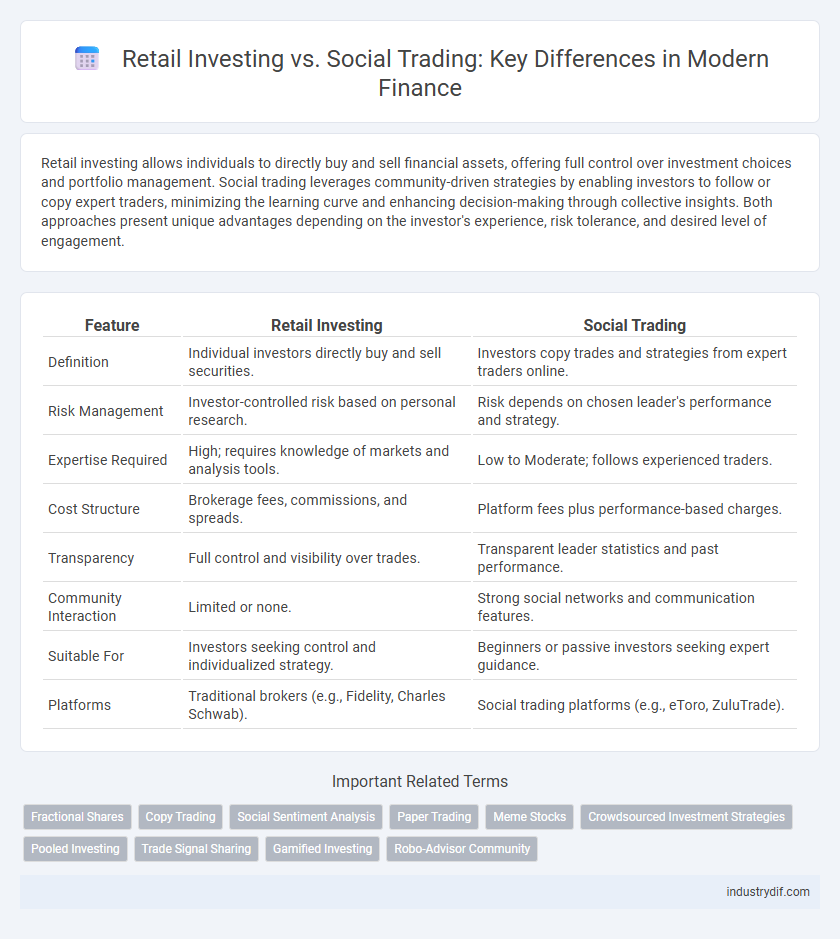

Retail investing allows individuals to directly buy and sell financial assets, offering full control over investment choices and portfolio management. Social trading leverages community-driven strategies by enabling investors to follow or copy expert traders, minimizing the learning curve and enhancing decision-making through collective insights. Both approaches present unique advantages depending on the investor's experience, risk tolerance, and desired level of engagement.

Table of Comparison

| Feature | Retail Investing | Social Trading |

|---|---|---|

| Definition | Individual investors directly buy and sell securities. | Investors copy trades and strategies from expert traders online. |

| Risk Management | Investor-controlled risk based on personal research. | Risk depends on chosen leader's performance and strategy. |

| Expertise Required | High; requires knowledge of markets and analysis tools. | Low to Moderate; follows experienced traders. |

| Cost Structure | Brokerage fees, commissions, and spreads. | Platform fees plus performance-based charges. |

| Transparency | Full control and visibility over trades. | Transparent leader statistics and past performance. |

| Community Interaction | Limited or none. | Strong social networks and communication features. |

| Suitable For | Investors seeking control and individualized strategy. | Beginners or passive investors seeking expert guidance. |

| Platforms | Traditional brokers (e.g., Fidelity, Charles Schwab). | Social trading platforms (e.g., eToro, ZuluTrade). |

Introduction to Retail Investing and Social Trading

Retail investing involves individuals purchasing securities such as stocks, bonds, and mutual funds through brokerage accounts to build personal portfolios. Social trading enables investors to mimic or follow the trades of experienced traders via online platforms, blending community insights with real-time market actions. Both approaches provide accessible entry points into financial markets, but differ in strategy, risk, and required expertise.

Key Differences Between Retail Investing and Social Trading

Retail investing involves individuals buying and selling financial assets independently through brokerage accounts, focusing on personal research and decision-making. Social trading enables investors to mimic or copy trades from experienced traders via online platforms, emphasizing collaboration and shared strategies. The primary differences lie in control, with retail investors managing their portfolios solo and social traders relying on community insights and automated copying features.

How Retail Investors Make Financial Decisions

Retail investors make financial decisions primarily based on individual research, personal risk tolerance, and investment goals, often relying on financial news, analyst reports, and market trends. Social trading platforms influence decision-making by providing real-time access to expert traders' strategies, peer insights, and automated copying of trades, enhancing transparency and collaborative learning. Behavioral biases such as herd behavior and overconfidence frequently impact retail investors, making social trading a valuable tool to mitigate emotional investment errors.

The Role of Technology in Social Trading

The role of technology in social trading revolutionizes retail investing by enabling real-time information sharing, algorithm-based insights, and automated trade execution through user-friendly platforms. Advanced analytics, AI-driven sentiment analysis, and mobile apps facilitate enhanced decision-making, allowing individual investors to mimic strategies of experienced traders with greater ease and transparency. This technological integration significantly reduces barriers to entry and fosters a collaborative investment environment, driving increased participation in financial markets.

Benefits of Retail Investing for Individuals

Retail investing empowers individuals to build personalized portfolios tailored to their financial goals, promoting greater control over asset allocation. It offers opportunities for long-term wealth accumulation through diverse investment options, including stocks, bonds, and mutual funds. Access to educational resources and brokerage platforms enhances investor knowledge and decision-making capabilities.

Advantages of Social Trading Platforms

Social trading platforms offer real-time access to expert traders' strategies, enabling retail investors to replicate successful trades and minimize risks through collective intelligence. These platforms promote transparency and social interaction, which enhance learning opportunities and decision-making confidence for novice investors. By integrating automated tools and social feedback, social trading platforms streamline the investment process and improve portfolio diversification.

Common Risks in Retail Investing and Social Trading

Retail investing and social trading both expose investors to significant market volatility and liquidity risks, which can lead to rapid losses especially in highly volatile assets. Retail investors often face limited access to professional advice and may fall prey to misinformation, while social trading introduces risks related to blindly following unverified traders without conducting personal due diligence. Both approaches carry the inherent danger of overleveraging and emotional decision-making driven by herd behavior, amplifying potential financial losses.

Regulatory Considerations for Investors

Retail investing involves direct ownership of financial assets, often regulated by securities commissions such as the SEC in the United States, requiring strict compliance with disclosure and investor protection rules. Social trading platforms, which allow investors to mimic trades of experienced peers, face evolving regulatory scrutiny to ensure transparency, mitigate conflicts of interest, and prevent market manipulation. Investors must understand the distinct regulatory frameworks governing each method to safeguard their investments and comply with relevant financial laws.

Performance Comparison: Retail Investing vs Social Trading

Retail investing often relies on individual research and traditional brokerage platforms, which can result in varied performance depending on investor expertise and market conditions. Social trading leverages crowd-sourced data and real-time insights from experienced traders, potentially enhancing performance through collective intelligence and trend-following strategies. Studies indicate that social trading platforms can outperform retail investing by providing diversified strategies and reduced emotional bias, though risks remain tied to market volatility and follower dependence.

Future Trends in Retail Investing and Social Trading

Retail investing is increasingly shaped by AI-driven analytics and personalized robo-advisors, enhancing decision-making accuracy and accessibility. Social trading platforms integrate advanced social sentiment analysis and blockchain transparency, fostering trust and collaborative strategies among investors. Future trends indicate a convergence of these technologies, with seamless integration of social interaction and algorithmic insights driving smarter, community-based retail investment ecosystems.

Related Important Terms

Fractional Shares

Fractional shares enable retail investors to buy portions of high-value stocks, increasing accessibility to diversified portfolios without needing substantial capital. Social trading platforms integrate fractional shares, allowing investors to replicate expert strategies with minimal investment, enhancing participation and flexibility in the retail finance market.

Copy Trading

Retail investing allows individual investors to buy and sell securities independently, while social trading, particularly copy trading, enables users to automatically replicate the trades of experienced investors in real-time. Copy trading platforms use algorithmic technology to mirror expert strategies, reducing the need for in-depth market analysis and allowing retail investors to benefit from professional insights and diversified portfolios.

Social Sentiment Analysis

Social sentiment analysis in social trading uses real-time data from investor discussions and social media to gauge market moods, enabling traders to make informed decisions based on collective investor behavior. Retail investing often relies on individual research and financial indicators, whereas social trading leverages crowd-sourced sentiment insights for enhanced market prediction accuracy.

Paper Trading

Retail investing allows individuals to buy and sell securities for personal portfolios, while social trading enables investors to follow and copy the strategies of experienced traders in real time. Paper trading offers a risk-free simulation environment for both retail and social investors to practice strategies and test market conditions without actual financial loss.

Meme Stocks

Retail investing in meme stocks involves individual investors buying shares based on viral trends and social media hype, often resulting in volatile price swings. Social trading platforms amplify this effect by enabling users to mimic the trades of popular investors, increasing market momentum behind meme stocks like GameStop and AMC.

Crowdsourced Investment Strategies

Crowdsourced investment strategies leverage collective intelligence from retail investors, enabling diversified portfolios and real-time market sentiment analysis that often outperform traditional methods. Social trading platforms amplify these benefits by facilitating transparency, peer collaboration, and strategy replication, revolutionizing retail investing dynamics.

Pooled Investing

Pooled investing in retail investing involves aggregating individual funds into a collective portfolio managed by professionals, enabling diversification and reduced risk exposure. Social trading leverages collective investor insights by allowing participants to replicate strategies from successful traders, fostering a collaborative approach to pooled asset management.

Trade Signal Sharing

Retail investing primarily relies on individual analysis and personal trade strategies, whereas social trading emphasizes trade signal sharing among community members to replicate successful trades. Trade signal sharing in social trading platforms empowers retail investors with real-time insights and actionable alerts, enhancing decision-making through collective intelligence.

Gamified Investing

Gamified investing merges retail investing with social trading by incorporating game-like features such as leaderboards, badges, and rewards, enhancing user engagement and education. This approach boosts investor participation and confidence by making complex financial concepts more accessible and interactive through social sharing and competition.

Robo-Advisor Community

Retail investing has evolved with the rise of robo-advisor communities that combine algorithm-driven portfolio management with social trading features, enabling investors to benefit from both automated asset allocation and peer insights. These hybrid platforms leverage artificial intelligence and user-generated data to optimize investment strategies while fostering collaborative decision-making among retail investors.

Retail Investing vs Social Trading Infographic

industrydif.com

industrydif.com