Insurance agents provide personalized guidance by understanding clients' unique needs and offering tailored policy recommendations, while robo-advisors use algorithms to automate the selection process for faster, cost-effective decisions. Agents excel in complex situations requiring human judgment and negotiation, whereas robo-advisors are ideal for straightforward coverage and quick quotes. Choosing between an agent and a robo-advisor depends on the balance between personalized service and convenience in insurance purchasing.

Table of Comparison

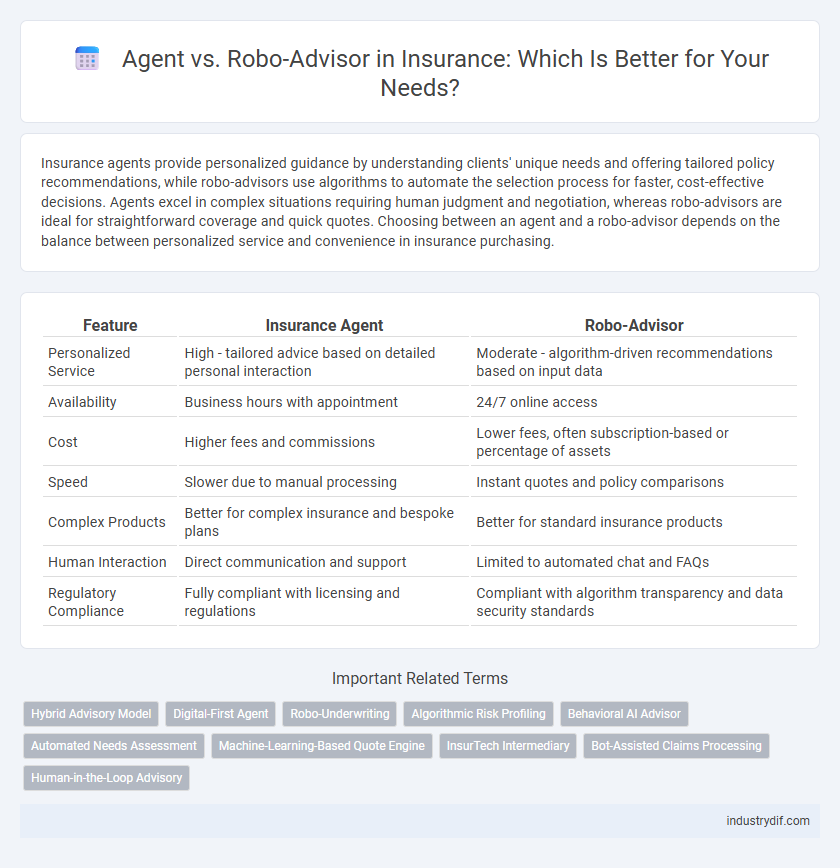

| Feature | Insurance Agent | Robo-Advisor |

|---|---|---|

| Personalized Service | High - tailored advice based on detailed personal interaction | Moderate - algorithm-driven recommendations based on input data |

| Availability | Business hours with appointment | 24/7 online access |

| Cost | Higher fees and commissions | Lower fees, often subscription-based or percentage of assets |

| Speed | Slower due to manual processing | Instant quotes and policy comparisons |

| Complex Products | Better for complex insurance and bespoke plans | Better for standard insurance products |

| Human Interaction | Direct communication and support | Limited to automated chat and FAQs |

| Regulatory Compliance | Fully compliant with licensing and regulations | Compliant with algorithm transparency and data security standards |

Introduction to Insurance Agents and Robo-Advisors

Insurance agents provide personalized service by assessing individual client needs, offering tailored policy recommendations, and facilitating claims processing, ensuring human interaction throughout the insurance lifecycle. Robo-advisors leverage algorithms and artificial intelligence to deliver automated, cost-effective insurance solutions, enabling efficient risk assessment and policy management through digital platforms. Both agents and robo-advisors play crucial roles in enhancing customer experience within the insurance industry by balancing human expertise and technological innovation.

Key Differences Between Agents and Robo-Advisors

Insurance agents provide personalized advice through direct human interaction, leveraging experience to tailor policies based on individual needs and complex circumstances. Robo-advisors utilize algorithms and data analytics to automate policy recommendations, offering quick, cost-effective solutions with limited customization. Key differences include the level of human involvement, customization depth, and accessibility, where agents excel in personalized service and robo-advisors prioritize efficiency and scalability.

Human Touch: The Role of Insurance Agents

Insurance agents provide personalized guidance by assessing individual risk profiles and coverage needs, ensuring tailored policies that align with clients' financial goals. Their ability to navigate complex claims and offer empathetic support during stressful situations creates trust and long-term client relationships. Unlike robo-advisors, agents leverage interpersonal communication and industry expertise to address unique circumstances beyond algorithmic recommendations.

Automation in Insurance: How Robo-Advisors Work

Robo-advisors automate insurance policy recommendations using algorithms that analyze customer data, risk profiles, and market trends to deliver personalized coverage options swiftly. These digital platforms reduce human error and operational costs by streamlining underwriting, claims processing, and policy management through AI-driven automation. In contrast to traditional agents, robo-advisors provide 24/7 accessibility and instant quote generation, enhancing efficiency and customer experience in insurance.

Cost Comparison: Agent Fees vs Robo-Advisor Charges

Traditional insurance agents typically charge commissions ranging from 5% to 15% of the policy premium, resulting in higher upfront costs for clients. Robo-advisors, leveraging automated algorithms, usually impose lower fees around 0.25% to 0.75% annually, significantly reducing ongoing expenses. Cost efficiency makes robo-advisors an attractive alternative for insurance clients seeking budget-friendly options without compromising coverage quality.

Personalization: Tailored Advice vs Algorithm-Driven Solutions

Insurance agents provide personalized advice by assessing individual client needs, preferences, and risk profiles through direct interaction, enabling customized policy recommendations. Robo-advisors use algorithm-driven solutions that analyze large data sets and automate policy selection, offering efficiency but limited adaptability to unique circumstances. The human agent's personalized approach often results in more nuanced coverage that better aligns with complex financial goals and life situations.

Accessibility and User Experience

Insurance agents offer personalized guidance tailored to individual needs, enhancing user trust and accessibility through direct interaction. Robo-advisors provide 24/7 digital access, streamlining the insurance selection process with user-friendly interfaces and instant policy comparisons. Both options improve accessibility but differ in user experience, where agents excel in human touch and robo-advisors prioritize convenience and speed.

Regulatory and Compliance Considerations

Insurance agents must adhere to strict regulations including licensing, fiduciary duties, and consumer protection laws, ensuring personalized compliance with state and federal standards. Robo-advisors operate under automated algorithms but are also subject to regulatory oversight such as SEC registration, data privacy rules, and suitability requirements for client recommendations. Both models require robust compliance frameworks to manage risk, protect sensitive information, and maintain transparency in client interactions.

Pros and Cons of Agents and Robo-Advisors in Insurance

Insurance agents offer personalized advice and can handle complex cases by evaluating individual needs, but their services may come with higher fees and potential bias from commission-based incentives. Robo-advisors provide cost-effective, fast insurance recommendations using algorithms and data analysis, yet they may lack the nuanced understanding and human empathy necessary for unique or complicated insurance situations. Choosing between agents and robo-advisors depends on whether policyholders prioritize personalized interaction and tailored service or efficiency and lower costs.

Choosing the Right Option: Agent or Robo-Advisor for Your Insurance Needs

Choosing between an insurance agent and a robo-advisor depends on your preference for personalized service versus automated efficiency. Insurance agents provide tailored advice and detailed policy explanations, ideal for complex needs or those valuing human interaction. Robo-advisors use algorithms to offer quick, cost-effective insurance recommendations, suitable for straightforward coverage and tech-savvy customers.

Related Important Terms

Hybrid Advisory Model

The Hybrid Advisory Model in insurance combines the personalized expertise of human agents with the efficiency and data-driven insights of robo-advisors, enhancing customer experience and decision accuracy. This model leverages AI algorithms for risk assessment and policy suggestions while allowing agents to address complex queries and build client trust.

Digital-First Agent

A Digital-First Agent leverages advanced AI and data analytics to deliver personalized insurance solutions, combining human expertise with digital efficiency for superior customer experience. This hybrid approach outperforms traditional agents and standalone robo-advisors by providing real-time insights, seamless policy management, and adaptive risk assessment.

Robo-Underwriting

Robo-underwriting leverages artificial intelligence and machine learning algorithms to assess risk and process insurance applications faster and with greater accuracy than traditional agents. This technology enhances underwriting efficiency by analyzing vast datasets, reducing human error, and enabling real-time policy decisions.

Algorithmic Risk Profiling

Agent-based insurance methods rely on personalized human judgment to assess risk profiles, allowing for nuanced understanding of individual client needs. Robo-advisors employ algorithmic risk profiling using data analytics and machine learning models, delivering scalable, consistent, and efficient evaluations while minimizing subjective biases.

Behavioral AI Advisor

Behavioral AI Advisors in insurance leverage advanced algorithms to analyze clients' emotional responses and decision-making patterns, enabling personalized policy recommendations that traditional agents may overlook. By integrating behavioral analytics, these AI-driven tools enhance accuracy and customer satisfaction through tailored risk assessments and proactive financial guidance.

Automated Needs Assessment

Automated needs assessment in insurance leverages robo-advisor algorithms to analyze customer data and recommend personalized coverage options faster and more accurately than traditional agents. While agents provide human insight and relationship-building, robo-advisors optimize insurance selection by continuously integrating real-time data and risk factors without manual intervention.

Machine-Learning-Based Quote Engine

Machine-learning-based quote engines enable insurance agents to generate highly personalized policy recommendations by analyzing vast datasets of client information and market trends, enhancing accuracy and efficiency. Robo-advisors leverage similar algorithms to provide instant, cost-effective insurance quotes, but may lack the nuanced understanding and customized advice that human agents offer.

InsurTech Intermediary

InsurTech intermediaries bridge the gap between traditional insurance agents and robo-advisors by combining personalized service with automated digital tools, enhancing customer experience and operational efficiency. These platforms leverage AI and data analytics to provide tailored insurance solutions while maintaining human oversight for complex cases.

Bot-Assisted Claims Processing

Bot-assisted claims processing leverages artificial intelligence to expedite damage assessment and streamline documentation, reducing human error and accelerating settlement times for policyholders. Insurance agents complement this by providing personalized guidance and complex claim evaluations, ensuring a balanced approach between automation efficiency and expert oversight.

Human-in-the-Loop Advisory

Human-in-the-loop advisory in insurance blends expert agent insights with robo-advisor efficiency, ensuring personalized risk assessment and tailored policy recommendations. This hybrid approach leverages AI-driven data analytics while retaining critical human judgment for complex decision-making and customer trust.

Agent vs Robo-Advisor Infographic

industrydif.com

industrydif.com