Process Automation Infographic

industrydif.com

industrydif.com