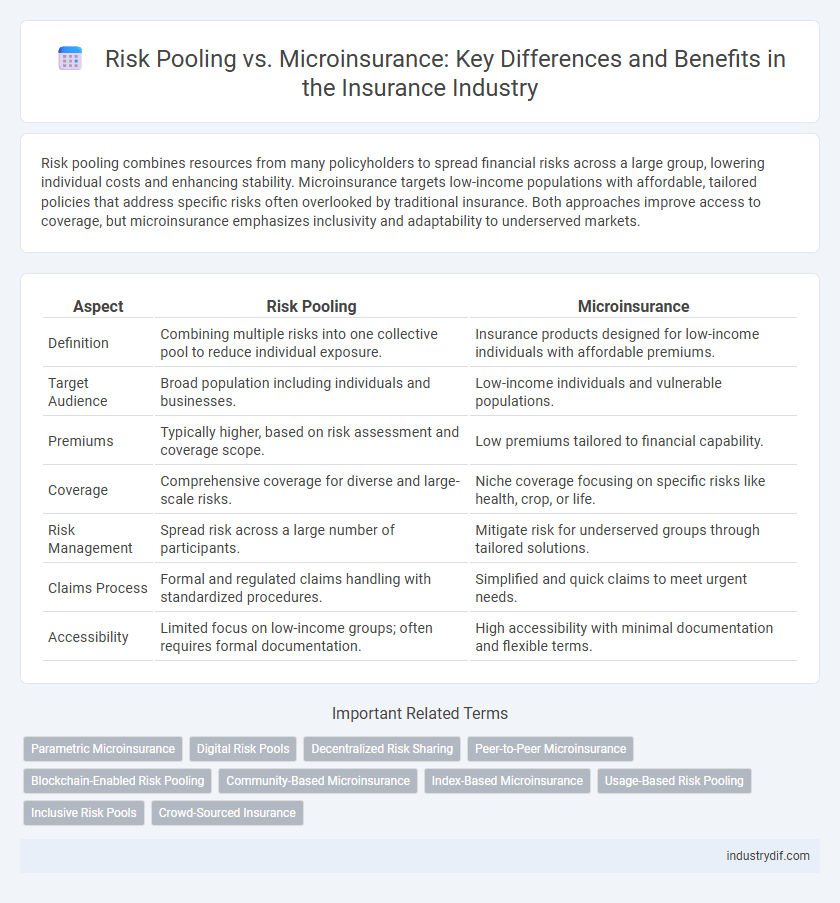

Risk pooling combines resources from many policyholders to spread financial risks across a large group, lowering individual costs and enhancing stability. Microinsurance targets low-income populations with affordable, tailored policies that address specific risks often overlooked by traditional insurance. Both approaches improve access to coverage, but microinsurance emphasizes inclusivity and adaptability to underserved markets.

Table of Comparison

| Aspect | Risk Pooling | Microinsurance |

|---|---|---|

| Definition | Combining multiple risks into one collective pool to reduce individual exposure. | Insurance products designed for low-income individuals with affordable premiums. |

| Target Audience | Broad population including individuals and businesses. | Low-income individuals and vulnerable populations. |

| Premiums | Typically higher, based on risk assessment and coverage scope. | Low premiums tailored to financial capability. |

| Coverage | Comprehensive coverage for diverse and large-scale risks. | Niche coverage focusing on specific risks like health, crop, or life. |

| Risk Management | Spread risk across a large number of participants. | Mitigate risk for underserved groups through tailored solutions. |

| Claims Process | Formal and regulated claims handling with standardized procedures. | Simplified and quick claims to meet urgent needs. |

| Accessibility | Limited focus on low-income groups; often requires formal documentation. | High accessibility with minimal documentation and flexible terms. |

Introduction to Risk Pooling and Microinsurance

Risk pooling involves combining multiple individual risks into a collective fund to reduce the financial impact of unexpected losses, thus enhancing overall coverage stability. Microinsurance targets low-income populations by offering affordable, tailored insurance products that address specific risks such as health, agriculture, and life insurance. Both approaches aim to increase accessibility and improve risk management, but microinsurance specifically focuses on meeting the unique needs of underserved communities through smaller, flexible coverage options.

Core Principles of Risk Pooling

Risk pooling in insurance involves aggregating risks from multiple policyholders to reduce individual exposure to financial loss and stabilize premium costs. This principle relies on the law of large numbers, which enhances predictability of claims and enables insurers to set more accurate pricing. Microinsurance applies these core risk pooling principles on a smaller scale, targeting low-income populations by spreading risk across a large, diverse group to provide affordable coverage.

Understanding Microinsurance: Key Features

Microinsurance targets low-income populations by offering affordable, tailored coverage with simplified policy terms and lower premiums. It relies on risk pooling to spread financial risk among a large group, ensuring sustainability despite smaller individual contributions. Key features include accessible enrollment processes, coverage for specific risks like health or natural disasters, and partnerships with local organizations to enhance outreach and trust.

Target Markets and Beneficiaries

Risk pooling primarily targets larger groups, such as businesses or populations in developed markets, to spread risk across many policyholders, ensuring financial stability and lowering individual premiums. Microinsurance focuses on low-income individuals and informal sector workers in developing regions, offering affordable coverage tailored to their specific needs and vulnerabilities. Beneficiaries of risk pooling benefit from collective financial protection against large-scale losses, while microinsurance beneficiaries gain access to essential risk management tools that promote social and economic inclusion.

Premium Structures and Affordability

Risk pooling distributes premiums across a large group, lowering individual costs but often requiring uniform payments that may be unaffordable for low-income participants. Microinsurance designs premium structures tailored to the financial capacity of underserved populations, featuring flexible, low-cost payments that enhance accessibility and affordability. This customization drives higher participation rates and risk diversification in microinsurance compared to traditional risk pooling schemes.

Claims Processes and Payout Mechanisms

Risk pooling in insurance involves aggregating premiums from a large group to cover claims collectively, enabling efficient claims processing through standardized procedures and faster payout mechanisms. Microinsurance targets low-income populations with tailored coverage, often using simplified claims submission, mobile technology, and quicker, lower-value payouts to ensure accessibility and timeliness. Both approaches rely on data analytics and digital platforms to optimize claims validation and payout accuracy, though microinsurance emphasizes speed and ease to accommodate resource-constrained clients.

Scalability and Distribution Channels

Risk pooling enables widespread risk-sharing across large populations, enhancing scalability through diversified risk exposure and economies of scale; microinsurance, however, targets low-income segments with tailored products that require adaptive distribution channels such as mobile platforms and community networks. Traditional insurers leverage established agents and brokers for expansive reach, while microinsurance depends heavily on innovative digital channels and local partnerships to penetrate underserved markets effectively. Scalability in risk pooling benefits from aggregated premiums and claims stabilization, whereas microinsurance scalability hinges on cost-efficient delivery mechanisms and localized trust-building efforts.

Regulatory Frameworks and Compliance

Regulatory frameworks for risk pooling often involve stringent compliance requirements to ensure adequate capital reserves and solvency, promoting financial stability within large groups. Microinsurance regulations emphasize accessibility and consumer protection, mandating simplified licensing processes and tailored compliance standards to accommodate low-income populations. Both frameworks aim to balance risk management with regulatory oversight, but microinsurance policies typically feature more flexible compliance mechanisms to foster broader market inclusion.

Advantages and Limitations of Each Model

Risk pooling spreads risk among a large group, lowering individual premiums and enhancing financial stability but requires a sizable, homogeneous group to function effectively, limiting flexibility. Microinsurance targets low-income populations with affordable, tailored policies, offering accessibility and inclusivity but often faces challenges like higher administrative costs and limited coverage scope. Both models balance risk management and market reach, making them suitable for different insurance needs and economic contexts.

Future Trends in Risk Management Solutions

Risk pooling is expected to evolve with advanced data analytics and AI integration, enhancing predictive accuracy and personalized coverage options. Microinsurance will increasingly leverage mobile technology and blockchain for seamless access and transparency in low-income markets. Future risk management solutions will emphasize hybrid models combining broad risk pools with targeted microinsurance to maximize coverage efficiency and affordability.

Related Important Terms

Parametric Microinsurance

Parametric microinsurance offers a streamlined risk pooling mechanism by triggering payouts based on predefined parameters such as weather events or natural disasters, minimizing claims processing time and administrative costs. This approach enhances financial inclusion for low-income individuals by providing rapid, transparent coverage tailored to specific, measurable risks.

Digital Risk Pools

Digital risk pools leverage technology to aggregate diverse individual risks into a single fund, enhancing affordability and coverage efficiency compared to traditional microinsurance models. These platforms utilize data analytics, blockchain, and AI to improve risk assessment, reduce fraud, and streamline claims processing, driving scalability and financial inclusion in underserved markets.

Decentralized Risk Sharing

Decentralized risk sharing enables risk pooling by distributing insurance liabilities across numerous independent participants, enhancing resilience and reducing systemic risk compared to traditional microinsurance models. This approach leverages blockchain technology and smart contracts to facilitate transparent, efficient, and cost-effective risk distribution among a broad base of insured individuals.

Peer-to-Peer Microinsurance

Peer-to-peer microinsurance leverages risk pooling within small, community-based groups to offer tailored coverage with lower premiums and increased trust, contrasting traditional risk pooling methods that aggregate large, impersonal risk pools. This decentralized approach enhances risk sharing efficiency by creating transparent, member-driven insurance models that cater to underserved populations and reduce moral hazard.

Blockchain-Enabled Risk Pooling

Blockchain-enabled risk pooling enhances transparency and efficiency in insurance by securely aggregating premium contributions and claims, reducing fraud and administrative costs. Unlike traditional microinsurance, this technology facilitates decentralized data management and automated smart contracts, enabling faster payout and improved access for underserved populations.

Community-Based Microinsurance

Community-based microinsurance leverages risk pooling among localized groups, allowing members to share risks and reduce individual financial burdens through collective premiums. This approach enhances accessibility and affordability for low-income populations by tailoring coverage to specific community needs and fostering mutual support mechanisms.

Index-Based Microinsurance

Index-based microinsurance leverages risk pooling by aggregating data from large groups of policyholders to assess and manage risks tied to specific index triggers, such as weather events or crop yields. This approach reduces administrative costs and moral hazard while providing affordable, transparent coverage to low-income populations vulnerable to environmental and economic shocks.

Usage-Based Risk Pooling

Usage-based risk pooling leverages real-time data from telematics and wearable devices to customize insurance premiums and coverage, enhancing risk assessment accuracy and reducing adverse selection. Unlike traditional microinsurance, which targets low-income populations with simplified policies, usage-based risk pooling enables dynamic pricing and personalized risk management across diverse customer segments.

Inclusive Risk Pools

Inclusive risk pools enhance financial protection by aggregating diverse, low-income populations to spread risk more effectively than traditional microinsurance schemes. These pools reduce individual premiums and increase coverage accessibility, promoting greater socioeconomic resilience among vulnerable groups.

Crowd-Sourced Insurance

Crowd-sourced insurance leverages risk pooling by aggregating premiums from a large number of low-risk individuals, reducing the overall exposure and enabling affordable microinsurance coverage for underserved segments. This model enhances risk diversification and cost efficiency compared to traditional microinsurance schemes reliant on limited participant pools.

Risk Pooling vs Microinsurance Infographic

industrydif.com

industrydif.com