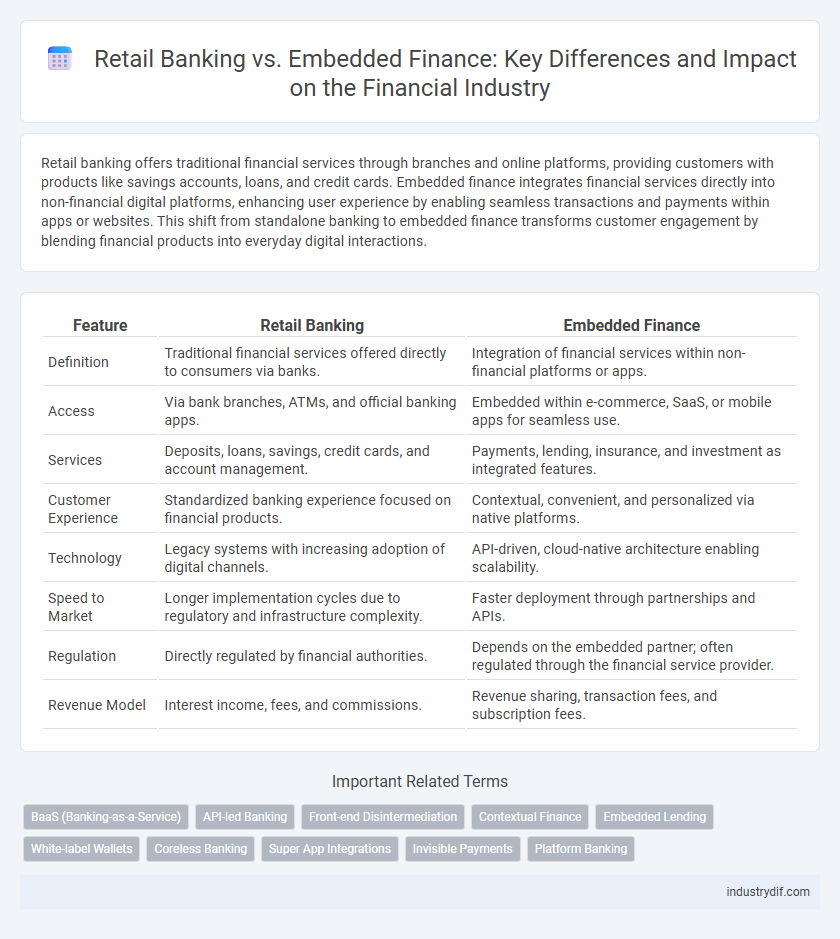

Retail banking offers traditional financial services through branches and online platforms, providing customers with products like savings accounts, loans, and credit cards. Embedded finance integrates financial services directly into non-financial digital platforms, enhancing user experience by enabling seamless transactions and payments within apps or websites. This shift from standalone banking to embedded finance transforms customer engagement by blending financial products into everyday digital interactions.

Table of Comparison

| Feature | Retail Banking | Embedded Finance |

|---|---|---|

| Definition | Traditional financial services offered directly to consumers via banks. | Integration of financial services within non-financial platforms or apps. |

| Access | Via bank branches, ATMs, and official banking apps. | Embedded within e-commerce, SaaS, or mobile apps for seamless use. |

| Services | Deposits, loans, savings, credit cards, and account management. | Payments, lending, insurance, and investment as integrated features. |

| Customer Experience | Standardized banking experience focused on financial products. | Contextual, convenient, and personalized via native platforms. |

| Technology | Legacy systems with increasing adoption of digital channels. | API-driven, cloud-native architecture enabling scalability. |

| Speed to Market | Longer implementation cycles due to regulatory and infrastructure complexity. | Faster deployment through partnerships and APIs. |

| Regulation | Directly regulated by financial authorities. | Depends on the embedded partner; often regulated through the financial service provider. |

| Revenue Model | Interest income, fees, and commissions. | Revenue sharing, transaction fees, and subscription fees. |

Overview of Retail Banking and Embedded Finance

Retail banking primarily involves traditional financial services such as savings accounts, loans, and credit cards offered directly to individual consumers through banks and branch networks. Embedded finance integrates financial services like payments, lending, or insurance into non-financial platforms, enabling businesses to offer seamless financial products within their customer experience. This approach leverages APIs and digital ecosystems to enhance accessibility and convenience beyond conventional retail banking structures.

Key Differences Between Retail Banking and Embedded Finance

Retail banking primarily offers traditional financial services through physical branches and digital platforms, focusing on savings, loans, and payment accounts directly to consumers. Embedded finance integrates financial services within non-financial platforms or ecosystems, allowing businesses to offer payments, lending, or insurance seamlessly within their apps or websites. Key differences include customer interaction models, with retail banking being a standalone service provider and embedded finance functioning as an integrated feature within other products or services.

Evolution of Retail Banking in the Digital Era

Retail banking has evolved significantly with the integration of embedded finance, allowing traditional banks to offer seamless financial services through non-bank platforms such as e-commerce sites, mobile apps, and fintech ecosystems. This shift leverages APIs and cloud computing to deliver personalized, real-time banking experiences, enhancing customer convenience and operational efficiency. The digital era accelerates retail banks' transformation by embedding credit, payments, and insurance products directly into everyday digital interactions, driving new revenue streams and expanding market reach.

What is Embedded Finance?

Embedded finance integrates financial services directly into non-financial digital platforms, enabling seamless access to banking, lending, or payment solutions within apps or websites. Unlike traditional retail banking that requires customers to interact with banks directly, embedded finance leverages APIs to offer contextual financial products at the point of need. This innovation enhances user experience, drives higher engagement, and opens new revenue streams for businesses outside the conventional banking sector.

Benefits of Retail Banking for Consumers

Retail banking offers consumers accessible financial services such as savings accounts, loans, and credit cards through established banking institutions with trusted security protocols. Customers benefit from personalized financial advice, regulatory protections, and extensive branch networks that facilitate in-person support and cash handling. These advantages enhance consumer confidence, financial inclusion, and convenience in managing day-to-day banking needs.

How Embedded Finance Transforms Customer Experience

Embedded finance integrates financial services directly into non-financial platforms, streamlining customer interactions by eliminating the need to navigate traditional retail banking interfaces. This seamless access enhances user convenience and personalization through real-time data-driven insights, leading to tailored financial products and faster decision-making. By embedding payments, lending, and insurance into everyday apps, businesses deliver frictionless experiences that boost customer engagement and satisfaction.

Technology Innovations Driving Embedded Finance

Retail banking relies heavily on traditional branches and legacy IT systems, limiting its ability to offer seamless customer experiences. Embedded finance integrates financial services directly into non-bank platforms using APIs, AI, and blockchain technologies to provide real-time, personalized solutions. These technology innovations enable embedded finance to disrupt traditional models by enhancing accessibility, speed, and convenience for consumers and businesses alike.

Regulatory Challenges in Retail Banking vs Embedded Finance

Retail banking faces stringent regulatory challenges including strict capital requirements, extensive consumer protection laws, and comprehensive anti-money laundering (AML) regulations enforced by bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). Embedded finance, integrated within non-financial platforms, encounters evolving regulatory scrutiny focusing on compliance gaps and data privacy issues, requiring adaptation to standards set by the Financial Conduct Authority (FCA) or similar regulators. The complexity in retail banking stems from legacy systems and established legal frameworks, whereas embedded finance must navigate emerging regulatory landscapes that often lack clear guidelines.

Impact on Financial Inclusion and Accessibility

Retail banking traditionally requires customers to access services through physical branches or dedicated apps, limiting financial inclusion for underserved populations. Embedded finance integrates financial services directly into non-financial platforms, enhancing accessibility by offering seamless, real-time financial products within everyday digital ecosystems. This shift significantly reduces barriers to entry, enabling broader participation from unbanked and underbanked communities.

Future Trends: Retail Banking and Embedded Finance Integration

Retail banking is rapidly evolving through integration with embedded finance, enabling seamless financial services within non-bank platforms and enhancing customer convenience. Future trends indicate increased collaboration between traditional banks and fintech firms to deliver personalized, real-time financial solutions leveraging AI and API-driven ecosystems. This convergence promotes financial inclusion, accelerates product innovation, and reshapes customer engagement by embedding banking services directly into everyday digital experiences.

Related Important Terms

BaaS (Banking-as-a-Service)

Retail banking primarily offers traditional financial products directly to consumers through branches and online platforms, while embedded finance integrates financial services like payments and lending into non-bank digital platforms. Banking-as-a-Service (BaaS) enables fintechs and businesses to seamlessly embed banking capabilities into their offerings by leveraging APIs from licensed banks, accelerating innovation and customer reach.

API-led Banking

API-led banking enables seamless integration between retail banking platforms and embedded finance solutions, allowing financial services to be embedded directly into non-financial apps for enhanced customer experience. This approach leverages open banking APIs to offer tailored financial products, driving innovation and expanding access beyond traditional retail banking channels.

Front-end Disintermediation

Retail banking traditionally relies on branch visits and intermediaries for customer interactions, while embedded finance integrates financial services directly into non-financial platforms, bypassing conventional front-end channels. This front-end disintermediation streamlines user experience, reduces onboarding friction, and accelerates digital adoption in financial services.

Contextual Finance

Retail banking offers traditional financial services through established banks with physical branches and digital platforms, whereas embedded finance integrates financial products directly into non-financial apps or services, providing seamless contextual finance experiences that enhance customer convenience and engagement. Contextual finance leverages real-time data and user behavior to deliver personalized, timely financial solutions within everyday activities, driving higher adoption rates and improved financial inclusion.

Embedded Lending

Embedded lending integrates credit solutions directly within non-financial platforms, enabling seamless access to loans at the point of sale or service consumption, which enhances customer experience and accelerates decision-making. Unlike traditional retail banking, embedded finance leverages API-driven technology to offer personalized, real-time credit options without requiring customers to navigate away from their preferred digital environments.

White-label Wallets

White-label wallets in retail banking offer branded digital payment solutions managed by traditional banks, enhancing customer engagement through customized user experiences and secure transaction processing. Embedded finance integrates these wallets seamlessly into non-financial platforms, allowing businesses to provide financial services directly within their ecosystems, increasing accessibility and driving higher transaction volume.

Coreless Banking

Coreless banking in retail banking eliminates traditional physical branches, enabling financial services through digital platforms to reduce operational costs and enhance customer convenience. Embedded finance integrates these services directly into non-financial apps or ecosystems, allowing seamless access to banking features without the need for standalone banking interfaces.

Super App Integrations

Retail banking traditionally relies on branch networks and standalone digital platforms, while embedded finance integrates financial services directly into non-bank super apps, enhancing user convenience and increasing transaction frequency. Super app integrations leverage APIs to embed payment processing, lending, and insurance within ecosystems like ride-hailing and e-commerce, accelerating customer acquisition and expanding financial accessibility.

Invisible Payments

Invisible payments in retail banking streamline customer transactions through traditional channels, while embedded finance integrates payment functionalities directly into non-financial platforms, enhancing seamless and real-time payment experiences. This evolution reduces friction by automating payment processes within apps and services, driving higher customer engagement and operational efficiency.

Platform Banking

Retail banking primarily offers traditional financial services through branch networks and digital channels, focusing on individual customers' savings, loans, and payment needs. Platform banking in embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions and personalized financial products within ecosystems such as e-commerce, enhancing customer engagement and expanding revenue streams.

Retail Banking vs Embedded Finance Infographic

industrydif.com

industrydif.com