Claims fraud detection traditionally relies on rule-based systems and manual investigations to identify suspicious activities, often resulting in delayed response times and higher false positives. Artificial intelligence-driven fraud analytics leverages machine learning algorithms and predictive models to analyze vast datasets in real-time, uncovering complex fraud patterns with greater accuracy and efficiency. This advanced approach significantly reduces financial losses by proactively detecting and preventing fraudulent claims before they impact insurers.

Table of Comparison

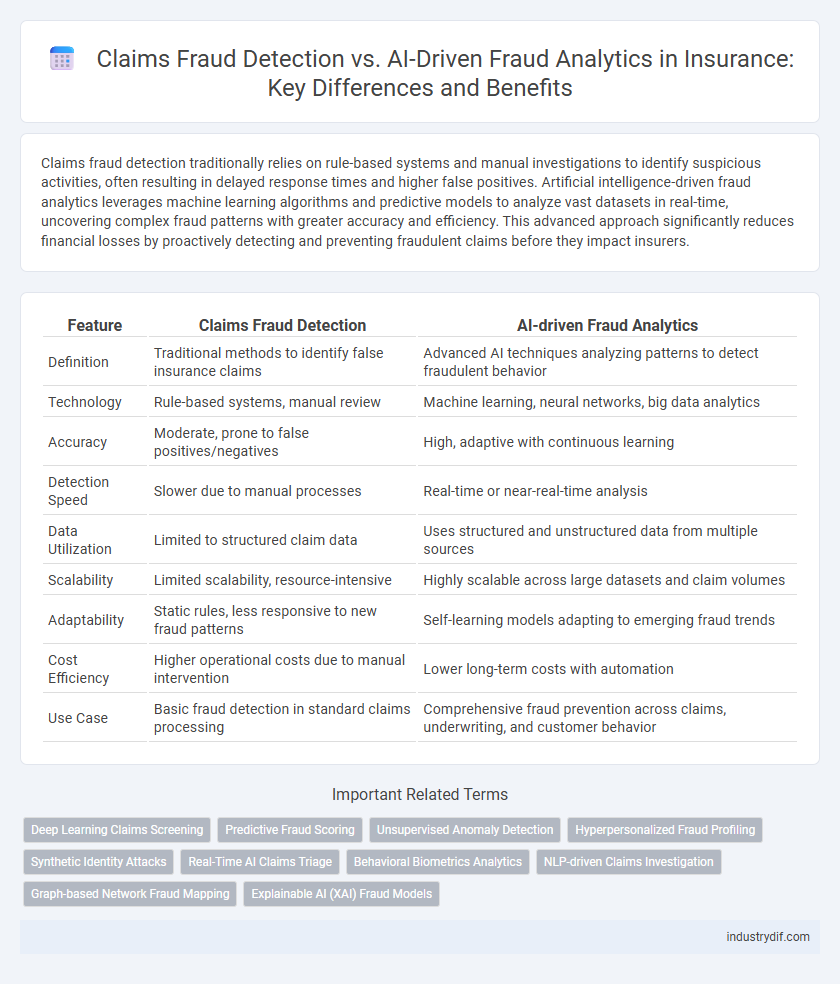

| Feature | Claims Fraud Detection | AI-driven Fraud Analytics |

|---|---|---|

| Definition | Traditional methods to identify false insurance claims | Advanced AI techniques analyzing patterns to detect fraudulent behavior |

| Technology | Rule-based systems, manual review | Machine learning, neural networks, big data analytics |

| Accuracy | Moderate, prone to false positives/negatives | High, adaptive with continuous learning |

| Detection Speed | Slower due to manual processes | Real-time or near-real-time analysis |

| Data Utilization | Limited to structured claim data | Uses structured and unstructured data from multiple sources |

| Scalability | Limited scalability, resource-intensive | Highly scalable across large datasets and claim volumes |

| Adaptability | Static rules, less responsive to new fraud patterns | Self-learning models adapting to emerging fraud trends |

| Cost Efficiency | Higher operational costs due to manual intervention | Lower long-term costs with automation |

| Use Case | Basic fraud detection in standard claims processing | Comprehensive fraud prevention across claims, underwriting, and customer behavior |

Introduction to Claims Fraud in the Insurance Sector

Claims fraud in the insurance sector significantly impacts financial stability, with false claims costing the industry billions annually. Traditional detection methods often rely on rule-based systems, which can miss complex fraudulent patterns. Artificial Intelligence-driven fraud analytics leverages machine learning algorithms and big data to identify subtle anomalies and evolving fraud schemes more effectively.

Traditional Claims Fraud Detection Methods

Traditional claims fraud detection methods rely heavily on rule-based systems and manual reviews, which often result in slower identification and higher false-positive rates. These approaches primarily analyze historical claim patterns using predefined criteria, limiting their adaptability to evolving fraudulent techniques. The lack of real-time data integration and advanced analytics in traditional methods restricts their effectiveness compared to AI-driven fraud analytics.

Limitations of Conventional Fraud Detection Techniques

Conventional fraud detection techniques in insurance rely heavily on rule-based systems and manual audits, which often result in high false positive rates and delayed identification of fraudulent claims. These traditional methods lack the ability to analyze large volumes of diverse data in real-time, limiting their effectiveness against sophisticated and evolving fraud schemes. Artificial intelligence-driven fraud analytics overcome these limitations by leveraging machine learning algorithms to detect complex patterns and anomalies with greater accuracy and speed.

The Rise of Artificial Intelligence in Insurance Analytics

Artificial Intelligence-driven fraud analytics leverages machine learning algorithms and predictive modeling to identify complex patterns and anomalies in insurance claims that traditional claims fraud detection methods often miss. Advanced AI systems process vast volumes of structured and unstructured data, enabling more accurate and real-time fraud detection while reducing false positives. The rise of artificial intelligence in insurance analytics is transforming fraud prevention by enhancing efficiency, minimizing financial losses, and improving compliance with regulatory standards.

How AI-Driven Analytics Transforms Fraud Detection

AI-driven fraud analytics revolutionizes insurance claims fraud detection by leveraging advanced machine learning algorithms to analyze vast datasets in real-time, identifying subtle patterns and anomalies that traditional methods often miss. This technology enhances predictive accuracy by continuously learning from new data, enabling insurers to detect complex fraud schemes earlier and reduce false positives. Implementing AI-driven analytics significantly improves operational efficiency, lowers investigation costs, and strengthens regulatory compliance by providing transparent and auditable fraud detection processes.

Key Technologies Powering AI-Based Fraud Analytics

Key technologies powering AI-based fraud analytics in insurance include machine learning algorithms that identify patterns and anomalies in claims data, natural language processing (NLP) for analyzing unstructured text in claim descriptions, and advanced predictive modeling techniques that forecast potential fraudulent activities. These technologies leverage big data platforms and real-time analytics to enhance accuracy and speed in detecting complex fraud schemes. Integration of AI with blockchain and IoT devices further strengthens data integrity and provides comprehensive fraud detection capabilities.

Comparing Manual vs. AI-Driven Fraud Detection Accuracy

Manual claims fraud detection relies heavily on human judgment and predefined rules, often resulting in slower identification and higher error rates. AI-driven fraud analytics utilize machine learning algorithms and pattern recognition to analyze vast datasets with greater accuracy and speed, reducing false positives effectively. Studies show AI models can improve detection accuracy by up to 90%, outperforming traditional manual processes in uncovering complex fraudulent activities.

Real-World Applications: AI Success Stories in Insurance

Insurance companies leverage artificial intelligence-driven fraud analytics to detect complex claims fraud patterns with remarkable accuracy, reducing false positives and improving investigation efficiency. Real-world applications demonstrate AI systems identifying suspicious claims behavior across auto, health, and property insurance sectors, leading to substantial cost savings and faster claim resolution. Insurers such as Progressive and Allstate report significant declines in fraudulent payouts after implementing AI-powered anomaly detection and predictive modeling tools.

Implementation Challenges and Considerations for Insurers

Implementing AI-driven fraud analytics in insurance claims fraud detection requires addressing data quality, integration complexities, and regulatory compliance. Insurers must invest in robust data governance frameworks to ensure accurate model training and effective pattern recognition. Balancing transparency and interpretability of AI models is essential to gain stakeholder trust and meet evolving industry standards.

The Future of Fraud Detection: Toward Predictive and Proactive Solutions

Insurance claims fraud detection is evolving with artificial intelligence-driven fraud analytics, enabling predictive and proactive solutions that identify suspicious patterns before losses occur. Machine learning algorithms analyze vast datasets, uncovering subtle anomalies and behavioral trends that traditional methods often miss, significantly improving fraud prevention accuracy. This shift toward AI-powered analytics not only enhances real-time detection but also facilitates adaptive strategies to counter emerging fraud tactics in the insurance industry's future.

Related Important Terms

Deep Learning Claims Screening

Deep learning claims screening leverages advanced neural networks to accurately identify patterns indicative of fraudulent insurance claims, significantly enhancing detection rates compared to traditional methods. Artificial intelligence-driven fraud analytics integrates these deep learning models with vast datasets to continuously adapt and improve fraud identification, reducing false positives and operational costs in claims processing.

Predictive Fraud Scoring

Predictive fraud scoring in insurance leverages artificial intelligence-driven fraud analytics to analyze historical claims data and identify patterns indicative of fraudulent behavior, enhancing detection accuracy and reducing false positives. Claims fraud detection traditionally relies on rule-based systems and manual reviews, whereas AI-powered predictive models continuously learn and adapt to emerging fraud trends, enabling more proactive and scalable fraud prevention.

Unsupervised Anomaly Detection

Claims fraud detection leverages unsupervised anomaly detection techniques within artificial intelligence-driven fraud analytics to identify unusual patterns without relying on labeled data, enhancing the accuracy of fraud identification in insurance claims. These AI models analyze vast datasets to detect deviations from normal claim behavior, enabling insurers to uncover hidden fraud risks and reduce false positives efficiently.

Hyperpersonalized Fraud Profiling

Claims fraud detection traditionally relies on rule-based systems and historical data patterns to identify suspicious activities, but artificial intelligence-driven fraud analytics enhances accuracy by utilizing machine learning algorithms that generate hyperpersonalized fraud profiling tailored to individual claimant behavior. This approach leverages real-time data integration and predictive modeling to detect subtle anomalies and reduce false positives, significantly improving fraud prevention efficiency in insurance claims processing.

Synthetic Identity Attacks

Claims fraud detection traditionally relies on rule-based systems that identify suspicious patterns through predefined red flags, but Synthetic Identity Attacks demand advanced Artificial Intelligence-driven fraud analytics to analyze vast datasets, detect subtle anomalies, and adapt to evolving fraud tactics. AI-powered models leverage machine learning algorithms and behavioral biometrics to accurately identify synthetic identities, reducing false positives and enhancing the accuracy of fraud prevention in insurance claims.

Real-Time AI Claims Triage

Real-time AI claims triage enhances insurance fraud detection by instantly analyzing claim data using advanced machine learning algorithms to identify suspicious patterns and anomalies, significantly reducing false positives and speeding up claim processing. By leveraging artificial intelligence-driven fraud analytics, insurers can prioritize high-risk claims for further investigation, improving accuracy and operational efficiency in fraud prevention.

Behavioral Biometrics Analytics

Behavioral biometrics analytics enhances insurance claims fraud detection by analyzing unique user patterns such as typing speed, mouse movements, and device handling to identify suspicious behavior with high accuracy. Unlike traditional methods, AI-driven fraud analytics integrates these behavioral signals into machine learning models, enabling real-time detection and prevention of fraudulent claims.

NLP-driven Claims Investigation

NLP-driven claims investigation enhances fraud detection by analyzing unstructured data within insurance claims, enabling the identification of subtle patterns and inconsistencies often missed by traditional methods. Artificial intelligence-driven fraud analytics leverages machine learning algorithms and natural language processing to efficiently detect and predict fraudulent activities, improving the accuracy and speed of claims assessment.

Graph-based Network Fraud Mapping

Graph-based network fraud mapping leverages artificial intelligence-driven fraud analytics to detect complex, hidden relationships among claimants and entities, significantly enhancing the identification of fraudulent insurance claims. This approach outperforms traditional claims fraud detection methods by analyzing interconnected data points to reveal fraud rings and suspicious patterns in real time.

Explainable AI (XAI) Fraud Models

Explainable AI (XAI) fraud models enhance claims fraud detection by providing transparent and interpretable insights into suspicious activities, enabling insurers to understand and trust automated decisions. These models leverage advanced algorithms and data-driven analytics to identify complex fraud patterns while ensuring regulatory compliance and facilitating effective fraud investigation processes.

Claims Fraud Detection vs Artificial Intelligence-driven Fraud Analytics Infographic

industrydif.com

industrydif.com