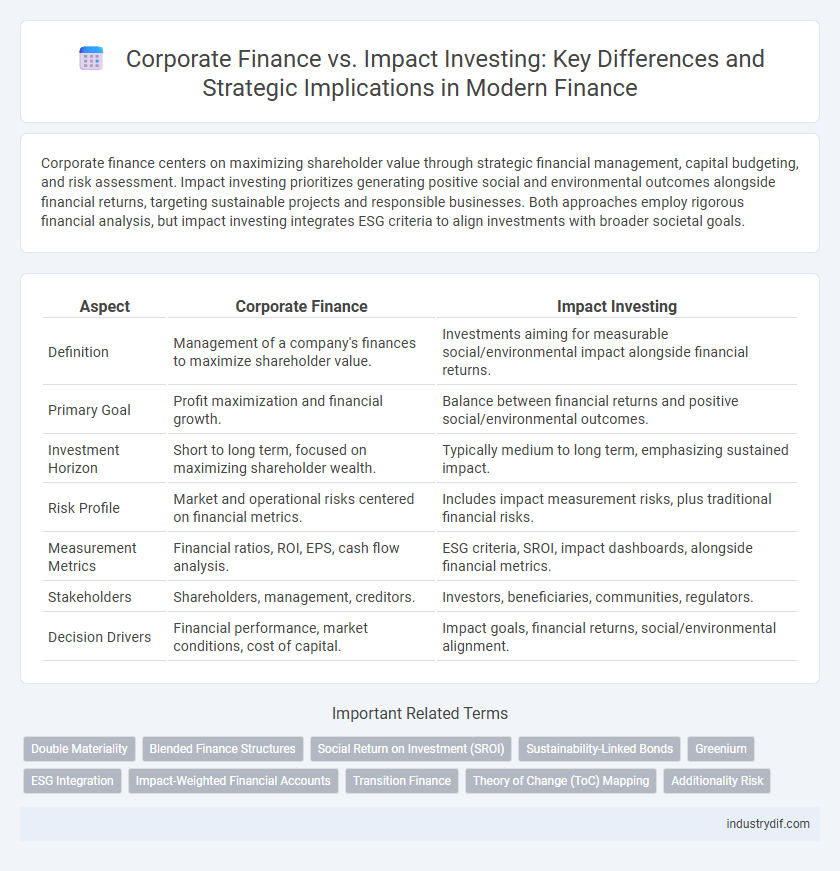

Corporate finance centers on maximizing shareholder value through strategic financial management, capital budgeting, and risk assessment. Impact investing prioritizes generating positive social and environmental outcomes alongside financial returns, targeting sustainable projects and responsible businesses. Both approaches employ rigorous financial analysis, but impact investing integrates ESG criteria to align investments with broader societal goals.

Table of Comparison

| Aspect | Corporate Finance | Impact Investing |

|---|---|---|

| Definition | Management of a company's finances to maximize shareholder value. | Investments aiming for measurable social/environmental impact alongside financial returns. |

| Primary Goal | Profit maximization and financial growth. | Balance between financial returns and positive social/environmental outcomes. |

| Investment Horizon | Short to long term, focused on maximizing shareholder wealth. | Typically medium to long term, emphasizing sustained impact. |

| Risk Profile | Market and operational risks centered on financial metrics. | Includes impact measurement risks, plus traditional financial risks. |

| Measurement Metrics | Financial ratios, ROI, EPS, cash flow analysis. | ESG criteria, SROI, impact dashboards, alongside financial metrics. |

| Stakeholders | Shareholders, management, creditors. | Investors, beneficiaries, communities, regulators. |

| Decision Drivers | Financial performance, market conditions, cost of capital. | Impact goals, financial returns, social/environmental alignment. |

Defining Corporate Finance

Corporate finance involves managing a company's capital structure, funding strategies, and investment decisions to maximize shareholder value and ensure sustainable growth. It encompasses activities such as budgeting, financial forecasting, capital raising through equity and debt, and risk management. The discipline focuses on optimizing the allocation of financial resources to enhance profitability and support long-term business objectives.

Understanding Impact Investing

Impact investing channels capital into enterprises generating measurable social and environmental benefits alongside financial returns, contrasting with traditional corporate finance that primarily prioritizes profit maximization. Investors in impact investing emphasize ESG (Environmental, Social, and Governance) criteria to evaluate potential investments, aligning financial objectives with sustainable development goals. This approach integrates impact measurement frameworks such as IRIS+ and GIIRS, enabling transparent assessment of social outcomes alongside financial performance.

Key Objectives: Profit Maximization vs Social Impact

Corporate finance primarily focuses on profit maximization by optimizing capital structure, managing financial risks, and ensuring shareholder value growth. Impact investing prioritizes generating measurable social and environmental benefits alongside financial returns, targeting projects that address issues such as sustainability, poverty alleviation, and community development. While corporate finance aims at maximizing shareholder wealth, impact investing balances financial performance with positive societal outcomes, often using metrics like social return on investment (SROI) to evaluate success.

Risk and Return Profiles

Corporate finance typically emphasizes maximizing shareholder value through risk-adjusted returns, focusing on metrics like weighted average cost of capital (WACC) and internal rate of return (IRR). Impact investing prioritizes generating measurable social and environmental outcomes alongside financial returns, often accepting lower or longer-term financial gains to achieve positive impact. The risk profiles differ as corporate finance investments generally target predictable cash flows, while impact investing embraces higher uncertainty due to evolving markets and impact measurement challenges.

Investment Strategies Explained

Corporate finance centers on maximizing shareholder value through capital structure optimization, mergers, and acquisitions, typically prioritizing financial returns and risk management. Impact investing integrates financial objectives with intentional social and environmental outcomes, targeting investments in sustainable enterprises or projects that generate measurable positive impact alongside profit. Both strategies require rigorous due diligence, but impact investing emphasizes aligning investment portfolios with broader ESG (Environmental, Social, and Governance) criteria and impact measurement frameworks.

Measuring Success: Financial Metrics vs Impact Metrics

Corporate finance prioritizes financial metrics such as return on investment (ROI), earnings per share (EPS), and net present value (NPV) to gauge success, focusing on profitability and shareholder value. Impact investing uses impact metrics including social return on investment (SROI), environmental, social, and governance (ESG) scores, and impact-weighted accounts to assess the social and environmental outcomes of investments. Measuring success in these domains requires balancing traditional financial performance indicators with qualitative and quantitative impact assessments to ensure both fiscal responsibility and positive societal contributions.

Stakeholder Engagement and Influence

Stakeholder engagement in corporate finance primarily targets maximizing shareholder value through strategic financial decisions and risk management. In impact investing, stakeholder influence extends to social and environmental outcomes, emphasizing collaborative partnerships with communities, regulators, and beneficiaries to drive sustainable impact. Effective stakeholder dialogue in both fields leverages transparent communication and shared value creation to align financial goals with broader societal objectives.

Regulatory and Reporting Frameworks

Corporate finance operates under established regulatory frameworks such as the Sarbanes-Oxley Act and International Financial Reporting Standards (IFRS), ensuring transparency and accountability in financial disclosures. Impact investing demands adherence to specialized reporting standards like the Global Impact Investing Network's (GIIN) IRIS+ metrics and the Sustainability Accounting Standards Board (SASB) guidelines, which emphasize social and environmental outcomes alongside financial performance. Regulatory bodies increasingly integrate Environmental, Social, and Governance (ESG) criteria, narrowing the gap between traditional corporate finance compliance and impact investing transparency.

Market Trends and Growth Potential

Corporate finance continues to evolve with increased emphasis on digital transformation and sustainable financial strategies, driving steady market growth projected at a CAGR of 6.5% through 2028. Impact investing is experiencing rapid expansion, with global assets under management surpassing $1.3 trillion and an expected annual growth rate exceeding 15% as investors prioritize environmental, social, and governance (ESG) outcomes alongside financial returns. The convergence of these trends highlights a shifting landscape where financial performance and positive societal impact increasingly influence capital allocation decisions.

Future Outlook: Integration or Divergence

Corporate finance increasingly incorporates environmental, social, and governance (ESG) criteria, signaling a trend toward integration with impact investing principles. Impact investing thrives on measurable social returns alongside financial performance, prompting traditional finance to adopt more sustainable metrics for risk assessment and capital allocation. The future outlook predicts a convergence where hybrid strategies leverage both financial rigor and social impact to drive long-term value creation.

Related Important Terms

Double Materiality

Corporate finance primarily concentrates on financial materiality, emphasizing impacts on enterprise value and stakeholder returns, while impact investing integrates double materiality by assessing both financial performance and the environmental or social consequences of investments. This dual-focus approach ensures that impact investors account for how external sustainability factors affect financial outcomes and how their investments influence broader societal and ecological systems.

Blended Finance Structures

Blended finance structures leverage public or philanthropic capital to mitigate risks for private investors, thereby catalyzing larger investments in sustainable development projects that balance financial returns with social impact. These hybrid models bridge corporate finance strategies and impact investing objectives by unlocking new funding sources and enhancing investment scalability in sectors like renewable energy, affordable housing, and healthcare.

Social Return on Investment (SROI)

Corporate finance primarily emphasizes maximizing financial returns and shareholder value through strategic capital allocation, whereas impact investing integrates financial goals with measurable social and environmental outcomes, prioritizing Social Return on Investment (SROI) as a key performance metric. SROI quantifies the social impact generated per dollar invested, enabling investors to assess the broader value created beyond traditional financial metrics.

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) integrate corporate finance strategies with impact investing principles by tying bond terms to measurable environmental, social, and governance (ESG) performance targets, aligning investor returns with sustainability outcomes. These bonds promote corporate accountability in reducing carbon emissions or enhancing social impact while providing flexible capital structures that encourage long-term sustainable growth.

Greenium

Corporate finance typically emphasizes maximizing shareholder value through traditional investment metrics, whereas impact investing incorporates environmental, social, and governance (ESG) criteria to generate measurable positive outcomes, often resulting in a "greenium"--a premium investors are willing to pay for sustainable assets. The greenium reflects growing demand for green bonds and sustainable investments, influencing cost of capital by offering lower yields due to perceived reduced risk and enhanced long-term value in climate-aligned corporate finance strategies.

ESG Integration

Corporate finance traditionally prioritizes maximizing shareholder value through financial metrics and strategic capital allocation, while impact investing emphasizes generating measurable social and environmental benefits alongside financial returns. ESG integration within corporate finance increasingly influences risk assessment and long-term value creation, whereas impact investing employs ESG criteria as core determinants in selecting investments that align with specific sustainability objectives.

Impact-Weighted Financial Accounts

Impact-Weighted Financial Accounts integrate social and environmental performance metrics into traditional financial statements, enabling corporations to quantify and report their broader societal impact alongside financial results. This innovative approach contrasts with conventional corporate finance by prioritizing value creation beyond profit, fostering transparency and accountability in sustainable investment decisions.

Transition Finance

Transition finance bridges corporate finance and impact investing by providing capital to companies moving toward sustainable practices without immediate financial returns. It enables corporations to fund environmentally focused projects that reduce carbon footprints while maintaining profitability and shareholder value.

Theory of Change (ToC) Mapping

Corporate finance revolves around optimizing capital structure and maximizing shareholder value through financial modeling and risk assessment, while impact investing integrates Theory of Change (ToC) mapping to align investments with social and environmental outcomes, systematically tracking causal pathways from capital deployment to measurable impact. ToC mapping in impact investing bridges financial returns and social objectives by defining inputs, activities, outputs, and long-term outcomes, offering a strategic framework that enhances decision-making beyond conventional corporate finance metrics.

Additionality Risk

Corporate finance prioritizes maximizing shareholder value through traditional investment metrics and risk assessments, often overlooking the unique challenges of additionality risk--the risk that impact investments would have occurred without the investor's capital. Impact investing specifically targets additionality risk by rigorously evaluating whether the invested resources create measurable social or environmental benefits that would not have happened otherwise, ensuring the investment's true incremental impact.

Corporate Finance vs Impact Investing Infographic

industrydif.com

industrydif.com