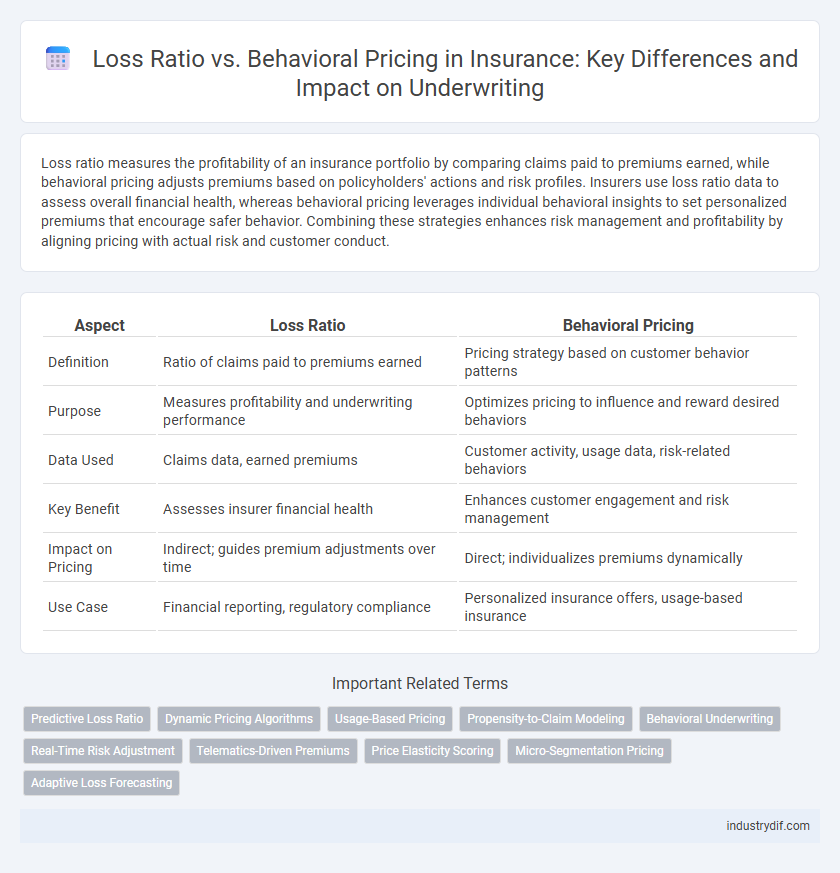

Loss ratio measures the profitability of an insurance portfolio by comparing claims paid to premiums earned, while behavioral pricing adjusts premiums based on policyholders' actions and risk profiles. Insurers use loss ratio data to assess overall financial health, whereas behavioral pricing leverages individual behavioral insights to set personalized premiums that encourage safer behavior. Combining these strategies enhances risk management and profitability by aligning pricing with actual risk and customer conduct.

Table of Comparison

| Aspect | Loss Ratio | Behavioral Pricing |

|---|---|---|

| Definition | Ratio of claims paid to premiums earned | Pricing strategy based on customer behavior patterns |

| Purpose | Measures profitability and underwriting performance | Optimizes pricing to influence and reward desired behaviors |

| Data Used | Claims data, earned premiums | Customer activity, usage data, risk-related behaviors |

| Key Benefit | Assesses insurer financial health | Enhances customer engagement and risk management |

| Impact on Pricing | Indirect; guides premium adjustments over time | Direct; individualizes premiums dynamically |

| Use Case | Financial reporting, regulatory compliance | Personalized insurance offers, usage-based insurance |

Understanding Loss Ratio in Insurance

Loss ratio in insurance measures the proportion of claims paid to premiums earned, serving as a key indicator of an insurer's financial health. A low loss ratio typically suggests efficient underwriting and profitability, while a high loss ratio may indicate pricing deficiencies or increased claims frequency. Understanding loss ratio enables insurers to refine behavioral pricing models, aligning premiums more accurately with individual risk profiles to enhance risk segmentation and policyholder fairness.

Defining Behavioral Pricing

Behavioral pricing in insurance refers to setting premiums based on individual customer behavior data, such as driving habits or payment patterns, rather than traditional risk factors alone. This approach aims to more accurately align insurance costs with actual risk, potentially reducing the loss ratio by discouraging high-risk behavior. By leveraging telematics and data analytics, insurers can create personalized pricing models that improve risk assessment and policyholder engagement.

Loss Ratio Calculation and Significance

Loss ratio calculation measures the percentage of claims paid out relative to the premiums earned, serving as a crucial indicator of an insurer's financial health. A lower loss ratio signifies higher profitability, while a higher ratio highlights increased claim costs or potential underwriting issues. Behavioral pricing leverages loss ratio data to adjust premiums based on individual risk behaviors, enhancing pricing accuracy and risk management.

Behavioral Pricing Strategies

Behavioral pricing in insurance leverages customer data and predictive analytics to set premiums based on individual risk profiles and behaviors, improving pricing accuracy compared to traditional loss ratio models. Unlike loss ratio metrics that analyze historic claims costs against premiums, behavioral pricing incorporates real-time data such as driving habits, credit scores, and lifestyle choices to tailor insurance rates dynamically. Implementing behavioral pricing strategies enhances risk segmentation and customer retention while optimizing profitability through personalized premium adjustments.

Impact of Loss Ratio on Premium Setting

Loss ratio directly influences premium setting by measuring the claims paid relative to earned premiums, guiding insurers to adjust rates for profitability and risk management. A high loss ratio signals underwriting losses, prompting premium increases to maintain solvency and cover future claims. Behavioral pricing models integrate loss ratio data with customer behavior patterns to personalize premiums, enhancing pricing accuracy and competitive advantage.

Influence of Behavioral Data on Pricing

Behavioral data significantly impacts insurance pricing by enabling more accurate risk assessment compared to traditional loss ratio methods, which primarily rely on historical claim data. Insurers leverage telematics, driving habits, and real-time behavior patterns to adjust premiums dynamically, reducing adverse selection and improving profitability. Integrating behavioral pricing leads to more personalized insurance policies, enhancing customer retention and competitive advantage in the market.

Traditional Underwriting vs Behavioral Pricing

Traditional underwriting relies on historical claims data and demographic factors to determine insurance premiums, often resulting in generalized loss ratio assessments. Behavioral pricing, however, utilizes real-time data from policyholders' actions, such as driving habits or lifestyle choices, enabling more personalized risk evaluation and dynamic premium adjustments. This shift enhances underwriting accuracy and can lead to improved loss ratios by aligning pricing more closely with individual risk profiles.

Loss Ratio Optimization Techniques

Loss ratio optimization techniques involve analyzing claims data to refine underwriting rules and pricing models, directly impacting profitability by minimizing underwriting losses. Advanced predictive analytics and machine learning algorithms enable insurers to segment risk more accurately, aligning premium charges with expected losses and reducing adverse selection. Behavioral pricing incorporates customer behavior and engagement metrics to dynamically adjust premiums, enhancing loss ratio outcomes by fostering proactive risk management and retention strategies.

Regulatory Implications of Behavioral Pricing and Loss Ratio

Behavioral pricing in insurance leverages customer data to adjust premiums based on individual risk behaviors, potentially impacting the loss ratio by aligning prices more closely with actual risk. Regulatory frameworks scrutinize these practices to ensure fairness, prevent discrimination, and maintain transparency in premium setting, often setting limits on how behavioral metrics influence pricing. Insurers must balance optimizing loss ratios through behavioral insights while complying with regulations that protect consumers and promote equitable treatment.

Future Trends: Integrating Loss Ratio and Behavioral Pricing

Future trends in insurance focus on integrating loss ratio analysis with behavioral pricing models to enhance risk assessment accuracy and premium customization. Insurers leverage advanced data analytics and machine learning algorithms to combine historical loss data with real-time behavioral insights, optimizing policy pricing and minimizing financial losses. This integration drives more personalized insurance products and improved customer retention by aligning premiums closely with individual risk profiles and behavior patterns.

Related Important Terms

Predictive Loss Ratio

Predictive loss ratio leverages historical claims data and advanced analytics to estimate future losses, enabling insurers to refine behavioral pricing models with greater accuracy. Integrating predictive loss ratios enhances risk assessment by dynamically adjusting premiums based on individual policyholder behavior patterns and anticipated claim costs.

Dynamic Pricing Algorithms

Dynamic pricing algorithms in insurance leverage behavioral data to adjust premiums in real-time, optimizing loss ratios by predicting policyholder risk more accurately. These advanced models integrate continuous behavioral inputs, enabling insurers to balance profitability and competitiveness while minimizing claim-related losses.

Usage-Based Pricing

Usage-based pricing, a behavioral pricing strategy in insurance, directly links premiums to actual driving behavior, improving risk assessment accuracy. This approach reduces the loss ratio by incentivizing safer driving habits and aligning costs more closely with individual risk profiles.

Propensity-to-Claim Modeling

Loss ratio analysis quantifies the proportion of claims paid against earned premiums, serving as a fundamental metric for underwriting profitability, while behavioral pricing leverages propensity-to-claim modeling to predict individual policyholders' likelihood to file a claim based on historical behavior and risk factors. By integrating loss ratio data with advanced behavioral pricing algorithms, insurers can optimize premium pricing, reduce adverse selection, and enhance risk segmentation accuracy.

Behavioral Underwriting

Behavioral underwriting enhances loss ratio management by integrating customer behavior data to more accurately assess risk and personalize insurance premiums, reducing adverse selection. This approach leverages predictive analytics and behavioral economics to align pricing with individual risk profiles, improving profitability and customer retention.

Real-Time Risk Adjustment

Loss ratio analysis serves as a critical metric in insurance, quantifying claims relative to premiums collected, while behavioral pricing leverages real-time risk adjustment to dynamically tailor rates based on individual policyholder actions and emerging risk data. Integrating real-time behavioral insights enhances underwriting accuracy, reduces adverse selection, and optimizes profitability by continuously aligning premiums with actual risk exposure.

Telematics-Driven Premiums

Loss ratio metrics critically influence telematics-driven premiums by integrating driver behavior data to adjust risk assessment and pricing accuracy. Behavioral pricing leverages real-time telematics insights, enabling insurers to reduce loss ratios through personalized premiums that reward safe driving habits and mitigate claims frequency.

Price Elasticity Scoring

Loss ratio analysis provides insurers with critical insights into claim costs relative to premiums earned, while behavioral pricing leverages price elasticity scoring to adjust premiums based on policyholder sensitivity to price changes. Integrating loss ratio data with price elasticity metrics enables insurers to optimize pricing strategies, balancing risk exposure and competitive positioning for improved profitability.

Micro-Segmentation Pricing

Micro-segmentation pricing in insurance leverages behavioral data to fine-tune premiums, directly impacting loss ratios by more accurately predicting policyholder risk. This targeted approach reduces loss ratios by minimizing adverse selection and improving risk stratification compared to traditional pricing models.

Adaptive Loss Forecasting

Adaptive loss forecasting leverages machine learning algorithms to analyze historical claims data and predict future loss ratios with high accuracy, enabling insurers to dynamically adjust premiums based on evolving risk patterns. This behavioral pricing approach enhances underwriting precision by incorporating driver behavior, demographic trends, and environmental factors, resulting in optimized loss ratio management and improved profitability.

Loss Ratio vs Behavioral Pricing Infographic

industrydif.com

industrydif.com