Underwriting evaluates individual risk factors such as health history or driving records to determine an insurance premium, while behavioral pricing relies on real-time data from policyholder actions like driving habits or lifestyle choices. Behavioral pricing allows insurers to tailor rates more dynamically, incentivizing safer behavior and potentially lowering costs for low-risk customers. Both methods aim to balance risk assessment with fair pricing, but behavioral pricing offers a more personalized and data-driven approach.

Table of Comparison

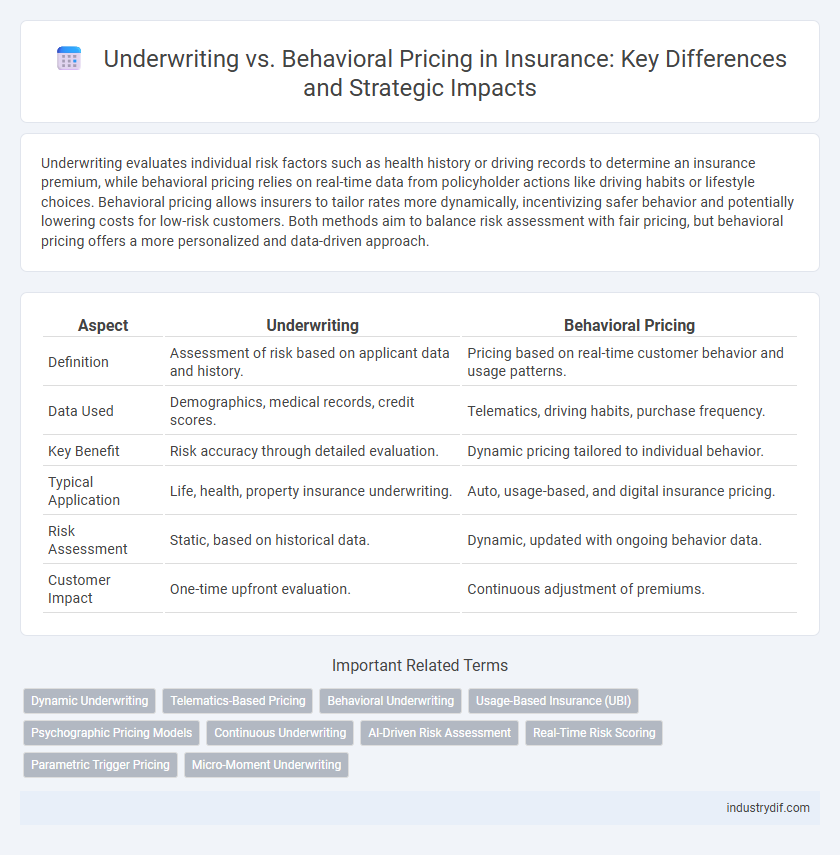

| Aspect | Underwriting | Behavioral Pricing |

|---|---|---|

| Definition | Assessment of risk based on applicant data and history. | Pricing based on real-time customer behavior and usage patterns. |

| Data Used | Demographics, medical records, credit scores. | Telematics, driving habits, purchase frequency. |

| Key Benefit | Risk accuracy through detailed evaluation. | Dynamic pricing tailored to individual behavior. |

| Typical Application | Life, health, property insurance underwriting. | Auto, usage-based, and digital insurance pricing. |

| Risk Assessment | Static, based on historical data. | Dynamic, updated with ongoing behavior data. |

| Customer Impact | One-time upfront evaluation. | Continuous adjustment of premiums. |

Understanding Underwriting in Insurance

Underwriting in insurance involves assessing risk by evaluating an applicant's personal information, health status, and financial history to determine coverage eligibility and premium rates. This process ensures that insurers set appropriate premiums reflecting the likelihood of claims while protecting against adverse selection. Accurate underwriting balances risk management with fair pricing, directly influencing the insurer's profitability and policyholder satisfaction.

Introduction to Behavioral Pricing

Behavioral pricing in insurance assesses individual risk by analyzing customer behaviors and data patterns beyond traditional underwriting metrics such as age and medical history. This approach leverages telematics, wearable devices, and real-time data to personalize premiums based on driving habits, lifestyle choices, and health behaviors. Insurers using behavioral pricing can offer more accurate risk assessments and incentivize safer behaviors while complementing conventional underwriting processes.

Key Differences Between Underwriting and Behavioral Pricing

Underwriting assesses risk using historical data, medical history, and credit scores to determine eligibility and premium rates in insurance policies. Behavioral pricing adjusts premiums based on real-time customer behaviors such as driving habits tracked via telematics or health activities monitored through wearable devices. The key difference lies in underwriting's static evaluation versus behavioral pricing's dynamic, personalized approach to risk assessment and premium determination.

Traditional Underwriting: Process and Criteria

Traditional underwriting in insurance involves a thorough evaluation of an applicant's risk profile based on factors such as age, health history, occupation, and lifestyle habits. This process relies on medical examinations, detailed questionnaires, and credit scores to determine eligibility and premium rates. Underwriting criteria prioritize statistical risk data and actuarial models to ensure accurate risk assessment and appropriate pricing.

The Role of Data Analytics in Behavioral Pricing

Data analytics plays a crucial role in behavioral pricing by leveraging vast amounts of customer data to assess risk more accurately than traditional underwriting methods. Advanced algorithms analyze patterns in behavior, such as driving habits or lifestyle choices, allowing insurers to personalize premiums based on real-time risk factors. This data-driven approach enhances pricing precision, reduces adverse selection, and improves overall profitability for insurance companies.

Risk Assessment Methods: Underwriting vs Behavioral Pricing

Risk assessment in insurance employs underwriting to evaluate individual risk factors through detailed analysis of applicant information, medical history, and credit scores, enabling personalized policy terms. Behavioral pricing leverages real-time data from customer behavior, such as driving patterns or lifestyle habits, to dynamically adjust premiums based on observed risk levels. Underwriting remains static and historical, while behavioral pricing offers continuous risk monitoring, enhancing precision in premium determination.

Impact on Premium Calculation

Underwriting evaluates individual risk factors such as health history and occupation to set insurance premiums, resulting in personalized pricing based on assessed risk. Behavioral pricing uses real-time data from policyholders' actions, like driving habits or lifestyle choices, to dynamically adjust premiums, promoting risk-reducing behavior. This shift toward behavioral pricing enhances premium accuracy by linking costs directly to actual risk exposure and individual behavior patterns.

Advantages and Limitations of Underwriting

Underwriting in insurance allows for precise risk assessment by analyzing individual applicant data, leading to tailored premiums and reduced adverse selection. Its advantages include enhanced risk mitigation and better alignment of coverage with individual risk profiles. However, underwriting is limited by the time-consuming nature of data collection and potential biases, which can reduce efficiency and lead to unfair premium pricing.

Benefits and Challenges of Behavioral Pricing

Behavioral pricing in insurance leverages real-time data from telematics and wearable devices to tailor premiums based on individual risk profiles, enhancing pricing accuracy and promoting safer behavior among policyholders. This approach enables insurers to offer personalized discounts, improve customer engagement, and reduce claim frequency, driving overall portfolio profitability. Challenges include concerns over data privacy, regulatory compliance, and potential biases in algorithmic risk assessment, requiring transparent communication and robust data security measures.

Future Trends: Integrating Underwriting and Behavioral Pricing

Integrating underwriting with behavioral pricing leverages advanced data analytics and machine learning to enhance risk assessment accuracy in insurance. Future trends indicate a shift towards real-time behavioral data incorporation, enabling more personalized and dynamic policy pricing based on individual risk behaviors. This fusion improves predictive modeling, reducing loss ratios and increasing customer engagement through tailored insurance products.

Related Important Terms

Dynamic Underwriting

Dynamic underwriting leverages real-time data analytics and machine learning algorithms to continuously assess risk profiles, enabling insurers to adjust policy terms more accurately than traditional underwriting methods. This approach integrates behavioral pricing by analyzing customer behavior patterns such as driving habits or health metrics, resulting in personalized premiums that reflect actual risk exposure dynamically.

Telematics-Based Pricing

Telematics-based pricing leverages real-time driving data to enhance underwriting accuracy and personalize insurance premiums, reducing risk assessment uncertainty compared to traditional methods. Incorporating behavioral analytics enables insurers to reward safe driving habits, fostering improved risk management and cost-efficiency in policy pricing.

Behavioral Underwriting

Behavioral underwriting utilizes data on a policyholder's real-time actions and lifestyle choices to assess risk more accurately than traditional underwriting methods, enhancing pricing precision. By integrating behavioral pricing models, insurers can tailor premiums based on driving habits, health behaviors, or financial responsibility, leading to personalized coverage and improved risk management.

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) leverages telematics data to assess driving behavior in real time, enabling more precise risk evaluation compared to traditional underwriting methods that rely on historical and demographic factors. Behavioral pricing models incorporate metrics such as mileage, speed, and braking patterns to tailor premiums, enhancing fairness and incentivizing safer driving habits.

Psychographic Pricing Models

Psychographic pricing models in insurance leverage customer lifestyle, values, and personality traits to enhance risk assessment beyond traditional underwriting metrics, enabling more personalized premium calculations. These models utilize behavioral data analytics to predict policyholder behavior, improving pricing accuracy and fostering tailored insurance products.

Continuous Underwriting

Continuous underwriting utilizes real-time data analytics to dynamically assess risk throughout the policy lifecycle, enhancing pricing accuracy compared to traditional underwriting methods. Behavioral pricing integrates customer behavior metrics to personalize premiums, but continuous underwriting offers a more comprehensive risk evaluation by continuously updating underwriting decisions based on evolving data.

AI-Driven Risk Assessment

AI-driven risk assessment in insurance enhances underwriting precision by analyzing vast datasets to identify risk factors and predict claim likelihood more accurately. Behavioral pricing leverages real-time customer behavior data through AI algorithms to personalize premiums, optimizing risk evaluation and competitive pricing strategies.

Real-Time Risk Scoring

Underwriting traditionally assesses risk through fixed criteria and historical data, whereas behavioral pricing leverages real-time risk scoring by analyzing dynamic customer behaviors and telematics data to adjust premiums instantly. Real-time risk scoring enhances accuracy in pricing by continuously evaluating driving patterns, usage, and environmental factors, leading to more personalized and fair insurance rates.

Parametric Trigger Pricing

Parametric trigger pricing uses predefined parameters, such as weather events or natural disasters, to automate insurance payouts, enhancing speed and transparency compared to traditional underwriting that assesses individual risk profiles. This approach reduces administrative costs and mitigates moral hazard by linking claims directly to objective, measurable events rather than subjective behavioral data.

Micro-Moment Underwriting

Micro-Moment Underwriting leverages real-time behavioral data and contextual insights to assess risk with greater precision, enhancing the accuracy of policy pricing beyond traditional underwriting models. By analyzing moment-to-moment actions and decisions, insurers can dynamically adjust premiums, offering personalized coverage that aligns closely with individual risk profiles.

Underwriting vs Behavioral Pricing Infographic

industrydif.com

industrydif.com