A high-yield digital wallet offers significantly higher interest rates compared to traditional savings accounts, maximizing your returns on idle funds. Unlike conventional savings accounts, digital wallets provide seamless access to funds with minimal fees and faster transaction times. Choosing a high-yield digital wallet can enhance financial growth while maintaining liquidity and convenience in managing everyday expenses.

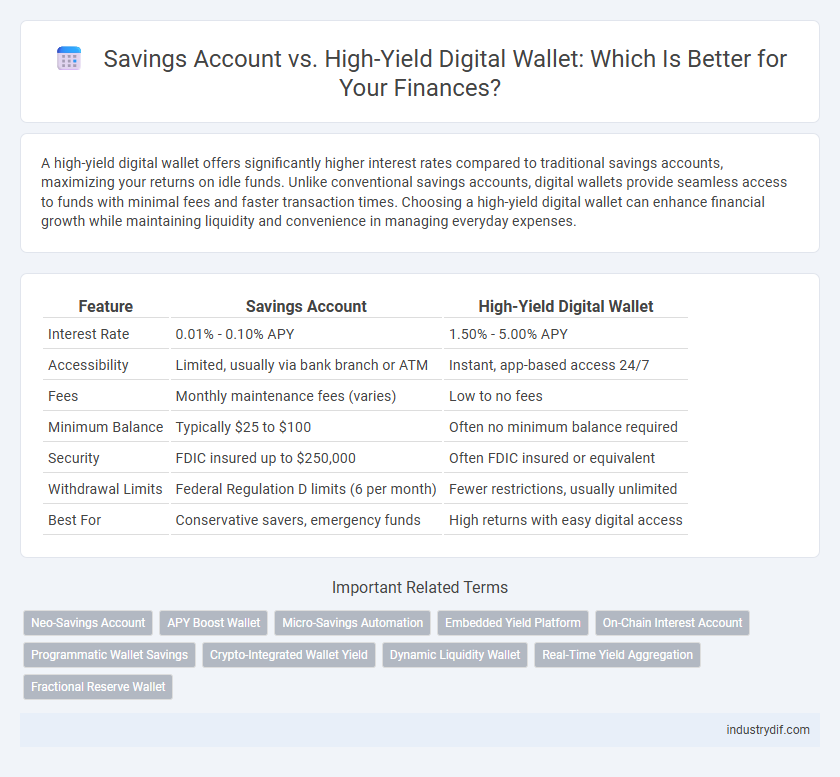

Table of Comparison

| Feature | Savings Account | High-Yield Digital Wallet |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 1.50% - 5.00% APY |

| Accessibility | Limited, usually via bank branch or ATM | Instant, app-based access 24/7 |

| Fees | Monthly maintenance fees (varies) | Low to no fees |

| Minimum Balance | Typically $25 to $100 | Often no minimum balance required |

| Security | FDIC insured up to $250,000 | Often FDIC insured or equivalent |

| Withdrawal Limits | Federal Regulation D limits (6 per month) | Fewer restrictions, usually unlimited |

| Best For | Conservative savers, emergency funds | High returns with easy digital access |

Overview of Savings Accounts and High-Yield Digital Wallets

Savings accounts offer a secure place to store funds with FDIC insurance and typically provide lower interest rates compared to high-yield digital wallets, which leverage technology to offer higher returns through diversified, low-risk investments. High-yield digital wallets combine features of traditional savings with enhanced liquidity and seamless digital access, targeting users seeking better growth on cash without sacrificing convenience. Both options serve different financial goals: savings accounts prioritize safety and stability, while high-yield digital wallets focus on maximizing interest earnings through innovative financial products.

Key Features Comparison

Savings accounts typically offer lower interest rates, federal deposit insurance, and easy access via bank branches, making them a stable option for emergency funds. High-yield digital wallets provide significantly higher APYs, instant transfer capabilities, and enhanced mobile integration but may lack traditional FDIC insurance and physical branch access. Evaluating liquidity needs, interest compound frequency, and security features helps determine the optimal choice for maximizing returns and maintaining financial flexibility.

Interest Rates: Traditional vs Digital Options

High-yield digital wallets typically offer interest rates ranging from 3% to 5%, significantly outperforming traditional savings accounts, which average around 0.01% to 0.5%. Digital wallets leverage lower overhead costs and tech-driven efficiencies to provide competitive yields and faster interest compounding. Saving money in a high-yield digital wallet can maximize returns and optimize cash growth over time compared to conventional savings vehicles.

Accessibility and Ease of Use

Savings accounts typically offer easy access through physical branches and ATMs, providing familiarity and security for users who prefer traditional banking methods. High-yield digital wallets prioritize seamless mobile and online access, enabling instant transactions and real-time balance updates with minimal fees. Users seeking convenience and speed often favor digital wallets, while those valuing in-person service may opt for savings accounts.

Security Measures and Protections

Savings accounts are typically insured by the FDIC up to $250,000, providing a strong layer of security and protection for deposited funds. High-yield digital wallets often employ advanced encryption, multi-factor authentication, and real-time fraud monitoring to secure user assets, though they may lack federal insurance coverage. Evaluating the security protocols and regulatory safeguards is crucial when choosing between traditional savings accounts and digital wallet services.

Fees and Minimum Balance Requirements

Savings accounts typically impose monthly maintenance fees and require a minimum balance ranging from $100 to $500, which can reduce net earnings on deposits. High-yield digital wallets offer fee-free access with no minimum balance, maximizing interest accrual on savings. The elimination of traditional banking fees and minimums in digital wallets provides a cost-effective alternative for consumers seeking liquidity and returns.

Withdrawal and Transfer Flexibility

Savings accounts typically impose withdrawal limits and may charge fees for excessive transactions, reducing flexibility. High-yield digital wallets offer greater ease in transferring funds instantly and often allow unlimited withdrawals without penalties. Consumers prioritizing quick access and frequent transfers benefit from the adaptable features of high-yield digital wallets compared to traditional savings accounts.

Suitability for Different Financial Goals

Savings accounts offer stable interest rates and FDIC insurance, making them ideal for emergency funds and short-term savings with low risk. High-yield digital wallets provide significantly higher returns through variable interest rates, suitable for customers seeking growth on idle cash with moderate risk tolerance. Choosing between the two depends on liquidity needs, risk appetite, and specific financial objectives such as wealth accumulation or capital preservation.

Regulatory Oversight and Insurance

Savings accounts are typically insured by the FDIC up to $250,000 per depositor, providing strong regulatory oversight and consumer protection, while high-yield digital wallets often lack FDIC insurance and operate under lighter regulatory frameworks. The regulatory oversight for digital wallets varies by jurisdiction and may include state money transmitter licenses but generally does not guarantee the same level of depositor protection as traditional savings accounts. Consumers prioritizing security and insured funds should consider the comprehensive federal insurance and strict regulations associated with savings accounts compared to the relatively higher risk profiles of digital wallets.

Choosing the Right Option for Your Needs

Selecting between a traditional savings account and a high-yield digital wallet depends on factors such as interest rates, accessibility, and security features. Savings accounts typically offer lower interest but provide FDIC insurance and easy access through branch networks, while high-yield digital wallets provide competitive APYs, seamless online management, and instant fund transfers. Evaluating personal financial goals, transaction frequency, and risk tolerance helps identify the optimal solution for maximizing returns and liquidity.

Related Important Terms

Neo-Savings Account

Neo-Savings Accounts offer higher interest rates compared to traditional savings accounts, leveraging digital platform efficiencies to maximize user returns while maintaining easy access to funds. These high-yield digital wallets provide seamless integration with financial apps, enhancing liquidity and enabling smarter money management through real-time tracking and automated savings features.

APY Boost Wallet

High-yield digital wallets like the APY Boost Wallet offer significantly higher annual percentage yields (APY) compared to traditional savings accounts, allowing users to maximize passive income with competitive interest rates often exceeding 4% APY. Unlike conventional savings accounts with lower returns and minimal interest compounding, the APY Boost Wallet provides seamless digital management and faster liquidity while maintaining FDIC insurance protection for secure savings growth.

Micro-Savings Automation

Micro-savings automation in high-yield digital wallets outperforms traditional savings accounts by enabling seamless, personalized deposits that maximize interest growth with minimal effort. These digital wallets leverage real-time analytics and AI-driven algorithms to optimize savings patterns, offering significantly higher annual percentage yields (APYs) compared to the standard 0.01%-0.10% rates typical of conventional savings accounts.

Embedded Yield Platform

Savings accounts offer traditional interest rates typically below 1%, while high-yield digital wallets leveraging embedded yield platforms provide significantly higher returns by automatically investing user funds in diversified, low-risk assets. Embedded yield platforms optimize liquidity and growth potential through seamless integration with decentralized finance protocols, enabling account holders to maximize passive income without sacrificing accessibility.

On-Chain Interest Account

On-chain interest accounts offered by high-yield digital wallets provide significantly higher annual percentage yields (APYs) compared to traditional savings accounts, leveraging decentralized finance (DeFi) protocols for automated interest compounding. These digital wallets enhance security through blockchain transparency and enable instant liquidity, positioning them as an efficient alternative to conventional banking for maximizing passive income.

Programmatic Wallet Savings

Programmatic wallet savings integrate automated budgeting and real-time interest optimization, offering higher yields compared to traditional savings accounts with fixed rates. These digital wallets leverage AI-driven algorithms to adjust fund allocations dynamically, maximizing returns while maintaining liquidity and security.

Crypto-Integrated Wallet Yield

Crypto-integrated high-yield digital wallets offer significantly higher interest rates compared to traditional savings accounts, often averaging 4-8% APY versus the typical 0.01-0.10% offered by banks. These wallets leverage decentralized finance (DeFi) protocols and staking mechanisms to generate passive income on cryptocurrency holdings, making them a compelling option for maximizing yield while maintaining liquidity.

Dynamic Liquidity Wallet

A Dynamic Liquidity Wallet offers superior flexibility and higher interest rates compared to traditional savings accounts by leveraging real-time market algorithms to optimize fund allocation across various liquid assets. This high-yield digital wallet enhances capital growth while maintaining instant access to funds, making it an efficient alternative for maximizing returns and managing cash flow in modern personal finance.

Real-Time Yield Aggregation

High-yield digital wallets leverage real-time yield aggregation by continuously scanning multiple financial platforms to optimize interest rates, often surpassing traditional savings account returns that typically offer fixed, lower yields. This dynamic approach maximizes passive income through instant adjustment to market rates, providing enhanced liquidity and better capital growth opportunities compared to standard savings accounts.

Fractional Reserve Wallet

A Fractional Reserve Wallet combines the liquidity and convenience of a high-yield digital wallet with the security of a traditional savings account, offering improved interest rates by lending a portion of deposited funds while maintaining user access. This hybrid model enhances capital efficiency, providing better returns than standard savings accounts while ensuring sufficient reserves for customer withdrawals.

Savings Account vs High-Yield Digital Wallet Infographic

industrydif.com

industrydif.com