Crowdfunding allows startups to raise capital from a large number of investors by offering rewards or equity, typically with fewer regulatory requirements and lower barriers to entry. Security Token Offerings (STOs) provide a regulated method for issuing digital securities that represent ownership in an asset, offering greater transparency, security, and compliance with financial laws. Investors in STOs benefit from enhanced liquidity and fractional ownership, whereas crowdfunding primarily targets early-stage ventures with simpler investment structures.

Table of Comparison

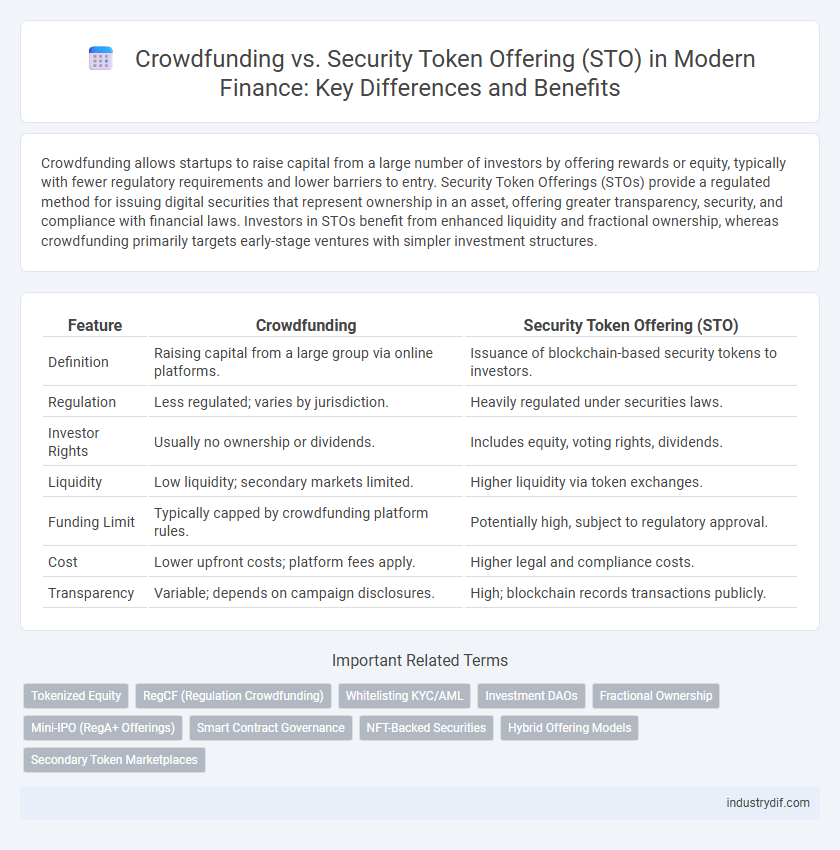

| Feature | Crowdfunding | Security Token Offering (STO) |

|---|---|---|

| Definition | Raising capital from a large group via online platforms. | Issuance of blockchain-based security tokens to investors. |

| Regulation | Less regulated; varies by jurisdiction. | Heavily regulated under securities laws. |

| Investor Rights | Usually no ownership or dividends. | Includes equity, voting rights, dividends. |

| Liquidity | Low liquidity; secondary markets limited. | Higher liquidity via token exchanges. |

| Funding Limit | Typically capped by crowdfunding platform rules. | Potentially high, subject to regulatory approval. |

| Cost | Lower upfront costs; platform fees apply. | Higher legal and compliance costs. |

| Transparency | Variable; depends on campaign disclosures. | High; blockchain records transactions publicly. |

Understanding Crowdfunding in Modern Finance

Crowdfunding in modern finance leverages online platforms to pool small investments from a large number of contributors, enabling startups and projects to access capital without traditional financial intermediaries. This method democratizes investment opportunities, allowing individuals to support ventures ranging from creative projects to innovative technologies with relatively low entry barriers. Unlike Security Token Offerings, crowdfunding typically does not offer equity or financial securities, focusing instead on rewards, donations, or pre-sales models.

What Is a Security Token Offering (STO)?

A Security Token Offering (STO) is a fundraising method that involves the issuance of tokenized securities representing ownership in assets, equity, or revenue streams, compliant with regulatory standards. Unlike traditional crowdfunding, STOs provide investors with legally enforceable rights and are subject to securities laws, enhancing transparency and investor protection. STOs leverage blockchain technology to offer fractional ownership, liquidity, and easier transferability of assets in a secure and compliant manner.

Key Differences Between Crowdfunding and STOs

Crowdfunding involves raising small amounts of capital from a large number of individuals through online platforms, usually in exchange for rewards or early access to products, whereas Security Token Offerings (STOs) represent investment contracts issued on blockchain, offering tokenized securities with regulatory compliance. Crowdfunding campaigns primarily rely on equity or donation-based models without extensive regulatory oversight, while STOs provide investors with legally enforceable ownership rights, dividends, or profit shares, backed by blockchain transparency and security. The key differences also lie in investor protection levels, fundraising scale, and the complexity of legal frameworks governing each method.

Regulatory Landscape: Crowdfunding vs STO

Crowdfunding operates under regulations like the SEC's Regulation Crowdfunding, which limits fundraising amounts and requires disclosures to protect investors. Security Token Offerings (STOs) comply with securities laws such as the Howey Test and typically require registration with regulatory bodies or exemptions under Regulation D or S. The regulatory landscape for STOs is more complex and stringent compared to crowdfunding, imposing higher compliance costs but offering greater investor protection and transparency.

Investor Eligibility and Participation

Investor eligibility in crowdfunding typically allows a broad range of participants, including non-accredited individuals, to contribute small amounts, fostering inclusive access to early-stage funding. Security Token Offerings (STOs) require investors to meet strict regulatory standards, often limiting participation to accredited or institutional investors to ensure compliance with securities laws. The participation process in STOs involves digital asset ownership on blockchain platforms, offering greater transparency and liquidity compared to traditional crowdfunding investments.

Fundraising Potential: Comparing Crowdfunding and STO

Crowdfunding allows startups to raise modest amounts from a large pool of individual investors, typically capped by regulatory limits, making it suitable for early-stage projects with lower capital needs. Security Token Offerings (STOs) enable the issuance of blockchain-based tokens representing ownership or investment contracts, facilitating access to larger pools of accredited investors and institutional funds, thus offering significantly higher fundraising potential. STOs leverage regulatory compliance and smart contract technology to attract more substantial investments, positioning them as a scalable option for companies seeking substantial capital.

Liquidity and Secondary Market Access

Crowdfunding typically offers limited liquidity as investors often face restrictions on transferring shares and lack access to formal secondary markets. In contrast, Security Token Offerings (STOs) leverage blockchain technology to provide enhanced liquidity by enabling fractional ownership and facilitating seamless trading on regulated secondary platforms. This improved liquidity and secondary market access in STOs attract investors seeking more flexible exit options and real-time asset valuation.

Risk Factors for Investors in Crowdfunding and STOs

Investors face varying risk factors in crowdfunding and Security Token Offerings (STOs), including regulatory uncertainty, fraud potential, and lack of liquidity. Crowdfunding often carries higher risks due to limited investor protections and less stringent vetting of projects, increasing exposure to project failure or mismanagement. STOs, while offering greater regulatory compliance and some asset-backed security, still involve volatility, complex legal frameworks, and market risks that require thorough due diligence.

Use Cases: When to Choose Crowdfunding or STO

Crowdfunding is ideal for startups and small businesses seeking seed capital with minimal regulatory hurdles, offering wide accessibility and quick fund mobilization from diverse retail investors. Security Token Offerings (STOs) suit companies aiming for larger, regulated fundraising rounds while providing investors with digital asset ownership and enhanced liquidity via blockchain technology. Choosing between crowdfunding and STO depends on factors like fundraising scale, compliance requirements, investor type, and desired post-offering liquidity.

Future Trends in Digital Fundraising Strategies

Crowdfunding and Security Token Offerings (STOs) represent evolving paradigms in digital fundraising, with STOs poised to dominate future finance due to regulatory clarity and blockchain integration. Investors favor STOs for their enhanced transparency, liquidity, and compliance with securities laws, signaling a shift towards tokenized assets as mainstream fundraising tools. Emerging trends indicate increased adoption of hybrid models combining crowdfunding's accessibility with STOs' security features, reshaping capital formation and democratizing investment opportunities globally.

Related Important Terms

Tokenized Equity

Tokenized equity in Security Token Offerings (STOs) represents a legally compliant digital asset backed by company shares, offering investors transparency, liquidity, and regulatory protection unlike traditional crowdfunding. Crowdfunding typically provides early access to project funding without equity rights, whereas STOs grant fractional ownership through blockchain-based security tokens, ensuring secure, tradable investment instruments.

RegCF (Regulation Crowdfunding)

Regulation Crowdfunding (RegCF) allows startups to raise up to $5 million annually from both accredited and non-accredited investors through SEC-registered online platforms, providing broader access compared to traditional Security Token Offerings (STOs) which primarily target accredited investors and use blockchain-based digital securities. RegCF offers clear regulatory compliance under the SEC's framework, making it a cost-effective and accessible fundraising method that balances investor protection with capital formation.

Whitelisting KYC/AML

Whitelisting in Crowdfunding primarily involves basic KYC/AML checks to ensure investor eligibility and regulatory compliance, whereas Security Token Offering (STO) requires more stringent and ongoing KYC/AML procedures due to the digital nature and security regulations of tokenized securities. STO platforms integrate automated whitelisting processes with blockchain technology to provide real-time compliance verification and secure investor onboarding.

Investment DAOs

Investment DAOs leverage decentralized governance to pool capital for diversified assets, contrasting with traditional crowdfunding's centralized control and Security Token Offerings' regulatory-compliant digital securities. The integration of blockchain in Investment DAOs enhances transparency, liquidity, and investor participation compared to conventional crowdfunding and STO frameworks.

Fractional Ownership

Fractional ownership in crowdfunding allows multiple investors to collectively fund and own a portion of a project, often with limited liquidity and regulatory oversight. Security Token Offerings (STOs) provide blockchain-based fractional ownership with enhanced transparency, tradability, and compliance through tokenized securities regulated by financial authorities.

Mini-IPO (RegA+ Offerings)

Mini-IPO structures under Regulation A+ enable companies to raise up to $75 million from both accredited and non-accredited investors through a streamlined public offering, providing greater funding access compared to traditional crowdfunding limits. Security Token Offerings (STOs) combine blockchain technology with regulatory compliance to represent fractionalized ownership, but Reg A+ mini-IPOs offer clearer regulatory frameworks and broader investor participation in securities issuance.

Smart Contract Governance

Smart contract governance in Security Token Offerings (STOs) enables automated compliance, transparent shareholder voting, and real-time dividend distribution, enhancing investor trust compared to traditional crowdfunding platforms. Unlike crowdfunding, STOs leverage blockchain-based governance to ensure regulatory adherence and reduce intermediary risks through programmable, self-executing contracts.

NFT-Backed Securities

NFT-backed securities combine the asset ownership benefits of non-fungible tokens with the fundraising potential of security token offerings, offering enhanced liquidity and fractional ownership compared to traditional crowdfunding. This innovative financing method leverages blockchain technology to provide transparent, verifiable investment opportunities while minimizing intermediary costs.

Hybrid Offering Models

Hybrid offering models in finance combine the broad investor access of crowdfunding with the compliance and tradability features of Security Token Offerings (STOs), enabling projects to raise capital efficiently while adhering to regulatory requirements. These models leverage blockchain technology to tokenize assets, providing enhanced liquidity and transparency alongside community engagement and diversified funding sources.

Secondary Token Marketplaces

Secondary token marketplaces for Security Token Offerings (STOs) provide regulated platforms enabling investors to trade security tokens with increased liquidity and compliance, contrasting with traditional crowdfunding which typically lacks a robust secondary market. The availability of these marketplaces enhances price discovery and market efficiency, making STOs a more attractive option for long-term investment diversification in the finance sector.

Crowdfunding vs Security Token Offering Infographic

industrydif.com

industrydif.com