Manual adjusting relies on on-site visits by claims adjusters to assess damages, which can be time-consuming and subject to human error. Drone-assisted adjusting enhances efficiency by capturing high-resolution aerial imagery and detailed data, enabling faster and more accurate damage evaluations. Integrating drone technology reduces claim processing time and improves safety by minimizing the need for physical inspections in hazardous locations.

Table of Comparison

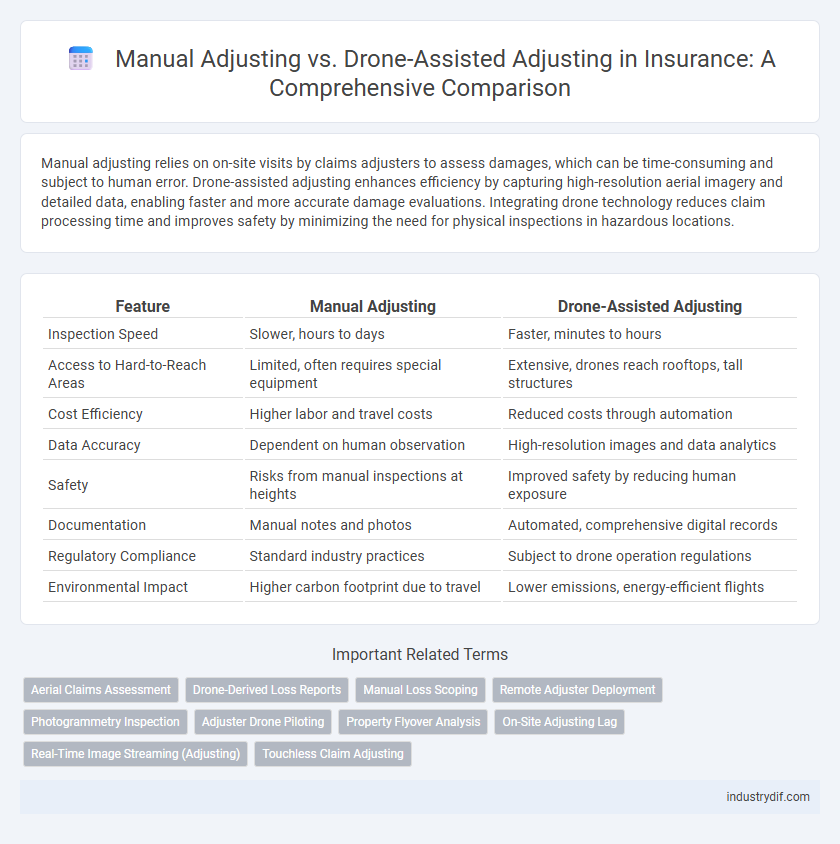

| Feature | Manual Adjusting | Drone-Assisted Adjusting |

|---|---|---|

| Inspection Speed | Slower, hours to days | Faster, minutes to hours |

| Access to Hard-to-Reach Areas | Limited, often requires special equipment | Extensive, drones reach rooftops, tall structures |

| Cost Efficiency | Higher labor and travel costs | Reduced costs through automation |

| Data Accuracy | Dependent on human observation | High-resolution images and data analytics |

| Safety | Risks from manual inspections at heights | Improved safety by reducing human exposure |

| Documentation | Manual notes and photos | Automated, comprehensive digital records |

| Regulatory Compliance | Standard industry practices | Subject to drone operation regulations |

| Environmental Impact | Higher carbon footprint due to travel | Lower emissions, energy-efficient flights |

Introduction to Adjusting Methods in Insurance

Manual adjusting in insurance involves on-site inspections and assessments by human adjusters who evaluate damage, document losses, and determine claim payouts based on firsthand observations. Drone-assisted adjusting leverages unmanned aerial vehicles equipped with high-resolution cameras and sensors to capture detailed imagery of damage, enabling faster and safer assessment of hard-to-reach areas. Integrating drone technology with traditional methods enhances accuracy, reduces assessment time, and improves overall claim processing efficiency in the insurance industry.

Overview of Manual Adjusting in Insurance Claims

Manual adjusting in insurance claims involves human adjusters physically inspecting damages, assessing losses, and determining claim settlements based on firsthand evaluations. This traditional approach relies heavily on the expertise and judgment of adjusters to analyze policy details, negotiate with claimants, and document findings through reports and photographs. Despite being time-intensive, manual adjusting remains essential for complex claims that require nuanced understanding and personalized assessments beyond automated data collection.

Emergence of Drone-Assisted Adjusting Technologies

Drone-assisted adjusting technologies have transformed the insurance industry by enabling faster and more accurate damage assessments, particularly in hard-to-reach or hazardous locations. These advanced drones capture high-resolution images and real-time data, reducing the need for manual inspections and accelerating claim approval processes. As adoption increases, insurers benefit from improved operational efficiency, cost savings, and enhanced customer satisfaction.

Key Differences Between Manual and Drone-Assisted Adjusting

Manual adjusting relies on physical inspections and on-site evaluations conducted by human adjusters, which can be time-consuming and prone to human error. Drone-assisted adjusting utilizes advanced drone technology to capture high-resolution images and data from hard-to-reach or hazardous locations, accelerating damage assessment and improving accuracy. Key differences include increased safety, faster data collection, enhanced precision, and reduced operational costs with drone-assisted methods compared to traditional manual processes.

Speed and Efficiency: Manual vs. Drone-Assisted Adjustments

Drone-assisted adjusting significantly accelerates the claims inspection process by capturing high-resolution aerial images and data in a fraction of the time required for manual assessments. Manual adjusting often involves physical site visits that are time-consuming and limited by terrain accessibility, reducing overall efficiency. The integration of drones reduces manpower needs and expedites damage evaluation, leading to faster claim resolutions and improved operational productivity in insurance adjusting.

Accuracy and Data Collection: Comparing Both Methods

Manual adjusting relies heavily on human expertise and on-site observations, which can introduce variability and potential errors in damage assessment. Drone-assisted adjusting enhances accuracy by capturing high-resolution aerial imagery and real-time data, enabling precise evaluation of hard-to-reach or extensive damage areas. Integrating drone technology with advanced software allows for comprehensive data collection, reducing subjective discrepancies and accelerating claim processing.

Safety Considerations for Adjusters

Manual adjusting exposes insurance adjusters to physical hazards such as unstable structures, hazardous materials, and difficult weather conditions, increasing the risk of injury. Drone-assisted adjusting mitigates these dangers by enabling remote inspection of hard-to-reach or unsafe areas, reducing the need for on-site presence. Enhanced safety protocols and real-time data provided by drones contribute to minimizing workplace accidents and improving overall adjuster safety.

Cost Implications of Manual and Drone-Assisted Adjusting

Manual adjusting in insurance claims often incurs higher labor costs due to extensive on-site inspections and prolonged assessment times. Drone-assisted adjusting significantly reduces expenses by enabling rapid, accurate damage evaluation from aerial data, minimizing the need for physical presence and accelerating claim processing. This technology-driven approach also lowers risk-related costs, such as potential injuries during inspections, leading to overall enhanced cost-efficiency for insurers.

Regulatory and Compliance Factors

Manual adjusting in insurance claims is subject to established regulatory frameworks that mandate strict documentation and verification processes to ensure compliance with privacy and data protection laws. Drone-assisted adjusting introduces new challenges, requiring adherence to aviation regulations, airspace permissions, and enhanced data security standards to protect sensitive claimant information. Insurers must balance these compliance requirements by integrating drone technology within existing legal structures to maintain accuracy and accountability.

Future Trends: The Evolving Role of Technology in Insurance Adjusting

Drone-assisted adjusting is revolutionizing the insurance industry by providing faster, safer, and more accurate damage assessments, especially in hard-to-reach areas affected by natural disasters. Advanced AI algorithms integrated with drone-captured data enhance claim evaluation precision, reducing operational costs and improving customer satisfaction. Future trends indicate increased adoption of autonomous drones and real-time data analytics, positioning technology as a critical driver in streamlining insurance adjusting workflows.

Related Important Terms

Aerial Claims Assessment

Drone-assisted adjusting revolutionizes aerial claims assessment by providing real-time high-resolution imagery and precise damage mapping, significantly reducing inspection time and improving accuracy compared to manual adjusting. This technology enhances risk evaluation, expedites claim processing, and minimizes human error in insurance assessments.

Drone-Derived Loss Reports

Drone-derived loss reports enhance accuracy and efficiency in insurance claims by providing high-resolution images and real-time data, reducing human error and accelerating the assessment process. These reports enable insurers to quickly identify damage extent, improving claim settlements while minimizing inspection costs compared to traditional manual adjusting methods.

Manual Loss Scoping

Manual loss scoping in insurance claims involves detailed physical inspections by adjusters to accurately assess damages, ensuring precise valuation and minimizing fraudulent claims. This traditional method allows for nuanced judgment in complex scenarios where automated or drone-assisted data may lack contextual understanding.

Remote Adjuster Deployment

Drone-assisted adjusting revolutionizes remote adjuster deployment by enabling fast, accurate damage assessments in inaccessible or hazardous locations, reducing on-site inspection time by up to 70%. Manual adjusting, while thorough, limits remote reach and increases response time, often necessitating multiple visits to gather comprehensive data.

Photogrammetry Inspection

Manual adjusting relies on in-person assessments, which can be time-consuming and prone to human error, whereas drone-assisted adjusting employs photogrammetry inspection techniques to capture high-resolution, precise imagery for accurate damage evaluation. This technology streamlines the claims process, enabling faster, safer, and more comprehensive damage assessments in insurance settlements.

Adjuster Drone Piloting

Adjuster drone piloting significantly enhances damage assessment accuracy and efficiency compared to manual adjusting by capturing high-resolution aerial images and real-time data in hard-to-reach areas. This technology reduces inspection time by up to 70%, minimizes human error, and improves claim processing speed in insurance evaluations.

Property Flyover Analysis

Manual adjusting relies on physical inspections to assess property damage, which can be time-consuming and prone to human error, while drone-assisted adjusting uses aerial flyover analysis for rapid, detailed, and accurate property evaluations. Drone technology enhances property flyover analysis by capturing high-resolution images and real-time data, improving claim accuracy and accelerating the insurance adjustment process.

On-Site Adjusting Lag

Manual adjusting often faces significant on-site adjusting lag due to the time required for physical inspections, travel, and data collection, delaying claim settlements. Drone-assisted adjusting reduces this lag by providing rapid aerial assessments and real-time data, enabling faster damage evaluations and more efficient claims processing.

Real-Time Image Streaming (Adjusting)

Manual adjusting often involves delayed claim assessments due to on-site inspections and physical documentation, whereas drone-assisted adjusting leverages real-time image streaming to provide instant aerial views of damages, enabling faster and more accurate claim evaluations. Real-time image streaming via drones enhances risk assessment precision, reduces adjustment time, and accelerates claim settlements by delivering high-resolution visuals directly to adjusters.

Touchless Claim Adjusting

Touchless claim adjusting significantly reduces processing time and enhances accuracy by leveraging drone-assisted technology to capture detailed site imagery remotely, minimizing human error and physical inspections. Manual adjusting, while traditional, often involves longer delays and increased risk exposure due to on-site inspections and subjective assessments.

Manual Adjusting vs Drone-Assisted Adjusting Infographic

industrydif.com

industrydif.com