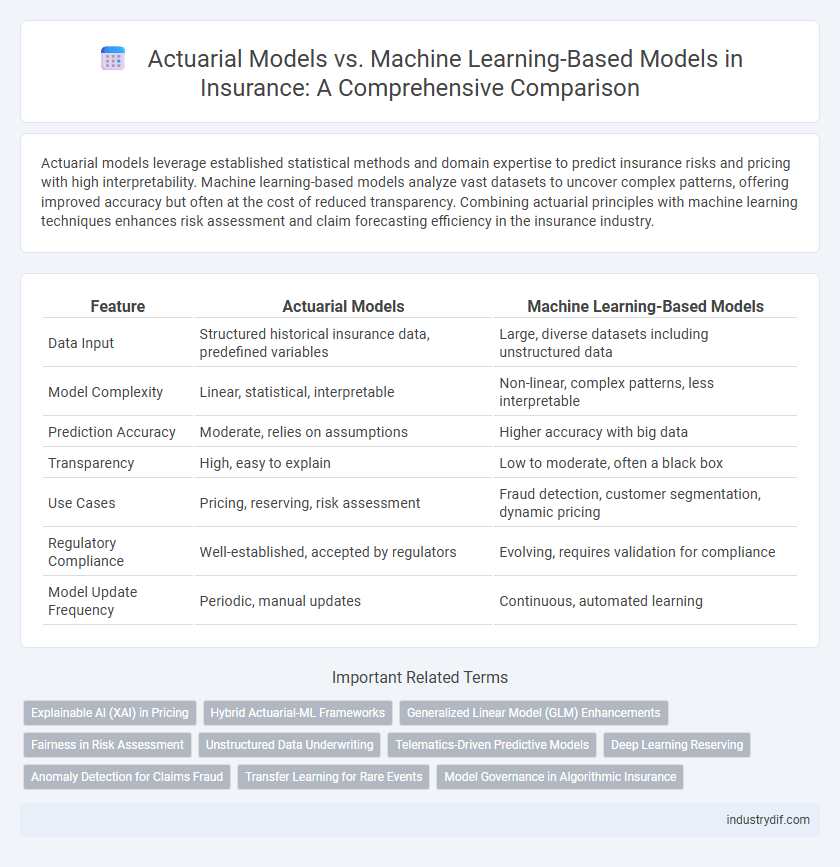

Actuarial models leverage established statistical methods and domain expertise to predict insurance risks and pricing with high interpretability. Machine learning-based models analyze vast datasets to uncover complex patterns, offering improved accuracy but often at the cost of reduced transparency. Combining actuarial principles with machine learning techniques enhances risk assessment and claim forecasting efficiency in the insurance industry.

Table of Comparison

| Feature | Actuarial Models | Machine Learning-Based Models |

|---|---|---|

| Data Input | Structured historical insurance data, predefined variables | Large, diverse datasets including unstructured data |

| Model Complexity | Linear, statistical, interpretable | Non-linear, complex patterns, less interpretable |

| Prediction Accuracy | Moderate, relies on assumptions | Higher accuracy with big data |

| Transparency | High, easy to explain | Low to moderate, often a black box |

| Use Cases | Pricing, reserving, risk assessment | Fraud detection, customer segmentation, dynamic pricing |

| Regulatory Compliance | Well-established, accepted by regulators | Evolving, requires validation for compliance |

| Model Update Frequency | Periodic, manual updates | Continuous, automated learning |

Introduction to Actuarial and Machine Learning-Based Models

Actuarial models use statistical methods and historical insurance data to estimate risk and calculate premiums based on probability theory and life contingencies. Machine learning-based models leverage large datasets and algorithms such as neural networks and decision trees to identify complex patterns and improve predictive accuracy in underwriting and claims forecasting. Integrating actuarial science with machine learning enhances risk assessment by combining domain expertise with data-driven insights.

Historical Evolution of Actuarial Models in Insurance

Actuarial models in insurance have evolved from simple statistical methods based on historical loss data to sophisticated techniques incorporating probability theory and mortality tables. Traditionally, these models relied heavily on manually curated datasets and expert judgment to estimate risk and set premiums accurately. Over time, advances in computing power enabled more complex actuarial models, integrating multivariate analysis and stochastic processes to enhance predictive precision.

Key Principles of Traditional Actuarial Methods

Traditional actuarial methods rely on statistical techniques such as generalized linear models (GLMs) and credibility theory to estimate insurance risks and premiums. These models emphasize interpretability, adherence to regulatory standards, and the use of historical claims data to ensure accuracy and consistency in predictions. Actuarial principles prioritize understanding underlying risk factors and maintaining stability over time, enabling reliable long-term financial forecasting for insurance products.

Overview of Machine Learning Applications in Insurance

Machine learning applications in insurance revolutionize risk assessment by leveraging vast datasets to identify patterns and predict claims more accurately than traditional actuarial models. Techniques such as natural language processing, image recognition, and predictive analytics enable insurers to enhance fraud detection, optimize pricing strategies, and personalize customer experiences. These data-driven models improve underwriting efficiency and claims management, driving innovation in the insurance industry's digital transformation.

Data Requirements: Actuarial vs. Machine Learning Models

Actuarial models rely heavily on structured historical insurance datasets, such as claims history, policyholder demographics, and risk factors, requiring well-curated and standardized data for accurate risk assessment. Machine learning-based models demand vast amounts of diverse and high-dimensional data, including unstructured sources like social media, telematics, and sensor data, to identify complex patterns and improve predictive accuracy. The data preprocessing and feature engineering in machine learning models are more intensive to handle data variability and noise compared to traditional actuarial approaches.

Predictive Accuracy and Model Performance Comparison

Actuarial models in insurance rely heavily on statistical methods and domain expertise to estimate risk and set premiums, often excelling in interpretability but sometimes lagging in predictive accuracy when faced with complex or non-linear data. Machine learning-based models leverage algorithms like gradient boosting, random forests, and neural networks to enhance predictive accuracy by capturing intricate data patterns and interactions, resulting in superior model performance on large, high-dimensional datasets. Comparative studies reveal that machine learning models consistently outperform traditional actuarial approaches in claims forecasting and risk segmentation, yet they require careful validation and transparency to ensure regulatory compliance and trust.

Interpretability and Transparency in Model Outputs

Actuarial models offer high interpretability and transparency due to their reliance on well-established statistical techniques and clearly defined assumptions, allowing actuaries to explain risk and pricing decisions confidently. Machine learning-based models often deliver superior predictive accuracy but typically operate as black boxes, making it challenging to interpret complex patterns and understand the rationale behind predictions. Balancing model transparency with predictive performance remains critical for regulatory compliance and stakeholder trust in insurance risk assessment.

Regulatory Implications and Compliance Concerns

Actuarial models, grounded in established statistical methods, align closely with regulatory frameworks requiring transparency and explainability, facilitating compliance with standards such as Solvency II and IFRS 17. Machine learning-based models, while offering enhanced predictive accuracy, raise concerns regarding model interpretability, algorithmic bias, and data privacy, complicating adherence to regulatory mandates and increasing scrutiny from bodies like the NAIC and EIOPA. Insurers must balance innovation with compliance by implementing robust validation processes, continuous monitoring, and transparent reporting to meet evolving regulatory expectations.

Future Trends: Integration of Actuarial Science and AI

Future trends in insurance highlight the integration of actuarial science with AI, leveraging machine learning algorithms to enhance risk assessment accuracy and predictive analytics. Actuarial models will increasingly incorporate big data and AI-driven insights to optimize pricing strategies and claims management. This fusion promises more adaptive, real-time decision-making frameworks that improve underwriting efficiency and customer experience.

Challenges and Opportunities for Insurers

Actuarial models provide established frameworks based on statistical methods and historical data, offering transparency and regulatory acceptance in insurance risk assessment. Machine learning-based models introduce opportunities for improved predictive accuracy and handling complex, high-dimensional data, but face challenges including interpretability, data quality requirements, and integration with traditional actuarial practices. Insurers must balance model reliability and innovation to optimize pricing, underwriting, and claims management while addressing regulatory compliance and stakeholder trust.

Related Important Terms

Explainable AI (XAI) in Pricing

Actuarial models in insurance pricing rely on traditional statistical techniques grounded in domain expertise, providing transparent and interpretable risk assessments aligned with regulatory standards. Machine learning-based models offer enhanced predictive accuracy but often lack inherent explainability; integrating Explainable AI (XAI) techniques such as SHAP values, LIME, and surrogate models improves transparency, enabling insurers to validate pricing decisions, ensure compliance, and maintain policyholder trust.

Hybrid Actuarial-ML Frameworks

Hybrid actuarial-machine learning frameworks combine traditional actuarial models' statistical rigor with machine learning's ability to capture complex, nonlinear patterns in insurance risk assessment. This integration enhances predictive accuracy and adaptability in pricing, reserving, and fraud detection by leveraging actuarial assumptions alongside data-driven algorithms.

Generalized Linear Model (GLM) Enhancements

Generalized Linear Models (GLMs) remain foundational in actuarial science for risk assessment and premium calculation, offering clear interpretability and regulatory compliance. Enhancements leveraging machine learning techniques, such as gradient boosting and regularization methods, improve predictive accuracy while preserving the structural advantages of traditional GLMs in insurance pricing and underwriting.

Fairness in Risk Assessment

Actuarial models rely on historical data and predefined risk factors to ensure consistent and interpretable risk assessments, while machine learning-based models analyze vast datasets to uncover complex patterns, potentially improving predictive accuracy but raising concerns about bias and fairness. Ensuring fairness in risk assessment requires rigorous validation and transparency criteria, balancing the actuarial rigor with the adaptive capabilities of machine learning to prevent discriminatory outcomes in insurance underwriting.

Unstructured Data Underwriting

Actuarial models in insurance rely heavily on structured historical data and predefined statistical assumptions, providing transparent and interpretable risk assessments, while machine learning-based models leverage unstructured data sources such as text, images, and sensor data to enhance underwriting accuracy by uncovering complex patterns and correlations. The integration of machine learning techniques enables insurers to process vast volumes of unstructured data from social media, claims notes, and telematics, resulting in more precise risk segmentation and improved predictive underwriting performance.

Telematics-Driven Predictive Models

Telematics-driven predictive models in insurance leverage real-time driving data to enhance risk assessment accuracy, outperforming traditional actuarial models by capturing dynamic behavioral patterns. Machine learning algorithms analyze vast telematics datasets to identify nuanced risk factors and personalize premiums, enabling more precise underwriting and claims management.

Deep Learning Reserving

Deep learning reserving models leverage complex neural networks to analyze vast insurance claim datasets, enabling more precise loss reserve predictions than traditional actuarial models relying on deterministic methods. These models improve accuracy by capturing nonlinear patterns and interactions in claim development, enhancing risk assessment and capital allocation for insurers.

Anomaly Detection for Claims Fraud

Actuarial models in insurance rely on statistical techniques and historical data to predict claims fraud, primarily focusing on known patterns and predefined risk factors. Machine learning-based models enhance anomaly detection by identifying complex, non-linear patterns and emerging fraudulent behaviors through adaptive algorithms and large datasets.

Transfer Learning for Rare Events

Transfer learning enhances actuarial models by leveraging pre-trained machine learning algorithms to improve predictions for rare insurance events with limited data, increasing accuracy in risk assessment. This approach reduces model development time and mitigates overfitting risks by transferring knowledge from related domains, enabling better handling of sparse claim occurrences.

Model Governance in Algorithmic Insurance

Actuarial models in insurance rely on established statistical methods and regulatory compliance frameworks to ensure transparent model governance, whereas machine learning-based models demand advanced governance protocols to address challenges in explainability, data bias, and algorithmic risk management. Effective governance in algorithmic insurance requires integrating continuous monitoring, validation, and documentation processes tailored to the complexity and dynamic nature of machine learning models compared to traditional actuarial approaches.

Actuarial Models vs Machine Learning-Based Models Infographic

industrydif.com

industrydif.com