Insurance premium pricing relies on traditional risk assessment, calculating costs based on historical data and individual policyholder characteristics. Parametric pricing offers a more transparent approach by triggering payouts when predefined parameters, such as weather events or natural disasters, are met, bypassing the need for loss adjustment. This method reduces administrative expenses and accelerates claims settlement, making it particularly effective for managing risks with measurable triggers.

Table of Comparison

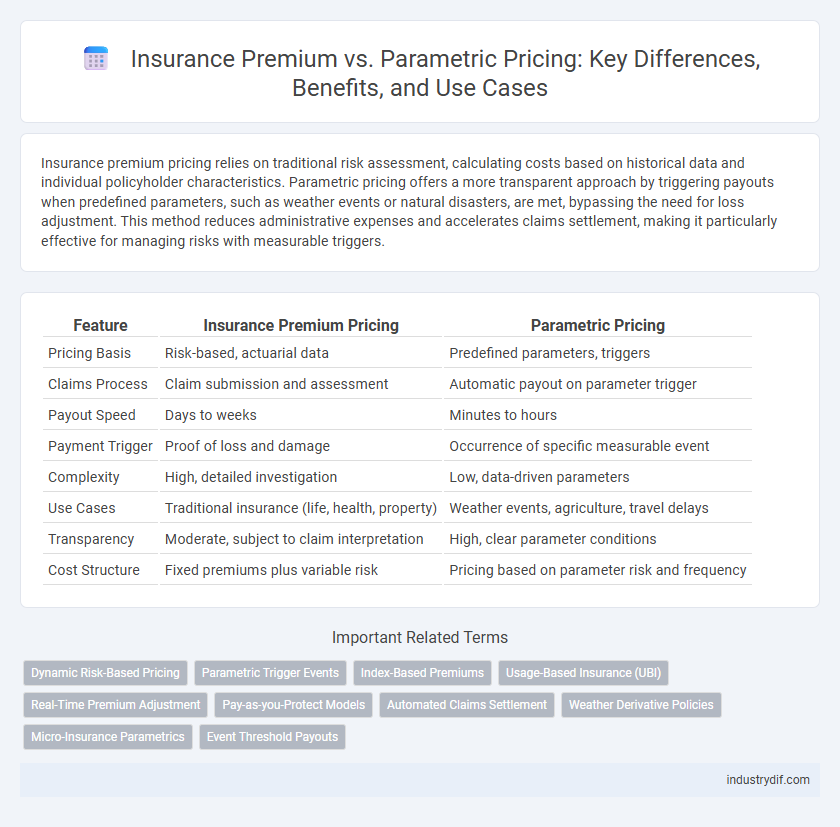

| Feature | Insurance Premium Pricing | Parametric Pricing |

|---|---|---|

| Pricing Basis | Risk-based, actuarial data | Predefined parameters, triggers |

| Claims Process | Claim submission and assessment | Automatic payout on parameter trigger |

| Payout Speed | Days to weeks | Minutes to hours |

| Payment Trigger | Proof of loss and damage | Occurrence of specific measurable event |

| Complexity | High, detailed investigation | Low, data-driven parameters |

| Use Cases | Traditional insurance (life, health, property) | Weather events, agriculture, travel delays |

| Transparency | Moderate, subject to claim interpretation | High, clear parameter conditions |

| Cost Structure | Fixed premiums plus variable risk | Pricing based on parameter risk and frequency |

Understanding Insurance Premiums: Traditional Models

Traditional insurance premiums are calculated based on historical data, risk assessments, and individual policyholder information to estimate potential future losses and expenses. These models rely heavily on actuarial analysis and detailed underwriting processes to determine the appropriate premium amount for coverage. Unlike parametric pricing, which pays out based on triggered events, traditional premiums involve indemnity payments that require claim verification and loss adjustment.

What is Parametric Pricing in Insurance?

Parametric pricing in insurance is a method where payouts are triggered by predefined parameters or events, such as weather conditions or natural disasters, rather than actual losses. This approach offers faster claim settlements and reduces administrative costs by relying on objective data from trusted sources like satellite measurements or seismic sensors. Unlike traditional insurance premiums, which are based on risk assessments and individual claims, parametric pricing enhances transparency and predictability for both insurers and policyholders.

Key Differences: Insurance Premiums vs Parametric Pricing

Insurance premiums are fixed amounts paid regularly based on risk assessments, underwriting criteria, and policy terms, providing coverage against specific losses. Parametric pricing, however, relies on predefined triggers or parameters such as weather events or natural disasters to automatically disburse payments, bypassing traditional claims processes. The key difference lies in insurance premiums being claim-dependent payments, while parametric pricing offers rapid, trigger-based payouts without the need for loss adjustment.

Benefits of Traditional Premium-Based Insurance

Traditional premium-based insurance offers personalized coverage by assessing individual risk factors, ensuring tailored protection for policyholders. It provides stable financial planning through predictable premium payments aligned with actual claims experience. This method fosters long-term relationships between insurers and clients, enhancing trust and customer service quality.

Advantages of Parametric Pricing for Policyholders

Parametric pricing offers policyholders faster claim settlements by triggering payouts based on predefined event parameters, reducing the need for lengthy loss assessments. This approach enhances transparency and predictability, allowing policyholders to better manage their financial planning with clear coverage conditions. Additionally, parametric insurance often lowers administrative costs, resulting in more affordable premiums and increased access to coverage for diverse risks.

Claims Processes: Traditional vs Parametric Approaches

Traditional insurance premium models involve complex claims processes requiring extensive documentation and long verification periods, often delaying payouts. Parametric insurance streamlines claims by triggering automatic payments based on predefined parameters such as weather data or natural disaster metrics, eliminating the need for individual loss assessments. This approach enhances efficiency and transparency, reducing administrative costs and speeding up financial relief for policyholders.

Risk Assessment Techniques in Both Models

Insurance premium pricing relies on traditional risk assessment techniques that analyze historical data, individual policyholder information, and actuarial models to calculate the probability and financial impact of potential claims. Parametric pricing uses predefined triggers based on measurable parameters, such as weather indexes or seismic activity, to quickly quantify risk exposure without detailed loss adjustment. Both models incorporate advanced data analytics and machine learning algorithms to enhance accuracy, but parametric pricing emphasizes speed and transparency by paying out based on verified event data rather than claim investigations.

Cost Predictability and Transparency: A Comparative Analysis

Insurance premium pricing typically involves assessing risk factors and historical data to calculate expected costs, which can lead to variability and complexity in premium rates. Parametric pricing offers enhanced cost predictability by triggering payments based on predefined parameters such as weather thresholds or seismic activity, increasing transparency and reducing disputes. This comparative approach highlights parametric pricing's advantage in providing clear, data-driven cost structures, while traditional premiums might fluctuate due to subjective underwriting and claims adjustments.

Industry Applications: When to Use Each Model

Insurance premiums are best suited for traditional risk models involving individual loss assessments and claims, commonly applied in auto, health, and property insurance sectors. Parametric pricing excels in scenarios requiring rapid payouts based on predefined triggers, such as weather events in agricultural insurance or natural disasters in catastrophe bonds. Selecting between premium and parametric models depends on the predictability of risks, speed of claim settlement needs, and data availability within industry applications.

Future Trends: Evolving Insurance Pricing Strategies

Future insurance pricing strategies increasingly embrace parametric pricing, leveraging real-time data and IoT devices to create transparent, event-driven payouts that streamline claims processing. Traditional insurance premiums, based on historical risk assessments, face transformation through AI-powered analytics enabling personalized, dynamic pricing models that reflect individual risk profiles more accurately. The convergence of big data, blockchain, and machine learning drives innovation in risk quantification, reducing asymmetry while enhancing customer trust and operational efficiency.

Related Important Terms

Dynamic Risk-Based Pricing

Dynamic risk-based pricing in insurance leverages real-time data and parametric triggers to adjust premiums accurately according to actual risk exposure, unlike traditional insurance premium models that often rely on static risk assessments. Parametric pricing enhances transparency and efficiency by automating payouts based on predefined parameters, reducing underwriting complexity and improving responsiveness to evolving risk factors.

Parametric Trigger Events

Parametric pricing in insurance relies on predefined trigger events such as specific weather conditions, earthquake magnitudes, or flood levels, enabling faster and more transparent claim settlements compared to traditional premium-based models. This method reduces ambiguity by automating payouts once measurable parameters are met, improving efficiency and policyholder trust in risk transfer mechanisms.

Index-Based Premiums

Index-based premiums in insurance leverage parametric pricing by triggering payouts based on predefined indices such as weather data or economic indicators, enhancing transparency and efficiency. This method reduces claims processing time and administrative costs compared to traditional insurance premiums, which rely on loss assessments and individual risk evaluations.

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) pricing leverages telematics data to calculate premiums based on actual driving behavior, offering more personalized and dynamic risk assessment compared to traditional insurance premiums that rely on static factors like demographics and historical claims. Parametric pricing in UBI triggers automatic payouts upon predefined events such as mileage thresholds or harsh braking incidents, enhancing transparency and accelerating claims processing while reducing administrative costs.

Real-Time Premium Adjustment

Real-time premium adjustment in insurance leverages parametric pricing models that use predefined triggers linked to measurable events, enabling immediate recalibration of premiums based on actual risk exposures. This dynamic approach contrasts with traditional fixed insurance premiums by enhancing risk accuracy, reducing delays in coverage costs, and fostering more responsive financial protection for policyholders.

Pay-as-you-Protect Models

Pay-as-you-protect models leverage parametric pricing by using predefined trigger events to instantly pay claims, contrasting with traditional insurance premiums that rely on risk assessment and loss adjustments. This approach enhances transparency and efficiency, reducing claim processing time and aligning costs more closely with actual exposure to risk.

Automated Claims Settlement

Parametric pricing leverages predefined parameters and real-time data to automate claims settlement, significantly reducing processing time compared to traditional insurance premium models. This approach minimizes friction and accelerates payouts by triggering automatic compensation once specific event thresholds are met.

Weather Derivative Policies

Weather derivative policies utilize parametric pricing by triggering payouts based on predefined weather indices, offering a clear alternative to traditional insurance premiums that depend on loss assessments. This model enhances risk management efficiency by providing faster claims settlement and reducing administrative costs linked to subjective damage evaluation in weather-related insurance coverage.

Micro-Insurance Parametrics

Micro-insurance parametric pricing leverages predefined triggers such as weather events or seismic activity to automate claim payouts, reducing administrative costs and enabling faster settlements compared to traditional insurance premiums based on assessed risk factors. This model enhances accessibility for low-income populations by offering affordable, transparent coverage and minimizes basis risk through data-driven parametric indices tailored to specific micro-level exposures.

Event Threshold Payouts

Insurance premium pricing relies on actuarial assessments of risk and historical loss data, resulting in variable payouts based on claim investigations, while parametric pricing offers predefined, event threshold payouts triggered by specific, measurable parameters such as wind speed or rainfall levels. Parametric insurance reduces claims processing time and uncertainty by automating payouts once a predetermined event threshold is met, enhancing transparency and efficiency in disaster risk management.

Insurance premium vs Parametric pricing Infographic

industrydif.com

industrydif.com