Payment gateways facilitate instant online transactions by securely processing credit card and digital payments, ensuring quick merchant settlements and enhanced customer trust. Buy Now Pay Later (BNPL) allows consumers to split purchases into interest-free installments, increasing purchasing power and boosting conversion rates for retailers. While payment gateways emphasize transaction speed and security, BNPL focuses on consumer flexibility and affordability, making both essential components in modern e-commerce finance strategies.

Table of Comparison

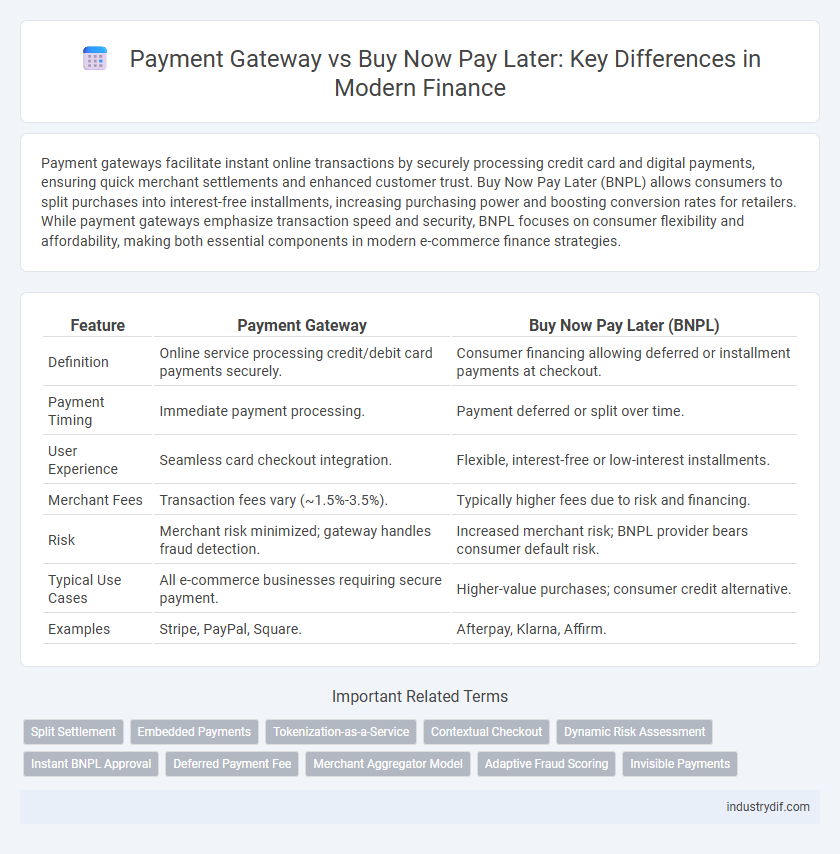

| Feature | Payment Gateway | Buy Now Pay Later (BNPL) |

|---|---|---|

| Definition | Online service processing credit/debit card payments securely. | Consumer financing allowing deferred or installment payments at checkout. |

| Payment Timing | Immediate payment processing. | Payment deferred or split over time. |

| User Experience | Seamless card checkout integration. | Flexible, interest-free or low-interest installments. |

| Merchant Fees | Transaction fees vary (~1.5%-3.5%). | Typically higher fees due to risk and financing. |

| Risk | Merchant risk minimized; gateway handles fraud detection. | Increased merchant risk; BNPL provider bears consumer default risk. |

| Typical Use Cases | All e-commerce businesses requiring secure payment. | Higher-value purchases; consumer credit alternative. |

| Examples | Stripe, PayPal, Square. | Afterpay, Klarna, Affirm. |

Introduction to Payment Gateway and Buy Now Pay Later

Payment gateways enable secure online transactions by processing credit card and digital payments, ensuring fast authorization and fraud prevention for e-commerce platforms. Buy Now Pay Later (BNPL) offers consumers the ability to split purchases into interest-free installments without using credit cards, enhancing affordability and boosting conversion rates. Both solutions play crucial roles in modern finance by improving payment flexibility and customer experience in digital commerce.

How Payment Gateways Work

Payment gateways securely process online transactions by encrypting customers' payment information and transmitting it to the acquiring bank for authorization. They integrate with e-commerce platforms to facilitate real-time approval or decline of payments, ensuring swift and secure fund transfers between buyers and sellers. These systems comply with PCI DSS standards to protect sensitive cardholder data and prevent fraud during digital payment processing.

Buy Now Pay Later: Definition and Mechanism

Buy Now Pay Later (BNPL) is a financing option that allows consumers to purchase products immediately and defer payment over a set period, often interest-free. This mechanism involves a third-party provider that pays the merchant upfront while the consumer repays the BNPL service in installments. BNPL solutions enhance cash flow management for consumers and merchants, offering an alternative to traditional credit card payments within the digital payment ecosystem.

Key Differences Between Payment Gateway and BNPL

Payment gateways serve as digital channels that authorize and process real-time online transactions by securely transmitting payment data between customers, merchants, and banks, whereas Buy Now Pay Later (BNPL) offers consumers the option to defer payments or split purchases into interest-free installments over time. Payment gateways facilitate immediate settlement and fund transfer, supporting multiple payment methods including credit cards, digital wallets, and bank transfers, contrasting with BNPL's credit-based model that involves risk assessment and delayed merchant payment. Merchant fees for payment gateways typically include transaction and service charges, while BNPL providers may charge higher merchant commissions in exchange for increased conversion rates and customer financing convenience.

Advantages of Using Payment Gateways

Payment gateways offer secure and instant transaction processing, reducing the risk of fraud and chargebacks for merchants. They support multiple payment methods, enhancing customer convenience and expanding market reach. Integration with existing e-commerce platforms streamlines checkout flows, improving conversion rates and overall sales performance.

Benefits of Buy Now Pay Later Solutions

Buy Now Pay Later (BNPL) solutions enhance customer purchasing power by allowing flexible installment payments without immediate full upfront costs, improving cash flow management. These solutions increase conversion rates and average order values for merchants by reducing purchase hesitation and providing interest-free payment options. BNPL services integrate seamlessly with e-commerce platforms, offering faster onboarding and advanced fraud protection compared to traditional payment gateways.

Payment Gateway Fees vs BNPL Charges

Payment gateways typically charge a fixed percentage fee per transaction, ranging from 1.5% to 3.5%, plus a small fixed fee, which merchants must pay regardless of customer repayment behavior. Buy Now Pay Later (BNPL) services often impose higher merchant fees, sometimes exceeding 4%, compensating for the risk of customer defaults and delayed payments. Comparing these fee structures helps businesses optimize cash flow management and reduce transaction costs while maintaining customer convenience.

Security and Compliance in Payment Systems

Payment gateways implement advanced encryption protocols and adhere to Payment Card Industry Data Security Standard (PCI DSS) to ensure secure transaction processing. Buy Now Pay Later (BNPL) services incorporate strict identity verification and compliance with financial regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) to mitigate fraud risks. Both systems prioritize secure data handling and regulatory compliance to protect users and maintain trust in digital payment ecosystems.

Impact on Consumer Experience

Payment gateways provide seamless and secure transaction processing, enhancing consumer trust and convenience during checkout by enabling instant payment authorization and multiple payment options. Buy Now Pay Later (BNPL) services improve consumer experience by offering flexible installment plans, increasing purchasing power and reducing immediate financial burden. Both technologies significantly boost conversion rates but differ in addressing immediate payment versus credit flexibility, shaping varied consumer purchasing behaviors.

Future Trends in Payment Processing Technologies

Payment gateway technology is rapidly evolving to incorporate AI-driven fraud detection and blockchain for enhanced transaction security, significantly improving payment processing speed and reliability. Buy Now Pay Later (BNPL) services are integrating with digital wallets and leveraging machine learning algorithms to offer personalized credit assessments, expanding consumer access without compromising risk management. Future trends indicate a convergence of instant payment authorization, biometric authentication, and decentralized finance (DeFi) solutions, reshaping the payment processing landscape across global markets.

Related Important Terms

Split Settlement

Payment gateway split settlement enables merchants to automatically divide transaction funds among multiple parties instantly, enhancing cash flow management and operational efficiency. Buy Now Pay Later (BNPL) typically involves deferred payments handled by a third party, with merchants receiving a lump sum upfront, limiting real-time split settlement capabilities.

Embedded Payments

Embedded payments seamlessly integrate payment gateway functionality within platforms, streamlining transactions without redirecting users, while Buy Now Pay Later (BNPL) offers consumers flexible credit options at checkout. Combining embedded payment gateways with BNPL solutions enhances user experience by facilitating instant approvals and real-time credit assessments directly within the purchasing interface.

Tokenization-as-a-Service

Tokenization-as-a-Service enhances payment gateway security by converting sensitive card information into unique tokens, reducing fraud risks during transactions. In contrast, Buy Now Pay Later solutions leverage tokenization to securely manage deferred payments without exposing consumer financial data, improving user trust and compliance.

Contextual Checkout

Contextual checkout enhances the payment experience by dynamically offering options like payment gateways and Buy Now Pay Later (BNPL) based on customer behavior and transaction context. Integrating BNPL within payment gateways reduces friction and increases conversion rates by providing flexible financing seamlessly during the checkout process.

Dynamic Risk Assessment

Dynamic risk assessment in payment gateways continuously evaluates transaction data using machine learning algorithms to detect fraud and reduce chargebacks, ensuring secure real-time authorization. Buy Now Pay Later (BNPL) platforms apply dynamic risk models by analyzing consumer creditworthiness and spending behavior, enabling flexible installment payments while mitigating default risks through adaptive credit limits.

Instant BNPL Approval

Instant BNPL approval significantly enhances customer purchase experience by offering seamless, interest-free payment options without extensive credit checks, unlike traditional payment gateways that process immediate transactions but require full upfront payment. This real-time approval process drives higher conversion rates and increases average order values by providing flexible financing solutions at checkout.

Deferred Payment Fee

Deferred payment fees in Payment Gateways typically apply as fixed transaction costs or percentage-based charges for delayed settlements, impacting overall merchant expenses. Buy Now Pay Later services often incorporate deferred payment fees as interest or administrative charges spread over installment periods, influencing consumer affordability and repayment terms.

Merchant Aggregator Model

The Merchant Aggregator Model streamlines payment processing by consolidating multiple payment methods into a single platform, offering merchants simplified access to Buy Now Pay Later services and traditional payment gateways. This model enhances cash flow management and customer conversion rates by enabling seamless transaction settlements while minimizing integration complexity.

Adaptive Fraud Scoring

Adaptive fraud scoring enhances payment gateway security by continuously analyzing transaction behavior to detect and prevent fraudulent activities in real-time. Buy Now Pay Later services leverage adaptive fraud scoring algorithms to minimize credit risk and ensure consumer authentication without disrupting the seamless checkout experience.

Invisible Payments

Invisible payments enhance customer experience by seamlessly processing transactions without interrupting the checkout flow, unlike traditional payment gateways that require explicit user input. Buy Now Pay Later services offer deferred payment options but often involve visible approval steps, making invisible payment technology crucial for frictionless, real-time financial interactions in e-commerce.

Payment Gateway vs Buy Now Pay Later Infographic

industrydif.com

industrydif.com