Traditional loans require borrowers to repay the full loan amount with interest over a fixed term, often involving credit checks and extensive approval processes. Buy Now Pay Later (BNPL) offers flexible payment options by splitting purchases into smaller installments, typically with little to no interest if paid on time. While traditional loans are suited for larger expenses and long-term financing, BNPL appeals to consumers seeking short-term, interest-free credit for everyday purchases.

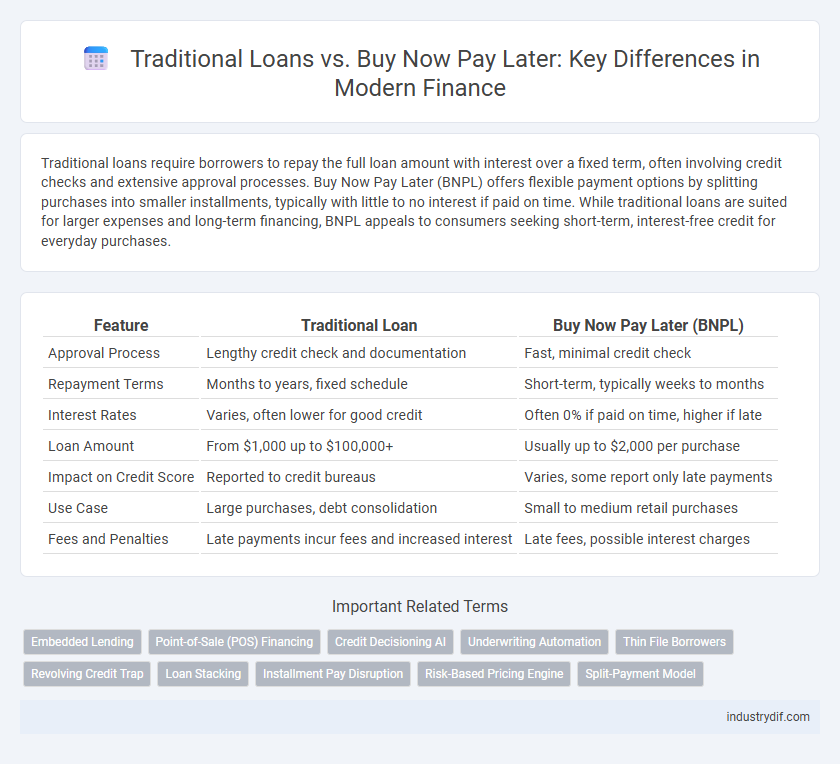

Table of Comparison

| Feature | Traditional Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Approval Process | Lengthy credit check and documentation | Fast, minimal credit check |

| Repayment Terms | Months to years, fixed schedule | Short-term, typically weeks to months |

| Interest Rates | Varies, often lower for good credit | Often 0% if paid on time, higher if late |

| Loan Amount | From $1,000 up to $100,000+ | Usually up to $2,000 per purchase |

| Impact on Credit Score | Reported to credit bureaus | Varies, some report only late payments |

| Use Case | Large purchases, debt consolidation | Small to medium retail purchases |

| Fees and Penalties | Late payments incur fees and increased interest | Late fees, possible interest charges |

Overview of Traditional Loans and Buy Now Pay Later

Traditional loans involve borrowing a fixed amount from a financial institution with scheduled repayments over a set term and often require credit checks and collateral. Buy Now Pay Later (BNPL) services allow consumers to purchase goods immediately and defer payments through short-term, interest-free installments, typically offered at the point of sale. While traditional loans focus on long-term financing with interest, BNPL emphasizes convenience and flexibility for smaller purchases without upfront cost.

Key Differences Between Traditional Loans and BNPL

Traditional loans typically involve fixed interest rates, longer repayment terms, and require credit checks to assess borrower eligibility, making them suitable for larger, planned purchases. Buy Now Pay Later (BNPL) services offer short-term, interest-free payment plans with minimal credit assessment, targeting consumers seeking immediate, smaller purchases with flexible installments. Key differences include loan duration, interest policies, credit requirements, and suitability for purchase size and urgency.

Eligibility Criteria: Traditional Loans vs BNPL

Traditional loans typically require a strong credit score, proof of steady income, and a detailed financial history to determine eligibility, often involving a stringent credit check process. Buy Now Pay Later (BNPL) services usually have more lenient eligibility criteria, focusing on factors like purchase amount and repayment capacity with minimal or no credit checks. While traditional loans cater to long-term financing needs, BNPL options are designed for short-term, smaller purchases with quick approval and simplified qualification requirements.

Application Process Comparison

Traditional loan applications require extensive documentation, including credit history, income proof, and collateral verification, often leading to longer approval times. Buy Now Pay Later (BNPL) services typically involve a streamlined, digital-first application process with minimal credit checks and instant decisions, enhancing user convenience. This efficiency in BNPL appeals to consumers seeking quick access to credit without the rigorous scrutiny of traditional lenders.

Interest Rates and Fees Analysis

Traditional loans often feature fixed or variable interest rates ranging from 3% to 15%, with fees such as origination charges and prepayment penalties, which can increase the overall borrowing cost. Buy Now Pay Later (BNPL) services typically offer zero or low interest rates but may impose late fees or account suspension for missed payments, making them cost-effective for short-term use. Comparing both, traditional loans suit long-term financing needs with predictable costs, whereas BNPL provides flexible, interest-free options suited for immediate, smaller purchases, albeit with potential penalties.

Impacts on Credit Score

Traditional loans typically require a credit check and timely repayments, which can positively impact credit scores by demonstrating responsible borrowing behavior. Buy Now Pay Later (BNPL) services often do not perform hard credit checks and may not report timely payments to credit bureaus, limiting their influence on building credit history. Missed BNPL payments, however, can be sent to collections and adversely affect credit scores, highlighting the importance of managing BNPL obligations carefully.

Flexibility and Repayment Terms

Traditional loans offer fixed repayment schedules with predetermined interest rates, which can limit borrower flexibility but provide predictable monthly payments. Buy Now Pay Later (BNPL) services typically allow shorter repayment periods with minimal or no interest, enabling consumers to manage cash flow by splitting purchase costs into smaller, interest-free installments. The BNPL model often appeals to those seeking immediate purchasing power without long-term debt commitments, contrasting with the structured, longer-term nature of traditional loans.

Consumer Experience and Accessibility

Traditional loans often require extensive credit checks and lengthy approval processes, which can delay access to funds and discourage consumers with lower credit scores. Buy Now Pay Later (BNPL) services offer instant approval and flexible payment plans, improving accessibility and enhancing the consumer experience with convenience and transparency. BNPL platforms typically integrate seamlessly with e-commerce, providing a smoother checkout process compared to traditional loan applications.

Regulatory Landscape and Compliance

Traditional loans are regulated under comprehensive frameworks such as the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA), ensuring strict compliance with disclosure, interest rate caps, and consumer protection measures. Buy Now Pay Later (BNPL) services often operate in a less regulated environment, with emerging guidelines from bodies like the Consumer Financial Protection Bureau (CFPB) focusing on transparency, affordability assessments, and data privacy. The evolving regulatory landscape for BNPL aims to close compliance gaps, aligning consumer rights and credit risk management more closely with traditional loan standards.

Suitability for Different Financial Needs

Traditional loans provide structured repayment schedules and fixed interest rates, making them suitable for long-term financial needs such as home mortgages or business expansions. Buy Now Pay Later (BNPL) services offer flexible, short-term payment options ideal for smaller purchases or consumers seeking interest-free installments. Borrowers with stable income and long-term goals benefit from traditional loans, while those needing quick, manageable payments often prefer BNPL solutions.

Related Important Terms

Embedded Lending

Embedded lending integrates financing options directly within the purchasing process, offering consumers immediate credit through Buy Now Pay Later (BNPL) solutions that enhance cash flow management compared to traditional loans requiring separate application and approval. This seamless credit embedding reduces friction, accelerates purchasing decisions, and often bypasses extensive credit checks, distinguishing BNPL as a flexible alternative to conventional loan structures in consumer finance.

Point-of-Sale (POS) Financing

Traditional loans provide borrowers with lump-sum financing subject to credit checks and fixed repayment schedules, while Buy Now Pay Later (BNPL) offers flexible, interest-free installments at the point of sale to enhance consumer purchasing power. POS financing through BNPL accelerates transaction approval and boosts conversion rates by integrating seamless, short-term credit solutions directly into checkout processes.

Credit Decisioning AI

Credit Decisioning AI enhances risk assessment accuracy by analyzing extensive data points in both traditional loans and Buy Now Pay Later (BNPL) models, enabling personalized credit limits and repayment plans. This technology reduces default rates and streamlines approval processes, providing lenders with real-time insights and improving customer credit experiences in diverse financing options.

Underwriting Automation

Traditional loan underwriting relies heavily on manual credit assessments and extensive paperwork, leading to longer approval times and higher operational costs. Buy Now Pay Later (BNPL) leverages automated underwriting algorithms that use real-time data and machine learning models to instantly evaluate credit risk, improve accuracy, and enhance customer experience.

Thin File Borrowers

Traditional loans often require extensive credit history, making it difficult for thin file borrowers to secure approval or favorable terms. Buy Now Pay Later (BNPL) services offer a flexible alternative, enabling thin file borrowers to access credit with minimal credit checks and immediate installment options.

Revolving Credit Trap

Traditional loans typically offer fixed repayment schedules that prevent users from accumulating excessive debt, whereas Buy Now Pay Later (BNPL) services often function as revolving credit, increasing the risk of a revolving credit trap with compounding interest and minimum payments that can lead to long-term financial instability. Consumers using BNPL lack structured oversight, frequently resulting in continuous debt cycles that damage credit scores and erode financial health.

Loan Stacking

Traditional loans often involve fixed repayment schedules and stringent credit checks, limiting the borrower's ability to acquire multiple loans simultaneously. Buy Now Pay Later (BNPL) services, while offering flexible short-term financing without immediate interest, increase the risk of loan stacking, where multiple BNPL purchases across platforms can accumulate, leading to potential over-indebtedness and credit challenges.

Installment Pay Disruption

Traditional loans typically require credit checks, fixed interest rates, and scheduled monthly payments over extended terms, while Buy Now Pay Later (BNPL) disrupts this model by offering short-term, interest-free installments that increase consumer purchasing power without immediate financial burden. BNPL platforms leverage seamless digital integration and minimal credit barriers, reshaping installment payments and challenging conventional lending frameworks by prioritizing speed and flexibility.

Risk-Based Pricing Engine

Risk-based pricing engines assess borrower credit risk by analyzing factors such as credit scores, income stability, and repayment history to determine interest rates for traditional loans, ensuring lenders balance risk and profitability. Buy Now Pay Later services also utilize these engines but often apply more flexible criteria and shorter-term repayment assessments, increasing accessibility while managing default risks through dynamic pricing models.

Split-Payment Model

Traditional loans typically require full repayment with interest over a fixed term, while Buy Now Pay Later (BNPL) uses a split-payment model that divides the total purchase amount into smaller, interest-free installments spread over weeks or months. The split-payment structure in BNPL enhances cash flow management and provides flexible financing options without the burden of long-term debt or high interest rates common in traditional loans.

Traditional Loan vs Buy Now Pay Later Infographic

industrydif.com

industrydif.com