Asset management offers diversified portfolios managed by professionals to optimize risk and returns through pooled investments. Direct indexing allows investors to replicate an index by individually owning its constituent securities, providing tax-loss harvesting opportunities and customization. Comparing these approaches highlights trade-offs between cost efficiency, personalization, and control in portfolio management strategies.

Table of Comparison

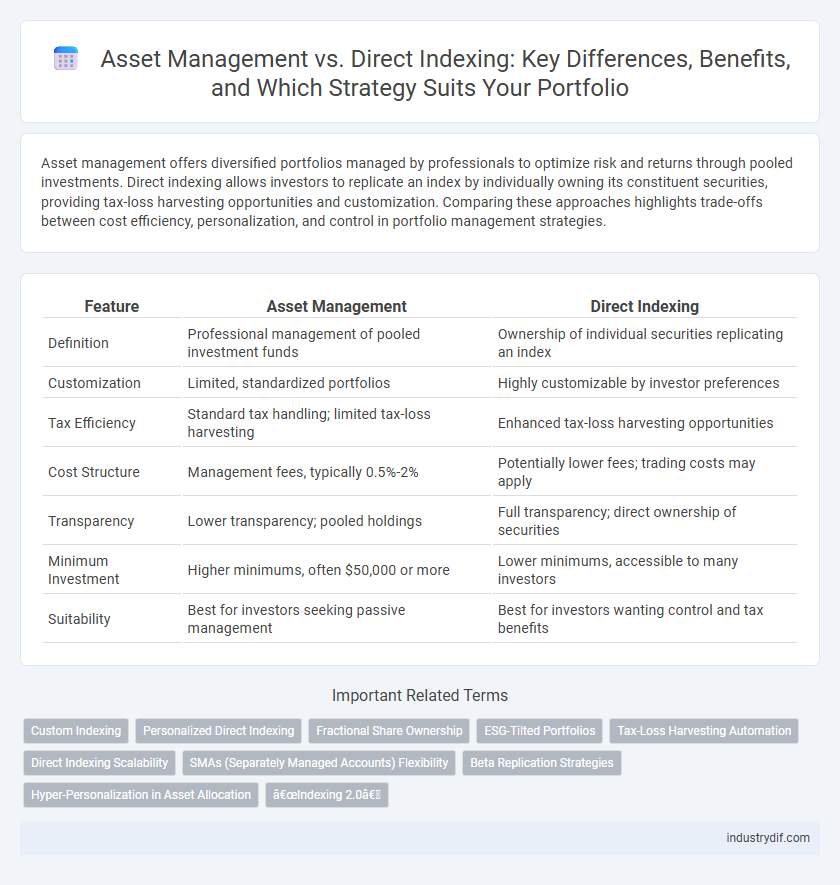

| Feature | Asset Management | Direct Indexing |

|---|---|---|

| Definition | Professional management of pooled investment funds | Ownership of individual securities replicating an index |

| Customization | Limited, standardized portfolios | Highly customizable by investor preferences |

| Tax Efficiency | Standard tax handling; limited tax-loss harvesting | Enhanced tax-loss harvesting opportunities |

| Cost Structure | Management fees, typically 0.5%-2% | Potentially lower fees; trading costs may apply |

| Transparency | Lower transparency; pooled holdings | Full transparency; direct ownership of securities |

| Minimum Investment | Higher minimums, often $50,000 or more | Lower minimums, accessible to many investors |

| Suitability | Best for investors seeking passive management | Best for investors wanting control and tax benefits |

Definition of Asset Management

Asset management involves the professional management of various investment securities and assets to meet specified investment goals for clients. It includes portfolio construction, continuous monitoring, and risk management across diverse asset classes such as stocks, bonds, and real estate. This approach aims to optimize returns and align with the investor's risk tolerance and financial objectives.

What Is Direct Indexing?

Direct indexing is an investment strategy where investors purchase individual securities in a benchmark index, replicating its performance while allowing for personalized tax management and customization. This approach contrasts with traditional asset management, which typically involves buying shares of mutual funds or exchange-traded funds (ETFs) that track the index. Direct indexing enhances portfolio optimization by enabling tax-loss harvesting and aligning investments with specific financial goals or values.

Core Differences: Asset Management vs Direct Indexing

Asset management involves professionally managing a diversified portfolio of assets to meet specific investment goals, often through mutual funds or ETFs, while direct indexing allows investors to own individual securities that replicate an index, providing more customization and tax-loss harvesting opportunities. Direct indexing offers greater control over portfolio composition and tax efficiency by enabling personalized security selection and strategic tax-loss harvesting, unlike traditional asset management which bundles assets in collective vehicles with less customization. The core difference lies in the level of control and tax optimization, with asset management prioritizing convenience and professional oversight, and direct indexing emphasizing tailored exposure and potential cost savings.

Key Benefits of Asset Management

Asset management provides professional oversight, ensuring portfolio diversification and risk management tailored to individual investment goals. It leverages institutional expertise and advanced analytics to optimize asset allocation and enhance long-term returns. Additionally, asset management offers scalability and liquidity advantages, making it suitable for a wide range of investors seeking efficient wealth growth.

Advantages of Direct Indexing

Direct indexing offers personalized tax-loss harvesting opportunities by allowing investors to sell individual securities at a loss while maintaining overall market exposure. It provides greater control over portfolio customization, enabling alignment with specific environmental, social, and governance (ESG) criteria or exclusion of certain industries. This approach often results in reduced fees compared to traditional asset management strategies, as investors bypass mutual fund or ETF expense ratios.

Tax Efficiency Comparison

Asset management typically involves pooled investments, where tax efficiency depends on the manager's ability to minimize capital gains distributions through fund structure and turnover. Direct indexing offers enhanced tax efficiency by allowing investors to realize losses and gains on individual securities, enabling personalized tax-loss harvesting strategies. Studies show direct indexing can improve after-tax returns by up to 1-2% annually compared to traditional asset management due to more precise control over tax events.

Customization Options in Asset Management and Direct Indexing

Asset management offers broad customization options through tailored portfolios managed by professionals, emphasizing diversification and risk management aligned with client goals. Direct indexing provides granular customization by allowing investors to select individual securities within an index, enabling tax-loss harvesting and personalized exposure to specific sectors or factors. Both approaches enhance portfolio alignment with investor preferences, but direct indexing delivers higher precision in customizing holdings.

Cost Structure: Fees and Expenses

Asset management typically involves management fees averaging 0.5% to 2% of assets under management, including administrative and advisory costs, which can reduce overall returns. Direct indexing tends to have lower ongoing fees, usually around 0.2% to 0.6%, but may incur additional transaction costs, such as brokerage fees and tax management expenses. Investors should evaluate total cost structures, including hidden fees and tax efficiency, to determine the most cost-effective strategy for their portfolio goals.

Ideal Investors for Each Approach

Asset management suits investors seeking professional portfolio oversight, diversification, and risk management without active involvement. Direct indexing benefits tax-savvy investors aiming for personalized portfolios, tax-loss harvesting, and direct ownership of individual securities. High-net-worth individuals often prefer direct indexing for customization, while those with moderate assets may favor traditional asset management for simplicity and scalability.

Future Trends in Asset Management and Direct Indexing

Future trends in asset management emphasize personalized investment strategies powered by advanced AI and machine learning algorithms, enhancing portfolio optimization and risk management. Direct indexing is expected to grow due to its tax efficiency, customization capabilities, and increasing demand for ESG-focused investing. The integration of real-time data analytics and blockchain technology will further transform asset management by providing transparency, reducing costs, and improving investor control.

Related Important Terms

Custom Indexing

Custom indexing in asset management allows investors to tailor portfolios by directly owning individual securities within an index, enhancing tax efficiency and aligning with specific financial goals. Unlike traditional asset management, direct indexing offers precise customization, enabling personalized risk management and strategic tracking error control.

Personalized Direct Indexing

Personalized Direct Indexing offers investors tailored portfolio construction by replicating a benchmark index with individual securities, enabling tax-loss harvesting and customization aligned with specific financial goals. Unlike traditional Asset Management, which typically involves pooled investments and less flexibility, Personalized Direct Indexing provides greater control over asset selection, risk exposure, and cost efficiency, enhancing after-tax returns and investment personalization.

Fractional Share Ownership

Fractional share ownership enables investors in both asset management and direct indexing to purchase partial shares of expensive securities, increasing portfolio diversification and capital efficiency. Direct indexing offers customized tax-loss harvesting and personalized portfolio construction, while traditional asset management typically aggregates fractional shares within mutual funds or ETFs for simplified access and liquidity.

ESG-Tilted Portfolios

ESG-tilted portfolios in asset management emphasize diversified investments across multiple funds with regulatory oversight, while direct indexing offers customization by allowing investors to individually select securities aligned with specific environmental, social, and governance criteria. Direct indexing enhances tax efficiency and precise ESG exposure control, whereas traditional asset management provides professional portfolio rebalancing and risk management for sustainable investing.

Tax-Loss Harvesting Automation

Tax-loss harvesting automation in asset management enhances portfolio efficiency by systematically identifying and realizing losses to offset gains, minimizing tax liabilities without manual intervention. Direct indexing allows investors to customize holdings for personalized tax-loss harvesting opportunities, optimizing after-tax returns through tailored, automated strategies.

Direct Indexing Scalability

Direct indexing offers unparalleled scalability by enabling personalized portfolio customization at scale through automated technology, which allows investors to efficiently manage thousands of individual securities. Unlike traditional asset management, direct indexing leverages tax-loss harvesting and customization features that can be tailored to specific investor preferences without the constraints of pooled fund structures.

SMAs (Separately Managed Accounts) Flexibility

Separately Managed Accounts (SMAs) offer greater flexibility compared to Direct Indexing by allowing personalized customization of asset allocations, tax strategies, and sector exposures tailored to individual investor goals. This level of customization enables asset managers to adjust holdings dynamically, optimizing portfolio performance and risk management beyond the constraints of traditional direct indexing models.

Beta Replication Strategies

Beta replication strategies in asset management typically use Exchange-Traded Funds (ETFs) or mutual funds to track market indices, offering diversified exposure with lower transaction costs and simplified portfolio management. Direct indexing, by contrast, replicates beta by purchasing individual securities within an index, enabling tax-loss harvesting and customization but requiring more complex execution and higher operational expenses.

Hyper-Personalization in Asset Allocation

Hyper-personalization in asset allocation through direct indexing allows investors to finely tailor portfolios by selecting individual securities that align with specific values, risk tolerances, and tax considerations, optimizing both performance and personal relevance. In contrast, traditional asset management relies on pooled funds and model portfolios, offering less granularity and customization, which may limit the ability to address unique investor preferences and dynamic market opportunities.

“Indexing 2.0”

Indexing 2.0 revolutionizes traditional asset management by enabling direct indexing strategies that offer personalized portfolio construction, tax-loss harvesting, and enhanced diversification beyond standard index funds. This approach leverages advanced data analytics and customized securities selection to align investments more precisely with individual goals while reducing costs and improving after-tax returns.

Asset Management vs Direct Indexing Infographic

industrydif.com

industrydif.com