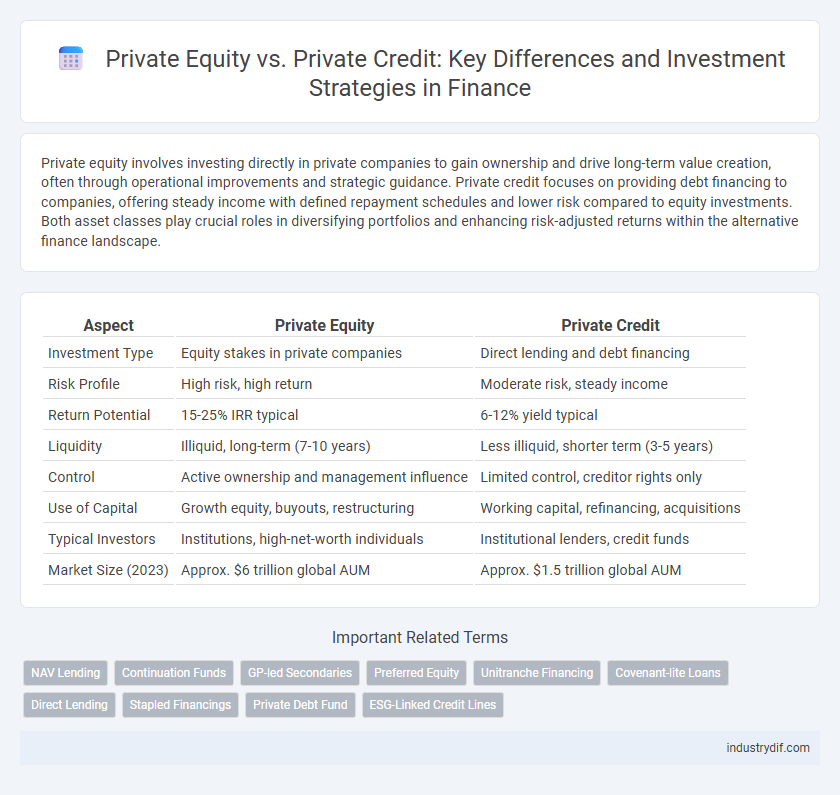

Private equity involves investing directly in private companies to gain ownership and drive long-term value creation, often through operational improvements and strategic guidance. Private credit focuses on providing debt financing to companies, offering steady income with defined repayment schedules and lower risk compared to equity investments. Both asset classes play crucial roles in diversifying portfolios and enhancing risk-adjusted returns within the alternative finance landscape.

Table of Comparison

| Aspect | Private Equity | Private Credit |

|---|---|---|

| Investment Type | Equity stakes in private companies | Direct lending and debt financing |

| Risk Profile | High risk, high return | Moderate risk, steady income |

| Return Potential | 15-25% IRR typical | 6-12% yield typical |

| Liquidity | Illiquid, long-term (7-10 years) | Less illiquid, shorter term (3-5 years) |

| Control | Active ownership and management influence | Limited control, creditor rights only |

| Use of Capital | Growth equity, buyouts, restructuring | Working capital, refinancing, acquisitions |

| Typical Investors | Institutions, high-net-worth individuals | Institutional lenders, credit funds |

| Market Size (2023) | Approx. $6 trillion global AUM | Approx. $1.5 trillion global AUM |

Overview of Private Equity and Private Credit

Private Equity involves investing directly in private companies or executing buyouts of public companies, aiming for capital appreciation through active management and eventual exit strategies such as IPOs or sales. Private Credit refers to non-bank lending to private companies, often characterized by higher yields and tailored financing solutions including mezzanine debt, senior secured loans, and unitranche structures. Both asset classes provide alternative investment opportunities with distinct risk-return profiles, liquidity considerations, and roles in portfolio diversification.

Key Differences Between Private Equity and Private Credit

Private Equity involves direct ownership or controlling stakes in companies, typically aiming for long-term capital appreciation through operational improvements or strategic growth. Private Credit provides non-equity capital, such as loans or debt instruments, focusing on generating steady income with defined risk profiles and shorter investment horizons. Key differences include the risk-return profile, investment duration, and liquidity, with Private Equity carrying higher risk and longer lock-up periods, while Private Credit offers more predictable cash flow and lower risk exposure.

Investment Structures in Private Equity vs Private Credit

Private Equity investments typically involve acquiring significant ownership stakes in companies through equity or equity-linked instruments, focusing on long-term capital appreciation. In contrast, Private Credit structures center on lending arrangements, providing debt financing such as senior secured loans or mezzanine debt, often with fixed interest payments and defined maturities. These structural distinctions influence risk profiles, liquidity, and returns, with Private Equity entailing more operational involvement, whereas Private Credit emphasizes contractual debt obligations.

Risk and Return Profiles

Private equity typically involves higher risk through equity stakes in companies, offering potential for substantial returns via capital appreciation but with longer illiquidity horizons. Private credit provides more stable income streams with lower volatility by lending to companies, often secured by collateral, leading to moderate returns and shorter investment durations. The risk-return profile of private equity leans toward higher growth potential at increased risk, whereas private credit emphasizes capital preservation and predictable cash flow.

Role in Portfolio Diversification

Private equity enhances portfolio diversification by providing access to high-growth companies with long-term capital appreciation potential, often less correlated with public markets. Private credit offers steady income streams and lower volatility through direct lending to mid-sized firms, serving as a diversifier against equity market fluctuations. Combining private equity and private credit improves risk-adjusted returns by balancing growth opportunities with income stability across different market cycles.

Due Diligence and Deal Sourcing

Due diligence in private equity involves comprehensive financial, legal, and operational analysis to assess target companies' growth potential and risks, emphasizing equity valuation and management team evaluation. Private credit due diligence prioritizes cash flow stability, borrower creditworthiness, and collateral quality to mitigate default risk, focusing on loan structuring and covenant assessment. Deal sourcing in private equity relies heavily on relationships with investment banks, industry experts, and proprietary networks, whereas private credit sourcing leverages borrower pipelines, banks' loan syndication channels, and direct origination platforms.

Typical Investors in Private Equity and Private Credit

Typical investors in private equity include institutional investors such as pension funds, endowments, and sovereign wealth funds seeking long-term capital appreciation through equity stakes in private companies. Private credit investors often consist of insurance companies, asset managers, and family offices aiming for steady income generation via debt instruments with negotiated interest rates and covenants. Both investor types prioritize diversifying portfolios but differ in risk tolerance and liquidity requirements due to the equity ownership versus debt exposure models.

Regulatory and Compliance Considerations

Private equity and private credit face distinct regulatory and compliance frameworks, with private equity primarily governed by securities laws and investment adviser regulations. Private credit often encounters additional scrutiny under banking regulations and lending-specific compliance, including credit risk assessments and borrower protections. Both sectors must navigate anti-money laundering (AML) standards, Know Your Customer (KYC) rules, and evolving disclosure obligations to maintain adherence and minimize legal risks.

Exit Strategies and Liquidity

Private equity investments typically rely on exit strategies such as initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales to generate liquidity, often requiring multi-year holding periods. Private credit offers more immediate liquidity prospects through scheduled repayments and interest income, with exit options including refinancing or loan maturity. Investors in private credit benefit from defined cash flow timelines, while private equity investors face greater uncertainty and longer horizons for realizing returns.

Future Trends in Private Equity and Private Credit

Future trends in private equity emphasize increased adoption of technology-driven due diligence, ESG integration, and a shift toward growth equity and impact investing. Private credit is expected to grow with greater institutional investor participation, enhanced regulatory frameworks, and expansion into niche markets like direct lending and specialty finance. Both sectors anticipate rising digital transformation and data analytics to improve deal sourcing, risk management, and portfolio monitoring.

Related Important Terms

NAV Lending

NAV lending in private equity involves securing loans against the net asset value of illiquid portfolio companies, providing funds without forced sales of assets. Private credit, focusing on direct lending to companies, typically offers higher yields but lacks the NAV-based collateral structure that mitigates risk in NAV lending strategies.

Continuation Funds

Continuation funds in private equity provide liquidity by transferring portfolio assets into new vehicles, enabling extended management and value realization beyond traditional fund lifespans, whereas private credit continuation funds focus on sustaining debt positions to optimize yield and credit risk management over time. These structures cater to differing investor priorities with private equity continuation funds emphasizing equity appreciation and private credit continuation funds prioritizing steady income streams and capital preservation.

GP-led Secondaries

GP-led secondaries in private equity involve general partners restructuring existing funds or assets to provide liquidity and extend hold periods, differing significantly from private credit where debt financing structures prioritize regular income over equity appreciation. These transactions often facilitate fund recapitalizations, allowing GPs to manage portfolio concentration and investor liquidity preferences while private credit investments focus primarily on generating consistent interest returns through leveraged loans and debt instruments.

Preferred Equity

Preferred equity in private equity offers investors a hybrid position with priority dividend payments and potential equity upside, providing a balance between risk and return. Unlike private credit, which focuses on fixed income through debt instruments, preferred equity aims to enhance capital structure flexibility while preserving downside protection via liquidation preferences.

Unitranche Financing

Unitranche financing, a hybrid debt structure combining senior and subordinated debt into a single loan, offers private equity firms streamlined access to capital with simplified documentation and faster execution. Private credit providers leverage unitranche loans to enhance yield opportunities while mitigating risk through blended interest rates and flexible covenants, distinguishing this financing approach from traditional multiple-tranche debt arrangements.

Covenant-lite Loans

Covenant-lite loans, which are prevalent in private credit markets, offer borrowers greater flexibility by limiting traditional financial maintenance covenants, contrasting with private equity's focus on equity stakes and active ownership. These loans attract investors seeking higher yields with less stringent monitoring, though they pose increased credit risk compared to covenant-heavy debt structures typical in private equity financing.

Direct Lending

Direct lending in private credit involves non-bank lenders providing loans directly to mid-market companies, offering flexible financing solutions often absent in traditional bank lending. Private equity focuses on equity investments and ownership stakes, while direct lending prioritizes debt instruments, delivering steady income streams and lower risk through secured loans.

Stapled Financings

Stapled financings in private equity typically bundle equity investments with pre-arranged debt from private credit sources, streamlining the capital raise process for acquisitions. This integrated approach provides portfolio companies with tailored financing structures, enhancing deal certainty and optimizing capital efficiency compared to traditional separate equity and credit arrangements.

Private Debt Fund

Private equity primarily involves equity ownership and operational control in portfolio companies, while private debt funds specialize in providing direct loan financing or credit solutions, often targeting middle-market firms with less dilution of ownership. Private debt funds offer flexible capital structures, predictable cash flows, and lower risk profiles compared to equity investments, making them a preferred choice for investors seeking steady income with downside protection.

ESG-Linked Credit Lines

Private equity investments often target long-term value creation with a focus on sustainable business practices, while private credit, particularly ESG-linked credit lines, integrates environmental, social, and governance criteria directly into loan agreements to incentivize measurable ESG improvements. ESG-linked credit lines provide borrowers with financial benefits tied to achieving specific ESG performance targets, aligning capital cost with sustainability outcomes and promoting responsible lending within the private credit market.

Private Equity vs Private Credit Infographic

industrydif.com

industrydif.com