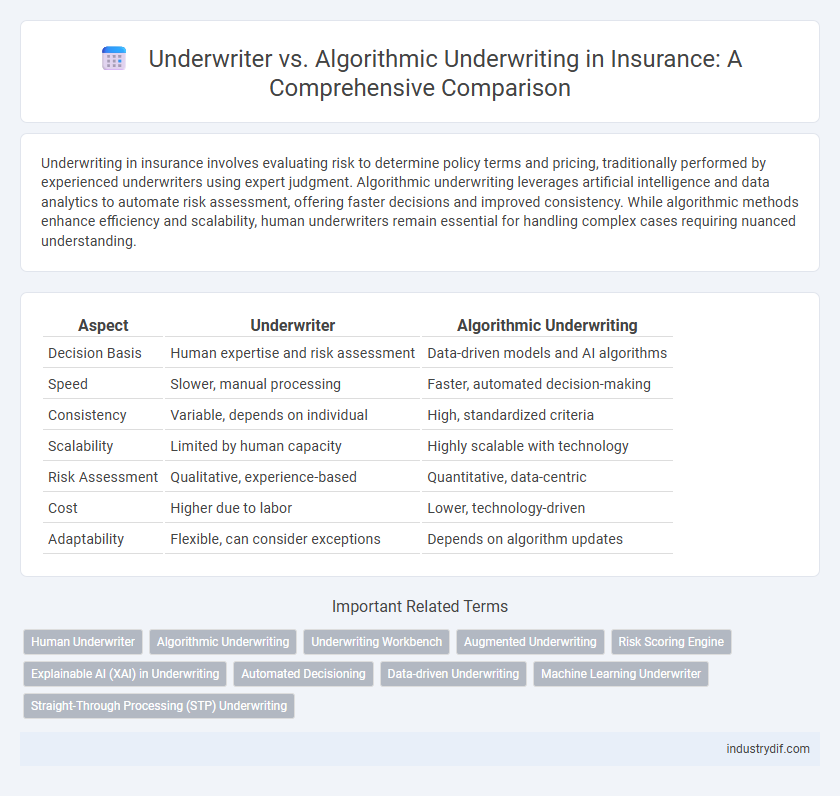

Underwriting in insurance involves evaluating risk to determine policy terms and pricing, traditionally performed by experienced underwriters using expert judgment. Algorithmic underwriting leverages artificial intelligence and data analytics to automate risk assessment, offering faster decisions and improved consistency. While algorithmic methods enhance efficiency and scalability, human underwriters remain essential for handling complex cases requiring nuanced understanding.

Table of Comparison

| Aspect | Underwriter | Algorithmic Underwriting |

|---|---|---|

| Decision Basis | Human expertise and risk assessment | Data-driven models and AI algorithms |

| Speed | Slower, manual processing | Faster, automated decision-making |

| Consistency | Variable, depends on individual | High, standardized criteria |

| Scalability | Limited by human capacity | Highly scalable with technology |

| Risk Assessment | Qualitative, experience-based | Quantitative, data-centric |

| Cost | Higher due to labor | Lower, technology-driven |

| Adaptability | Flexible, can consider exceptions | Depends on algorithm updates |

Definition of Underwriter in Insurance

An underwriter in insurance is a professional who evaluates risks and determines the terms and pricing of insurance policies based on detailed risk assessments. Traditional underwriting relies on human expertise to analyze applications, medical records, and financial data to decide coverage eligibility. This process contrasts with algorithmic underwriting, which uses machine learning models to automate risk evaluation and pricing decisions.

What is Algorithmic Underwriting?

Algorithmic underwriting leverages advanced machine learning models and artificial intelligence to assess insurance risks and determine policy terms with greater accuracy and speed. This automated process analyzes vast datasets, including historical claims, customer behavior, and external factors, enabling insurers to make data-driven decisions while reducing human error and bias. By streamlining risk evaluation, algorithmic underwriting enhances pricing precision and improves customer experience compared to traditional manual underwriting methods.

Traditional Underwriting Process Explained

Traditional underwriting in insurance involves a detailed evaluation by human underwriters who assess risk factors such as medical history, financial status, and lifestyle to determine eligibility and premium rates. This manual process relies heavily on expertise and judgment, often requiring extensive documentation and time-consuming reviews to ensure accurate risk assessment. Compared to algorithmic underwriting, traditional methods provide nuanced decision-making but may lack the speed and efficiency enabled by automated data analysis.

Key Differences Between Human and Algorithmic Underwriting

Underwriters evaluate insurance risk using expertise, judgment, and qualitative data, whereas algorithmic underwriting relies on data-driven models and machine learning to assess risk objectively. Human underwriters can consider complex nuances and unique cases, while algorithmic underwriting excels in speed, consistency, and processing large data volumes. Differences in decision-making transparency and adaptability highlight fundamental contrasts between human intuition and algorithmic precision in underwriting.

Advantages of Human Underwriting

Human underwriting provides nuanced risk assessment by incorporating qualitative factors such as applicant behavior, intent, and unique circumstances that algorithms may overlook. Experienced underwriters exercise judgment and adaptability, enabling personalized policy decisions that improve accuracy and customer satisfaction. This expertise reduces false negatives and positives, mitigating potential losses and fostering trust in complex or atypical cases.

Benefits of Algorithmic Underwriting

Algorithmic underwriting leverages advanced data analytics and machine learning models to assess risk more accurately and efficiently than traditional underwriters. This method enhances precision in policy pricing, reduces human bias, and significantly accelerates the approval process. Insurers benefit from lower operational costs and improved customer satisfaction due to faster, data-driven decisions.

Risks and Limitations of Manual Underwriting

Manual underwriting relies heavily on human judgment, which introduces risks such as inconsistent risk assessment and potential biases that can affect decision accuracy. This traditional approach often leads to slower processing times and limits scalability, making it challenging to handle large volumes of applications efficiently. In contrast, manual underwriting may overlook complex patterns in data that algorithmic underwriting systems can detect, resulting in less precise risk evaluation.

Challenges Facing Algorithmic Underwriting

Algorithmic underwriting faces significant challenges including data privacy concerns, model bias, and regulatory compliance complexities. Ensuring accurate risk assessment is difficult due to limited transparency in algorithmic decision-making and the potential for skewed data inputs. These issues complicate integration within traditional underwriting frameworks and raise questions about fairness and accountability.

Impact on Customer Experience

Traditional underwriters provide personalized risk assessment, leveraging human judgment to tailor insurance policies, which can foster trust and nuanced understanding of individual circumstances. Algorithmic underwriting accelerates the approval process by using data-driven models and artificial intelligence, resulting in faster policy issuance and often lower premiums. The impact on customer experience includes increased efficiency and consistency, though some customers may miss the personalized interaction and expert insights offered by human underwriters.

The Future of Underwriting: Human vs. Algorithmic Approaches

Underwriting in insurance is evolving as algorithmic underwriting leverages machine learning and big data analytics to improve risk assessment accuracy and efficiency. Human underwriters bring nuanced judgment and contextual understanding, essential for complex or atypical cases that algorithms may misinterpret. The future of underwriting likely involves a hybrid model where algorithmic tools enhance human decision-making, optimizing precision and scalability in policy issuance.

Related Important Terms

Human Underwriter

Human underwriters assess insurance applications by evaluating risk factors through experience and judgment, enabling nuanced decision-making that algorithms may overlook. Their expertise in interpreting complex cases and adjusting for intangible variables ensures personalized risk assessment beyond data-driven models.

Algorithmic Underwriting

Algorithmic underwriting leverages artificial intelligence and machine learning models to analyze vast datasets, improving risk assessment accuracy and speed compared to traditional underwriters. This technology automates decision-making processes, reduces human bias, and enables insurers to offer more personalized policies based on real-time data analytics.

Underwriting Workbench

The Underwriting Workbench integrates traditional underwriter expertise with algorithmic underwriting models to enhance risk assessment accuracy and streamline decision-making processes. This hybrid approach leverages advanced data analytics and machine learning within the Workbench platform, optimizing policy evaluation while maintaining human judgment in complex insurance underwriting cases.

Augmented Underwriting

Augmented underwriting combines traditional underwriter expertise with advanced algorithms and artificial intelligence to enhance risk assessment accuracy and efficiency in insurance. This approach leverages data analytics, machine learning models, and human judgment to optimize policy pricing, reduce underwriting time, and improve loss prediction accuracy.

Risk Scoring Engine

Traditional underwriters assess insurance applications by evaluating risk factors based on experience and judgment, while algorithmic underwriting leverages risk scoring engines that analyze vast datasets using machine learning models to predict risk more accurately and consistently. Risk scoring engines integrate variables such as credit history, claims records, and behavioral data, enabling faster decision-making and personalized premium pricing in insurance underwriting.

Explainable AI (XAI) in Underwriting

Explainable AI (XAI) in underwriting enhances transparency by providing clear, interpretable insights into algorithmic decisions, enabling underwriters to understand risk assessments and improve trust in automated processes. This integration supports compliance and ethical standards, bridging the gap between traditional underwriters' expertise and advanced machine learning models for more accurate, unbiased insurance evaluations.

Automated Decisioning

Automated decisioning in insurance leverages algorithmic underwriting to analyze vast datasets rapidly, enhancing accuracy and efficiency over traditional underwriters. This technology minimizes human bias and accelerates risk assessment, enabling real-time policy approvals and dynamic premium calculations.

Data-driven Underwriting

Data-driven underwriting leverages advanced algorithms and machine learning to analyze vast datasets, enabling precise risk assessment and personalized insurance pricing. Unlike traditional underwriters who rely on experience and manual evaluation, algorithmic underwriting enhances efficiency and accuracy by detecting patterns and predicting outcomes from diverse data sources.

Machine Learning Underwriter

Machine learning underwriters leverage advanced algorithms to analyze vast datasets, improving risk assessment accuracy and accelerating decision-making processes compared to traditional human underwriters. This approach enhances predictive modeling by continuously learning from new data patterns, reducing underwriting errors and enabling more personalized insurance pricing.

Straight-Through Processing (STP) Underwriting

Straight-Through Processing (STP) Underwriting leverages algorithmic models to automate risk assessment, significantly reducing manual intervention and accelerating policy issuance. This contrasts with traditional underwriters who rely on experience and judgment, as STP enhances efficiency and accuracy by processing vast data inputs seamlessly.

Underwriter vs Algorithmic Underwriting Infographic

industrydif.com

industrydif.com