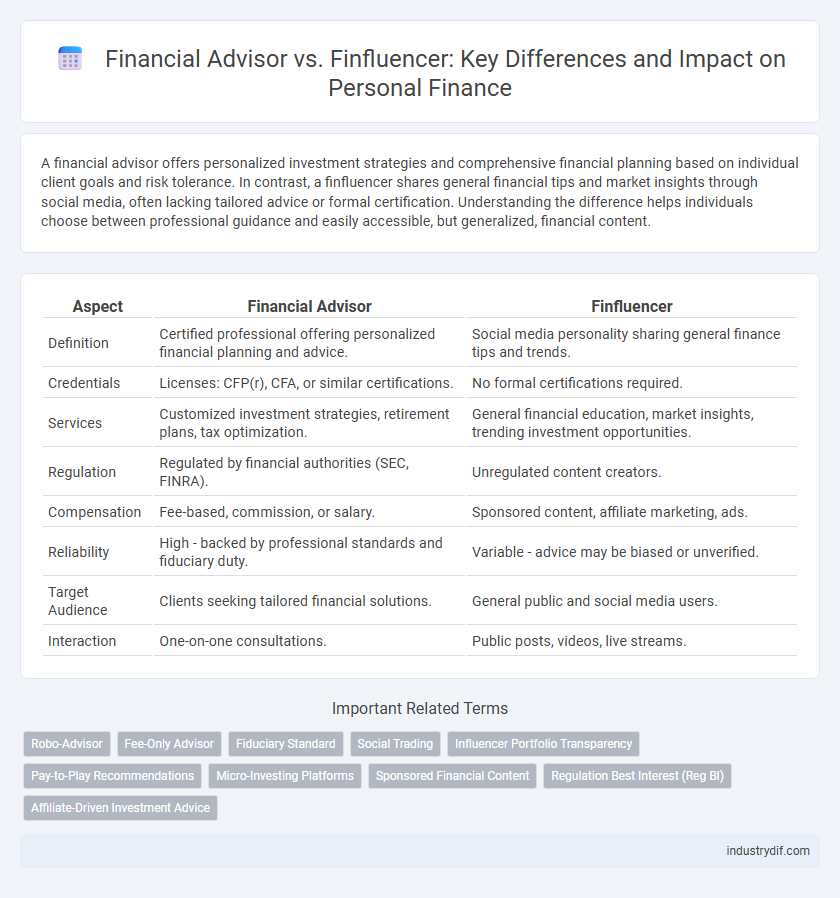

A financial advisor offers personalized investment strategies and comprehensive financial planning based on individual client goals and risk tolerance. In contrast, a finfluencer shares general financial tips and market insights through social media, often lacking tailored advice or formal certification. Understanding the difference helps individuals choose between professional guidance and easily accessible, but generalized, financial content.

Table of Comparison

| Aspect | Financial Advisor | Finfluencer |

|---|---|---|

| Definition | Certified professional offering personalized financial planning and advice. | Social media personality sharing general finance tips and trends. |

| Credentials | Licenses: CFP(r), CFA, or similar certifications. | No formal certifications required. |

| Services | Customized investment strategies, retirement plans, tax optimization. | General financial education, market insights, trending investment opportunities. |

| Regulation | Regulated by financial authorities (SEC, FINRA). | Unregulated content creators. |

| Compensation | Fee-based, commission, or salary. | Sponsored content, affiliate marketing, ads. |

| Reliability | High - backed by professional standards and fiduciary duty. | Variable - advice may be biased or unverified. |

| Target Audience | Clients seeking tailored financial solutions. | General public and social media users. |

| Interaction | One-on-one consultations. | Public posts, videos, live streams. |

Defining Financial Advisors and Finfluencers

Financial advisors are licensed professionals who provide personalized financial planning, investment advice, and wealth management based on clients' financial goals and regulatory standards. Finfluencers are social media content creators who share financial tips, market insights, and investment strategies with a broad audience but typically lack formal credentials or fiduciary responsibilities. The key differentiation lies in financial advisors' regulated expertise and personalized service versus finfluencers' mass communication and informal guidance.

Qualifications and Regulatory Standards

Financial advisors possess formal qualifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations and are subject to strict regulatory standards enforced by bodies like the SEC or FINRA, ensuring adherence to fiduciary duties. Finfluencers typically lack formal certifications and operate without regulatory oversight, focusing instead on social media influence and content creation. This disparity highlights significant differences in credibility, accountability, and client protection between licensed financial advisors and online financial influencers.

Scope of Financial Advice

A Financial Advisor offers personalized, comprehensive financial planning and investment strategies tailored to individual client needs, encompassing retirement, tax, estate, and risk management. Finfluencers provide broad, general financial tips and market insights targeting a wide audience through social media platforms, often lacking personalized guidance or regulatory oversight. While advisors deliver fiduciary responsibility and customized solutions, finfluencers primarily focus on awareness and education within trending financial topics.

Risks and Limitations of Finfluencers

Finfluencers often lack formal financial certifications, which increases the risk of spreading inaccurate or misleading investment advice. Unlike certified financial advisors, finfluencers may prioritize popularity and engagement over the accuracy and suitability of financial recommendations. This can lead to significant financial losses for followers who make decisions based on incomplete or biased information.

Credibility and Trustworthiness

Financial advisors are certified professionals bound by regulatory standards and fiduciary duties, ensuring personalized and reliable financial guidance. Finfluencers, while often popular on social media platforms, may lack formal credentials and regulatory oversight, raising concerns about the accuracy and trustworthiness of their advice. Clients seeking long-term financial stability typically benefit from the accountability and expertise that licensed financial advisors provide.

Revenue Models and Incentives

Financial advisors typically generate revenue through fees based on assets under management, hourly rates, or commissions from financial products, aligning incentives with client wealth growth and personalized financial planning. Finfluencers monetize primarily via sponsored content, affiliate marketing, and advertising, creating incentives to maximize follower engagement and promote trending financial products. The divergence in revenue models influences their advice credibility, with advisors focusing on fiduciary duties and finfluencers driven by content virality and brand partnerships.

Impact on Investor Behavior

Financial advisors provide personalized investment strategies and regulatory-compliant guidance, promoting disciplined decision-making and long-term portfolio growth. Finfluencers leverage social media to rapidly disseminate market trends and investment tips, often influencing short-term investor sentiment and risk-taking behaviors. The contrasting impact on investor behavior highlights the balance between expert-driven advice and peer-influenced market dynamics.

Social Media Influence in Finance

Financial advisors provide personalized investment strategies grounded in formal certifications and fiduciary duties, ensuring client-specific financial goals are met. Finfluencers leverage social media platforms like Instagram and TikTok to disseminate financial tips, investment ideas, and market trends, often appealing to younger, tech-savvy audiences. The rise of finfluencers has democratized access to financial information but raises concerns about credibility and regulatory oversight compared to licensed financial advisors.

Regulatory Challenges and Consumer Protection

Financial advisors operate under strict regulatory frameworks such as the SEC and FINRA, ensuring fiduciary duty and consumer protection through licensing and compliance requirements. Finfluencers, often unregulated, pose challenges including the potential dissemination of misleading financial advice and lack of accountability. Consumers risk exposure to unverified information, underscoring the need for clear regulatory guidelines to safeguard investors in digital financial advice environments.

Choosing the Right Financial Guidance

Selecting the right financial guidance depends on assessing credentials, expertise, and personalized service; financial advisors hold certifications such as CFP or CFA, offering tailored investment strategies and fiduciary responsibility. Finfluencers leverage social media platforms to share broad financial tips and trends but often lack formal qualifications and regulatory oversight. Prioritizing verified professionals ensures accurate advice aligned with individual financial goals and risk tolerance.

Related Important Terms

Robo-Advisor

Robo-advisors leverage advanced algorithms to provide automated, low-cost investment management, offering a scalable alternative to traditional financial advisors who deliver personalized, human-driven financial planning. Unlike finfluencers who primarily share general financial tips on social media, robo-advisors utilize real-time data and risk assessment models to optimize portfolio allocation and tax efficiency.

Fee-Only Advisor

Fee-only financial advisors provide personalized, fiduciary financial planning and investment management without earning commissions from product sales, ensuring unbiased advice tailored to clients' goals. In contrast, finfluencers often promote financial products or strategies online and may receive compensation through sponsorships or affiliate marketing, which can create conflicts of interest absent in fee-only advisory models.

Fiduciary Standard

Financial advisors are legally bound by the fiduciary standard to act in their clients' best interests, ensuring personalized and transparent financial planning. In contrast, finfluencers often provide general financial advice or opinions without fiduciary responsibility, risking potential conflicts of interest and less tailored guidance.

Social Trading

Financial advisors provide personalized investment strategies based on comprehensive financial analysis, ensuring tailored portfolio management aligned with individual goals. Finfluencers leverage social trading platforms to share market insights and trade signals, enabling followers to replicate trades in real time but often lack the regulatory oversight that safeguards traditional advisory services.

Influencer Portfolio Transparency

Financial advisors provide regulated, personalized investment strategies with documented fiduciary accountability, ensuring portfolio transparency through formal disclosures and compliance standards. Finfluencers often showcase selective portfolio highlights on social media without standardized auditing, resulting in limited transparency and higher risk of biased or incomplete financial advice.

Pay-to-Play Recommendations

Financial advisors provide personalized, fiduciary-duty-driven advice tailored to clients' financial goals, often avoiding pay-to-play recommendations to maintain impartiality and trust. Finfluencers may promote pay-to-play products for commission or sponsorship, potentially biasing their recommendations and prioritizing influencer revenue over client interests.

Micro-Investing Platforms

Financial advisors provide personalized investment strategies tailored to individual financial goals, while finfluencers often promote micro-investing platforms that democratize access to investing through low-cost, automated portfolios. Micro-investing platforms enable users to invest small amounts regularly, appealing to younger demographics and beginners seeking hands-on financial growth without high entry barriers.

Sponsored Financial Content

Sponsored financial content by financial advisors prioritizes personalized investment strategies, fiduciary responsibility, and compliance with regulatory standards, ensuring client trust and tailored financial planning. In contrast, finfluencers often promote sponsored products to a broad audience, emphasizing trending financial topics and personal experiences, which may lack individualized advice and regulatory oversight.

Regulation Best Interest (Reg BI)

Financial Advisors are legally bound by Regulation Best Interest (Reg BI) to prioritize clients' financial well-being through fiduciary responsibilities, ensuring transparent, suitable investment recommendations. Finfluencers, while often influential on social media platforms, are not typically subject to Reg BI, leading to potential conflicts of interest and less formal regulatory oversight in their financial advice.

Affiliate-Driven Investment Advice

Financial advisors provide personalized investment strategies based on comprehensive financial planning and fiduciary responsibility, ensuring tailored advice aligned with clients' best interests, whereas finfluencers often promote affiliate-driven investment products prioritizing commission over personalized guidance. The affiliate model in finfluencing can lead to biased recommendations influenced by marketing incentives rather than objective financial analysis, potentially increasing risks for inexperienced investors.

Financial Advisor vs Finfluencer Infographic

industrydif.com

industrydif.com