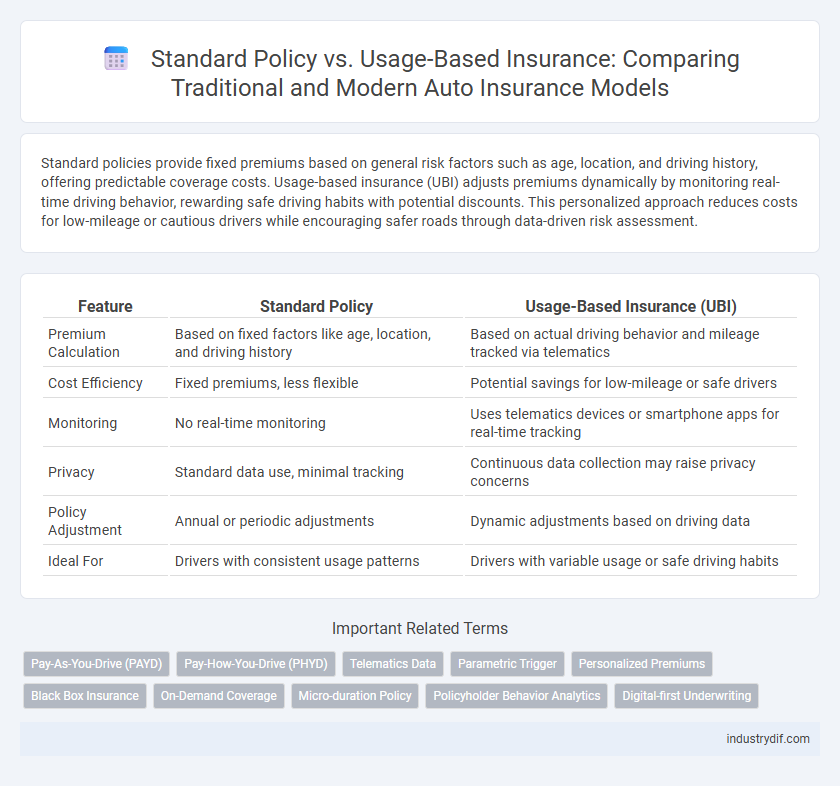

Standard policies provide fixed premiums based on general risk factors such as age, location, and driving history, offering predictable coverage costs. Usage-based insurance (UBI) adjusts premiums dynamically by monitoring real-time driving behavior, rewarding safe driving habits with potential discounts. This personalized approach reduces costs for low-mileage or cautious drivers while encouraging safer roads through data-driven risk assessment.

Table of Comparison

| Feature | Standard Policy | Usage-Based Insurance (UBI) |

|---|---|---|

| Premium Calculation | Based on fixed factors like age, location, and driving history | Based on actual driving behavior and mileage tracked via telematics |

| Cost Efficiency | Fixed premiums, less flexible | Potential savings for low-mileage or safe drivers |

| Monitoring | No real-time monitoring | Uses telematics devices or smartphone apps for real-time tracking |

| Privacy | Standard data use, minimal tracking | Continuous data collection may raise privacy concerns |

| Policy Adjustment | Annual or periodic adjustments | Dynamic adjustments based on driving data |

| Ideal For | Drivers with consistent usage patterns | Drivers with variable usage or safe driving habits |

Introduction to Standard vs Usage-Based Insurance

Standard insurance policies offer fixed premiums based on general risk factors such as age, driving history, and location, providing predictable coverage and cost. Usage-Based Insurance (UBI) leverages telematics technology to monitor real-time driving behavior, enabling personalized premiums that reward safe and low-mileage drivers with potential savings. These contrasting models reflect the shift from traditional risk assessment to data-driven decision-making in the insurance industry.

Key Features of Standard Insurance Policies

Standard insurance policies provide fixed premiums based on generalized risk factors such as age, location, and driving history, offering predictable costs for policyholders. Coverage typically includes liability, collision, and comprehensive protection with established deductibles and limits predefined by the insurer. These policies ensure consistent terms and straightforward claims processes without real-time usage monitoring or adjustments.

How Usage-Based Insurance Works

Usage-based insurance (UBI) monitors driving behavior through telematics devices or smartphone apps, collecting data such as mileage, speed, braking patterns, and time of day. This real-time data allows insurers to calculate premiums based on actual driving habits, promoting personalized and potentially lower rates compared to traditional standard policies. UBI incentivizes safer driving by directly linking driving performance with insurance costs, offering a dynamic alternative to fixed-rate insurance coverage.

Benefits of Standard Insurance

Standard insurance policies offer predictable premium costs, making budgeting easier for policyholders without worrying about fluctuating rates. These policies provide broad coverage, ensuring protection regardless of individual driving behavior or mileage, which benefits low-risk drivers who drive infrequently. Fixed premiums in standard insurance also facilitate straightforward claims processing and simplified policy management.

Advantages of Usage-Based Insurance

Usage-Based Insurance (UBI) offers personalized premiums by utilizing telematics data to monitor driving behavior, promoting safer habits and reducing overall costs for low-risk drivers. It provides real-time feedback, encouraging responsible driving and enhancing policy transparency compared to traditional Standard Policies that rely on static risk assessments. Additionally, UBI can lead to significant savings for infrequent or careful drivers through pay-as-you-drive models, fostering fairness and cost efficiency in auto insurance.

Cost Comparison: Standard vs Usage-Based

Standard insurance policies typically charge fixed premiums based on generalized risk factors, often resulting in higher costs for low-mileage or low-risk drivers. Usage-Based Insurance (UBI) employs telematics to monitor driving behavior and mileage, allowing insurers to offer personalized premiums that can significantly reduce costs for safe or infrequent drivers. Data from the National Association of Insurance Commissioners indicates that UBI participants save an average of 20-30% on premiums compared to traditional standard policyholders, highlighting the financial advantage of usage-based models.

Data Collection and Privacy Concerns

Standard insurance policies rely on fixed data such as driving records and demographic information, offering limited insight into real-time behavior. Usage-Based Insurance (UBI) collects detailed telematics data including mileage, speed, and driving patterns, raising significant privacy concerns regarding data storage and third-party access. Insurers must balance the benefits of personalized premiums with stringent measures to protect policyholders' personal and behavioral data.

Ideal Customers for Each Insurance Type

Standard insurance policies suit customers who prefer predictable premiums and consistent coverage without monitoring their driving habits, typically ideal for infrequent or cautious drivers. Usage-based insurance attracts tech-savvy policyholders who drive regularly and seek cost savings based on actual mileage and driving behavior, making it perfect for low-mileage, safe drivers. Both types cater to distinct profiles, with standard insurance appealing to those valuing simplicity and usage-based targeting those focused on personalized risk assessment.

Impact on Claims and Premiums

Standard insurance policies calculate premiums based on general risk factors like age, location, and driving history, resulting in fixed payments regardless of actual usage or driving behavior. Usage-based insurance (UBI) leverages telematics data to assess real-time driving patterns, enabling more personalized premiums that often lead to lower costs for safe drivers and quicker identification of claims events. This shift towards UBI also impacts claims processing by providing detailed driving data, which helps insurers verify incidents accurately and expedite settlements.

Future Trends in Auto Insurance

Usage-Based Insurance (UBI) leverages telematics and real-time driving data to offer personalized premiums, reflecting individual driving behavior more accurately than standard policies. Future trends in auto insurance point towards increased integration of AI and IoT technologies, enabling insurers to enhance risk assessment and fraud detection. This shift promises more dynamic pricing models and greater customer engagement, transforming traditional insurance frameworks.

Related Important Terms

Pay-As-You-Drive (PAYD)

Standard insurance policies charge fixed premiums based on factors like age, location, and vehicle type, whereas Pay-As-You-Drive (PAYD) insurance adjusts premiums according to actual mileage driven, promoting cost savings for low-mileage drivers. PAYD uses telematics data to monitor driving behavior and distance, enabling personalized pricing that aligns insurance costs with real-world usage patterns.

Pay-How-You-Drive (PHYD)

Standard insurance policies charge fixed premiums based on general risk factors, whereas Usage-Based Insurance (UBI) like Pay-How-You-Drive (PHYD) adjusts rates dynamically by monitoring individual driving behaviors such as speed, braking, and mileage through telematics devices. PHYD policies enhance cost efficiency and safety incentives by rewarding safer driving patterns with lower premiums, providing a personalized approach compared to traditional flat-rate insurance plans.

Telematics Data

Standard insurance policies rely on fixed premiums determined by factors like age and driving history, while usage-based insurance (UBI) leverages telematics data such as mileage, acceleration, braking patterns, and driving time to customize rates in real-time. Telematics devices collect precise driving behavior metrics, enabling insurers to offer personalized pricing, improve risk assessment, and incentivize safer driving habits.

Parametric Trigger

Standard insurance policies rely on predefined coverage terms and claims assessments, whereas usage-based insurance incorporates parametric triggers such as telematics data or weather events to automatically validate claims. Parametric insurance enhances efficiency by using specific, measurable parameters like mileage or rainfall thresholds to trigger payouts, reducing claim processing time and increasing transparency.

Personalized Premiums

Standard insurance policies offer fixed premiums based on generalized risk factors, while usage-based insurance (UBI) calculates personalized premiums using real-time data such as driving behavior, mileage, and time of use. This data-driven approach enables insurers to tailor rates more accurately, rewarding safe drivers with lower costs and promoting fairer pricing models.

Black Box Insurance

Standard insurance policies charge premiums based on generalized risk factors such as age, location, and driving history, whereas usage-based insurance (UBI), often known as Black Box insurance, tailors premiums according to real-time driving behavior tracked through telematics devices. Black Box insurance enhances risk assessment accuracy by monitoring metrics like speed, acceleration, braking patterns, and mileage, enabling insurers to offer personalized rates and encourage safer driving habits.

On-Demand Coverage

On-demand coverage in usage-based insurance offers flexible, pay-as-you-drive protection tailored to actual driving habits, contrasting with the fixed premiums of standard policies. This model enhances cost efficiency and personalization, leveraging telematics data to activate coverage only during insured periods.

Micro-duration Policy

Micro-duration policies in insurance offer flexible coverage for short, specific timeframes, contrasting with standard policies that provide fixed terms typically spanning six months or a year. Usage-based insurance leverages real-time data from telematics to adjust premiums based on actual driving behavior, optimizing cost efficiency for policyholders who prefer micro-duration coverage.

Policyholder Behavior Analytics

Standard policies rely on historical data and fixed premiums, providing limited insights into individual behavior, whereas usage-based insurance leverages telematics and real-time data to analyze driving patterns, enabling dynamic pricing and personalized risk assessment. Policyholder behavior analytics in usage-based insurance enhance fraud detection, optimize claims management, and incentivize safer driving habits through data-driven feedback.

Digital-first Underwriting

Standard insurance policies rely on traditional risk assessments based on demographic data and historical claims, whereas Usage-Based Insurance (UBI) leverages real-time telematics and digital-first underwriting to tailor premiums according to actual driving behavior. Digital-first underwriting enhances accuracy by utilizing big data analytics, IoT sensors, and machine learning algorithms to continuously monitor risk and optimize coverage.

Standard Policy vs Usage-Based Insurance Infographic

industrydif.com

industrydif.com