Retail banking offers traditional financial services through physical branches and direct customer interactions, emphasizing account management, loans, and deposits. Open banking leverages APIs to enable third-party providers to access customer data securely, fostering innovation and personalized financial products. The integration of open banking enhances retail banking by increasing transparency, competition, and tailored customer experiences.

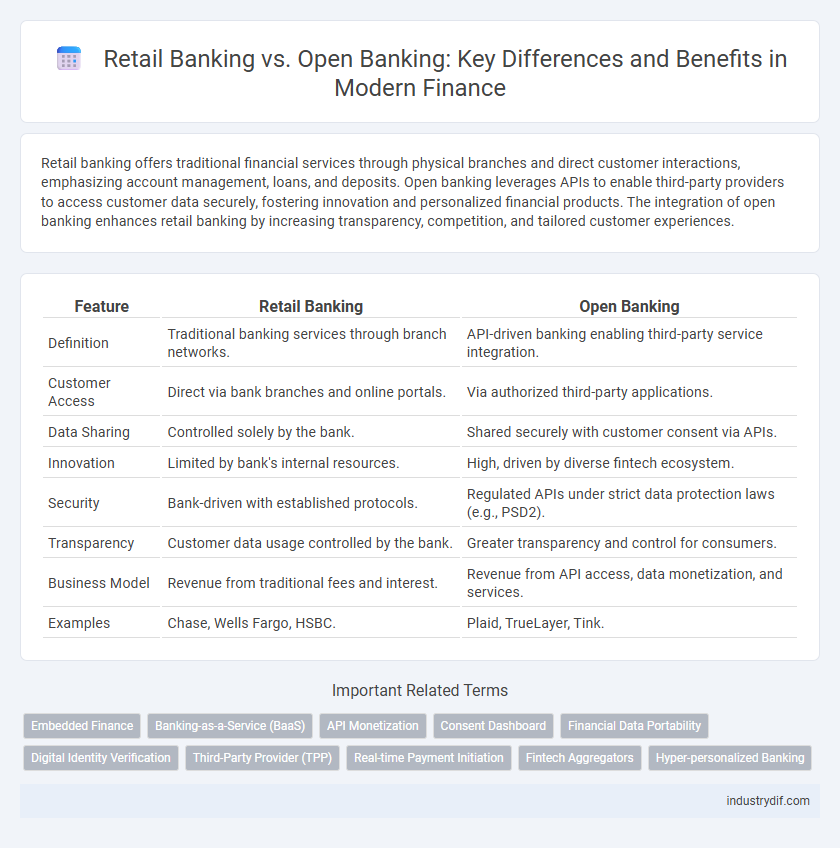

Table of Comparison

| Feature | Retail Banking | Open Banking |

|---|---|---|

| Definition | Traditional banking services through branch networks. | API-driven banking enabling third-party service integration. |

| Customer Access | Direct via bank branches and online portals. | Via authorized third-party applications. |

| Data Sharing | Controlled solely by the bank. | Shared securely with customer consent via APIs. |

| Innovation | Limited by bank's internal resources. | High, driven by diverse fintech ecosystem. |

| Security | Bank-driven with established protocols. | Regulated APIs under strict data protection laws (e.g., PSD2). |

| Transparency | Customer data usage controlled by the bank. | Greater transparency and control for consumers. |

| Business Model | Revenue from traditional fees and interest. | Revenue from API access, data monetization, and services. |

| Examples | Chase, Wells Fargo, HSBC. | Plaid, TrueLayer, Tink. |

Introduction to Retail Banking and Open Banking

Retail banking offers traditional financial services such as savings accounts, loans, and credit cards through established institutions directly to consumers. Open banking leverages API technology to enable third-party providers to access customer financial data securely, fostering innovation and personalized services. This shift enhances transparency, competition, and customer control within the financial ecosystem.

Key Differences Between Retail Banking and Open Banking

Retail banking primarily offers traditional financial services such as savings accounts, personal loans, and mortgages through established banks, emphasizing customer relationship and physical branch access. Open banking leverages APIs to enable third-party providers to securely access financial data, fostering innovation, personalized services, and increased competition in the financial ecosystem. Key differences include data ownership, service delivery methods, and regulatory frameworks, with open banking promoting transparency and customer consent over fixed banking models.

Traditional Retail Banking: Features and Services

Traditional retail banking offers a range of services including savings and checking accounts, personal loans, mortgages, and credit cards, catering primarily to individual consumers. These banks maintain physical branches and provide face-to-face customer support, ensuring trust and personalized service. Security and regulatory compliance are integral, with institutions adhering to strict guidelines from financial authorities to protect customer assets and data.

Open Banking: Definition and Core Principles

Open Banking is a financial services model that enables third-party providers to access consumer banking data securely through APIs, fostering transparency and innovation. Core principles include customer consent, data security, interoperability, and regulatory compliance such as PSD2 in Europe, ensuring users retain control over their financial information. This paradigm shift drives personalized financial products and competitive services, transforming traditional retail banking by enhancing consumer choice and market efficiency.

Regulatory Frameworks Impacting Retail and Open Banking

Regulatory frameworks such as PSD2 in Europe have significantly transformed retail banking by mandating banks to open customer data to third-party providers, fostering the growth of open banking ecosystems. Compliance requirements around data privacy, security standards, and customer consent have reshaped how traditional retail banks innovate and collaborate with fintech firms. These regulations drive competition, increase transparency, and enhance consumer control over financial information in both retail and open banking sectors.

Customer Experience in Retail vs Open Banking

Retail banking offers traditional, branch-based services with personalized interactions that build trust through face-to-face engagement, while open banking enhances customer experience by providing seamless, real-time access to financial data via APIs, enabling personalized financial management and third-party innovations. Open banking platforms empower customers with greater control and choice over their financial services, resulting in improved convenience and tailored product offerings compared to the standardized services of retail banks. The integration of data analytics in open banking drives proactive financial insights, enhancing customer satisfaction beyond the transactional focus typical of retail banking.

Security and Data Privacy: A Comparative Analysis

Retail banking traditionally relies on centralized data storage with stringent access controls, ensuring customer data is protected within a closed system. Open banking leverages APIs to share financial data securely with third-party providers, employing advanced encryption and strong customer authentication to mitigate risks. Despite enhanced innovation and personalization, open banking poses new challenges in data privacy that require robust regulatory frameworks like PSD2 and GDPR compliance to maintain user trust.

Technological Innovations Driving Open Banking

Technological innovations driving open banking include APIs, which enable seamless data sharing between banks and third-party providers, fostering personalized financial services. Enhanced cybersecurity measures and blockchain technology increase transaction transparency and data protection, essential for customer trust. Cloud computing supports scalable infrastructure, allowing real-time access to financial products and accelerating innovation in retail banking services.

Benefits and Challenges for Financial Institutions

Retail banking offers financial institutions a stable revenue stream from traditional services like savings accounts, loans, and mortgages, ensuring customer loyalty through personalized relationships. Open banking, leveraging APIs, enhances innovation by enabling seamless third-party integrations that improve customer experience and broaden service offerings. Challenges for retail banking include high operational costs and legacy system limitations, while open banking faces data security risks and regulatory compliance complexities that require robust infrastructure and governance.

The Future of Banking: Trends in Retail and Open Banking

The future of banking is driven by the convergence of retail banking and open banking, leveraging APIs to enable seamless data sharing and personalized financial services. Retail banking continues to evolve with enhanced digital experiences, while open banking fosters innovation through third-party integrations, increasing competition and customer empowerment. Emerging trends include AI-driven analytics for credit risk assessment, real-time payments, and enhanced security protocols to protect user data.

Related Important Terms

Embedded Finance

Embedded finance integrates retail banking services directly into third-party platforms, enabling seamless financial transactions without traditional bank interactions. This approach leverages APIs and open banking infrastructure to offer payment, lending, and insurance products within non-bank environments, enhancing customer convenience and expanding financial access.

Banking-as-a-Service (BaaS)

Retail banking focuses on providing traditional financial services such as savings accounts, loans, and credit cards directly to consumers, while Open Banking leverages APIs to enable third-party providers to access financial data and offer integrated services. Banking-as-a-Service (BaaS) platforms are pivotal in bridging the gap by allowing fintech companies to embed banking functions within their ecosystems, enhancing customer experience and accelerating innovation in financial services.

API Monetization

Retail banking leverages traditional customer data and legacy systems, limiting API monetization opportunities compared to open banking, which utilizes standardized APIs to securely share data and services with third-party developers, enabling diversified revenue streams through API usage fees, partnerships, and innovative financial products. The open banking model drives API monetization by fostering ecosystem collaboration, increasing customer engagement, and allowing banks to capitalize on real-time data exchanges and personalized financial services.

Consent Dashboard

Retail banking consent dashboards centralize customer authorization management for traditional account access and financial services within established banking frameworks. Open banking consent dashboards enhance this by enabling granular permissions control for third-party applications, promoting transparency, data sharing, and regulatory compliance under PSD2 and similar standards.

Financial Data Portability

Retail banking maintains customer data within proprietary systems, limiting financial data portability and restricting consumers' ability to seamlessly share information across platforms. Open banking leverages APIs to enable secure financial data portability, empowering customers with greater control and facilitating innovative financial services through third-party integrations.

Digital Identity Verification

Retail banking relies heavily on traditional digital identity verification methods such as passwords, PINs, and security questions, which can be vulnerable to fraud and identity theft. Open banking enhances customer authentication by integrating biometric data and multi-factor verification through API-driven platforms, significantly improving security and user experience.

Third-Party Provider (TPP)

Third-Party Providers (TPPs) play a crucial role in Open Banking by enabling secure access to customer financial data through APIs, fostering innovation and personalized financial services beyond the traditional retail banking framework. Unlike retail banking, where services are confined within a single institution, Open Banking facilitates seamless integration of multiple financial service providers, enhancing competition and customer choice.

Real-time Payment Initiation

Retail banking primarily relies on traditional payment systems with batch processing, leading to delays in fund transfers, whereas open banking leverages APIs to enable real-time payment initiation, enhancing transaction speed and customer experience. Real-time payment initiation through open banking APIs facilitates instant fund transfers, improves liquidity management, and supports seamless integration with third-party financial services.

Fintech Aggregators

Fintech aggregators leverage open banking APIs to consolidate customer financial data from multiple retail banking sources, enabling personalized financial management tools and innovative service offerings. This integration disrupts traditional retail banking by enhancing transparency, user control, and real-time insights, driving competitive advantage in the digital finance ecosystem.

Hyper-personalized Banking

Retail banking traditionally offers standardized financial products, but open banking leverages APIs and real-time data to deliver hyper-personalized banking experiences tailored to individual customer behavior and preferences. Utilizing machine learning algorithms and aggregated data, open banking enables personalized product recommendations, dynamic pricing, and customized financial advice that significantly enhance customer engagement and satisfaction.

Retail Banking vs Open Banking Infographic

industrydif.com

industrydif.com