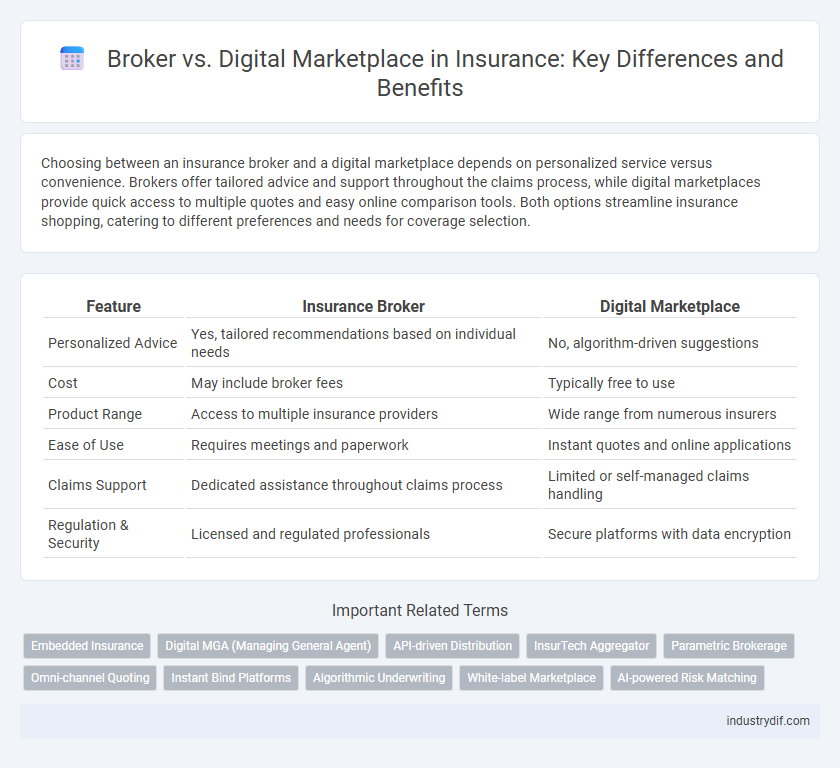

Choosing between an insurance broker and a digital marketplace depends on personalized service versus convenience. Brokers offer tailored advice and support throughout the claims process, while digital marketplaces provide quick access to multiple quotes and easy online comparison tools. Both options streamline insurance shopping, catering to different preferences and needs for coverage selection.

Table of Comparison

| Feature | Insurance Broker | Digital Marketplace |

|---|---|---|

| Personalized Advice | Yes, tailored recommendations based on individual needs | No, algorithm-driven suggestions |

| Cost | May include broker fees | Typically free to use |

| Product Range | Access to multiple insurance providers | Wide range from numerous insurers |

| Ease of Use | Requires meetings and paperwork | Instant quotes and online applications |

| Claims Support | Dedicated assistance throughout claims process | Limited or self-managed claims handling |

| Regulation & Security | Licensed and regulated professionals | Secure platforms with data encryption |

Introduction to Brokers and Digital Marketplaces in Insurance

Insurance brokers act as licensed intermediaries who provide personalized advice and access to multiple insurance providers, enhancing tailored coverage solutions for clients. Digital marketplaces aggregate numerous insurance options on a single platform, empowering consumers with real-time comparisons, transparent pricing, and streamlined policy purchases. Both channels optimize insurance acquisition, with brokers emphasizing expert guidance and digital marketplaces prioritizing convenience and accessibility.

Key Differences Between Insurance Brokers and Digital Marketplaces

Insurance brokers provide personalized guidance by assessing individual needs and offering tailored policy recommendations, often representing multiple insurers to find the best fit. Digital marketplaces enable consumers to compare a wide range of insurance products online, emphasizing convenience and transparency through automated tools and user reviews. While brokers focus on human expertise and customized service, digital marketplaces prioritize efficiency and self-service in policy selection.

How Insurance Brokers Operate

Insurance brokers operate by directly advising clients to find tailored coverage options across multiple insurers, leveraging personalized risk assessments and market expertise to secure competitive policies. They facilitate claims, provide ongoing support, and act as intermediaries ensuring clients understand policy details, exclusions, and benefits. Brokers often build long-term relationships, enabling customized insurance solutions that address unique client needs beyond standardized offerings found on digital marketplaces.

How Digital Insurance Marketplaces Work

Digital insurance marketplaces operate by aggregating multiple insurance providers and policies into a single online platform, allowing users to compare premiums, coverage options, and policy features instantly. These marketplaces use algorithms and data analytics to personalize recommendations based on user inputs such as age, location, and coverage needs. By streamlining quotes and policy management, digital insurance marketplaces provide increased transparency, convenience, and often lower costs compared to traditional insurance brokers.

Advantages of Using an Insurance Broker

Insurance brokers offer personalized risk assessment and tailored coverage options that digital marketplaces often cannot match, ensuring clients receive policies suited to their specific needs. Brokers provide expert advice, helping clients navigate complex policy terms and maximize benefits while avoiding coverage gaps. Their trusted relationships with multiple insurers facilitate access to exclusive deals and faster claim resolutions compared to automated platforms.

Benefits of Digital Marketplaces for Insurance Buyers

Digital marketplaces for insurance buyers offer unparalleled access to a wide range of policies from multiple insurers, enabling comprehensive price comparisons and tailored coverage options in real time. Advanced algorithms and user reviews enhance decision-making by providing transparent insights into insurer reliability and claim settlements. This streamlined, self-service approach reduces dependency on brokers, cuts costs, and accelerates the purchase process, empowering buyers with convenience and control.

Customer Experience: Broker vs Digital Marketplace

Brokers offer personalized insurance guidance, tailoring policies to individual customer needs through expert advice and relationship building. Digital marketplaces provide a streamlined, self-service experience with instant quotes and easy comparison across multiple insurers, enhancing convenience and speed. Customers valuing human interaction may prefer brokers, while those seeking efficiency and broad choices often favor digital marketplaces.

Technology and Innovation in Insurance Distribution

Insurance brokers leverage personalized service and expert advice supported by advanced CRM and AI-driven tools to tailor risk solutions, enhancing customer trust and retention. Digital marketplaces utilize scalable cloud platforms, big data analytics, and automated underwriting algorithms to streamline policy comparison, pricing, and purchasing, offering customers fast and transparent access to multiple insurance products. Both models innovate through integration of blockchain for secure transactions and IoT devices for real-time risk assessment, driving efficiencies in insurance distribution.

Cost Comparison: Broker vs Digital Marketplace

Insurance brokers often charge commissions ranging from 5% to 20% of the premium, which can increase the overall cost for policyholders. Digital marketplaces typically offer lower fees or no commissions, enabling consumers to access competitive insurance quotes directly from multiple providers. Cost savings on digital platforms can reach 15% to 30% compared to traditional broker services, depending on the insurance type and coverage level.

Choosing the Right Solution: Broker or Digital Marketplace

Choosing the right insurance solution depends on individual needs, with brokers offering personalized advice and tailored coverage options through expert guidance. Digital marketplaces provide quick comparisons across multiple insurers, enabling cost-efficient selections and transparent pricing. Assess factors such as complexity of coverage, level of support desired, and comfort with digital tools to determine the best fit for your insurance purchase.

Related Important Terms

Embedded Insurance

Embedded insurance integrated within digital marketplaces streamlines the purchasing process by offering tailored coverage options at the point of sale, enhancing customer convenience and increasing policy uptake. Traditional brokers provide personalized advice and risk assessment but often lack the seamless, real-time insurance solutions delivered through embedded platforms in e-commerce and service ecosystems.

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced technology platforms to streamline underwriting and policy management, offering personalized insurance products more efficiently than traditional brokers or digital marketplaces. Their data-driven approach enables faster risk assessment and tailored coverage options, enhancing customer experience and operational agility in the insurance sector.

API-driven Distribution

API-driven distribution enhances brokers' ability to offer personalized insurance solutions by integrating multiple carriers' products seamlessly, increasing policy options and competitive pricing. Digital marketplaces leverage these APIs to streamline user experience, enabling consumers to compare and purchase insurance policies instantly while accessing real-time underwriting and claims data.

InsurTech Aggregator

InsurTech aggregators streamline insurance buying by comparing multiple policies from various brokers on a single digital platform, enhancing transparency and pricing efficiency. Unlike traditional brokers who offer personalized advice, these marketplaces leverage AI algorithms to quickly match consumers with optimal coverage options based on real-time data.

Parametric Brokerage

Parametric brokerage leverages real-time data and predefined parameters to provide swift, transparent insurance solutions, distinguishing itself from traditional brokers who rely on manual underwriting and personal risk assessment. Digital marketplaces streamline access to a variety of parametric insurance products, offering clients instant quotes and automated claims processing, enhancing efficiency and customer experience.

Omni-channel Quoting

Omni-channel quoting in insurance enables brokers to integrate personalized service with digital platforms, offering clients seamless access to multiple insurance options through both human interaction and automated online tools. Digital marketplaces centralize policy comparisons and instant quotes but often lack the tailored expertise brokers provide, making a hybrid approach essential for enhanced customer experience and optimized policy selection.

Instant Bind Platforms

Instant bind platforms in insurance empower brokers with real-time quoting and immediate policy issuance, streamlining the underwriting process and enhancing client satisfaction. Digital marketplaces aggregate multiple insurer options, offering consumers a transparent comparison but often lack the personalized expertise and tailored service that brokers with advanced bind platforms provide.

Algorithmic Underwriting

Algorithmic underwriting in insurance leverages advanced data analytics and machine learning to assess risk more accurately and quickly than traditional brokers, enabling personalized policy recommendations and competitive pricing. Digital marketplaces use these algorithms to automate quotes and streamline the purchasing process, while brokers offer tailored advice and human insight for complex coverage needs.

White-label Marketplace

White-label marketplaces enable insurance brokers to offer personalized digital platforms under their own brand, enhancing customer trust and retention by providing seamless access to multiple insurance products. These marketplaces combine the expertise and personalized service of brokers with the convenience and scalability of digital platforms, driving higher engagement and sales conversion rates.

AI-powered Risk Matching

AI-powered risk matching in insurance brokers leverages advanced machine learning algorithms to analyze client data and provide personalized policy recommendations, enhancing accuracy and efficiency. Digital marketplaces utilize AI to aggregate multiple insurer options and instantly match users with optimal coverage based on individual risk profiles, streamlining the comparison and purchasing process.

Broker vs Digital Marketplace Infographic

industrydif.com

industrydif.com