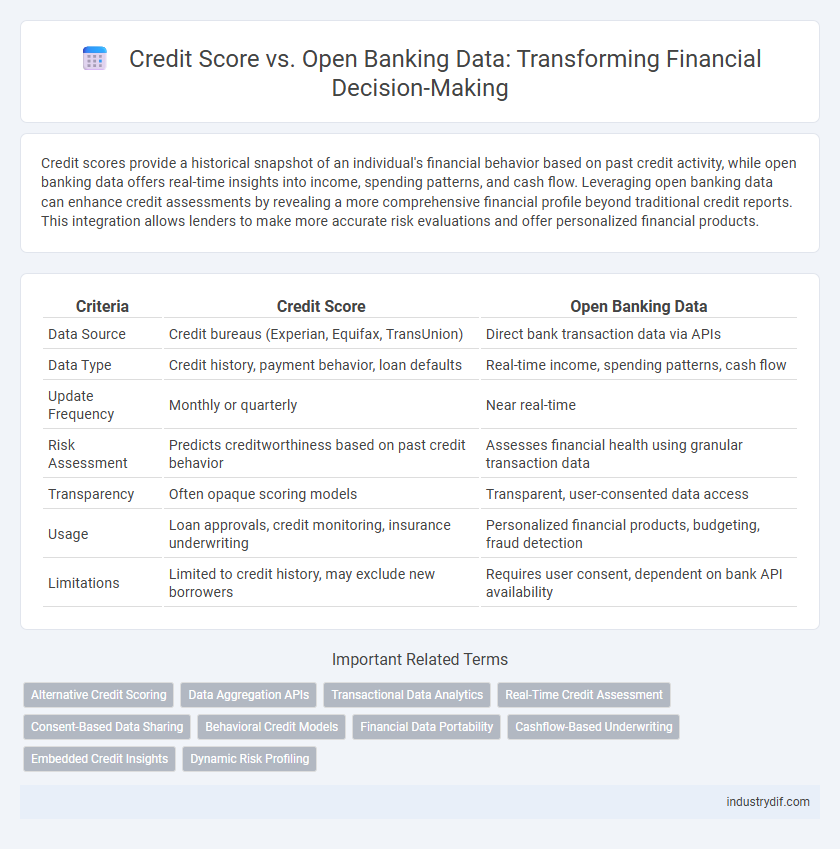

Credit scores provide a historical snapshot of an individual's financial behavior based on past credit activity, while open banking data offers real-time insights into income, spending patterns, and cash flow. Leveraging open banking data can enhance credit assessments by revealing a more comprehensive financial profile beyond traditional credit reports. This integration allows lenders to make more accurate risk evaluations and offer personalized financial products.

Table of Comparison

| Criteria | Credit Score | Open Banking Data |

|---|---|---|

| Data Source | Credit bureaus (Experian, Equifax, TransUnion) | Direct bank transaction data via APIs |

| Data Type | Credit history, payment behavior, loan defaults | Real-time income, spending patterns, cash flow |

| Update Frequency | Monthly or quarterly | Near real-time |

| Risk Assessment | Predicts creditworthiness based on past credit behavior | Assesses financial health using granular transaction data |

| Transparency | Often opaque scoring models | Transparent, user-consented data access |

| Usage | Loan approvals, credit monitoring, insurance underwriting | Personalized financial products, budgeting, fraud detection |

| Limitations | Limited to credit history, may exclude new borrowers | Requires user consent, dependent on bank API availability |

Understanding Credit Scores: Definition and Importance

Credit scores quantify an individual's creditworthiness using data such as payment history, credit utilization, and length of credit history, playing a crucial role in loan approvals and interest rate determination. Open banking data enhances this assessment by providing real-time financial information from bank accounts, offering a comprehensive view of income, spending patterns, and financial behavior. Understanding credit scores and integrating open banking data allows lenders to make more accurate risk evaluations and borrowers to access tailored financial products.

What is Open Banking Data?

Open Banking data refers to financial information shared securely by banks and financial institutions with authorized third-party providers through APIs, enabling more personalized and accurate financial services. Unlike traditional credit scores that rely primarily on credit history and repayment behavior, Open Banking data includes real-time transactional data, income, spending patterns, and account balances. This comprehensive dataset enhances credit risk assessment, offering lenders deeper insights into borrowers' financial health beyond conventional credit reports.

Key Differences: Credit Scores vs Open Banking Data

Credit scores aggregate historical credit behavior using data from credit bureaus, reflecting an individual's creditworthiness based on past loans, repayments, and defaults. Open Banking data provides real-time financial insights by accessing transaction histories, income patterns, and spending habits directly from bank accounts, offering a dynamic view of financial health. Unlike credit scores, Open Banking data enables lenders to assess current cash flow and affordability more accurately, improving loan decision precision.

How Credit Scores are Calculated

Credit scores are calculated using a combination of factors including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. These scores rely heavily on data reported by traditional credit bureaus, capturing a borrower's debt management and repayment habits over time. Open banking data, by contrast, provides real-time financial information directly from bank accounts, offering supplementary income, spending, and savings patterns that can enhance traditional credit assessments.

The Role of Open Banking in Financial Assessment

Open Banking data plays a crucial role in modern financial assessment by providing a comprehensive view of an individual's financial behavior beyond traditional credit scores. Unlike credit scores, which rely primarily on historical credit repayment records, Open Banking aggregates real-time data such as bank transactions, income patterns, and spending habits to deliver a more accurate risk profile. This enhanced data-driven approach allows lenders to make more informed decisions, improving credit accessibility and personalized financial products.

Benefits of Using Open Banking Data for Lenders

Open banking data offers lenders enhanced insights into borrowers' real-time financial behavior, allowing for more accurate credit risk assessments compared to traditional credit scores. By accessing transaction histories and cash flow patterns directly, lenders can identify creditworthy individuals with limited or no credit history, expanding financial inclusion. This granular financial data reduces default rates and streamlines loan approval processes by enabling personalized lending decisions.

Limitations of Traditional Credit Scores

Traditional credit scores often rely on historical repayment data and fail to capture real-time financial behavior, limiting their accuracy for assessing creditworthiness. They exclude valuable insights from open banking data, such as cash flow patterns, income stability, and spending habits, which provide a more comprehensive financial profile. This narrow scope can result in underserved consumers being misclassified or denied access to credit opportunities.

Enhanced Risk Assessment with Open Banking

Open Banking data provides granular insights into a consumer's real-time financial behavior, enabling lenders to perform enhanced risk assessments beyond traditional credit scores. By analyzing transaction histories, income patterns, and spending habits, Open Banking offers a dynamic and comprehensive view of creditworthiness that reduces default risks. This approach improves lending accuracy, supports better decision-making, and fosters financial inclusion by capturing a broader spectrum of consumer financial health.

Consumer Impact: Credit Score vs Open Banking Data

Credit scores traditionally rely on historical credit reports and payment history, often excluding consumers with limited credit activity, leading to credit access barriers. Open banking data incorporates real-time financial transactions and income patterns, providing a comprehensive view of consumer financial behavior, which can enhance credit assessment accuracy. This inclusive approach helps lenders identify creditworthy individuals beyond conventional criteria, improving loan approval rates and offering fairer credit opportunities.

The Future of Credit Assessment in Finance

Credit assessment in finance is evolving as open banking data provides a more comprehensive and real-time view of an individual's financial behavior compared to traditional credit scores. This shift enables lenders to evaluate creditworthiness with greater accuracy by analyzing transaction patterns, income stability, and spending habits. Incorporating open banking data enhances predictive models, reduces default risks, and expands access to credit for underserved populations.

Related Important Terms

Alternative Credit Scoring

Alternative credit scoring leverages open banking data such as transaction history, income patterns, and spending behavior to provide a more comprehensive and accurate assessment of creditworthiness beyond traditional credit scores. Incorporating these real-time financial insights reduces reliance on limited credit bureau records and expands lending opportunities for underserved consumers.

Data Aggregation APIs

Data Aggregation APIs enable lenders to access comprehensive financial data beyond traditional credit scores, incorporating open banking information such as transaction history and real-time account balances for more accurate risk assessment. Leveraging open banking data through these APIs enhances credit evaluation by providing a holistic view of consumer financial behavior, improving decision-making in lending processes.

Transactional Data Analytics

Transactional data analytics in open banking offers a granular view of a consumer's spending patterns, income streams, and financial habits, enabling more accurate credit risk assessments beyond traditional credit scores. By leveraging real-time transaction data, lenders can identify reliable borrowers who might be underserved by conventional credit scoring models, enhancing financial inclusion and decision precision.

Real-Time Credit Assessment

Real-time credit assessment leverages open banking data to provide instant insights into a borrower's financial behavior, enhancing traditional credit score models by incorporating transactional information and cash flow patterns. This dynamic approach reduces reliance on static credit scores, enabling lenders to make more accurate, timely decisions based on current financial activity.

Consent-Based Data Sharing

Credit scores provide a traditional risk assessment based on historical credit behavior, while open banking data offers real-time financial insights through consent-based data sharing, enhancing accuracy and personalization in lending decisions. Consent-based data sharing empowers consumers to control access to their financial information, promoting transparency and enabling lenders to assess creditworthiness beyond conventional indicators.

Behavioral Credit Models

Behavioral credit models leverage open banking data, such as transaction patterns and income flows, to provide a more dynamic and real-time assessment of creditworthiness compared to traditional credit scores. These models improve risk prediction accuracy by incorporating consumer financial behavior, enhancing lending decisions and financial inclusion.

Financial Data Portability

Credit score models primarily rely on historical credit behavior and payment records, while open banking data enables access to a broader range of real-time financial information, enhancing financial data portability through secure sharing of bank account transactions and income details. Leveraging open banking data allows for more personalized lending decisions and financial services, overcoming traditional credit score limitations by incorporating diverse and dynamic financial insights.

Cashflow-Based Underwriting

Cashflow-based underwriting leverages open banking data to provide a real-time, comprehensive view of a borrower's financial health, surpassing traditional credit scores that often rely on historical payment behavior. By analyzing transaction patterns, income stability, and spending habits, lenders can more accurately assess creditworthiness and reduce default risk in dynamic financial environments.

Embedded Credit Insights

Embedded credit insights integrate open banking data with traditional credit scores to offer a more comprehensive financial profile, enhancing risk assessment accuracy. Leveraging real-time transaction data alongside credit history enables lenders to tailor credit decisions and improve customer experiences.

Dynamic Risk Profiling

Dynamic risk profiling leverages real-time open banking data, such as transaction history and cash flow patterns, to provide a more nuanced creditworthiness assessment compared to traditional static credit scores. This approach enhances predictive accuracy by capturing lifestyle changes and financial behavior shifts, enabling lenders to tailor credit offers and manage risk proactively.

Credit Score vs Open Banking Data Infographic

industrydif.com

industrydif.com