Hedge funds are traditional investment vehicles managed by professionals who actively seek to maximize returns through diversified asset strategies, often requiring high minimum investments and regulatory oversight. Decentralized Autonomous Organizations (DAOs) leverage blockchain technology to enable collective investment decisions without centralized control, promoting transparency and community governance. While hedge funds rely on expert management and confidentiality, DAOs prioritize decentralization and democratized access to financial opportunities.

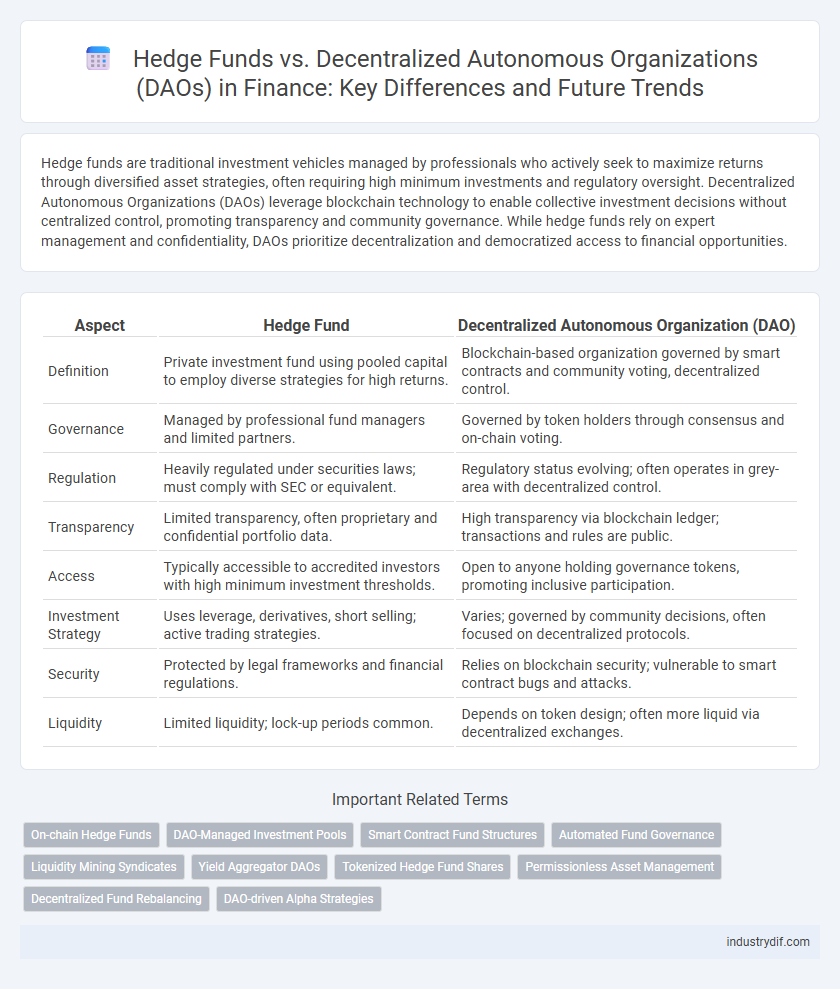

Table of Comparison

| Aspect | Hedge Fund | Decentralized Autonomous Organization (DAO) |

|---|---|---|

| Definition | Private investment fund using pooled capital to employ diverse strategies for high returns. | Blockchain-based organization governed by smart contracts and community voting, decentralized control. |

| Governance | Managed by professional fund managers and limited partners. | Governed by token holders through consensus and on-chain voting. |

| Regulation | Heavily regulated under securities laws; must comply with SEC or equivalent. | Regulatory status evolving; often operates in grey-area with decentralized control. |

| Transparency | Limited transparency, often proprietary and confidential portfolio data. | High transparency via blockchain ledger; transactions and rules are public. |

| Access | Typically accessible to accredited investors with high minimum investment thresholds. | Open to anyone holding governance tokens, promoting inclusive participation. |

| Investment Strategy | Uses leverage, derivatives, short selling; active trading strategies. | Varies; governed by community decisions, often focused on decentralized protocols. |

| Security | Protected by legal frameworks and financial regulations. | Relies on blockchain security; vulnerable to smart contract bugs and attacks. |

| Liquidity | Limited liquidity; lock-up periods common. | Depends on token design; often more liquid via decentralized exchanges. |

Understanding Hedge Funds: Definition and Structure

Hedge funds are pooled investment vehicles managed by professional fund managers employing diverse strategies to maximize returns and mitigate risk. They typically utilize leverage, derivatives, and short-selling within a flexible regulatory framework, attracting high-net-worth individuals and institutional investors. The structure of hedge funds involves limited partnerships, where general partners control operations, and limited partners contribute capital with limited liability.

What is a Decentralized Autonomous Organization (DAO)?

A Decentralized Autonomous Organization (DAO) is an innovative, blockchain-based entity governed through smart contracts without centralized control, enabling transparent and democratic decision-making. Unlike traditional hedge funds managed by financial experts, DAOs rely on token holders to propose and vote on investment strategies, ensuring collective ownership and reduced intermediary costs. This structure leverages decentralized finance (DeFi) principles to enhance efficiency, security, and global participation in asset management.

Key Differences: Hedge Funds vs DAOs

Hedge funds operate as centralized investment vehicles managed by professional fund managers using traditional financial instruments and regulatory frameworks, while decentralized autonomous organizations (DAOs) leverage blockchain technology to enable community-driven decision-making and transparent governance without intermediaries. Hedge funds typically require high minimum investments and operate under strict compliance with securities laws, whereas DAOs allow token holders to participate in governance, often with lower entry barriers and greater transparency. The key differences lie in their organizational structure, regulatory environment, and level of participant control over investment strategies.

Investment Strategies: Traditional vs Decentralized Approaches

Hedge funds employ traditional investment strategies emphasizing active management, leveraging market analysis, derivatives, and short-selling to achieve high returns. Decentralized autonomous organizations (DAOs) utilize blockchain technology to enable community-driven investment decisions, relying on smart contracts and token-based voting systems for transparent, automated asset management. These decentralized approaches democratize access to investment opportunities, contrasting with hedge funds' centralized, expert-led decision-making processes.

Governance Models: Centralized Fund Managers vs Community Voting

Hedge funds operate under centralized governance models where fund managers make strategic decisions and control asset allocation, ensuring coherent oversight and rapid response to market changes. In contrast, decentralized autonomous organizations (DAOs) rely on community voting mechanisms, distributing decision-making power among token holders to promote transparency and collective agreement on investment strategies. These contrasting governance structures highlight the trade-off between centralized control for efficiency and decentralized participation for democratized financial management.

Regulatory Environment: Compliance for Hedge Funds and DAOs

Hedge funds operate under stringent regulatory frameworks such as the SEC's Investment Advisers Act, requiring extensive compliance measures including registration, reporting, and investor protections. Decentralized Autonomous Organizations (DAOs) face a nascent and evolving regulatory environment, often lacking clear guidelines, which challenges compliance with securities laws and anti-money laundering requirements. Regulatory scrutiny on DAOs is increasing as jurisdictions consider frameworks to address governance transparency, investor rights, and liability issues distinct from traditional hedge fund regulations.

Risk Management: How Risks Are Mitigated in Each Model

Hedge funds employ professional fund managers who utilize sophisticated financial instruments, diversification strategies, and regulatory compliance to mitigate market, credit, and operational risks. Decentralized Autonomous Organizations (DAOs) mitigate risks through transparent smart contracts, decentralized decision-making, and community governance, reducing single points of failure and enhancing security. While hedge funds rely on expert oversight and traditional risk controls, DAOs focus on algorithmic enforcement and collective consensus to manage uncertainties.

Transparency and Reporting Standards

Hedge funds typically operate with limited transparency, offering periodic reports mainly to accredited investors, while decentralized autonomous organizations (DAOs) leverage blockchain technology to ensure real-time, immutable transparency through publicly accessible smart contracts. Reporting standards for hedge funds are governed by regulatory frameworks such as the SEC, requiring audited financial statements, whereas DAOs rely on decentralized governance protocols that enable community-driven financial disclosures and operational updates without central authority. This contrast highlights the trade-off between traditional regulatory compliance in hedge funds and the self-regulated, transparent ecosystem characteristic of DAOs.

Accessibility: Barriers to Entry for Investors

Hedge funds often require high minimum investments and accreditation, creating significant barriers to entry for individual investors. Decentralized autonomous organizations (DAOs) leverage blockchain technology to enable broader participation through token-based governance, lowering entry thresholds and increasing accessibility. This democratization allows retail investors to engage in financial decision-making processes without traditional gatekeepers.

The Future of Asset Management: Hedge Funds and DAOs in Perspective

Hedge funds leverage traditional financial expertise and regulatory frameworks to manage diversified investment portfolios, focusing on maximizing returns through active management and risk mitigation strategies. Decentralized autonomous organizations (DAOs) utilize blockchain technology to democratize asset management, enabling transparent, community-driven decision-making without centralized control. The future of asset management lies in the integration of these models, combining hedge funds' sophisticated strategies with DAOs' innovative governance to enhance efficiency, transparency, and investor accessibility.

Related Important Terms

On-chain Hedge Funds

On-chain hedge funds leverage blockchain technology to enable transparent, automated investment strategies and real-time auditing, distinguishing them from traditional hedge funds confined to centralized management. Decentralized autonomous organizations (DAOs) govern on-chain hedge funds through token-based voting, enhancing collective decision-making and reducing reliance on intermediaries in financial asset management.

DAO-Managed Investment Pools

DAO-managed investment pools leverage blockchain technology to enable transparent, decentralized decision-making and reduce intermediaries compared to traditional hedge funds, which rely on centralized management and strict regulatory oversight. These pools utilize smart contracts to automate asset allocation and governance, offering participants direct voting power and increased liquidity in a trustless environment.

Smart Contract Fund Structures

Smart contract fund structures in decentralized autonomous organizations (DAOs) enable automated, transparent investment management through blockchain technology, reducing reliance on traditional intermediaries found in hedge funds. While hedge funds typically operate with centralized control and regulatory oversight, DAOs leverage programmable contracts to execute trades and enforce rules autonomously, enhancing efficiency and democratizing access to fund governance.

Automated Fund Governance

Hedge funds rely on centralized management teams to make investment decisions, whereas Decentralized Autonomous Organizations (DAOs) utilize blockchain technology and smart contracts for automated fund governance, enabling transparent, real-time decision-making without intermediaries. This automation reduces operational costs and enhances security by eliminating human error and bias in portfolio management.

Liquidity Mining Syndicates

Hedge funds offer centralized management and regulatory oversight, providing investors with structured liquidity and risk management, while Decentralized Autonomous Organizations (DAOs) enable community-driven liquidity mining syndicates that leverage smart contracts for transparent, permissionless asset pooling and yield optimization. Liquidity mining syndicates within DAOs enhance capital efficiency by incentivizing token holders to provide liquidity, fostering decentralized finance (DeFi) innovation with automated governance and reduced operational costs compared to traditional hedge fund models.

Yield Aggregator DAOs

Hedge funds manage pooled investments using centralized strategies and professional fund managers, while Yield Aggregator DAOs operate on blockchain technology to autonomously optimize yield farming opportunities across decentralized finance protocols. Yield Aggregator DAOs leverage smart contracts to automatically redistribute assets for maximizing returns, reducing management fees and increasing transparency compared to traditional hedge funds.

Tokenized Hedge Fund Shares

Tokenized hedge fund shares represent a novel convergence between traditional hedge funds and decentralized autonomous organizations (DAOs), enabling fractional ownership and increased liquidity through blockchain technology. This innovative structure enhances transparency and accessibility by allowing investors to trade fund shares on decentralized platforms, reducing reliance on intermediaries and lowering entry barriers in the finance sector.

Permissionless Asset Management

Hedge funds operate under centralized management with strict regulatory oversight, limiting access to accredited investors and imposing high minimum investment thresholds, whereas decentralized autonomous organizations (DAOs) enable permissionless asset management by allowing anyone to participate, vote, and allocate funds through smart contracts on blockchain networks. DAOs provide increased transparency, reduced operational costs, and democratized decision-making, contrasting with the traditional hedge fund's hierarchical structure and opaque investment strategies.

Decentralized Fund Rebalancing

Decentralized autonomous organizations (DAOs) enable transparent, algorithm-driven fund management with real-time rebalancing based on smart contract protocols, contrasting with traditional hedge funds that rely on human managers and discretionary decisions. DAO-based decentralized fund rebalancing enhances efficiency, reduces operational costs, and mitigates risks linked to centralized control and delayed response times.

DAO-driven Alpha Strategies

DAO-driven alpha strategies leverage blockchain transparency and decentralized governance to minimize information asymmetry and reduce operational costs, potentially outperforming traditional hedge fund models. Unlike hedge funds reliant on centralized decision-making and opaque fee structures, DAOs enable real-time investor participation, enhancing agility and aligning incentives for superior risk-adjusted returns.

Hedge fund vs Decentralized autonomous organization Infographic

industrydif.com

industrydif.com