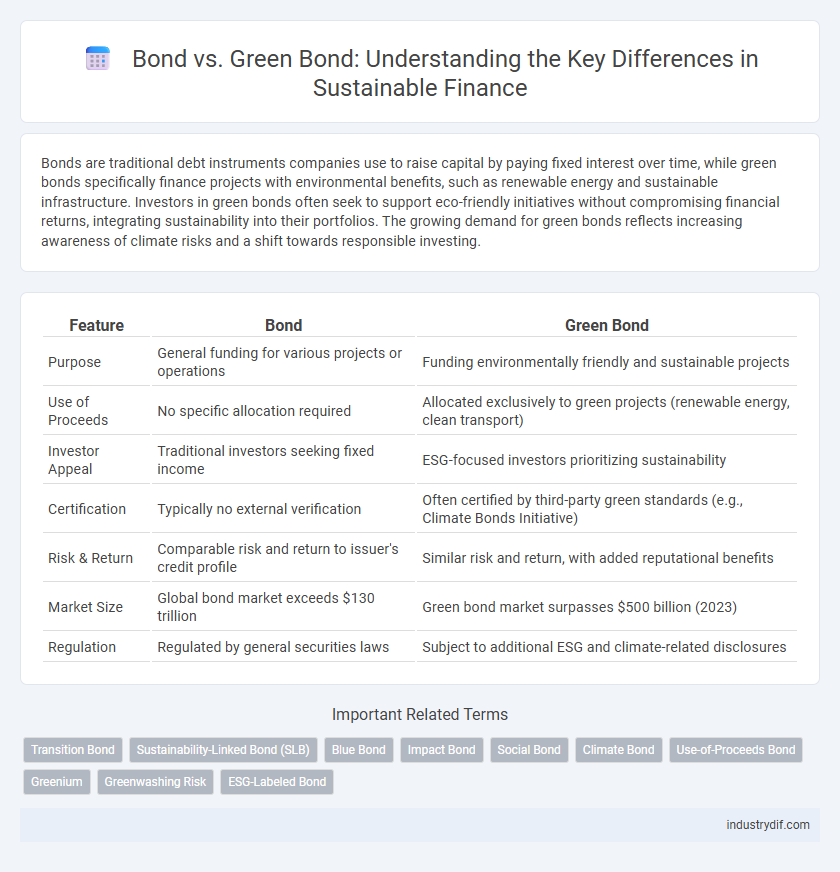

Bonds are traditional debt instruments companies use to raise capital by paying fixed interest over time, while green bonds specifically finance projects with environmental benefits, such as renewable energy and sustainable infrastructure. Investors in green bonds often seek to support eco-friendly initiatives without compromising financial returns, integrating sustainability into their portfolios. The growing demand for green bonds reflects increasing awareness of climate risks and a shift towards responsible investing.

Table of Comparison

| Feature | Bond | Green Bond |

|---|---|---|

| Purpose | General funding for various projects or operations | Funding environmentally friendly and sustainable projects |

| Use of Proceeds | No specific allocation required | Allocated exclusively to green projects (renewable energy, clean transport) |

| Investor Appeal | Traditional investors seeking fixed income | ESG-focused investors prioritizing sustainability |

| Certification | Typically no external verification | Often certified by third-party green standards (e.g., Climate Bonds Initiative) |

| Risk & Return | Comparable risk and return to issuer's credit profile | Similar risk and return, with added reputational benefits |

| Market Size | Global bond market exceeds $130 trillion | Green bond market surpasses $500 billion (2023) |

| Regulation | Regulated by general securities laws | Subject to additional ESG and climate-related disclosures |

Understanding Traditional Bonds

Traditional bonds are debt securities issued by governments or corporations to raise capital through fixed or variable interest payments over a predetermined period. Investors receive periodic coupon payments and the return of principal at maturity, making these bonds a reliable income source and risk management tool in diversified portfolios. Unlike green bonds, which specifically fund environmentally friendly projects, traditional bonds have no such targeted use of proceeds, emphasizing broad financial objectives.

What Sets Green Bonds Apart?

Green bonds distinguish themselves by exclusively financing projects with environmental benefits, such as renewable energy, clean transportation, and sustainable water management. Unlike traditional bonds, green bonds require issuers to provide transparency through third-party verification and detailed reporting on the environmental impact. This specialized focus attracts investors prioritizing environmental, social, and governance (ESG) criteria, supporting sustainable development goals while seeking stable returns.

Core Features: Bond vs Green Bond

Bonds are debt securities issued by corporations or governments to raise capital, offering fixed or variable interest payments over a defined period. Green bonds are a specialized type of bond where proceeds are exclusively allocated to environmentally sustainable projects, ensuring impact transparency and eligibility criteria aligned with climate goals. Both instruments feature credit ratings and maturity terms, but green bonds emphasize environmental benefits, reporting standards, and investor accountability on ecological outcomes.

Environmental Impact and Sustainability

Green bonds specifically finance projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable agriculture, directly supporting sustainability goals. Traditional bonds fund a wide range of sectors without explicit environmental criteria, potentially contributing to non-sustainable practices. The environmental impact of green bonds is quantifiable through reduced carbon emissions and enhanced resource efficiency, aligning with global climate initiatives like the Paris Agreement.

Issuance Process: Standard vs Green Bonds

The issuance process for standard bonds involves traditional underwriting, credit rating evaluation, and regulatory compliance aimed at raising capital through debt instruments. Green bonds follow a more rigorous issuance path, incorporating environmental objectives, mandatory use-of-proceeds frameworks, and third-party verification to ensure funds finance sustainable projects. Certification schemes like the Climate Bonds Standard increase transparency and investor confidence in green bond offerings compared to conventional bond issuance.

Regulatory Frameworks and Standards

Green bonds are subject to specialized regulatory frameworks and standards such as the Climate Bonds Standard and the EU Green Bond Regulation, which ensure environmental impact transparency and eligibility criteria. Conventional bonds generally follow broader securities regulations without specific environmental performance benchmarks. Compliance with these green bond guidelines enhances market trust and attracts ESG-focused investors, impacting issuance and pricing dynamics.

Market Growth and Investor Demand

Green bonds have experienced rapid market growth, with issuance surpassing $500 billion globally in 2023, reflecting heightened investor demand for sustainable investment options. Traditional bonds continue to dominate overall bond markets, but green bonds attract a growing segment of ESG-focused investors seeking to support environmental projects. Increasing regulatory support and corporate commitments to sustainability are driving the expansion of green bond markets, enhancing their appeal relative to conventional bonds.

Risks and Returns Comparison

Traditional bonds typically offer stable returns with moderate risk linked to issuer creditworthiness and interest rate fluctuations. Green bonds, while yielding comparable financial returns, carry added risks associated with project-specific environmental performance and regulatory changes in sustainability standards. Investors must evaluate both financial stability and the impact of environmental risk factors when comparing potential returns and losses in bond portfolios.

Case Studies: Notable Bond and Green Bond Projects

The notable bond project of the Apple Inc. $2.5 billion bond issuance in 2020 set a benchmark for corporate debt financing by demonstrating investor confidence in tech sector growth. In contrast, the World Bank's green bond program, launched in 2008 with over $16 billion raised, funds renewable energy and climate resilience projects worldwide, exemplifying sustainable investment impact. Case studies highlight how traditional bonds prioritize capital growth while green bonds emphasize environmental benefits alongside financial returns.

Future Trends in Bond and Green Bond Markets

The bond market is increasingly integrating environmental, social, and governance (ESG) criteria, with green bonds projected to grow at a compound annual growth rate (CAGR) exceeding 15% through 2030. Innovations such as blockchain for bond issuance and smart contracts are enhancing transparency and efficiency in bond trading. Institutional investors are progressively allocating capital to green bonds, driven by regulatory incentives and escalating demand for sustainable investment options.

Related Important Terms

Transition Bond

Transition bonds finance companies shifting toward sustainable practices, bridging the gap between traditional bonds and green bonds by supporting projects that reduce environmental impact without fully meeting green bond criteria. These bonds attract investors seeking impact-aligned returns while facilitating carbon reduction in high-emission industries transitioning to greener operations.

Sustainability-Linked Bond (SLB)

Sustainability-Linked Bonds (SLBs) differ from traditional bonds and Green Bonds by tying financial performance to achieving specific environmental, social, and governance (ESG) targets rather than earmarking proceeds for designated green projects. SLBs incentivize issuers to meet ambitious sustainability goals, offering a flexible financing tool that directly aligns with corporate ESG commitments and regulatory frameworks for sustainable finance.

Blue Bond

Blue bonds are debt instruments specifically designed to fund marine and ocean conservation projects, contrasting with traditional bonds that finance general corporate or governmental activities and green bonds that target a broader scope of environmental initiatives including renewable energy and pollution reduction. Issued by governments or organizations, blue bonds help address challenges like overfishing, habitat destruction, and climate change impacts on aquatic ecosystems, offering investors targeted impact investing opportunities linked to ocean sustainability.

Impact Bond

Impact bonds, a subset of green bonds, specifically fund projects that deliver measurable social or environmental benefits alongside financial returns, emphasizing accountability through performance-based outcomes. Unlike traditional bonds, these instruments mobilize private capital toward sustainable development goals by aligning investor interests with tangible impact metrics.

Social Bond

Social bonds are debt instruments specifically issued to finance projects that generate positive social outcomes, such as affordable housing, healthcare, and education, distinguishing them from traditional bonds that primarily focus on financial returns and green bonds that fund environmental initiatives. Investors increasingly prioritize social bonds for their dual impact of delivering steady financial returns while addressing societal challenges, enhancing their appeal in sustainable finance portfolios.

Climate Bond

Climate bonds, a subset of green bonds, specifically finance projects that promote environmental sustainability and combat climate change, such as renewable energy and clean transportation. Unlike traditional bonds, climate bonds are certified under standards like the Climate Bonds Initiative, ensuring transparency and measurable environmental impact.

Use-of-Proceeds Bond

Green bonds allocate funds exclusively for environmentally sustainable projects, such as renewable energy, energy efficiency, and pollution reduction, ensuring transparency through dedicated use-of-proceeds reporting. Traditional bonds finance a wide range of corporate or governmental activities without specifying project categories, offering broader capital allocation flexibility but less environmental impact assurance.

Greenium

Green bonds often trade at a premium known as the "greenium," reflecting investors' willingness to accept lower yields due to the environmental benefits and sustainable impact associated with these securities. This greenium signifies a growing market preference for sustainable finance, where green bonds typically offer slightly lower returns compared to traditional bonds but attract increased demand from ESG-focused investors.

Greenwashing Risk

Green bonds offer environmental benefits by financing sustainable projects but carry a higher greenwashing risk due to inconsistent standards and lack of rigorous third-party verification. Traditional bonds lack these environmental claims, reducing greenwashing concerns but also limiting appeal to socially responsible investors.

ESG-Labeled Bond

ESG-labeled bonds, such as green bonds, are fixed-income securities specifically designated to finance projects with positive environmental, social, and governance impacts, distinguishing them from traditional bonds that do not have such criteria. Investors increasingly favor green bonds due to their alignment with sustainable development goals and the growing demand for transparent reporting on the use of proceeds and measurable ESG outcomes.

Bond vs Green Bond Infographic

industrydif.com

industrydif.com