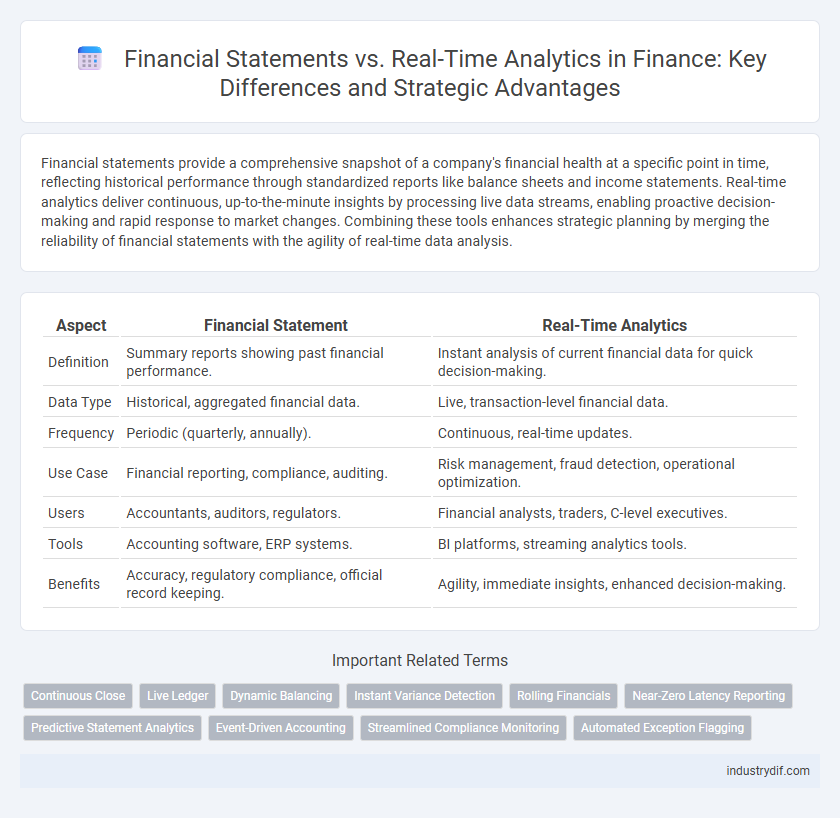

Financial statements provide a comprehensive snapshot of a company's financial health at a specific point in time, reflecting historical performance through standardized reports like balance sheets and income statements. Real-time analytics deliver continuous, up-to-the-minute insights by processing live data streams, enabling proactive decision-making and rapid response to market changes. Combining these tools enhances strategic planning by merging the reliability of financial statements with the agility of real-time data analysis.

Table of Comparison

| Aspect | Financial Statement | Real-Time Analytics |

|---|---|---|

| Definition | Summary reports showing past financial performance. | Instant analysis of current financial data for quick decision-making. |

| Data Type | Historical, aggregated financial data. | Live, transaction-level financial data. |

| Frequency | Periodic (quarterly, annually). | Continuous, real-time updates. |

| Use Case | Financial reporting, compliance, auditing. | Risk management, fraud detection, operational optimization. |

| Users | Accountants, auditors, regulators. | Financial analysts, traders, C-level executives. |

| Tools | Accounting software, ERP systems. | BI platforms, streaming analytics tools. |

| Benefits | Accuracy, regulatory compliance, official record keeping. | Agility, immediate insights, enhanced decision-making. |

Understanding Financial Statements: Key Components

Financial statements consist of the balance sheet, income statement, and cash flow statement, each providing critical insights into a company's financial health. The balance sheet details assets, liabilities, and equity at a specific point in time, while the income statement shows revenues, expenses, and profits over a period. Cash flow statements track the movement of cash, enabling businesses to manage liquidity and operational efficiency, contrasting real-time analytics that offer continuous, dynamic financial data updates.

Introduction to Real-Time Analytics in Finance

Real-time analytics in finance enables instantaneous processing and analysis of financial data, enhancing decision-making accuracy and speed. Unlike traditional financial statements that provide historical snapshots, real-time analytics leverages streaming data from markets, transactions, and risk indicators to offer up-to-the-minute insights. This dynamic approach supports proactive risk management, fraud detection, and optimized portfolio performance in fast-paced financial environments.

Historical Data vs Live Insights: A Comparative Overview

Financial statements provide a comprehensive snapshot of an organization's historical financial performance through standardized reports like balance sheets and income statements, essential for regulatory compliance and strategic planning. Real-time analytics leverages live data streams and advanced algorithms to deliver immediate insights, enabling proactive decision-making and rapid response to market changes. Combining historical data from financial statements with live insights enhances forecasting accuracy and operational agility in dynamic financial environments.

Benefits of Financial Statements for Business Analysis

Financial statements provide a comprehensive and standardized overview of a company's financial health, enabling accurate assessment of profitability, liquidity, and solvency. They offer a historical record essential for trend analysis and compliance with regulatory requirements, ensuring transparency and accountability. These statements form the foundation for strategic decision-making by delivering reliable data that supports budgeting, forecasting, and investment evaluation.

Real-Time Analytics: Advantages for Decision-Making

Real-time analytics in finance provide instant access to up-to-date financial data, enabling proactive decision-making and risk management. This dynamic insight enhances cash flow forecasting, budget adjustments, and performance monitoring, surpassing the static nature of traditional financial statements. Businesses leveraging real-time analytics can respond swiftly to market fluctuations, improving operational efficiency and competitive advantage.

Limitations of Traditional Financial Statements

Traditional financial statements provide historical data that often lags behind real-time business operations, limiting timely decision-making. These statements typically lack granular insights into cash flow dynamics, market fluctuations, and operational efficiency, restricting their usefulness in fast-paced environments. The absence of immediate analytics capabilities hinders proactive risk management and strategic agility.

Integrating Real-Time Analytics with Legacy Reporting

Integrating real-time analytics with legacy financial reporting enhances decision-making by providing up-to-the-minute insights alongside historical data. Financial statements deliver standardized, audited snapshots crucial for compliance, while real-time analytics offer dynamic, granular views of cash flow, expenses, and revenue trends. Combining these tools enables finance teams to forecast more accurately, optimize budgeting, and swiftly respond to market fluctuations.

Accuracy and Reliability: Financial Statements vs Real-Time Data

Financial statements provide accuracy and reliability through standardized accounting principles and audited records, ensuring consistent and compliant reporting. Real-time analytics offer immediate data insights but may lack the rigorous verification processes of traditional financial statements, potentially impacting precision. Combining both approaches enhances decision-making by balancing timely data with validated financial facts.

Impact on Strategic Planning and Forecasting

Financial statements provide historical data essential for baseline analysis in strategic planning, while real-time analytics offer dynamic insights that enable immediate adjustments and more accurate forecasting. Integrating real-time data with traditional financial reports enhances decision-making accuracy by identifying emerging trends and risks faster. This combination supports proactive strategy development and improves the agility of financial forecasts in volatile markets.

Future Trends: Evolving Roles in Financial Reporting

Financial statements remain essential for compliance and historical performance analysis, while real-time analytics increasingly drive proactive decision-making through instant data insights. Emerging trends highlight the integration of AI and machine learning to enhance predictive accuracy and automate anomaly detection in financial reporting. The evolving landscape emphasizes a hybrid approach, combining traditional reporting with continuous, data-driven analytics to optimize strategic financial management.

Related Important Terms

Continuous Close

Continuous Close integrates real-time analytics with financial statements by updating financial data continuously throughout the accounting period, enabling more accurate and timely decision-making. This approach reduces the traditional end-of-period reporting lag, enhancing transparency and operational agility in financial management.

Live Ledger

Financial statements provide historical financial performance summaries, while real-time analytics offer continuous insights into current financial activities through a live ledger, enabling immediate detection of discrepancies and cash flow trends. Live ledger technology enhances decision-making accuracy by integrating transactional data streams, ensuring up-to-date financial visibility for proactive risk management and operational efficiency.

Dynamic Balancing

Financial statements provide a historical snapshot of an organization's financial health, while real-time analytics enable dynamic balancing by continuously monitoring cash flow, expenses, and revenue to optimize decision-making. Utilizing dynamic balancing through real-time analytics enhances liquidity management and financial agility compared to the static nature of traditional financial statements.

Instant Variance Detection

Financial statements provide a historical overview of a company's financial performance, while real-time analytics enable instant variance detection by continuously monitoring transactions and key metrics. This immediate insight supports proactive decision-making, enhancing accuracy in forecasting and risk management.

Rolling Financials

Rolling financials provide continuous updates by integrating real-time analytics with traditional financial statements, enabling organizations to monitor performance dynamically rather than relying solely on periodic reports. This approach enhances decision-making accuracy through timely insights into cash flow, expenses, and revenue trends, optimizing financial management and forecasting.

Near-Zero Latency Reporting

Near-zero latency reporting revolutionizes financial statements by enabling real-time analytics that provide instantaneous insights into cash flow, liabilities, and assets, enhancing decision-making accuracy. This approach surpasses traditional financial statement delays, allowing businesses to respond swiftly to market fluctuations and regulatory changes with up-to-date financial data.

Predictive Statement Analytics

Financial statements provide historical financial data essential for compliance and auditing, while real-time analytics enable dynamic insights through continuous data processing. Predictive statement analytics leverages machine learning algorithms to forecast financial trends, enhance decision-making accuracy, and identify potential risks before they impact business outcomes.

Event-Driven Accounting

Event-driven accounting transforms traditional financial statements by capturing and analyzing transactions as they occur, providing real-time insights into cash flow, expenses, and revenues. This approach enables dynamic financial reporting and decision-making, surpassing static end-of-period statements with up-to-date, accurate data streams.

Streamlined Compliance Monitoring

Financial statements provide standardized, historical financial data essential for regulatory reporting, whereas real-time analytics enable continuous compliance monitoring by instantly detecting anomalies and flagging potential risks. Employing real-time analytics tools enhances accuracy and responsiveness in meeting evolving regulatory requirements, reducing the risk of non-compliance penalties.

Automated Exception Flagging

Financial statements provide a comprehensive historical overview of an organization's financial health, while real-time analytics enable dynamic monitoring and automated exception flagging to identify anomalies instantly. Automated exception flagging leverages algorithms to detect discrepancies and unusual transactions, enhancing accuracy and enabling proactive decision-making in financial management.

Financial Statement vs Real-Time Analytics Infographic

industrydif.com

industrydif.com