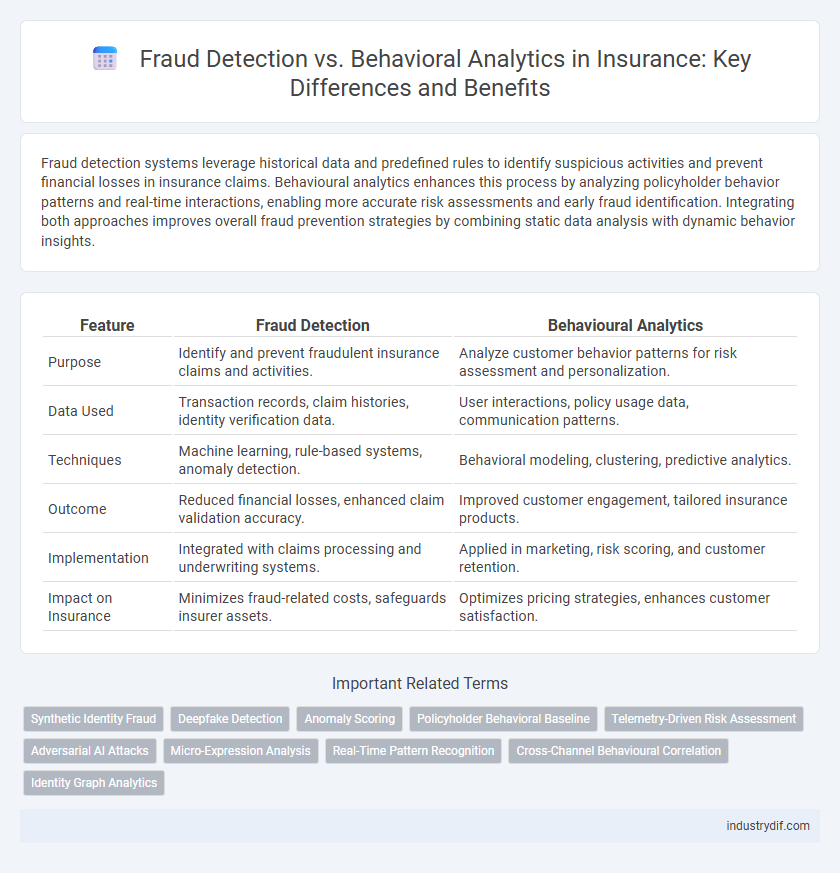

Fraud detection systems leverage historical data and predefined rules to identify suspicious activities and prevent financial losses in insurance claims. Behavioural analytics enhances this process by analyzing policyholder behavior patterns and real-time interactions, enabling more accurate risk assessments and early fraud identification. Integrating both approaches improves overall fraud prevention strategies by combining static data analysis with dynamic behavior insights.

Table of Comparison

| Feature | Fraud Detection | Behavioural Analytics |

|---|---|---|

| Purpose | Identify and prevent fraudulent insurance claims and activities. | Analyze customer behavior patterns for risk assessment and personalization. |

| Data Used | Transaction records, claim histories, identity verification data. | User interactions, policy usage data, communication patterns. |

| Techniques | Machine learning, rule-based systems, anomaly detection. | Behavioral modeling, clustering, predictive analytics. |

| Outcome | Reduced financial losses, enhanced claim validation accuracy. | Improved customer engagement, tailored insurance products. |

| Implementation | Integrated with claims processing and underwriting systems. | Applied in marketing, risk scoring, and customer retention. |

| Impact on Insurance | Minimizes fraud-related costs, safeguards insurer assets. | Optimizes pricing strategies, enhances customer satisfaction. |

Understanding Fraud Detection in Insurance

Fraud detection in insurance employs advanced algorithms and machine learning to identify suspicious claims by analyzing patterns and anomalies within large datasets. Behavioral analytics enhances this process by examining policyholders' actions and historical behavior to detect deviations that may indicate fraudulent activity. Integrating these technologies improves accuracy in fraud prevention, reduces false positives, and protects insurers from financial losses.

Introduction to Behavioural Analytics

Behavioural analytics in insurance leverages data patterns from customer interactions to identify anomalies indicative of fraud, enhancing traditional fraud detection methods. By analyzing behavioral cues such as transaction frequency, claim submission times, and user navigation paths, insurers can predict and prevent fraudulent activities more accurately. Advanced machine learning algorithms within behavioural analytics enable real-time monitoring and adaptive threat detection, improving risk management and claim verification processes.

Key Differences Between Fraud Detection and Behavioural Analytics

Fraud detection in insurance primarily focuses on identifying patterns and anomalies that indicate fraudulent claims or activities by analyzing historical data and known fraud indicators. Behavioural analytics, on the other hand, examines individual policyholders' behavior and interaction patterns in real-time to uncover subtle deviations that may signal emerging risks or fraud attempts. While fraud detection targets explicit fraud signals, behavioural analytics provides a deeper, proactive insight into customer actions, enabling more dynamic risk management and personalized intervention strategies.

The Role of Data in Fraud Detection

Data plays a crucial role in fraud detection within the insurance industry by enabling the identification of suspicious patterns and anomalies through advanced analytics. Behavioral analytics leverages extensive datasets to understand normal customer actions, distinguishing fraudulent activities by deviations in behavior. Integrating diverse data sources enhances predictive accuracy, reducing false positives and improving overall fraud prevention efficiency.

How Behavioural Analytics Transforms Insurance

Behavioural analytics revolutionizes insurance by leveraging advanced algorithms to analyze patterns in customer behavior, enabling precise fraud detection and risk assessment. By monitoring real-time data such as transaction history, policyholder interactions, and claim filing patterns, insurers can identify anomalies that traditional methods might overlook. This proactive approach reduces false positives, enhances claim validation processes, and ultimately lowers operational costs while improving customer trust.

Benefits of Combining Fraud Detection with Behavioural Analytics

Combining fraud detection with behavioral analytics enhances accuracy by leveraging machine learning algorithms to identify unusual patterns in customer behavior, reducing false positives and enabling quicker fraud response. Insurers benefit from real-time insights into deviations from typical user activity, improving risk assessment and customer profiling. This integrated approach strengthens overall security, minimizes financial losses, and boosts customer trust through proactive fraud prevention.

Challenges in Implementing Fraud Detection Tools

Implementing fraud detection tools in insurance faces challenges such as handling vast and diverse data sets while ensuring real-time analysis accuracy. Behavioral analytics integration demands sophisticated algorithms to interpret patterns accurately, avoiding false positives that can erode customer trust. Limited interoperability with legacy systems and evolving fraud tactics further complicate the deployment and effectiveness of these fraud detection solutions.

Enhancing Claims Processing with Behavioural Insights

Fraud detection in insurance relies on identifying suspicious patterns and anomalies in claims data to prevent financial losses. Behavioural analytics enhances claims processing by analyzing policyholder behavior, enabling more accurate risk assessment and faster identification of fraudulent activities. Integrating behavioural insights with traditional fraud detection methods improves claim verification efficiency and reduces false positives, ultimately streamlining the insurance claims workflow.

Emerging Trends in Insurance Fraud Prevention

Emerging trends in insurance fraud prevention increasingly leverage behavioural analytics to enhance traditional fraud detection methods by analyzing patterns such as unusual claim submissions and customer interactions. Machine learning algorithms identify anomalies in large datasets, enabling insurers to predict and prevent fraudulent activities with higher accuracy. Integration of real-time data from IoT devices and social media further supports proactive risk assessment and fraud mitigation strategies.

Future Outlook: Integrating AI in Fraud Detection and Behavioural Analytics

The future of insurance fraud detection hinges on the seamless integration of Artificial Intelligence (AI) with behavioural analytics to enhance predictive accuracy and real-time anomaly identification. AI-powered machine learning models continuously adapt to evolving fraud patterns by analyzing vast datasets of consumer behaviour, transaction histories, and biometric data, enabling quicker and more precise fraud alerts. This synergy transforms traditional fraud detection into an intelligent, proactive system that minimizes false positives and strengthens insurance risk management strategies.

Related Important Terms

Synthetic Identity Fraud

Synthetic identity fraud detection leverages behavioral analytics to identify patterns and anomalies in claimant actions that deviate from typical customer behavior, enabling insurers to uncover fabricated identities created by combining real and fictitious data. By analyzing device fingerprints, transaction sequences, and interaction timings, behavioral analytics enhances fraud detection systems to effectively combat synthetic identity fraud in insurance claims.

Deepfake Detection

Fraud detection in insurance increasingly leverages behavioural analytics to identify anomalies in claim patterns, with deepfake detection emerging as a critical tool to verify the authenticity of audio and video submissions. Advanced AI algorithms analyze biometric cues and inconsistencies in manipulated content, enabling insurers to prevent fraudulent claims and reduce financial losses.

Anomaly Scoring

Anomaly scoring in fraud detection leverages behavioral analytics to quantify deviations from typical policyholder actions, enabling insurers to identify suspicious claims with higher accuracy. By assigning risk scores based on behavioral anomalies, insurers streamline investigations and reduce false positives, enhancing fraud mitigation efforts.

Policyholder Behavioral Baseline

Policyholder behavioral baseline in fraud detection establishes normal activity patterns by analyzing historical data, enabling insurers to identify anomalies indicative of fraudulent claims. Behavioral analytics enhances fraud detection accuracy by continuously monitoring deviations from these established baselines, reducing false positives and improving risk assessment.

Telemetry-Driven Risk Assessment

Fraud detection in insurance leverages telemetry-driven risk assessment by analyzing real-time data from connected devices such as telematics in vehicles to identify anomalies and potential fraudulent activities. Behavioural analytics enhances this process by interpreting patterns in customer behavior and driving habits, improving accuracy in risk scoring and reducing false positives in claims evaluation.

Adversarial AI Attacks

Fraud detection in insurance leverages machine learning models to identify suspicious claims but remains vulnerable to adversarial AI attacks that manipulate input data to evade detection. Behavioral analytics enhances traditional methods by analyzing user patterns and anomalies, providing a robust defense against these adversarial manipulations that aim to deceive fraud detection systems.

Micro-Expression Analysis

Micro-expression analysis in insurance fraud detection identifies involuntary facial expressions to reveal concealed emotions indicative of deceit, enhancing the accuracy of behavioral analytics models. Integrating micro-expression data with traditional fraud detection systems improves risk assessment by detecting subtle, rapid emotional cues often missed in standard claim evaluations.

Real-Time Pattern Recognition

Fraud detection in insurance leverages real-time pattern recognition to identify anomalies in claims and transactions, enhancing accuracy by cross-referencing vast historical data sets and behavioral indicators. Behavioral analytics further refines this process by analyzing user actions and interactions, enabling insurers to detect subtle deviations indicative of potential fraud before payouts occur.

Cross-Channel Behavioural Correlation

Cross-channel behavioural correlation in insurance fraud detection enhances accuracy by analyzing patterns across multiple platforms such as mobile apps, websites, and call centers to identify inconsistencies. Integrating behavioural analytics with fraud detection systems enables insurers to detect suspicious activities faster, reducing false positives and improving claim verification efficiency.

Identity Graph Analytics

Fraud detection in insurance leverages identity graph analytics to map complex relationships between entities such as policyholders, devices, and transaction histories, enabling precise identification of fraudulent patterns. Behavioural analytics complements this approach by analyzing user interactions and anomalies over time, enhancing the accuracy and responsiveness of fraud prevention systems.

Fraud Detection vs Behavioural Analytics Infographic

industrydif.com

industrydif.com