Health insurance offers standalone coverage specifically designed to protect individuals from medical expenses, providing comprehensive benefits such as hospital stays, medications, and preventive care. Embedded insurance integrates health coverage within other products or services, streamlining access by bundling insurance with offerings like travel packages or employer benefits. Choosing between health insurance and embedded insurance depends on factors like coverage needs, convenience, and cost-effectiveness.

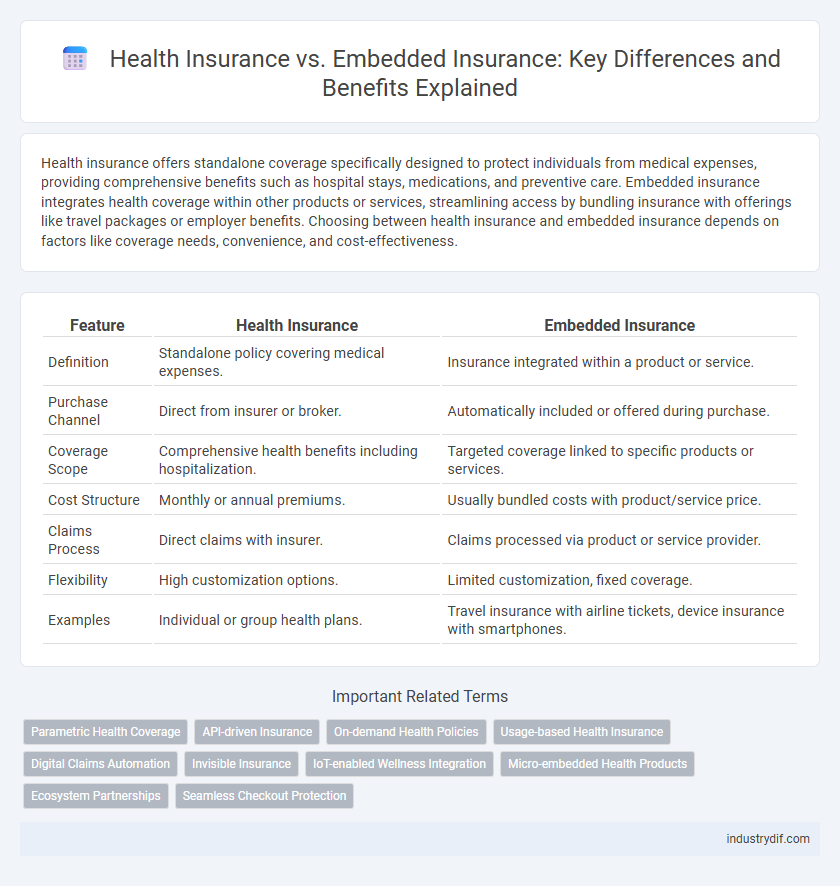

Table of Comparison

| Feature | Health Insurance | Embedded Insurance |

|---|---|---|

| Definition | Standalone policy covering medical expenses. | Insurance integrated within a product or service. |

| Purchase Channel | Direct from insurer or broker. | Automatically included or offered during purchase. |

| Coverage Scope | Comprehensive health benefits including hospitalization. | Targeted coverage linked to specific products or services. |

| Cost Structure | Monthly or annual premiums. | Usually bundled costs with product/service price. |

| Claims Process | Direct claims with insurer. | Claims processed via product or service provider. |

| Flexibility | High customization options. | Limited customization, fixed coverage. |

| Examples | Individual or group health plans. | Travel insurance with airline tickets, device insurance with smartphones. |

Understanding Health Insurance: Core Features and Benefits

Health insurance provides comprehensive coverage for medical expenses, including hospitalization, prescription drugs, and preventive care, ensuring financial protection against unexpected health costs. Embedded insurance integrates health coverage directly within other products or services, such as travel or employment benefits, offering seamless access without separate policies. Understanding the core features of health insurance helps consumers evaluate coverage limits, network providers, premiums, and co-payments to select the most suitable plan for their needs.

What Is Embedded Insurance? Definition and Key Characteristics

Embedded insurance refers to the seamless integration of insurance products within the purchase of goods or services, allowing consumers to obtain coverage without a separate transaction. Key characteristics include real-time underwriting, automated claims processing, and context-specific insurance offerings tailored to the primary product, enhancing customer convenience. This approach leverages technology and data analytics to deliver personalized, instant protection embedded directly into the customer journey.

Health Insurance vs Embedded Insurance: Primary Differences

Health insurance provides standalone coverage specifically for medical expenses, offering consumers direct protection against healthcare costs through dedicated policies. Embedded insurance integrates health coverage within other products or services, such as travel bookings or device purchases, enhancing convenience and accessibility by bundling health benefits with primary offerings. The primary difference lies in standalone health insurance's focus on comprehensive medical protection, while embedded insurance emphasizes seamless inclusion of health benefits within broader consumer experiences.

Key Advantages of Traditional Health Insurance Policies

Traditional health insurance policies offer extensive coverage for a wide range of medical expenses, including hospitalization, surgeries, prescription drugs, and preventive care, ensuring comprehensive financial protection. These policies often provide greater flexibility in choosing healthcare providers and hospitals, allowing policyholders to access specialist consultations without referrals. Additionally, traditional health insurance typically includes benefits such as cashless claim facilities, lifelong renewability, and coverage for pre-existing conditions after a waiting period, making it a reliable option for long-term health security.

The Rise of Embedded Insurance in the Health Sector

Embedded insurance is transforming the health sector by integrating coverage directly into healthcare services and products, providing seamless protection at the point of care or purchase. This approach improves accessibility and convenience, enabling patients to obtain health insurance automatically when accessing medical treatments or buying health-related equipment. As digital health platforms and telemedicine expand, embedded insurance leverages real-time data and personalized offerings, driving enhanced risk management and customer engagement within the health insurance ecosystem.

Cost Comparison: Health Insurance vs Embedded Insurance

Health insurance typically involves monthly premiums, deductibles, and co-pays that can vary widely based on coverage levels, whereas embedded insurance often comes bundled at no additional direct cost within products or services, reducing out-of-pocket expenses. Consumers may find embedded insurance more cost-effective due to lower upfront payments and simplified claims processes, but it may offer less comprehensive coverage compared to traditional health insurance plans. Evaluating cost-effectiveness requires analyzing premium rates, coverage limits, and potential out-of-pocket expenses across both insurance types.

Coverage Scope: Which Option Offers Better Protection?

Health insurance typically provides comprehensive coverage for medical expenses, including hospital stays, surgeries, prescriptions, and preventive care, ensuring broad protection against health-related financial risks. Embedded insurance, integrated within products like travel bookings or electronics purchases, offers more limited, contextual coverage tailored to specific scenarios but lacks the extensive benefits of standalone health policies. Therefore, health insurance usually offers better overall protection due to its wider scope and inclusivity of various healthcare services.

Consumer Experience: Enrollment and Claims Processes

Health insurance typically requires a separate enrollment process with detailed underwriting, leading to longer waiting times and more paperwork for consumers. Embedded insurance seamlessly integrates coverage into existing purchases or services, streamlining enrollment through minimal input and automating claims processing. This integration enhances consumer experience by reducing administrative burdens and accelerating claims settlements.

Regulatory Considerations for Health and Embedded Insurance

Health insurance regulations typically mandate comprehensive coverage standards, privacy protections under HIPAA, and strict solvency requirements to safeguard policyholders. Embedded insurance, often integrated within non-insurance products, faces evolving regulatory scrutiny to ensure transparency, consumer consent, and alignment with financial conduct rules. Compliance frameworks for embedded insurance are progressively adapting to address the unique distribution models and data-sharing practices inherent to these products.

Future Trends: The Impact of Embedded Insurance on Healthcare

Embedded insurance is revolutionizing healthcare by integrating health coverage directly into medical services and digital health platforms, streamlining access and reducing administrative barriers. Future trends indicate a surge in personalized insurance products powered by AI and data analytics, enabling real-time risk assessment and tailored healthcare solutions. This integration enhances patient experience, lowers costs, and drives preventive care, positioning embedded insurance as a critical component in the evolution of health insurance ecosystems.

Related Important Terms

Parametric Health Coverage

Parametric health coverage leverages predefined triggers such as biometric data or environmental factors to automate claim payouts, contrasting traditional health insurance that relies on claim adjustments and assessments. Embedded insurance integrates parametric health products directly into services or devices, enhancing seamless access and real-time protection while reducing administrative friction for consumers.

API-driven Insurance

API-driven embedded insurance seamlessly integrates health insurance coverage into existing platforms, enhancing customer accessibility and real-time data exchange. This approach contrasts with traditional standalone health insurance, offering streamlined policy management and personalized risk assessment through seamless API connectivity.

On-demand Health Policies

On-demand health insurance offers flexible, pay-as-you-go coverage ideal for short-term medical needs, contrasting with embedded insurance which integrates health benefits into broader products like travel or device plans. This flexibility allows consumers to activate health policies only during specific periods or events, optimizing cost-efficiency and personalized protection.

Usage-based Health Insurance

Usage-based health insurance leverages real-time data from wearable devices and health apps to tailor premiums and coverage based on individual behavior and lifestyle, enhancing personalized risk assessment and cost-effectiveness. Embedded insurance integrates health coverage directly into services or products, streamlining access but often lacking the dynamic, data-driven customization found in usage-based health insurance models.

Digital Claims Automation

Digital claims automation in health insurance leverages AI and machine learning to streamline the claims process, reducing errors and accelerating reimbursements. Embedded insurance integrates health coverage seamlessly within digital platforms, enhancing user experience by enabling instant claims processing and real-time policy management through automated workflows.

Invisible Insurance

Invisible insurance, often integrated within health insurance policies, offers seamless coverage without the need for separate purchase or visible documentation, enhancing customer convenience and reducing claim friction. Embedded insurance leverages digital platforms and data analytics to provide real-time, context-specific health protection that operates silently in the background, redefining risk management and policyholder experience.

IoT-enabled Wellness Integration

Health insurance with IoT-enabled wellness integration leverages real-time biometric data from wearable devices to personalize coverage and promote preventive care, reducing claims costs and enhancing customer engagement. Embedded insurance seamlessly incorporates health coverage into IoT ecosystems, enabling automatic risk assessment and tailored wellness incentives within connected devices, streamlining user experience and optimizing health outcomes.

Micro-embedded Health Products

Micro-embedded health products integrate health insurance coverage seamlessly within everyday services, offering tailored protection at the point of use unlike traditional health insurance plans that require separate enrollment and payments. These solutions enhance accessibility and affordability by embedding risk coverage in micro-transactions, catering to underserved populations with flexible, on-demand health insurance options.

Ecosystem Partnerships

Health insurance integrated with embedded insurance solutions enhances consumer experience by offering seamless coverage through ecosystem partnerships within digital platforms like banks or retailers. Collaborations between health insurers and tech companies enable personalized, real-time policy adjustments and streamlined claims processing, driving higher engagement and customer retention.

Seamless Checkout Protection

Embedded insurance integrates health coverage directly into the checkout process, offering seamless protection without separate applications or approvals. This approach enhances user experience by automatically including health insurance benefits in product purchases, reducing friction and improving policy uptake compared to traditional health insurance models.

Health Insurance vs Embedded Insurance Infographic

industrydif.com

industrydif.com