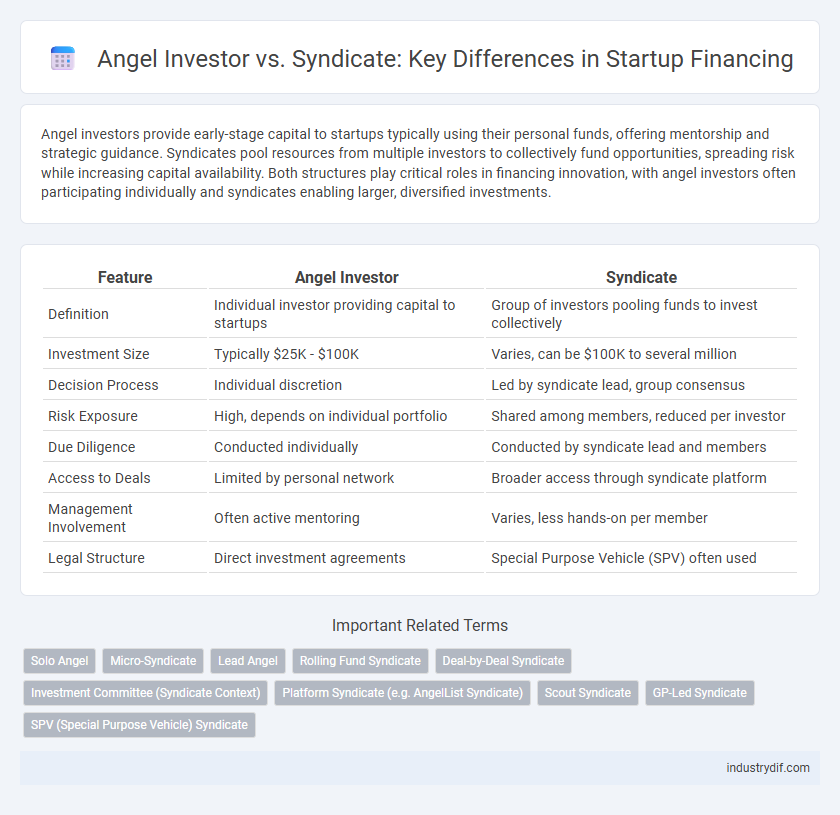

Angel investors provide early-stage capital to startups typically using their personal funds, offering mentorship and strategic guidance. Syndicates pool resources from multiple investors to collectively fund opportunities, spreading risk while increasing capital availability. Both structures play critical roles in financing innovation, with angel investors often participating individually and syndicates enabling larger, diversified investments.

Table of Comparison

| Feature | Angel Investor | Syndicate |

|---|---|---|

| Definition | Individual investor providing capital to startups | Group of investors pooling funds to invest collectively |

| Investment Size | Typically $25K - $100K | Varies, can be $100K to several million |

| Decision Process | Individual discretion | Led by syndicate lead, group consensus |

| Risk Exposure | High, depends on individual portfolio | Shared among members, reduced per investor |

| Due Diligence | Conducted individually | Conducted by syndicate lead and members |

| Access to Deals | Limited by personal network | Broader access through syndicate platform |

| Management Involvement | Often active mentoring | Varies, less hands-on per member |

| Legal Structure | Direct investment agreements | Special Purpose Vehicle (SPV) often used |

Introduction to Angel Investors and Syndicates

Angel investors are high-net-worth individuals who provide early-stage capital to startups in exchange for equity, offering not only funds but mentorship and industry connections. Syndicates are groups of angel investors who pool resources to collectively invest larger sums in startups, spreading risk and increasing investment reach. Both play critical roles in startup financing by fueling growth and innovation during the initial phases.

Key Differences Between Angel Investors and Syndicates

Angel investors provide individual capital and mentorship to startups, often investing personal funds and taking an active role in business development. Syndicates pool resources from multiple investors, allowing for larger collective investments and risk sharing, managed by a lead investor who sources and vets opportunities. Key differences include investment scale, decision-making structure, and involvement level, with angel investors typically more hands-on and syndicates offering diversified capital access.

How Angel Investors Operate in the Finance Sector

Angel investors typically operate by providing early-stage capital to startups in exchange for equity ownership, often bringing industry expertise and mentorship alongside financial support. They invest individually or as part of informal groups and conduct thorough due diligence to evaluate a startup's potential, focusing on innovation, market opportunity, and team capability. Unlike syndicates, which pool resources from multiple investors to fund ventures collectively, angel investors maintain more direct control and decision-making power over their investments.

Structure and Functioning of Investment Syndicates

Investment syndicates in finance are structured as groups of angel investors pooling their capital to co-invest in startups, often led by a syndicate lead who sources deals and manages communication with entrepreneurs. These syndicates function to diversify risk, increase capital availability, and provide startups with a broader network of expertise and mentorship. Unlike individual angel investors, syndicates streamline the investment process by consolidating due diligence and negotiations, offering a more efficient and collaborative approach to early-stage funding.

Risk Profiles: Angel Investing vs Syndicate Investments

Angel investors typically assume higher individual risk by investing their own capital directly into early-stage startups, often with limited diversification. Syndicate investments pool multiple investors' funds, spreading risk across various ventures and leveraging collective due diligence to mitigate potential losses. The risk profile of angel investing is generally higher and more concentrated, while syndicates offer a more balanced approach through shared liability and diversified investment portfolios.

Capital Requirements for Angels and Syndicate Members

Angel investors typically invest personal capital ranging from $25,000 to $100,000 per deal, enabling quick decision-making and individual control over investment terms. Syndicate members combine their funds, often contributing smaller amounts between $5,000 and $20,000, to collectively meet larger capital requirements and diversify risk. Syndicates allow investors to participate in larger deals with lower individual capital commitments, while angels carry the full financial responsibility independently.

Decision-Making Processes: Angels vs Syndicates

Angel investors make individual decisions based on personal expertise, risk tolerance, and intuition, allowing for faster investment actions but with narrower due diligence. Syndicates pool resources and knowledge from multiple investors, enabling comprehensive evaluation and shared risk, which often leads to more meticulous and consensus-driven decision-making. This collaborative approach helps syndicates leverage diverse insights, resulting in balanced investment choices and mitigated risks.

Advantages and Disadvantages of Angel Investors

Angel investors provide startups with substantial early-stage capital and valuable industry expertise, often offering more flexible terms than venture capitalists. However, their limited funding capacity can restrict the scale of investment, and reliance on individual decision-making may introduce higher risk and potential lack of ongoing support. Despite these drawbacks, angel investors often bring personalized mentorship and strong networking opportunities, crucial for early business growth.

Advantages and Disadvantages of Investment Syndicates

Investment syndicates consolidate capital from multiple angel investors, enabling larger funding rounds and risk diversification. They provide access to a network of expertise and deal flow but often involve shared decision-making, which can slow the investment process and reduce individual control. While syndicates offer scalability and pooled resources, potential conflicts among members and lower individual returns compared to solo investments present notable drawbacks.

Choosing Between Angel Investing and Syndicate Participation

Choosing between angel investing and syndicate participation depends on risk tolerance, capital availability, and desired involvement level. Angel investors commit personal funds and often provide strategic guidance, while syndicate members pool resources to spread risk and gain access to larger deals. Evaluating the trade-offs in decision-making autonomy and due diligence responsibilities is crucial for maximizing returns in early-stage ventures.

Related Important Terms

Solo Angel

A solo angel investor independently provides early-stage capital, leveraging personal funds and expertise to support startups without the collective decision-making constraints found in syndicates, which pool resources from multiple investors to diversify risk. Solo angels often offer faster investment decisions and deeper, personalized mentorship, differentiating their impact from syndicate-based funding structures.

Micro-Syndicate

Angel investors provide early-stage capital individually, often bringing personal expertise and networks, while micro-syndicates pool resources from multiple accredited investors to collectively invest in startups. Micro-syndicates streamline deal access and due diligence, enabling smaller contributors to participate in larger financing rounds with reduced risk exposure.

Lead Angel

A lead angel in an angel syndicate plays a pivotal role by conducting thorough due diligence, setting investment terms, and coordinating communication among co-investors, thereby streamlining the decision-making process. This leadership position enhances deal flow efficiency and risk management compared to individual angel investing.

Rolling Fund Syndicate

A Rolling Fund Syndicate allows angel investors to pool capital continuously, providing startups with ongoing access to funding and investors with diversified exposure over multiple investment cycles. This model contrasts with traditional angel investing, where individual investors commit capital upfront without the structured, recurring investment and operational support inherent in rolling funds.

Deal-by-Deal Syndicate

Deal-by-deal syndicates allow angel investors to evaluate and invest in individual startups separately, providing flexibility and mitigating risk compared to committing to a full syndicate fund upfront. This structure enables tailored investment decisions while benefiting from the lead investor's due diligence and deal flow expertise.

Investment Committee (Syndicate Context)

An investment committee in a syndicate plays a crucial role in evaluating and approving funding opportunities by leveraging collective expertise and rigorous due diligence processes. This structured decision-making approach contrasts with individual angel investors who rely primarily on personal judgment and experience when making investment choices.

Platform Syndicate (e.g. AngelList Syndicate)

AngelList Syndicate offers a platform-based approach where lead investors pool capital from multiple backers, enabling access to larger deals and diversified risk compared to a single angel investor's independent funding. Syndicates leverage platform technology to streamline deal flow, due diligence, and investment management, enhancing efficiency and scalability in startup financing.

Scout Syndicate

Scout syndicates enable angel investors to pool resources, increasing capital deployment efficiency and diversifying risk across multiple early-stage startups. Unlike solo angel investors, scout syndicate members leverage collective expertise and deal flow access, maximizing potential returns in competitive funding environments.

GP-Led Syndicate

GP-led syndicates in finance involve general partners pooling capital from multiple angel investors to co-invest in startups, providing diversified risk and enhanced deal flow. Unlike individual angel investors, GP-led syndicates benefit from professional management, streamlined due diligence, and access to larger funding rounds.

SPV (Special Purpose Vehicle) Syndicate

An SPV Syndicate pools capital from multiple angel investors into a single Special Purpose Vehicle, enabling streamlined management and reduced individual risk in startup investments. This structure allows angels to participate in larger deals with collective due diligence while limiting liability to their pro-rata investment within the SPV.

Angel Investor vs Syndicate Infographic

industrydif.com

industrydif.com