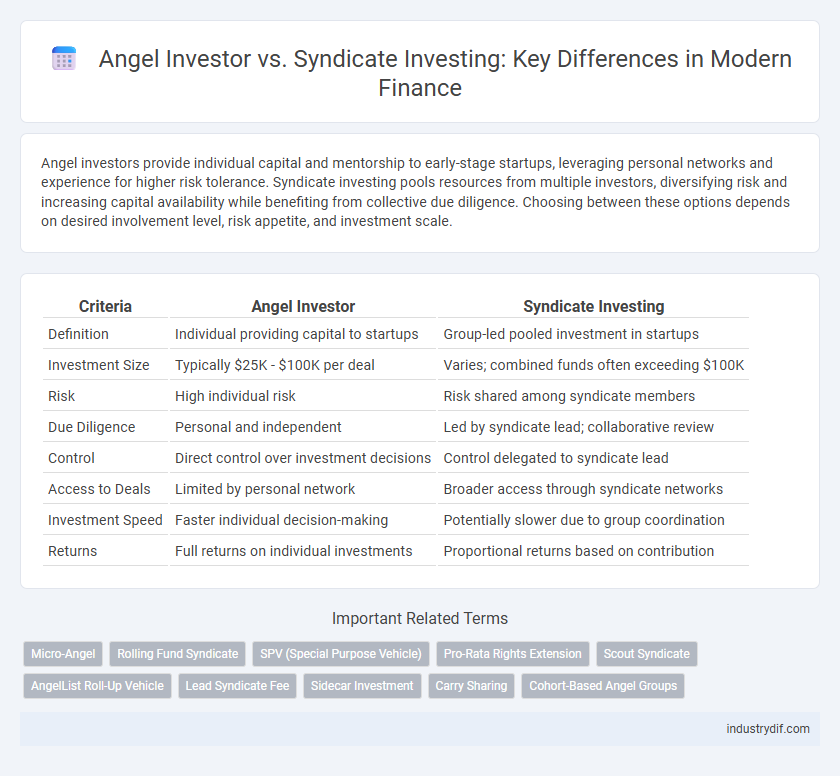

Angel investors provide individual capital and mentorship to early-stage startups, leveraging personal networks and experience for higher risk tolerance. Syndicate investing pools resources from multiple investors, diversifying risk and increasing capital availability while benefiting from collective due diligence. Choosing between these options depends on desired involvement level, risk appetite, and investment scale.

Table of Comparison

| Criteria | Angel Investor | Syndicate Investing |

|---|---|---|

| Definition | Individual providing capital to startups | Group-led pooled investment in startups |

| Investment Size | Typically $25K - $100K per deal | Varies; combined funds often exceeding $100K |

| Risk | High individual risk | Risk shared among syndicate members |

| Due Diligence | Personal and independent | Led by syndicate lead; collaborative review |

| Control | Direct control over investment decisions | Control delegated to syndicate lead |

| Access to Deals | Limited by personal network | Broader access through syndicate networks |

| Investment Speed | Faster individual decision-making | Potentially slower due to group coordination |

| Returns | Full returns on individual investments | Proportional returns based on contribution |

Definition of Angel Investors

Angel investors are high-net-worth individuals who provide capital to early-stage startups in exchange for equity ownership, often contributing not only funds but also mentorship and industry connections. Typically investing personal funds, angel investors play a crucial role in bridging the gap between friends-and-family funding and venture capital rounds. Their investments range widely, generally from $25,000 to $500,000, targeting high-potential companies in sectors like technology, healthcare, and consumer products.

Understanding Syndicate Investing

Syndicate investing pools capital from multiple angel investors to co-invest in startups, enhancing diversification and reducing individual risk. Unlike solo angel investing, syndicates allow participation in larger deals and access to shared due diligence conducted by experienced lead investors. This collaborative approach leverages collective expertise and increases investment opportunities within the early-stage venture ecosystem.

Key Differences Between Angel Investors and Syndicates

Angel investors typically invest their own capital individually, offering personalized mentorship and quick decision-making, while syndicate investing pools funds from multiple investors led by a lead investor or syndicate manager to diversify risk and access larger deal flows. Angel investors provide direct engagement and control over investment choices, whereas syndicates enable smaller individual contributions within collective investments, leveraging shared due diligence and expertise. Syndicates often attract limited partners seeking access to exclusive startups without the need for individual deal sourcing or management responsibilities.

Investment Process Comparison

Angel investors conduct independent due diligence, swiftly making funding decisions based on personal expertise and network insights. Syndicate investing involves a lead investor who performs in-depth analysis and pools resources from multiple backers, streamlining deal flow and risk sharing. This collective approach often grants startups access to larger capital sums and diversified mentorship during growth stages.

Pros and Cons of Angel Investing

Angel investing offers direct involvement with startups, providing high-growth potential and the opportunity to leverage personal expertise, yet it carries significant risks including illiquidity and the chance of complete capital loss. Angel investors benefit from early-stage entry but face challenges such as limited diversification and the need for substantial due diligence. While angel investing can yield substantial returns, the time commitment and lack of structured support compared to syndicate investing can be seen as drawbacks.

Advantages and Risks of Syndicate Investing

Syndicate investing enables individual investors to pool resources, accessing larger deals and benefiting from the lead investor's expertise, which can enhance due diligence and reduce individual risk exposure. However, syndicates can introduce greater complexity in decision-making and potential conflicts among members, possibly affecting investment timelines and returns. The reliance on the lead investor's judgment also amplifies risk if their assessment is flawed, making syndicate investing both collaborative and potentially vulnerable.

Capital Requirements: Angel vs Syndicate

Angel investors typically commit individual capital ranging from $25,000 to $100,000 per deal, leveraging personal funds and taking on higher risk independently. Syndicate investing pools resources from multiple investors, enabling access to larger capital amounts, often exceeding $1 million, which diversifies risk and increases investment capacity. The lower capital threshold for angels contrasts with syndicates' collective funding power, influencing deal size and startup valuation opportunities.

Role in Startup Funding Rounds

Angel investors provide early-stage capital by investing their own funds, often offering mentorship and industry expertise to startups during seed and pre-seed rounds. Syndicate investing pools resources from multiple angel investors, enabling larger funding amounts and risk distribution in seed or Series A rounds. Both play critical roles in startup funding, with angels acting individually and syndicates leveraging collective power to accelerate growth.

Decision-Making and Control Dynamics

Angel investors typically exercise individual discretion in decision-making, retaining direct control over investment choices and portfolio management. Syndicate investing consolidates multiple investors' capital, with decisions often delegated to a lead investor who drives investment strategy, thereby diluting individual control but increasing access to diversified expertise. This dynamic influences risk exposure and governance, as angel investors maintain personalized oversight while syndicates operate through collective consensus and shared due diligence.

Which Investment Strategy Suits You?

Angel investing offers individual investors direct control and personal involvement in startup funding, ideal for those seeking hands-on experience and higher-risk high-reward opportunities. Syndicate investing pools funds from multiple investors, reducing individual risk and providing access to larger deals and expert due diligence, making it suitable for investors preferring collaborative decision-making and diversified exposure. Assess your risk tolerance, desired level of involvement, and capital availability to determine which investment strategy aligns best with your financial goals.

Related Important Terms

Micro-Angel

Micro-angel investing involves individual investors contributing smaller capital amounts to early-stage startups, providing more agile funding options compared to traditional angel investors who typically invest larger sums independently. Syndicate investing pools resources from multiple micro-angels under a lead investor, increasing capital availability and reducing individual risk while leveraging collective expertise in the startup ecosystem.

Rolling Fund Syndicate

Angel investors provide early-stage capital individually, while syndicate investing through rolling fund syndicates pools resources from multiple accredited investors to deploy capital continuously into startups. Rolling fund syndicates offer structured, recurring investment commitments, enabling consistent deal flow and diversification across emerging companies in sectors like fintech and biotech.

SPV (Special Purpose Vehicle)

Angel investors often use Special Purpose Vehicles (SPVs) to pool capital and simplify management when syndicate investing, allowing multiple investors to collectively invest in startups while limiting individual liability. Syndicate investing via SPVs enhances due diligence efficiency and provides startups with streamlined capital infusions by consolidating investor agreements under a single legal entity.

Pro-Rata Rights Extension

Angel investors typically secure pro-rata rights to maintain their ownership percentage during future funding rounds, enabling them to avoid dilution. Syndicate investing platforms often extend pro-rata rights collectively, allowing lead investors to negotiate better terms and optimize investment stakes across multiple participants.

Scout Syndicate

Scout syndicates offer a streamlined method for angel investors to pool resources and access high-quality deal flow from experienced lead investors, increasing diversification and reducing individual risk. Unlike solo angel investing, scout syndicates leverage collective expertise and capital, enabling smaller investors to participate in larger startup rounds and benefit from the syndicate's due diligence and network.

AngelList Roll-Up Vehicle

AngelList Roll-Up Vehicle (ROLV) streamlines syndicate investing by pooling multiple accredited investors under one legal entity, enabling efficient, large-scale capital deployment into startups. Unlike individual angel investors who invest independently, ROLVs reduce administrative burdens and increase diversification, enhancing access to high-quality deal flow and better terms.

Lead Syndicate Fee

Lead syndicate fees typically range from 5% to 20% of the total raised capital, paid to the lead investor for sourcing and managing the deal. Angel investors investing independently avoid these fees but often face higher individual risk and require more due diligence effort.

Sidecar Investment

Sidecar investment allows angel investors to participate alongside syndicates, combining individual capital with collective expertise to mitigate risk and enhance deal flow. This strategy leverages the syndicate's due diligence while maintaining the angel's flexibility and control over investment size and terms.

Carry Sharing

Angel investors typically receive a carry percentage ranging from 20% to 30% on profits generated by their investments, reflecting their direct capital risk and active involvement. In syndicate investing, carry sharing is distributed among lead investors and backers, often with the lead securing a higher carry stake around 15% to 20%, while passive investors receive a smaller portion, aligning incentives between parties.

Cohort-Based Angel Groups

Cohort-based angel groups streamline syndicate investing by pooling resources from individual angel investors to fund startups collectively, increasing deal flow and risk diversification. These structured groups leverage shared due diligence and expertise, enhancing investment efficiency compared to solo angel investing.

Angel Investor vs Syndicate Investing Infographic

industrydif.com

industrydif.com