Traditional banking offers in-person customer service and a wide network of physical branches, providing a sense of security and familiarity for many users. Neobanks operate entirely online, delivering lower fees and faster digital transactions through innovative technology and streamlined processes. Both models cater to different customer needs, with traditional banks emphasizing legacy and trust, while neobanks prioritize convenience and modern financial solutions.

Table of Comparison

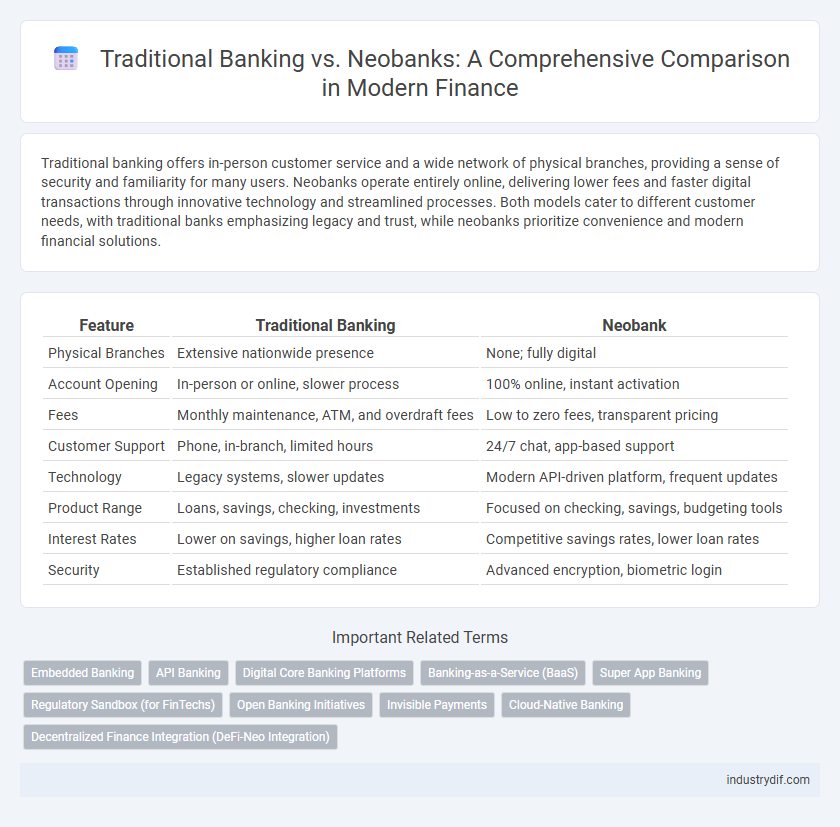

| Feature | Traditional Banking | Neobank |

|---|---|---|

| Physical Branches | Extensive nationwide presence | None; fully digital |

| Account Opening | In-person or online, slower process | 100% online, instant activation |

| Fees | Monthly maintenance, ATM, and overdraft fees | Low to zero fees, transparent pricing |

| Customer Support | Phone, in-branch, limited hours | 24/7 chat, app-based support |

| Technology | Legacy systems, slower updates | Modern API-driven platform, frequent updates |

| Product Range | Loans, savings, checking, investments | Focused on checking, savings, budgeting tools |

| Interest Rates | Lower on savings, higher loan rates | Competitive savings rates, lower loan rates |

| Security | Established regulatory compliance | Advanced encryption, biometric login |

Overview of Traditional Banking and Neobanks

Traditional banking relies on extensive branch networks, offering in-person services such as deposits, loans, and financial advice, with established regulatory frameworks ensuring customer security. Neobanks operate exclusively online, leveraging digital platforms and mobile apps to provide streamlined financial services with lower fees and enhanced user experience. These digital-first banks focus on agility, rapid innovation, and integration with fintech ecosystems, appealing to tech-savvy customers seeking convenience and accessibility.

Key Differences Between Traditional Banks and Neobanks

Traditional banks operate with physical branches and offer a wide range of financial services including loans, mortgages, and in-person customer support, backed by established regulatory frameworks and extensive networks. Neobanks function entirely online, leveraging advanced digital technology to provide seamless mobile banking experiences, lower fees, and real-time transaction tracking, often targeting tech-savvy consumers and underserved markets. Security protocols differ, with traditional banks relying on legacy systems and neobanks adopting cutting-edge encryption and biometric authentication to enhance digital trust and convenience.

Regulatory Frameworks: Legacy Banks vs Digital-First Institutions

Traditional banks operate under extensive regulatory frameworks established over decades, complying with stringent capital requirements, anti-money laundering (AML) protocols, and consumer protection laws enforced by entities like the FDIC and Federal Reserve. Neobanks, classified as digital-first institutions, often partner with licensed banks to navigate regulatory challenges, leveraging modern technology to streamline compliance with Know Your Customer (KYC) and data privacy regulations. The evolving regulatory environment continues to shape the competitive landscape, as neobanks must adapt to frameworks traditionally designed for brick-and-mortar banking models while advocating for updated policies that reflect digital innovation.

Product Offerings and Financial Services Comparison

Traditional banking institutions provide a comprehensive range of financial services including savings and checking accounts, personal and business loans, mortgages, and investment products underpinned by physical branch networks. Neobanks specialize in digital-first services, offering streamlined checking accounts, low-fee financial products, real-time transaction tracking, and often unique fintech integrations such as automated budgeting tools and instant peer-to-peer payments. The primary distinction lies in delivery channels and user experience, with neobanks leveraging technology for convenience and cost efficiency, while traditional banks emphasize a broader product suite supported by in-person customer service.

User Experience: Branch-Based vs Digital-Only Banking

Traditional banking relies on branch-based services offering face-to-face interactions, often providing personalized assistance but limited by physical location and hours. Neobanks operate exclusively online, delivering seamless, 24/7 digital experiences with intuitive mobile apps and faster transaction processing. Users value neobanks for convenience, lower fees, and real-time access, while traditional banks attract customers prioritizing in-person trust and comprehensive financial products.

Security Measures: Established Protocols vs Innovative Tech

Traditional banking relies on established security protocols such as multi-factor authentication, encryption standards, and regulatory compliance to protect customer assets and data. Neobanks leverage innovative technologies like biometric authentication, AI-driven fraud detection, and blockchain to enhance security and offer real-time threat monitoring. Both approaches prioritize safeguarding financial information but differ in methodology, with traditional banks emphasizing proven frameworks and neobanks focusing on cutting-edge digital solutions.

Cost Structure: Fee Models in Traditional vs Neobanks

Traditional banks typically rely on a fee-based revenue model including account maintenance fees, overdraft charges, and ATM fees, which contribute significantly to their cost structures. Neobanks minimize operational expenses by leveraging digital platforms, allowing them to offer low or zero-fee accounts with revenue primarily derived from interchange fees and premium services. This divergence in fee models reflects the efficiency of digital technology in reducing costs and increasing customer value in the neobanking sector.

Financial Inclusion: Accessibility and Reach

Traditional banking often faces limitations in serving underbanked populations due to physical branch constraints and stringent documentation requirements. Neobanks leverage digital platforms and mobile technology to enhance financial inclusion by providing accessible, low-cost banking services with minimal barriers. Expanding reach through smartphone penetration and simplified account opening processes allows neobanks to bridge gaps for underserved communities globally.

Customer Trust and Brand Perception

Traditional banking institutions benefit from long-established reputations, fostering high levels of customer trust through physical branches and personalized service. Neobanks leverage innovative digital platforms and user-friendly interfaces to appeal to tech-savvy customers but often face challenges in building brand credibility due to their relatively recent market presence. Trust in neobanks grows with transparent security protocols and positive user experiences, gradually enhancing brand perception in the competitive financial sector.

Future Trends in Banking: Evolution and Industry Impact

Traditional banking is rapidly evolving as neobanks leverage advanced digital technologies and AI-driven platforms to offer personalized financial services with greater efficiency and lower operational costs. The future of banking centers on seamless omnichannel experiences, enhanced cybersecurity measures, and blockchain integration to ensure transparency and real-time transactions. As consumer preferences shift towards mobile-first solutions, neobanks are driving industry innovation, compelling traditional banks to adopt agile practices and invest heavily in fintech partnerships.

Related Important Terms

Embedded Banking

Traditional banking relies on physical branches and legacy infrastructure, limiting flexibility in offering seamless financial services, whereas neobanks leverage embedded banking to integrate banking features directly into non-financial platforms. Embedded banking enhances customer experience by enabling real-time payments, personalized financial products, and streamlined digital onboarding within apps, positioning neobanks as agile competitors in the finance industry.

API Banking

Traditional banking relies on legacy systems with limited API integration, resulting in slower transaction processing and less personalized financial services. Neobanks leverage advanced API banking to offer seamless, real-time financial products, enabling rapid innovation and enhanced customer experiences.

Digital Core Banking Platforms

Traditional banking relies on legacy systems that often hinder agility and innovation, while neobanks leverage advanced digital core banking platforms offering seamless real-time processing, enhanced scalability, and superior customer experience. These digital platforms enable neobanks to integrate API-driven services, automate compliance, and deliver personalized financial products faster than conventional banks constrained by outdated infrastructure.

Banking-as-a-Service (BaaS)

Traditional banking relies on legacy infrastructure and physical branches, while neobanks leverage cloud-native platforms and Banking-as-a-Service (BaaS) models to offer seamless digital experiences. BaaS enables fintech companies to integrate banking services through APIs, accelerating product innovation and reducing time-to-market compared to conventional banks.

Super App Banking

Traditional banking relies on physical branches and legacy systems, limiting seamless digital integration, while neobank super apps offer all-in-one financial services such as payments, investments, loans, and insurance through a single mobile platform, enhancing user convenience and real-time financial management. The rise of super app banking in neobanks drives increased customer engagement and cost efficiency by leveraging AI-driven personalization, cloud infrastructure, and open banking APIs.

Regulatory Sandbox (for FinTechs)

Regulatory sandboxes provide neobanks with a controlled environment to test innovative financial products under relaxed regulations, accelerating fintech development compared to traditional banking's slower, more compliance-heavy processes. By enabling real-time feedback from regulators, sandboxes reduce time-to-market for neobank services while maintaining consumer protection standards.

Open Banking Initiatives

Traditional banking relies on established brick-and-mortar branches and proprietary systems, which limits seamless customer data sharing, whereas neobanks leverage Open Banking initiatives to enhance financial transparency and enable secure API-driven access to customer data. Open Banking frameworks accelerate innovation by fostering collaboration among financial institutions, fintechs, and third-party providers, resulting in personalized services and streamlined digital experiences.

Invisible Payments

Traditional banking systems rely on physical branches and manual transactions, resulting in slower processing times for payments. Neobanks leverage advanced APIs and real-time payment technologies to enable seamless and invisible payment experiences, enhancing customer convenience and transaction speed.

Cloud-Native Banking

Cloud-native banking enables neobanks to operate with greater scalability, flexibility, and cost efficiency compared to traditional banking systems reliant on legacy infrastructure. Leveraging cloud technology, neobanks deliver faster digital innovation, enhanced customer experience, and real-time data analytics, reshaping the competitive landscape in financial services.

Decentralized Finance Integration (DeFi-Neo Integration)

Traditional banking systems rely on centralized ledgers and intermediaries, limiting real-time transaction transparency and cross-border efficiency, whereas neobanks with decentralized finance (DeFi) integration leverage blockchain technology to offer enhanced security, reduced fees, and instant global transactions. DeFi-Neo integration enables programmable smart contracts and liquidity pools, facilitating innovative financial products and seamless asset management directly on-chain, disrupting conventional banking paradigms.

Traditional Banking vs Neobank Infographic

industrydif.com

industrydif.com