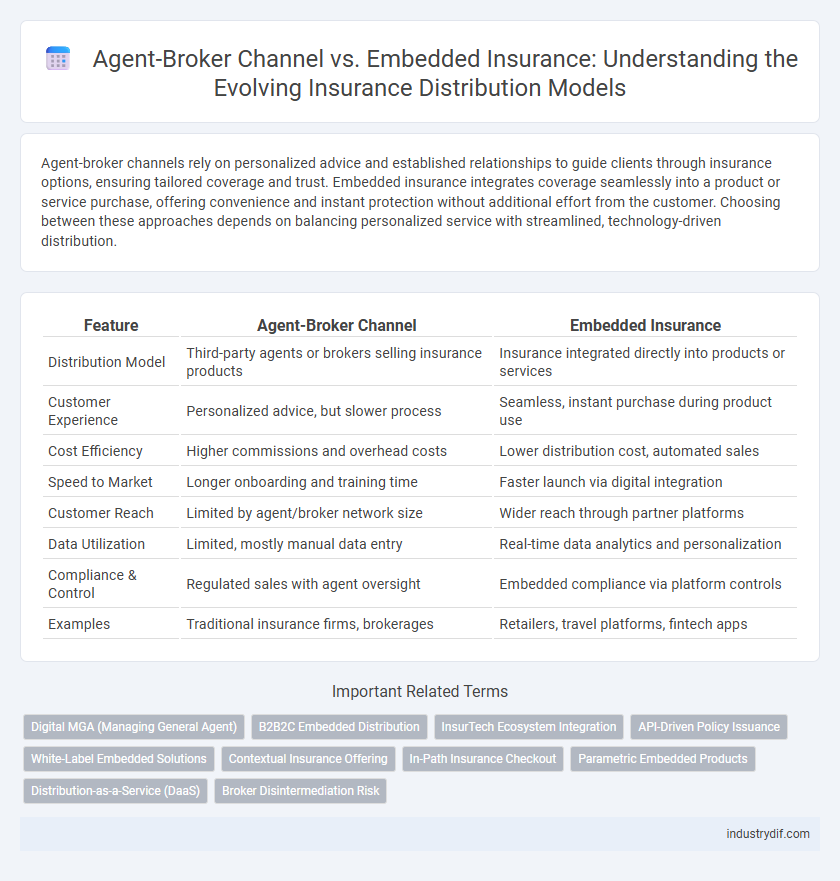

Agent-broker channels rely on personalized advice and established relationships to guide clients through insurance options, ensuring tailored coverage and trust. Embedded insurance integrates coverage seamlessly into a product or service purchase, offering convenience and instant protection without additional effort from the customer. Choosing between these approaches depends on balancing personalized service with streamlined, technology-driven distribution.

Table of Comparison

| Feature | Agent-Broker Channel | Embedded Insurance |

|---|---|---|

| Distribution Model | Third-party agents or brokers selling insurance products | Insurance integrated directly into products or services |

| Customer Experience | Personalized advice, but slower process | Seamless, instant purchase during product use |

| Cost Efficiency | Higher commissions and overhead costs | Lower distribution cost, automated sales |

| Speed to Market | Longer onboarding and training time | Faster launch via digital integration |

| Customer Reach | Limited by agent/broker network size | Wider reach through partner platforms |

| Data Utilization | Limited, mostly manual data entry | Real-time data analytics and personalization |

| Compliance & Control | Regulated sales with agent oversight | Embedded compliance via platform controls |

| Examples | Traditional insurance firms, brokerages | Retailers, travel platforms, fintech apps |

Introduction to Agent-Broker Channel and Embedded Insurance

The agent-broker channel serves as a traditional distribution model where licensed agents or brokers provide personalized advice and sell insurance products directly to customers, facilitating risk assessment and policy customization. Embedded insurance integrates insurance products seamlessly into third-party platforms, such as e-commerce or travel booking sites, enabling customers to purchase coverage instantly within the user experience. This model leverages digital ecosystems to enhance accessibility and streamline the buying process, often increasing conversion rates through contextual relevance.

Defining the Agent-Broker Channel in Insurance

The agent-broker channel in insurance involves licensed professionals who act as intermediaries between insurers and customers, facilitating policy sales and providing expert advice. This channel emphasizes personalized service, helping clients navigate complex insurance products and customize coverage to their specific needs. Unlike embedded insurance, which integrates coverage seamlessly into non-insurance products or services, the agent-broker channel relies on direct human interaction to build trust and ensure informed decisions.

What Is Embedded Insurance?

Embedded insurance integrates insurance products directly into the purchase of goods or services, streamlining customer experience by eliminating separate insurance transactions. Unlike the traditional agent-broker channel, which relies on intermediaries to sell policies, embedded insurance leverages digital platforms and partnerships to offer coverage at the point of sale. This innovation enhances convenience, increases policy adoption rates, and enables seamless risk protection tailored to specific purchases.

Key Differences: Agent-Broker Channel vs Embedded Insurance

The Agent-Broker Channel involves insurance products sold through intermediaries who provide personalized advice and customize policies to meet individual client needs, while Embedded Insurance integrates coverage directly into the purchase of a product or service for seamless customer experience. Embedded Insurance enables real-time, context-specific policy activation and often leverages digital platforms for instant issuance, contrasting with the Agent-Broker Channel's reliance on human interaction and longer sales cycles. The key differences lie in distribution model efficiency, customer engagement, and integration level, impacting underwriting processes and claim handling timelines.

Customer Experience: Personalization vs Seamlessness

Agent-broker channels offer personalized customer experiences through direct interaction, allowing tailored advice and relationship-building that enhances trust and satisfaction. Embedded insurance delivers seamless integration within the customer's purchasing journey, minimizing friction and simplifying the buying process without the need for separate insurance searches. Combining personalization with seamlessness can elevate overall customer experience by providing relevant coverage recommendations smoothly within existing workflows.

Distribution Models: Traditional vs Digital Integration

Agent-broker channels rely on personalized interactions and established relationships to distribute insurance products, ensuring tailored advice and trust-building with clients. Embedded insurance integrates coverage directly into digital platforms like e-commerce sites or travel apps, streamlining the purchase process and enhancing user experience with real-time, context-specific offerings. Traditional agent-broker models excel in complex, customizable policies, while embedded insurance leverages data-driven automation to scale distribution efficiently in the digital ecosystem.

Cost Structures and Revenue Models

Agent-broker channels typically operate on commission-based revenue models, where agents earn a percentage of the premium, leading to higher acquisition costs and variable commission expenses for insurers. Embedded insurance integrates directly within product or service offerings, often utilizing fixed-fee or revenue-sharing structures, resulting in lower distribution costs and scalable revenue streams. Cost structures in embedded insurance benefit from reduced marketing expenses and streamlined customer onboarding, whereas agent-broker channels incur higher operational costs due to agent management and sales incentives.

Regulatory and Compliance Considerations

Agent-broker channels operate under stringent licensing and disclosure requirements, ensuring compliance with local insurance laws and consumer protection regulations. Embedded insurance integrates coverage seamlessly within product offerings but faces evolving regulatory scrutiny to maintain transparency and prevent conflicts of interest. Both models must adapt to data privacy laws and anti-money laundering regulations to uphold trust and legal integrity in insurance distribution.

Impact on Insurtech and Digital Transformation

The agent-broker channel remains a vital distribution method in insurance, leveraging personalized advice and strong customer relationships, but it faces challenges in scalability and speed. Embedded insurance integrates policies directly into non-insurance platforms, streamlining customer experience and accelerating digital transformation by leveraging APIs and real-time data analytics. Insurtech companies benefit by adopting embedded models to drive innovation, reduce distribution costs, and enhance seamless digital engagement, fundamentally reshaping traditional insurance workflows.

Future Trends and Market Outlook

The agent-broker channel remains a critical distribution method in insurance, leveraging personalized service and established trust, but future trends indicate a gradual shift towards embedded insurance due to its seamless integration into digital platforms and ecosystems. Market forecasts project embedded insurance to grow significantly, driven by advancements in IoT, AI, and API-driven partnerships that enable real-time coverage offerings within retail, automotive, and travel sectors. Insurers focusing on omnichannel strategies that combine traditional agents with embedded solutions are expected to achieve competitive advantage and capture emerging customer segments.

Related Important Terms

Digital MGA (Managing General Agent)

Digital MGAs leverage advanced data analytics and automated underwriting processes to streamline the agent-broker channel, enhancing efficiency and customer reach. Embedded insurance integrates directly into digital platforms, allowing Digital MGAs to offer seamless, on-demand coverage, driving growth through personalized, real-time risk management solutions.

B2B2C Embedded Distribution

B2B2C embedded insurance distribution integrates insurance products directly into third-party platforms, streamlining customer experience and reducing reliance on traditional agent-broker channels that often involve multiple intermediaries. This model enhances scalability and data-driven personalization, enabling businesses to offer tailored insurance solutions seamlessly within their existing customer journeys.

InsurTech Ecosystem Integration

Agent-broker channels leverage personalized customer relationships and expert advice, driving trust and tailored policy solutions within the InsurTech ecosystem. Embedded insurance integrates seamlessly into digital platforms, enabling real-time risk assessment and streamlined policy issuance, enhancing user experience and operational efficiency in InsurTech ecosystems.

API-Driven Policy Issuance

API-driven policy issuance accelerates underwriting and real-time risk assessment in embedded insurance, enabling seamless integration within digital platforms without relying on traditional agent-broker channels. This shift enhances customer experience by automating policy binding and claims processing, drastically reducing operational costs and time-to-market compared to conventional distribution models.

White-Label Embedded Solutions

White-label embedded insurance solutions enable seamless integration of insurance products directly within non-insurance platforms, enhancing customer experience and driving higher conversion rates compared to traditional agent-broker channels. This approach empowers businesses to offer tailored coverage under their own brand while leveraging the expertise of specialized insurers, streamlining distribution and reducing operational costs.

Contextual Insurance Offering

Agent-broker channels provide personalized, expert guidance tailored to individual needs, leveraging human interaction to understand complex risk profiles. Embedded insurance integrates coverage seamlessly within product or service purchases, offering contextual insurance solutions that enhance convenience and customer experience through real-time protection.

In-Path Insurance Checkout

In-path insurance checkout streamlines customer experience by integrating insurance purchase directly within the primary sales process, contrasting the traditional agent-broker channel where insurance is offered separately through representatives. Embedded insurance leverages real-time data and seamless technology, enhancing conversion rates and reducing friction compared to agent-mediated sales.

Parametric Embedded Products

Agent-broker channels traditionally facilitate personalized insurance advice and tailored coverage, while parametric embedded insurance products integrate automated, data-driven claims triggered by predefined parameters, streamlining customer experience and reducing claim processing times. Parametric embedded insurance leverages IoT and AI to deliver instant payouts based on event metrics such as weather data or flight delays, offering scalable and transparent risk transfer solutions within digital ecosystems.

Distribution-as-a-Service (DaaS)

Distribution-as-a-Service (DaaS) revolutionizes insurance by integrating embedded insurance directly within digital platforms, offering seamless customer access and enhanced personalization compared to traditional agent-broker channels. Leveraging APIs and data-driven insights, DaaS enables insurers to scale distribution efficiently while reducing reliance on intermediaries, optimizing cost structures and accelerating policy issuance.

Broker Disintermediation Risk

Agent-broker channels face significant broker disintermediation risk as embedded insurance models integrate coverage directly into products, bypassing traditional intermediaries and reducing brokers' market share. This shift challenges brokers to innovate value propositions to maintain relevance amid rising direct-to-consumer insurance distribution trends.

Agent-broker Channel vs Embedded Insurance Infographic

industrydif.com

industrydif.com