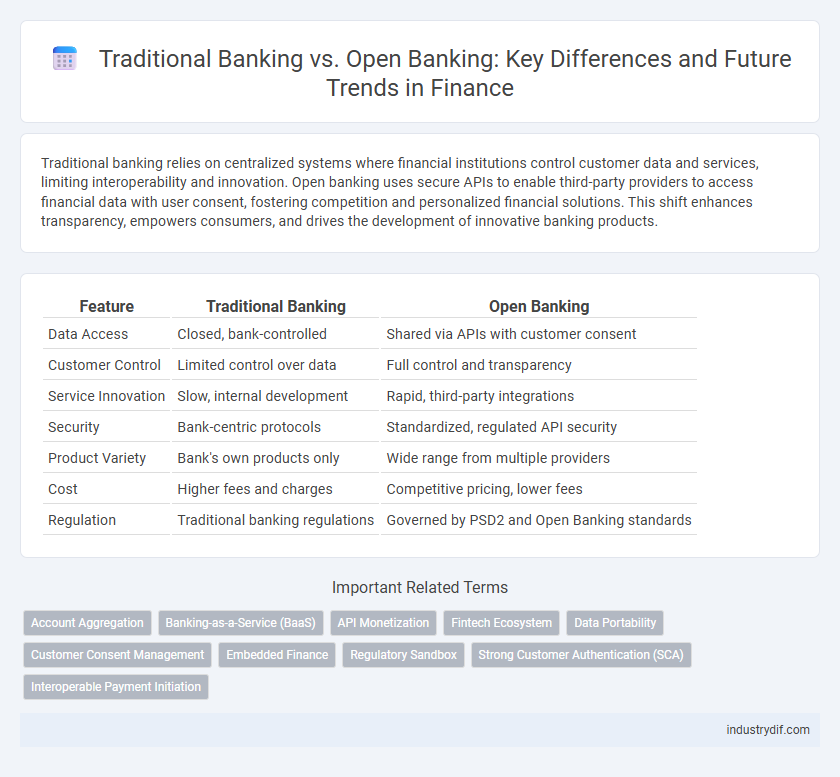

Traditional banking relies on centralized systems where financial institutions control customer data and services, limiting interoperability and innovation. Open banking uses secure APIs to enable third-party providers to access financial data with user consent, fostering competition and personalized financial solutions. This shift enhances transparency, empowers consumers, and drives the development of innovative banking products.

Table of Comparison

| Feature | Traditional Banking | Open Banking |

|---|---|---|

| Data Access | Closed, bank-controlled | Shared via APIs with customer consent |

| Customer Control | Limited control over data | Full control and transparency |

| Service Innovation | Slow, internal development | Rapid, third-party integrations |

| Security | Bank-centric protocols | Standardized, regulated API security |

| Product Variety | Bank's own products only | Wide range from multiple providers |

| Cost | Higher fees and charges | Competitive pricing, lower fees |

| Regulation | Traditional banking regulations | Governed by PSD2 and Open Banking standards |

Foundations of Traditional Banking

Traditional banking relies on centralized financial institutions that manage customer accounts, process transactions, and provide credit through established regulatory frameworks. These banks operate with proprietary systems that limit data sharing, ensuring security but reducing flexibility and innovation. Customer trust is built on longstanding relationships, standardized products, and legacy infrastructure that underpin risk management and compliance.

Understanding Open Banking

Open Banking revolutionizes traditional banking by enabling customers to securely share their financial data with third-party providers through APIs, fostering increased transparency and innovation. This data sharing empowers personalized financial services, seamless payment solutions, and enhanced customer experiences beyond the limitations of conventional banks. Regulators worldwide, including PSD2 in Europe, support Open Banking to boost competition, drive digital transformation, and promote financial inclusion.

Key Differences Between Traditional and Open Banking

Traditional banking relies on centralized institutions managing customer accounts and transactions within proprietary systems, often limiting third-party access to financial data. Open banking uses APIs to securely share financial data with authorized third-party providers, fostering innovation in personalized financial services and greater transparency. Key differences include data accessibility, customer control, and the level of digital integration in service delivery.

Regulatory Frameworks Shaping Both Models

Regulatory frameworks for traditional banking emphasize strict capital requirements, risk management protocols, and consumer protection laws under authorities like the Federal Reserve and Basel Committee on Banking Supervision. Open banking regulations focus on data privacy, secure API standards, and consent-driven data sharing, driven by directives such as PSD2 in the European Union and the UK's Open Banking Standard. Both models are shaped by evolving compliance mandates aiming to balance innovation, security, and customer rights in the financial ecosystem.

The Role of Technology in Open Banking

Technology in open banking revolutionizes financial services by enabling secure API integrations that facilitate real-time data sharing between banks and third-party providers. Advanced encryption, biometric authentication, and blockchain technology enhance security and trust, promoting seamless customer experiences and personalized financial products. These innovations drive competition and innovation, challenging traditional banking models reliant on legacy systems and limited data access.

Security and Data Privacy Considerations

Traditional banking relies on secure, centralized systems with strict regulatory oversight to protect customer data, offering robust encryption and access controls. Open banking introduces third-party access to financial data through APIs, raising concerns over data privacy and potential vulnerabilities but also enforcing strong consent mechanisms and regulatory standards like PSD2 and GDPR. Both models prioritize security, yet open banking demands enhanced transparency and continuous monitoring to safeguard customer information against emerging cyber threats.

Customer Experience: Traditional vs Open Banking

Traditional banking often limits customer experience with slower transaction times, rigid service hours, and less personalized financial products. Open banking enhances customer experience by enabling seamless, real-time access to financial data through APIs, fostering tailored services and greater financial control. Customers benefit from improved transparency, faster payments, and integrated third-party applications that drive convenience and innovation.

Impact on Financial Services Providers

Traditional banking relies on closed systems with limited third-party access, resulting in slower innovation and reduced customer personalization for financial services providers. Open banking enables secure data sharing via APIs, fostering enhanced collaboration, increased competition, and the development of tailored financial products. This shift drives providers to adopt advanced technologies, improve customer experience, and expand service offerings to remain competitive.

Challenges and Risks in the Transition

Traditional banking faces challenges in the transition to open banking due to legacy IT systems that limit seamless data integration and real-time access. Open banking introduces risks such as increased cybersecurity threats and data privacy concerns, requiring robust regulatory compliance and enhanced authentication protocols. The shift also demands significant cultural change and agility to manage partnerships with third-party providers while maintaining customer trust and operational stability.

Future Trends: The Evolution of Banking

Traditional banking is evolving rapidly as open banking technologies enable seamless data sharing through APIs, fostering greater financial innovation and personalized services. Future trends highlight increased collaboration between banks and fintech companies to enhance customer experiences and improve real-time payment systems. Regulatory frameworks and improved cybersecurity measures will play crucial roles in shaping the integration and adoption of open banking solutions worldwide.

Related Important Terms

Account Aggregation

Traditional banking consolidates account information within a single institution, limiting visibility across multiple financial services, whereas open banking enables account aggregation through secure APIs, providing consumers with a comprehensive view of their finances in real time. This enhanced connectivity fosters greater financial transparency, personalized insights, and improved decision-making capabilities across diverse banking platforms.

Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) enables traditional banks to integrate and offer digital financial services by leveraging open APIs, bridging the gap between conventional banking infrastructure and innovative fintech solutions. This approach fosters seamless collaboration, accelerates product development, and enhances customer experience by providing modular banking components through cloud-based platforms.

API Monetization

Traditional banking relies on closed systems with limited external access, restricting API monetization opportunities and stifling innovation. Open banking leverages secure APIs to enable third-party integrations, creating diverse revenue streams through data sharing, transaction fees, and value-added financial services.

Fintech Ecosystem

Traditional banking relies on centralized financial institutions controlling customer data and transactions, limiting innovation within the fintech ecosystem. Open banking enables secure data sharing through APIs, fostering collaboration between banks and fintech firms to deliver personalized financial services and enhance customer experience.

Data Portability

Data portability in open banking enables customers to securely transfer their financial data across multiple institutions, fostering greater control and personalized financial services compared to traditional banking's limited data accessibility. This enhanced data transfer capability supports innovation, competition, and improved customer experience by breaking down data silos inherent in conventional banking systems.

Customer Consent Management

Traditional banking relies heavily on manual customer consent processes with limited transparency, often leading to delays and increased operational costs. Open banking streamlines consent management through secure APIs, enabling real-time authorization, enhanced user control, and improved regulatory compliance under frameworks like PSD2 and GDPR.

Embedded Finance

Embedded finance integrates financial services directly into non-bank platforms, disrupting traditional banking by enhancing user experience and streamlining transactions without switching apps. Traditional banks often rely on legacy systems, whereas open banking APIs enable seamless integration of payments, lending, and insurance into everyday digital ecosystems.

Regulatory Sandbox

Regulatory sandboxes enable traditional banks and fintech firms to test innovative financial products and services in a controlled environment, accelerating the adoption of open banking frameworks. This approach mitigates regulatory risks, enhances compliance agility, and fosters secure data sharing between banks and third-party providers.

Strong Customer Authentication (SCA)

Traditional banking relies on legacy authentication methods that often lack flexibility, whereas Open Banking mandates Strong Customer Authentication (SCA) under PSD2 regulations, enhancing security through two-factor authentication and real-time risk analysis. Implementing SCA reduces fraud risks and boosts customer trust by requiring multiple verification factors such as biometrics, one-time passwords, or device recognition during financial transactions.

Interoperable Payment Initiation

Interoperable payment initiation in open banking enables seamless, real-time transactions across multiple financial institutions by leveraging standardized APIs, enhancing customer convenience and reducing payment friction. Traditional banking relies on closed networks and proprietary systems, limiting cross-platform transaction capabilities and slowing payment processing times.

Traditional Banking vs Open Banking Infographic

industrydif.com

industrydif.com