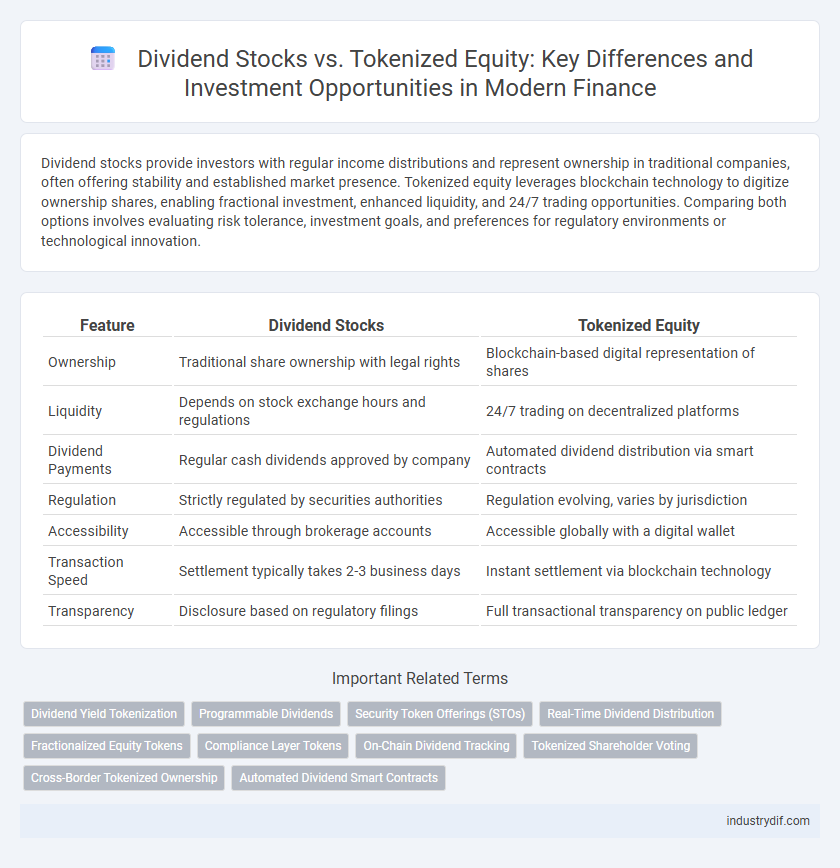

Dividend stocks provide investors with regular income distributions and represent ownership in traditional companies, often offering stability and established market presence. Tokenized equity leverages blockchain technology to digitize ownership shares, enabling fractional investment, enhanced liquidity, and 24/7 trading opportunities. Comparing both options involves evaluating risk tolerance, investment goals, and preferences for regulatory environments or technological innovation.

Table of Comparison

| Feature | Dividend Stocks | Tokenized Equity |

|---|---|---|

| Ownership | Traditional share ownership with legal rights | Blockchain-based digital representation of shares |

| Liquidity | Depends on stock exchange hours and regulations | 24/7 trading on decentralized platforms |

| Dividend Payments | Regular cash dividends approved by company | Automated dividend distribution via smart contracts |

| Regulation | Strictly regulated by securities authorities | Regulation evolving, varies by jurisdiction |

| Accessibility | Accessible through brokerage accounts | Accessible globally with a digital wallet |

| Transaction Speed | Settlement typically takes 2-3 business days | Instant settlement via blockchain technology |

| Transparency | Disclosure based on regulatory filings | Full transactional transparency on public ledger |

Understanding Dividend Stocks: Traditional Wealth Building

Dividend stocks represent shares in established companies that regularly distribute a portion of their profits to shareholders, offering a steady income stream and potential for capital appreciation. These stocks have historically been a reliable method for long-term wealth building due to consistent dividend payouts and reinvestment opportunities. Investors prioritize dividend yields, payout ratios, and company financial health when selecting dividend stocks to maximize returns and manage risk within their portfolios.

Introducing Tokenized Equity: The Digital Evolution

Tokenized equity represents a revolutionary shift in finance by enabling fractional ownership of shares through blockchain technology, enhancing liquidity and accessibility compared to traditional dividend stocks. Unlike conventional dividend stocks that rely on periodic payouts, tokenized equity offers instantaneous settlement, 24/7 trading, and programmable dividends via smart contracts. This digital evolution democratizes investment opportunities, reduces transaction costs, and increases transparency in equity markets.

Key Differences Between Dividend Stocks and Tokenized Equity

Dividend stocks represent traditional shares in publicly traded companies that pay regular dividends to shareholders, providing steady income and potential capital appreciation. Tokenized equity refers to digital tokens issued on a blockchain that represent ownership in a company, offering enhanced liquidity, fractional ownership, and easier access to diverse global investors. The key differences lie in dividend distribution methods, regulatory frameworks, and the accessibility and transferability of ownership stakes.

Regulatory Frameworks: Compliance and Investor Protection

Dividend stocks are regulated under established securities laws providing comprehensive investor protections, including mandatory disclosures and stringent compliance standards enforced by entities like the SEC. Tokenized equity operates within emerging regulatory frameworks that vary by jurisdiction, often requiring adherence to both securities regulations and blockchain-specific rules to ensure transparency and prevent fraud. Both investment forms prioritize compliance, but tokenized equity demands ongoing adaptation to evolving legal standards for effective investor protection.

Liquidity and Accessibility: Comparative Analysis

Dividend stocks offer established liquidity through traditional stock exchanges, enabling investors to buy and sell shares with relative ease and access regular dividend payouts. Tokenized equity leverages blockchain technology to enhance accessibility, allowing fractional ownership and 24/7 trading on decentralized platforms, which significantly lowers entry barriers for retail investors. The comparative liquidity of tokenized equity is evolving rapidly, potentially surpassing traditional dividend stocks by facilitating faster settlement times and broader global participation.

Dividend Yields vs. Token Rewards: How Investors Earn

Dividend stocks offer investors periodic income through dividend yields, providing steady cash flow based on company profits. Tokenized equity delivers returns via token rewards, often integrating blockchain technology that allows fractional ownership and potentially faster, more flexible payouts. Comparing the two, dividend yields represent traditional, regulated dividends, while token rewards offer innovative, programmable income streams that can enhance liquidity and accessibility.

Transparency and Governance in Both Models

Dividend stocks offer established transparency and governance through regulatory frameworks and audited financial disclosures, ensuring investors have clear insights into company performance and dividend policies. Tokenized equity leverages blockchain technology to provide real-time transaction visibility, immutable records, and decentralized governance mechanisms, enhancing shareholder voting processes and reducing intermediaries. Both models prioritize shareholder rights, but tokenized equity introduces increased transparency and streamlined governance via smart contracts and decentralized ledgers.

Risks and Volatility: What Investors Should Know

Dividend stocks typically offer steady income with lower volatility, backed by established companies with predictable cash flows. Tokenized equity, representing fractional ownership on blockchain platforms, introduces higher risks due to regulatory uncertainties and market liquidity challenges. Investors should assess the potential for price fluctuations and the security of their holdings before diversifying into tokenized assets alongside traditional dividend stocks.

Tax Implications: Dividend Income vs. Tokenized Gains

Dividend stocks generate taxable income typically subject to dividend tax rates, which vary depending on whether dividends are qualified or ordinary. Tokenized equity gains often involve capital gains tax upon selling tokens, with potential tax advantages like deferred taxation until realization. Understanding the differing tax treatments between dividend income and tokenized equity gains is crucial for optimizing after-tax investment returns.

Future Outlook: Integration of Traditional and Digital Assets

Dividend stocks continue to offer stable income and proven long-term value in traditional finance, while tokenized equity introduces liquidity, fractional ownership, and real-time trading on blockchain platforms. The future outlook points toward seamless integration where regulated tokenized equities coexist with dividend stocks, enhancing portfolio diversification and accessibility for global investors. This convergence is expected to drive innovation in asset management, regulatory frameworks, and investor engagement across both conventional and digital financial ecosystems.

Related Important Terms

Dividend Yield Tokenization

Dividend yield tokenization merges traditional dividend stocks with blockchain technology, enabling fractional ownership and real-time dividend distribution through tokenized assets. This innovation enhances liquidity and accessibility compared to conventional dividend stocks, allowing investors to earn proportional dividend yields seamlessly via decentralized finance platforms.

Programmable Dividends

Programmable dividends in tokenized equity enable automated, transparent, and real-time distribution of profits through smart contracts, offering greater flexibility and efficiency compared to traditional dividend stocks. This innovation allows investors to receive pro-rata dividends instantly on blockchain platforms, reducing administrative costs and enhancing liquidity in the financial ecosystem.

Security Token Offerings (STOs)

Dividend stocks provide regular income through company profit distributions, while tokenized equity via Security Token Offerings (STOs) offers fractional ownership with enhanced liquidity and blockchain-based transparency. STOs combine regulatory compliance with digital asset benefits, enabling efficient trading and broader investor access compared to traditional dividend stock investments.

Real-Time Dividend Distribution

Dividend stocks provide periodic payouts based on company profits, typically distributed quarterly, while tokenized equity enables real-time dividend distribution through blockchain technology, allowing investors to receive earnings instantly. This immediate liquidity and transparency enhance investor experience by reducing settlement times and increasing access to dividend income streams.

Fractionalized Equity Tokens

Fractionalized equity tokens represent shares of dividend stocks digitally, enabling investors to buy smaller portions of high-value assets with increased liquidity and reduced entry barriers compared to traditional stock ownership. These tokens provide real-time trading capabilities and automated dividend payments through smart contracts, enhancing accessibility and efficiency in portfolio diversification.

Compliance Layer Tokens

Dividend stocks provide investors with regulated income streams adhering to established securities laws, while tokenized equity leverages blockchain technology to represent ownership via compliance layer tokens that automate regulatory adherence through smart contracts. Compliance layer tokens enhance transparency and streamline KYC/AML processes, offering a programmable, secure alternative to traditional dividend distribution frameworks in financial markets.

On-Chain Dividend Tracking

On-chain dividend tracking enables transparent, automated distribution of dividends in tokenized equity, reducing administrative overhead and enhancing real-time shareholder payout verification. Unlike traditional dividend stocks that rely on centralized systems, blockchain technology ensures immutable records and immediate dividend settlements directly to investors' digital wallets.

Tokenized Shareholder Voting

Tokenized equity enhances shareholder voting by enabling real-time, transparent, and secure participation through blockchain technology, significantly reducing traditional voting inefficiencies found in dividend stocks. This digital approach ensures greater investor engagement and accurate vote tallying, fostering improved corporate governance and shareholder value.

Cross-Border Tokenized Ownership

Cross-border tokenized equity enables seamless, secure ownership transfer and dividend distribution across global markets, overcoming traditional dividend stocks' limitations related to regulatory barriers and settlement delays. Tokenized ownership leverages blockchain technology to enhance transparency and liquidity, making dividend payments more efficient for international investors.

Automated Dividend Smart Contracts

Automated dividend smart contracts streamline the distribution process for tokenized equity, ensuring real-time, transparent, and immutable payouts directly to shareholders' digital wallets. Unlike traditional dividend stocks, these blockchain-based contracts reduce intermediaries, minimize errors, and enhance liquidity by enabling instant settlement and fractional ownership.

Dividend Stocks vs Tokenized Equity Infographic

industrydif.com

industrydif.com