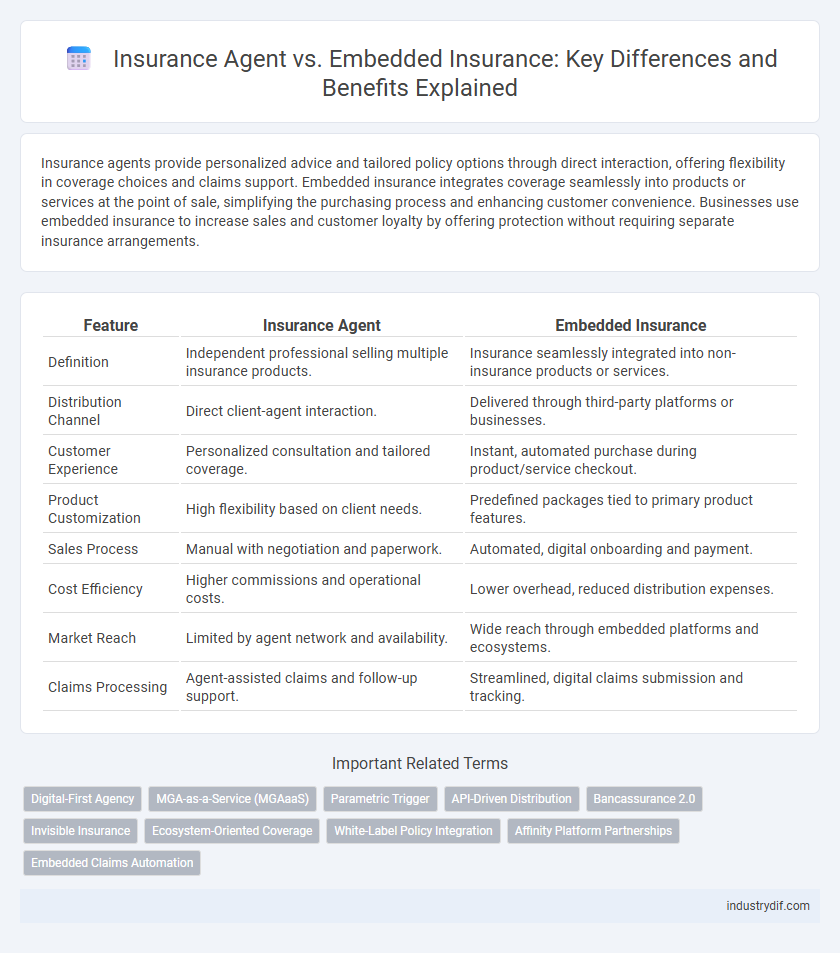

Insurance agents provide personalized advice and tailored policy options through direct interaction, offering flexibility in coverage choices and claims support. Embedded insurance integrates coverage seamlessly into products or services at the point of sale, simplifying the purchasing process and enhancing customer convenience. Businesses use embedded insurance to increase sales and customer loyalty by offering protection without requiring separate insurance arrangements.

Table of Comparison

| Feature | Insurance Agent | Embedded Insurance |

|---|---|---|

| Definition | Independent professional selling multiple insurance products. | Insurance seamlessly integrated into non-insurance products or services. |

| Distribution Channel | Direct client-agent interaction. | Delivered through third-party platforms or businesses. |

| Customer Experience | Personalized consultation and tailored coverage. | Instant, automated purchase during product/service checkout. |

| Product Customization | High flexibility based on client needs. | Predefined packages tied to primary product features. |

| Sales Process | Manual with negotiation and paperwork. | Automated, digital onboarding and payment. |

| Cost Efficiency | Higher commissions and operational costs. | Lower overhead, reduced distribution expenses. |

| Market Reach | Limited by agent network and availability. | Wide reach through embedded platforms and ecosystems. |

| Claims Processing | Agent-assisted claims and follow-up support. | Streamlined, digital claims submission and tracking. |

Definition of Insurance Agent

An insurance agent is a licensed professional who represents one or more insurance companies to sell and service policies directly to clients, providing personalized advice tailored to individual needs. Unlike embedded insurance, where coverage is integrated seamlessly into the purchase of goods or services, insurance agents offer a more traditional, consultative approach to obtaining insurance. Their expertise includes assessing risk, explaining policy details, and managing claims to ensure clients receive appropriate protection.

Overview of Embedded Insurance

Embedded insurance integrates coverage directly within the purchase of products or services, streamlining the customer experience by eliminating the need for separate insurance transactions. This approach leverages digital platforms and APIs to offer real-time, context-specific insurance options tailored to individual needs. By embedding insurance, businesses can increase conversion rates and provide value-added services while agents focus on personalized advice and complex risk assessments.

Key Differences Between Insurance Agent and Embedded Insurance

An insurance agent acts as an intermediary who directly sells and manages insurance policies, providing personalized advice and tailored coverage options to clients. Embedded insurance integrates insurance products seamlessly within non-insurance platforms, such as e-commerce or travel services, enabling customers to purchase coverage instantly without separate interactions with insurers. Key differences lie in distribution channels, with agents offering individualized service versus embedded insurance providing convenience through digital ecosystems.

Roles and Responsibilities of Insurance Agents

Insurance agents act as the primary link between clients and insurance companies, assessing individual needs to recommend appropriate policies. They handle client inquiries, process applications, and provide ongoing support to ensure policyholders understand coverage details and claims procedures. Agents also play a crucial role in risk assessment, policy customization, and compliance with regulatory requirements.

How Embedded Insurance Works

Embedded insurance integrates coverage options directly into the purchase process of products or services through digital platforms, allowing consumers to obtain insurance without separate applications. This seamless integration uses APIs to connect insurers with retailers or service providers, enabling real-time quotes and instant policy issuance. The process enhances customer convenience and accelerates insurance adoption by embedding protection within everyday transactions.

Customer Experience: Traditional vs Embedded Insurance

Traditional insurance agents offer personalized service through direct human interaction, which can build trust but often involves longer processing times and complex paperwork. Embedded insurance integrates coverage seamlessly into customer journeys via digital platforms, enhancing convenience, speed, and transparency. This streamlined approach reduces friction, delivers instant policy options, and improves overall customer satisfaction in the insurance buying process.

Distribution Channels in Insurance

Insurance agents serve as personalized intermediaries who provide tailored advice and build client relationships, enhancing customer trust and satisfaction through direct interaction. Embedded insurance integrates coverage seamlessly into non-insurance products or services, leveraging digital platforms to offer convenient, on-the-spot protection, thereby expanding reach and simplifying the purchase process. Distribution channels in insurance are evolving with technological advancements, as embedded insurance capitalizes on ecosystem partnerships, while traditional agents maintain value through expertise and customized service.

Regulatory Implications for Agents and Embedded Insurance

Insurance agents face stringent regulatory requirements, including licensing, compliance audits, and fiduciary duties to clients, ensuring transparency and consumer protection. Embedded insurance, integrated into products or services, navigates a complex regulatory landscape that often varies by jurisdiction, with evolving rules targeting data privacy, disclosure standards, and distribution channels. Regulators increasingly emphasize clarity in policy terms and fair treatment in both models, demanding adaptive compliance strategies to mitigate legal risks and enhance consumer trust.

Technology’s Role in Modern Insurance Models

Technology has revolutionized modern insurance models by enabling embedded insurance to seamlessly integrate coverage options within digital platforms, enhancing customer convenience and real-time policy management. Insurance agents leverage advanced data analytics and AI-driven tools to provide personalized risk assessments and tailored policy recommendations. This technological synergy strengthens both traditional agency roles and embedded insurance solutions, creating a more efficient, customer-centric insurance ecosystem.

Future Trends: Insurance Agents vs Embedded Insurance

Future trends in insurance reveal a growing shift from traditional insurance agents toward embedded insurance models integrated within digital platforms and ecosystems. Embedded insurance offers seamless, real-time coverage purchase experiences, driving higher customer engagement and operational efficiency compared to conventional agent-driven channels. Advanced AI and data analytics further empower embedded insurance to provide personalized policies, forecasting a gradual decline in reliance on standalone insurance agents.

Related Important Terms

Digital-First Agency

Digital-first insurance agencies leverage advanced technology platforms to streamline policy management, enhance customer engagement, and deliver personalized coverage options through a seamless digital experience. Embedded insurance integrates policies directly into non-insurance products or services, enabling real-time access and purchase decisions, while digital-first agents focus on proactive client interaction and data-driven risk assessments to optimize policy recommendations.

MGA-as-a-Service (MGAaaS)

MGA-as-a-Service (MGAaaS) revolutionizes traditional insurance agency models by integrating embedded insurance directly within digital platforms, enabling seamless policy distribution and real-time underwriting automation. This approach enhances customer engagement and operational efficiency by combining the expertise of managing general agents (MGAs) with advanced technology, bypassing conventional agent dependencies.

Parametric Trigger

Parametric triggers in embedded insurance automate claim settlements by activating payouts based on predefined parameters, enhancing efficiency compared to traditional insurance agents who rely on manual claim assessments. This model reduces processing time and dispute risks, leveraging data analytics for precise event detection and swift customer compensation.

API-Driven Distribution

API-driven distribution revolutionizes insurance by embedding coverage options directly into third-party platforms, enhancing customer access beyond traditional insurance agent interactions. This seamless integration leverages real-time data exchange to automate policy issuance and claims processing, optimizing efficiency and personalized risk assessments.

Bancassurance 2.0

Bancassurance 2.0 integrates embedded insurance directly within banking platforms, streamlining policy purchase and claims management without traditional insurance agents. This model leverages digital ecosystems to enhance customer experience, reduce acquisition costs, and increase insurance penetration through seamless banking interactions.

Invisible Insurance

Invisible insurance integrates coverage seamlessly into products or services, eliminating the need for traditional insurance agents and enhancing customer experience by providing automatic, context-driven protection. This embedded model leverages technology and data analytics to offer tailored insurance solutions at the point of sale, improving accessibility and reducing friction compared to conventional agent-led processes.

Ecosystem-Oriented Coverage

Insurance agents provide personalized advice and tailored policies by directly interacting with clients, ensuring customized coverage solutions. Embedded insurance integrates seamlessly within digital ecosystems, offering real-time, context-specific protection that enhances user experience and increases adoption through automated, ecosystem-oriented coverage options.

White-Label Policy Integration

White-label policy integration streamlines embedded insurance by allowing insurers to offer customized coverage directly through non-insurance platforms, enhancing customer experience without the need for traditional agent involvement. Insurance agents traditionally facilitate personalized risk assessment and client interaction, but embedded insurance leverages white-label solutions to embed policies seamlessly into digital ecosystems, accelerating policy adoption and reducing distribution costs.

Affinity Platform Partnerships

Insurance agents provide personalized service and expert guidance while embedded insurance integrates coverage directly within affinity platform partnerships, streamlining customer access and enhancing user experience. Affinity platform partnerships leverage embedded insurance to increase conversion rates by offering tailored insurance solutions seamlessly within existing digital ecosystems.

Embedded Claims Automation

Embedded claims automation streamlines the insurance process by integrating claims management directly within partner platforms, reducing manual intervention and accelerating settlement times. Insurance agents traditionally handle claims through direct customer interaction, but embedded systems leverage AI and real-time data processing to enhance efficiency and customer experience.

Insurance Agent vs Embedded Insurance Infographic

industrydif.com

industrydif.com