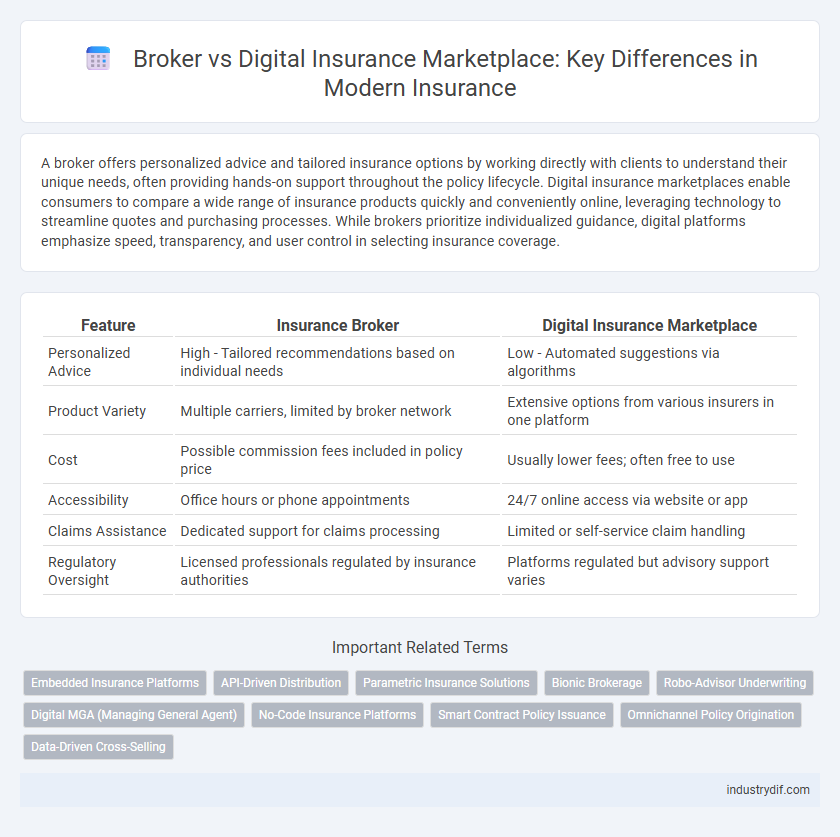

A broker offers personalized advice and tailored insurance options by working directly with clients to understand their unique needs, often providing hands-on support throughout the policy lifecycle. Digital insurance marketplaces enable consumers to compare a wide range of insurance products quickly and conveniently online, leveraging technology to streamline quotes and purchasing processes. While brokers prioritize individualized guidance, digital platforms emphasize speed, transparency, and user control in selecting insurance coverage.

Table of Comparison

| Feature | Insurance Broker | Digital Insurance Marketplace |

|---|---|---|

| Personalized Advice | High - Tailored recommendations based on individual needs | Low - Automated suggestions via algorithms |

| Product Variety | Multiple carriers, limited by broker network | Extensive options from various insurers in one platform |

| Cost | Possible commission fees included in policy price | Usually lower fees; often free to use |

| Accessibility | Office hours or phone appointments | 24/7 online access via website or app |

| Claims Assistance | Dedicated support for claims processing | Limited or self-service claim handling |

| Regulatory Oversight | Licensed professionals regulated by insurance authorities | Platforms regulated but advisory support varies |

Understanding Insurance Brokers

Insurance brokers act as licensed intermediaries who provide personalized advice and tailored policy options by assessing individual client needs and risk profiles. Unlike digital insurance marketplaces that offer automated, comparison-based solutions, brokers offer expert guidance, negotiate on behalf of clients, and assist with claims management. Their hands-on approach ensures comprehensive coverage and supports customers throughout the entire insurance lifecycle.

What is a Digital Insurance Marketplace?

A digital insurance marketplace is an online platform that allows consumers to compare, customize, and purchase insurance policies from multiple providers instantly. Unlike traditional brokers who offer personalized advice and intermediary services, digital marketplaces provide automated tools and transparent pricing, enabling users to make quick, informed decisions. These marketplaces leverage big data and AI algorithms to tailor insurance options, improving accessibility and efficiency in policy selection.

Key Differences Between Brokers and Marketplaces

Brokers provide personalized insurance advice and tailor policies to individual needs, often offering a wider range of coverage options through direct relationships with insurers. Digital insurance marketplaces allow consumers to compare quotes instantly from multiple carriers, emphasizing convenience and price transparency through automated algorithms. Brokers excel in expert guidance and claim support, while marketplaces prioritize speed, user experience, and broad market access.

How Brokers Add Value for Policyholders

Insurance brokers provide personalized guidance by assessing individual risk profiles, ensuring policyholders receive tailored coverage that matches specific needs. Their expertise enables negotiation with insurers to secure better premiums and policy terms, often inaccessible through digital marketplaces. Brokers offer ongoing support through claims assistance and policy management, enhancing the overall customer experience beyond initial purchase.

Benefits of Using Digital Insurance Marketplaces

Digital insurance marketplaces offer consumers a streamlined platform to compare multiple insurance policies side-by-side, enhancing transparency and empowering more informed decisions. These marketplaces often provide instant quotes and policy customization options, saving time compared to traditional broker interactions. Access to broader insurance options and automated tools for policy management further improve convenience and potential cost savings.

Comparing Customer Experience: Broker vs Marketplace

Insurance brokers provide personalized advice and tailored policy recommendations based on individual customer needs, ensuring a human touch throughout the buying process. Digital insurance marketplaces offer a streamlined, self-service platform with instant quotes, price comparisons, and broader options, enhancing convenience and speed for tech-savvy users. Customers seeking expert guidance may prefer brokers, while those valuing autonomy and efficiency often favor digital marketplaces.

Technology’s Role in Modern Insurance Distribution

Technology revolutionizes modern insurance distribution by enabling digital insurance marketplaces to offer personalized policy comparisons and instant quotes through advanced algorithms and AI. Brokers leverage technology to enhance client relationships with tailored advice and efficient portfolio management, combining human expertise with digital tools. Integration of AI, big data, and seamless mobile platforms distinguishes digital marketplaces' scalability from brokers' customized service in the evolving insurance landscape.

Cost Implications: Broker Commissions vs Marketplace Fees

Broker commissions typically range from 10% to 20% of the insurance premium, which can significantly increase overall costs for policyholders. Digital insurance marketplaces often operate with lower fees or flat charges, reducing expenses by eliminating intermediary commissions. This cost difference makes digital platforms a more budget-friendly option for consumers seeking affordable insurance solutions.

Navigating Complex Policies: Human Insight vs Algorithm

Navigating complex insurance policies requires a deep understanding that human brokers provide through personalized advice, interpreting nuanced terms and tailoring coverage to individual needs. Digital insurance marketplaces use sophisticated algorithms to quickly analyze large data sets, offering cost-effective comparisons and streamlined enrollment processes. While algorithms excel in efficiency, human insight remains crucial for addressing unique situations and negotiating exceptions within intricate policy frameworks.

Which Is Right for You—Broker or Digital Marketplace?

Choosing between a broker and a digital insurance marketplace depends on your need for personalized advice versus convenience and speed. Brokers offer tailored policy recommendations based on your unique financial situation and risk profile, while digital marketplaces provide quick access to multiple quotes for easy price comparison. Assess your comfort with technology and desire for human interaction to determine which option aligns best with your insurance goals.

Related Important Terms

Embedded Insurance Platforms

Embedded insurance platforms integrate coverage seamlessly into third-party services, enhancing customer convenience and enabling personalized policy options through real-time data analytics. Brokers offer expert advice and tailored risk assessment, but embedded platforms streamline policy issuance and claims processing by leveraging API-driven ecosystems within digital marketplaces.

API-Driven Distribution

API-driven distribution in digital insurance marketplaces enables seamless integration with multiple insurers, offering consumers real-time policy comparisons and instant quotes, enhancing transparency and choice. Traditional brokers rely on personalized service and expert advice, but digital platforms leverage APIs to automate underwriting, pricing, and claims processing, significantly improving efficiency and scalability.

Parametric Insurance Solutions

Parametric insurance solutions provide predefined payouts triggered by specific measurable events, offering faster claims processing compared to traditional broker-led policies. Digital insurance marketplaces leverage automated data analytics and real-time event monitoring to efficiently match clients with parametric coverage, enhancing transparency and reducing administrative overhead.

Bionic Brokerage

Bionic Brokerage combines the personalized expertise of traditional insurance brokers with the efficiency and transparency of digital insurance marketplaces, leveraging AI-driven analytics to tailor coverage options to individual client needs. This hybrid model enhances risk assessment accuracy and streamlines policy customization, offering a superior client experience compared to conventional brokers or standalone digital platforms.

Robo-Advisor Underwriting

Robo-advisor underwriting in digital insurance marketplaces leverages artificial intelligence and machine learning algorithms to provide fast, personalized policy recommendations based on real-time data analytics, significantly reducing underwriting time and human error compared to traditional brokers. Brokers rely on expert judgment and relationship-building but often face limitations in speed and scalability, whereas robo-advisors enhance efficiency and accessibility in insurance selection and risk assessment.

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced technology to streamline underwriting, policy management, and claims processing, offering faster and more personalized insurance solutions compared to traditional brokers. These platforms aggregate multiple insurers' products in a centralized marketplace, enhancing transparency and competitive pricing for customers while maintaining regulatory compliance and risk management expertise.

No-Code Insurance Platforms

No-code insurance platforms empower brokers and digital insurance marketplaces to rapidly customize and deploy insurance solutions without extensive coding, enhancing operational efficiency and customer engagement. These platforms streamline policy management, automate underwriting processes, and enable seamless integration with multiple carriers, driving innovation in the insurance distribution landscape.

Smart Contract Policy Issuance

Smart contract policy issuance automates underwriting and claim verification processes, enhancing transparency and reducing processing time in digital insurance marketplaces. Traditional brokers often lack this blockchain-based efficiency, leading to slower policy administration and higher operational costs.

Omnichannel Policy Origination

Broker-driven insurance leverages personalized guidance through omnichannel policy origination, integrating phone, in-person, and digital touchpoints to enhance customer trust and tailored coverage solutions. Digital insurance marketplaces optimize omnichannel interactions with seamless self-service portals and instant quotes, enabling efficient policy comparison and rapid purchase decisions.

Data-Driven Cross-Selling

Data-driven cross-selling in insurance brokers leverages personalized client insights and relationship history to recommend tailored products, enhancing customer trust and retention. In contrast, digital insurance marketplaces use advanced algorithms and real-time data analytics to automatically suggest complementary policies, optimizing upsell opportunities at scale.

Broker vs Digital Insurance Marketplace Infographic

industrydif.com

industrydif.com