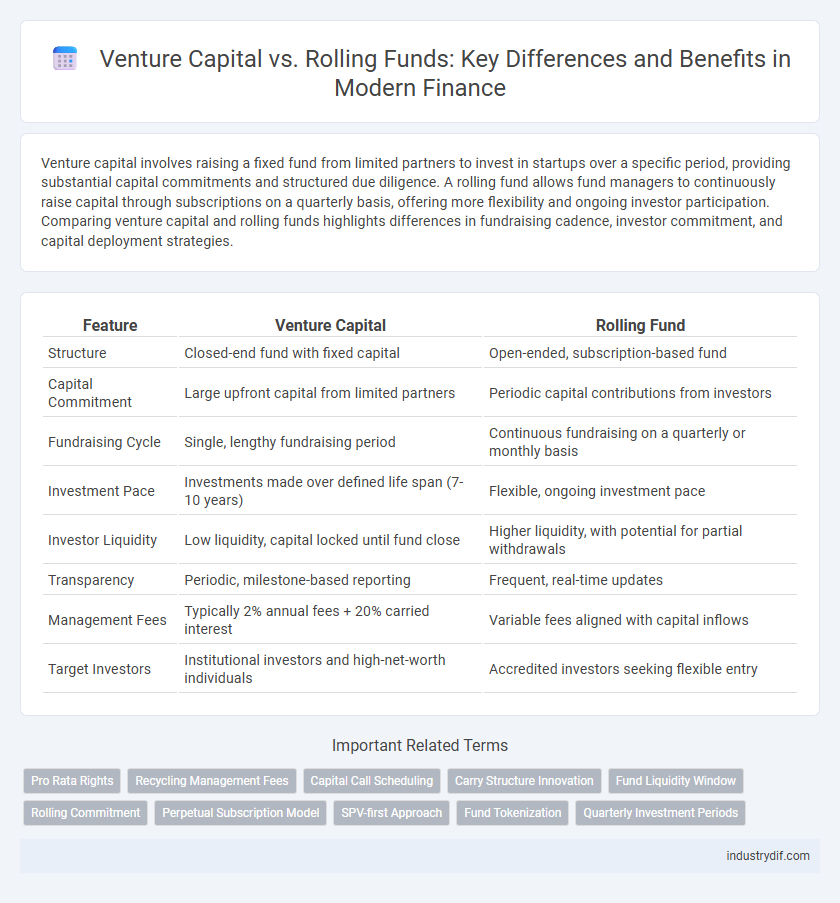

Venture capital involves raising a fixed fund from limited partners to invest in startups over a specific period, providing substantial capital commitments and structured due diligence. A rolling fund allows fund managers to continuously raise capital through subscriptions on a quarterly basis, offering more flexibility and ongoing investor participation. Comparing venture capital and rolling funds highlights differences in fundraising cadence, investor commitment, and capital deployment strategies.

Table of Comparison

| Feature | Venture Capital | Rolling Fund |

|---|---|---|

| Structure | Closed-end fund with fixed capital | Open-ended, subscription-based fund |

| Capital Commitment | Large upfront capital from limited partners | Periodic capital contributions from investors |

| Fundraising Cycle | Single, lengthy fundraising period | Continuous fundraising on a quarterly or monthly basis |

| Investment Pace | Investments made over defined life span (7-10 years) | Flexible, ongoing investment pace |

| Investor Liquidity | Low liquidity, capital locked until fund close | Higher liquidity, with potential for partial withdrawals |

| Transparency | Periodic, milestone-based reporting | Frequent, real-time updates |

| Management Fees | Typically 2% annual fees + 20% carried interest | Variable fees aligned with capital inflows |

| Target Investors | Institutional investors and high-net-worth individuals | Accredited investors seeking flexible entry |

Overview of Venture Capital and Rolling Funds

Venture capital is a traditional investment model where limited partners commit capital to a fund managed by general partners who invest in startups over a defined period. Rolling funds are a newer, subscription-based vehicle allowing investors to contribute capital quarterly, providing continuous inflow and flexibility in funding rounds. Both structures aim to support high-growth companies but differ in capital deployment cadence and investor access.

Key Differences Between Venture Capital and Rolling Funds

Venture capital typically involves a fixed pool of capital raised from limited partners, emphasizing long-term investments in high-growth startups with a structured fund lifecycle of 7-10 years. Rolling funds offer quarterly subscriptions from investors, enabling continuous capital deployment and greater flexibility in deal sourcing and investment size. The key differences lie in capital commitment structure, investment pace, and investor accessibility, with rolling funds democratizing access for smaller investors compared to traditional venture capital.

Structure and Fundraising Mechanisms

Venture capital typically involves raising a fixed pool of capital from limited partners, structured as a closed-end fund with a defined investment period and exit timeline. Rolling funds use a subscription-based model, allowing investors to commit capital on a quarterly or periodic basis, providing continuous fundraising and greater flexibility. This structure enables rolling funds to deploy capital more dynamically compared to traditional venture capital funds, which rely on upfront capital commitments.

Investment Strategies and Focus Areas

Venture capital firms typically deploy capital through structured funds targeting early-stage startups, emphasizing high-growth sectors such as technology, healthcare, and fintech. Rolling funds offer a more flexible investment model, allowing backers to subscribe on a quarterly basis and enabling generalized exposure to emerging companies with a focus on innovation and founder-led businesses. Both strategies prioritize thorough due diligence, but rolling funds often emphasize agility and recurring commitments, appealing to investors seeking continuous deal flow rather than fixed-term cycles.

Accessibility for Investors

Rolling funds provide greater accessibility for investors by allowing smaller, recurring commitments over time, contrasting with traditional venture capital funds that often require large, upfront minimum investments. This model lowers the financial barrier to entry and enables broader participation from individual accredited investors. Furthermore, rolling funds offer increased transparency and flexibility, making them attractive to investors seeking more agile investment opportunities in private markets.

Due Diligence and Deal Sourcing

Venture capital firms conduct comprehensive due diligence involving detailed financial, market, and legal analysis before committing to investments, ensuring robust risk assessment for high-value deals. Rolling funds streamline deal sourcing by providing continuous capital deployment, allowing investors to quickly evaluate opportunities through subscription-based funding rather than lump-sum commitments. This flexible funding model accelerates due diligence cycles and diversifies deal flow compared to traditional venture capital processes.

Returns and Risk Profiles

Venture capital funds typically offer higher return potential due to concentrated investments in early-stage startups but come with significant risk and longer lock-up periods. Rolling funds provide more liquidity and allow for periodic capital commitments, which diversifies risk over time while aiming for steady returns. Investors in rolling funds benefit from the flexibility to adjust exposure, balancing moderate risk with smoother capital deployment compared to traditional venture capital.

Regulatory Considerations

Venture capital funds are typically regulated under the Investment Company Act of 1940 and must comply with strict filing requirements and investor qualification standards. Rolling funds operate under a more flexible SEC framework, often registered as private funds with ongoing capital commitments, reducing regulatory burden and enabling continuous fundraising. Compliance strategies vary significantly, impacting fund structure, investor onboarding, and reporting obligations in both models.

Pros and Cons for Founders and Startups

Venture capital offers startups significant funding amounts and strategic expertise but often requires giving up substantial equity and entails lengthy negotiation processes. Rolling funds provide founders with ongoing, flexible capital access and a broader investor base, though they may involve variability in funding continuity and potentially less hands-on support. Founders must weigh the trade-offs between immediate large-scale investment and adaptable, incremental funding that rolling funds offer.

Future Trends in Venture Capital and Rolling Funds

Future trends in venture capital and rolling funds indicate a shift toward increased flexibility and accessibility for both investors and startups. Rolling funds, characterized by continuous capital commitments and periodic fundraising, are gaining popularity for their ability to provide ongoing liquidity and streamlined investment processes. Traditional venture capital is expected to integrate more technology-driven deal sourcing and data analytics to enhance decision-making and portfolio management.

Related Important Terms

Pro Rata Rights

Pro rata rights in venture capital allow investors to maintain their ownership percentage by participating in subsequent funding rounds, ensuring protection against dilution. Rolling funds offer a flexible structure where pro rata rights can be extended to investors on a subscription basis, enabling continuous capital deployment with ongoing ownership participation.

Recycling Management Fees

Venture capital firms typically charge a fixed management fee, limiting the ability to recycle capital efficiently, whereas rolling funds allow managers to continuously reinvest management fees and gains back into new deals, optimizing capital deployment and fund sustainability. This recycling mechanism in rolling funds enhances flexibility and aligns incentives by reducing capital drag and increasing overall fund return potential.

Capital Call Scheduling

Venture capital typically requires rigid capital call scheduling with fixed intervals and predetermined amounts, ensuring committed capital is deployed as per fund strategy. Rolling funds offer flexible capital call schedules, allowing investors to commit capital on a monthly or quarterly basis, aligning contributions more closely with ongoing investment opportunities.

Carry Structure Innovation

Venture capital typically employs a fixed carry structure, often around 20% carried interest after returning capital to limited partners, while rolling funds introduce innovative carry models that adapt to continuous capital deployment and investor entry over time. This flexibility enhances alignment between general partners and limited partners by dynamically adjusting carry distributions based on real-time fund performance and cash flows, promoting more efficient capital allocation in evolving market conditions.

Fund Liquidity Window

Venture capital funds typically have a fixed liquidity window of 7 to 10 years, requiring investors to lock up capital until exits occur, whereas rolling funds offer continuous fundraising with quarterly liquidity options, allowing investors to redeem commitments more frequently. This flexible liquidity structure in rolling funds adapts better to evolving market conditions and investor cash flow needs compared to traditional VC funds.

Rolling Commitment

Rolling funds offer venture capital investors the advantage of a rolling commitment structure, allowing capital contributions on a quarterly basis instead of a one-time fundraising event. This flexible model enables continuous investment streams, improving cash flow management and adapting swiftly to emerging market opportunities compared to traditional venture capital funds.

Perpetual Subscription Model

The perpetual subscription model in rolling funds offers continuous capital deployment and investor participation without the finite lifecycle constraints typical of traditional venture capital funds, enabling more flexible and adaptive investment strategies. This model benefits fund managers by providing ongoing fee structures and supports investors through regular subscription opportunities aligned with evolving market conditions.

SPV-first Approach

The SPV-first approach in venture capital allows investors to pool capital into a special purpose vehicle, providing a streamlined, deal-by-deal investment structure compared to the ongoing capital commitments of rolling funds. This method enhances transparency and investor control by isolating each investment, reducing risk exposure and simplifying legal and operational complexities.

Fund Tokenization

Fund tokenization in venture capital enables fractional ownership, liquidity, and transparency, transforming traditional rolling funds by digitizing share issuance on blockchain platforms. This innovation reduces entry barriers for investors and streamlines capital allocation compared to conventional VC fund structures.

Quarterly Investment Periods

Venture capital funds typically operate on fixed investment cycles, with capital deployment occurring over a series of quarters or years based on predetermined funding rounds. Rolling funds offer investors the flexibility of committing capital on a quarterly basis, enabling continuous fundraising and investment without the constraints of traditional fixed-period venture capital commitments.

Venture Capital vs Rolling Fund Infographic

industrydif.com

industrydif.com