Premium payment involves a fixed amount paid regularly regardless of actual usage, providing predictable costs and stable coverage. Usage-based payment adjusts premiums according to real-time data like mileage or driving behavior, offering personalized rates that can lead to potential savings. Evaluating factors such as driving habits and financial stability helps determine the most cost-effective and suitable payment model.

Table of Comparison

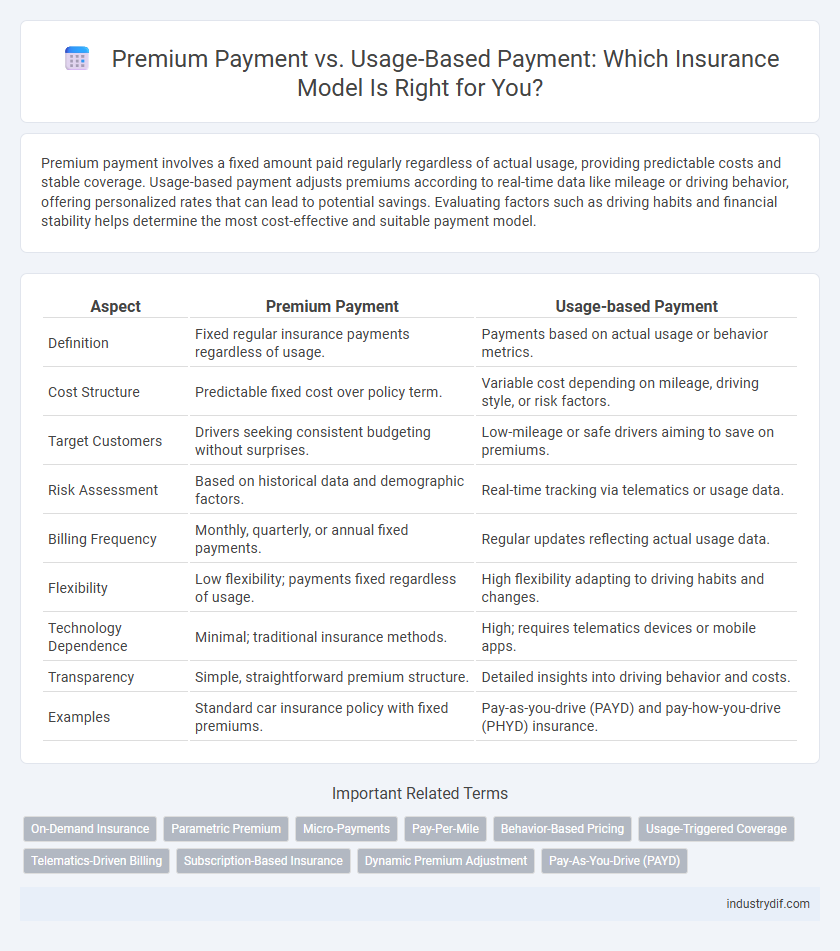

| Aspect | Premium Payment | Usage-based Payment |

|---|---|---|

| Definition | Fixed regular insurance payments regardless of usage. | Payments based on actual usage or behavior metrics. |

| Cost Structure | Predictable fixed cost over policy term. | Variable cost depending on mileage, driving style, or risk factors. |

| Target Customers | Drivers seeking consistent budgeting without surprises. | Low-mileage or safe drivers aiming to save on premiums. |

| Risk Assessment | Based on historical data and demographic factors. | Real-time tracking via telematics or usage data. |

| Billing Frequency | Monthly, quarterly, or annual fixed payments. | Regular updates reflecting actual usage data. |

| Flexibility | Low flexibility; payments fixed regardless of usage. | High flexibility adapting to driving habits and changes. |

| Technology Dependence | Minimal; traditional insurance methods. | High; requires telematics devices or mobile apps. |

| Transparency | Simple, straightforward premium structure. | Detailed insights into driving behavior and costs. |

| Examples | Standard car insurance policy with fixed premiums. | Pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) insurance. |

Understanding Premium Payment in Insurance

Premium payment in insurance refers to the fixed amount policyholders pay regularly, usually monthly or annually, to maintain their coverage and ensure financial protection against specified risks. This traditional payment method contrasts with usage-based payment models, which adjust premiums based on actual usage or behavior data, such as mileage or driving habits in auto insurance. Understanding the stability and predictability of premium payments helps consumers manage budgeting and evaluate the financial commitment required for comprehensive insurance coverage.

What is Usage-Based Payment?

Usage-based payment in insurance refers to a pricing model where premiums are calculated based on the actual usage or behavior of the insured, such as driving distance, speed, or time of day for auto insurance. This approach leverages telematics data and real-time monitoring to offer personalized rates, rewarding low-risk behavior with lower premiums. Usage-based payment contrasts with traditional premium payment systems that use static factors like age or credit score, promoting fairness and potential savings for cautious policyholders.

Key Differences Between Premium Payment and Usage-Based Payment

Premium payment in insurance involves fixed regular payments based on risk assessment, ensuring predictable costs for policyholders. Usage-based payment models calculate premiums dynamically according to actual usage or behavior, such as miles driven or driving habits, offering personalized cost efficiency. Key differences include payment structure stability, risk assessment precision, and potential cost savings aligned with individual usage patterns.

Benefits of Traditional Premium Payment Models

Traditional premium payment models offer predictable costs and simplified budgeting for policyholders, ensuring consistent coverage without fluctuating expenses. These models facilitate straightforward claims processing and maintain widespread acceptance among insurers and customers alike. Stability in premium collection also supports the insurer's ability to manage risk pools effectively and deliver reliable financial planning.

Advantages of Usage-Based Payment Systems

Usage-based payment systems in insurance offer personalized premium adjustments based on actual driving behavior, promoting fairness and cost savings for low-risk drivers. These systems leverage telematics data to provide real-time feedback, encouraging safer habits and reducing claim frequency. Insurers benefit from improved risk assessment accuracy, enhancing profitability and customer satisfaction through tailored pricing models.

Challenges of Premium Payment Methods

Premium payment methods in insurance often pose challenges such as financial strain on policyholders due to fixed regular payments regardless of usage or risk level. These methods lack flexibility, making it difficult for customers to align payments with their actual insurance consumption or changing circumstances. Insurers face increased risk of policy lapses and reduced customer satisfaction, impacting retention rates and profitability.

Limitations of Usage-Based Insurance Payments

Usage-based insurance payments often face limitations such as privacy concerns due to continuous tracking of driving behavior, potential inaccuracies from external factors like road conditions or technical glitches, and limited applicability for infrequent drivers who may not benefit from reduced premiums. These constraints can lead to customer dissatisfaction and may restrict widespread adoption of usage-based insurance models. Insurers must balance data collection with transparency and fairness to address these challenges effectively.

How to Choose Between Premium and Usage-Based Payments

Choosing between premium payment and usage-based payment depends on your driving habits and risk tolerance. Premium payments offer predictable costs with fixed monthly or annual rates, while usage-based payments adjust based on actual mileage and driving behavior tracked through telematics. Analyze your average mileage, frequency of trips, and preference for cost stability to select the most cost-effective insurance payment model.

Future Trends: Evolving Payment Models in Insurance

Future trends in insurance highlight a shift from traditional premium payment models to usage-based payment systems driven by telematics and IoT data analytics. Insurers leverage real-time data on driving behavior, health metrics, or asset usage to offer personalized pricing, enhancing risk assessment accuracy and customer engagement. This evolution promotes fairness in pricing, reduces claim fraud, and aligns costs directly with individual usage patterns, revolutionizing policy structures in the insurance industry.

Impact of Payment Methods on Customer Experience

Premium payment methods provide customers with predictable, fixed costs that enhance budgeting and financial planning, leading to higher satisfaction and trust in the insurer. Usage-based payment models offer personalized pricing based on actual behavior, encouraging safer habits and empowering customers with cost control, which increases engagement and loyalty. The choice between these payment methods significantly influences customer experience by balancing financial predictability and personalized incentives, shaping overall satisfaction and retention rates.

Related Important Terms

On-Demand Insurance

On-demand insurance offers a flexible premium payment model where policyholders pay only for the coverage they actively use, contrasting with traditional fixed premium payments. This usage-based payment system leverages real-time data and telematics to adjust costs dynamically, enhancing affordability and personalized risk assessment.

Parametric Premium

Parametric premium insurance calculates payments based on predefined triggers such as weather conditions or natural disasters, enabling faster and more transparent claims processing compared to traditional premium payments. Usage-based payment models leverage telematics and real-time data to adjust premiums according to actual risk exposure, offering personalized coverage and potential cost savings for policyholders.

Micro-Payments

Micro-payment models in insurance enable policyholders to pay premiums incrementally based on actual usage or exposure, enhancing affordability and flexibility compared to traditional lump-sum premium payments. Usage-based payment systems leverage telematics and data analytics to calculate dynamic micro-payments that align costs with individual risk profiles and consumption patterns.

Pay-Per-Mile

Premium payment insurance involves fixed monthly or annual fees regardless of driving behavior, while usage-based payment models like Pay-Per-Mile charge policyholders based on the actual miles driven, aligning costs more closely with vehicle usage. Pay-Per-Mile insurance leverages telematics to track mileage, offering potential savings for low-mileage drivers and encouraging safer, more economical driving habits.

Behavior-Based Pricing

Behavior-based pricing in insurance assesses premium payments by analyzing individual driving habits through telematics data, resulting in cost adjustments aligned with actual risk levels. This usage-based payment model incentivizes safer behavior, reduces fraud, and offers personalized premiums compared to traditional fixed-rate premium payments.

Usage-Triggered Coverage

Usage-triggered coverage in insurance adjusts premium costs based on actual policyholder behavior, such as mileage or driving habits, ensuring personalized risk assessment and fairer pricing. This model leverages telematics and real-time data to offer dynamic premiums that reflect individual usage patterns rather than fixed payments.

Telematics-Driven Billing

Telematics-driven billing leverages real-time data from connected devices to tailor insurance premiums based on actual driving behavior, enhancing accuracy compared to traditional fixed premium payments. Usage-based payment models incentivize safer driving by assessing factors like mileage, speed, and braking patterns, resulting in personalized cost savings and reduced risk exposure for insurers.

Subscription-Based Insurance

Subscription-based insurance offers flexible premium payment options, allowing policyholders to pay fixed monthly fees or usage-based payments tied directly to actual risk exposure, such as driving behavior or mileage. This model enhances affordability and personalization, leveraging telematics and real-time data to adjust premiums dynamically and promote customer engagement.

Dynamic Premium Adjustment

Dynamic premium adjustment in insurance allows for real-time recalibration of premium payments based on policyholders' behavior, enhancing accuracy and fairness compared to traditional fixed premium models. Usage-based payment systems leverage telematics and data analytics to continuously assess risk factors, enabling insurers to tailor premiums dynamically and reward safer driving patterns.

Pay-As-You-Drive (PAYD)

Pay-As-You-Drive (PAYD) insurance models calculate premiums based on actual miles driven, promoting cost savings and personalized risk assessment compared to traditional fixed premium payments. This usage-based payment system employs telematics to monitor driving behavior and mileage, allowing insurers to offer more accurate pricing and incentivize safer driving habits.

Premium Payment vs Usage-based Payment Infographic

industrydif.com

industrydif.com