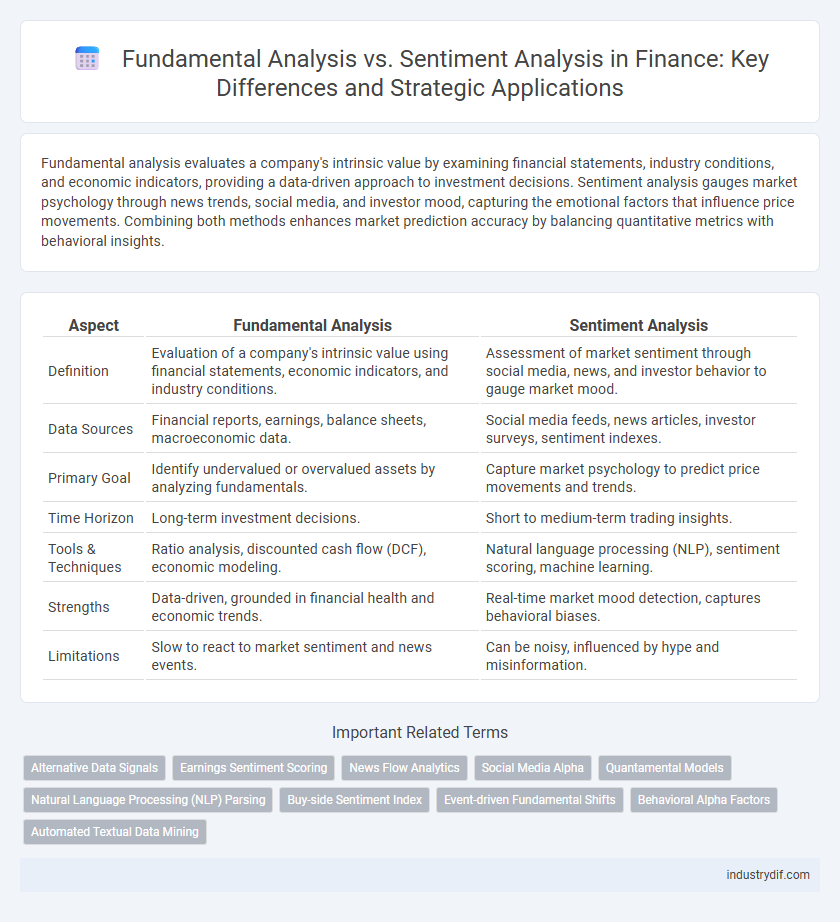

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, industry conditions, and economic indicators, providing a data-driven approach to investment decisions. Sentiment analysis gauges market psychology through news trends, social media, and investor mood, capturing the emotional factors that influence price movements. Combining both methods enhances market prediction accuracy by balancing quantitative metrics with behavioral insights.

Table of Comparison

| Aspect | Fundamental Analysis | Sentiment Analysis |

|---|---|---|

| Definition | Evaluation of a company's intrinsic value using financial statements, economic indicators, and industry conditions. | Assessment of market sentiment through social media, news, and investor behavior to gauge market mood. |

| Data Sources | Financial reports, earnings, balance sheets, macroeconomic data. | Social media feeds, news articles, investor surveys, sentiment indexes. |

| Primary Goal | Identify undervalued or overvalued assets by analyzing fundamentals. | Capture market psychology to predict price movements and trends. |

| Time Horizon | Long-term investment decisions. | Short to medium-term trading insights. |

| Tools & Techniques | Ratio analysis, discounted cash flow (DCF), economic modeling. | Natural language processing (NLP), sentiment scoring, machine learning. |

| Strengths | Data-driven, grounded in financial health and economic trends. | Real-time market mood detection, captures behavioral biases. |

| Limitations | Slow to react to market sentiment and news events. | Can be noisy, influenced by hype and misinformation. |

Introduction to Fundamental and Sentiment Analysis

Fundamental analysis evaluates a company's financial health by examining financial statements, earnings reports, and economic indicators to determine intrinsic value. Sentiment analysis assesses market psychology by analyzing news, social media, and investor behavior to gauge overall market mood. Integrating both approaches helps investors make informed decisions by combining quantitative data with qualitative market sentiment.

Core Principles of Fundamental Analysis

Fundamental analysis centers on evaluating a company's intrinsic value by examining financial statements, earnings, revenue growth, cash flow, and industry conditions. It relies on quantitative metrics such as price-to-earnings ratio, return on equity, and debt-to-equity ratio to assess long-term investment potential. This analytical approach strives to identify undervalued or overvalued stocks based on economic realities rather than market emotions or investor sentiment.

Key Metrics in Fundamental Analysis

Key metrics in fundamental analysis include earnings per share (EPS), price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio, which provide insights into a company's profitability, valuation, and financial health. Analysts evaluate revenue growth, cash flow, and dividend yield to assess operational efficiency and shareholder value. These quantitative indicators form the foundation for making informed investment decisions contrasted with sentiment analysis that relies on market mood and behavioral data.

Sentiment Analysis: Definition and Importance

Sentiment analysis in finance involves evaluating market emotions and investor attitudes by analyzing news, social media, and financial reports to predict stock price movements and market trends. It captures real-time investor psychology, helping traders make informed decisions beyond traditional financial metrics. Incorporating sentiment analysis enhances risk management and can identify potential market shifts before they are reflected in fundamental data.

Data Sources for Sentiment Analysis

Sentiment analysis in finance relies heavily on diverse data sources such as social media platforms like Twitter and StockTwits, financial news articles, and analyst reports to gauge market mood and investor sentiment. Real-time streaming of tweets and news headlines enables quantitative models to detect shifts in market sentiment that may precede price movements. Alternative data sources, including earnings call transcripts and consumer forums, further enrich sentiment analysis by capturing nuanced investor opinions often missed by traditional fundamental analysis.

Comparative Advantages: Fundamental vs. Sentiment Analysis

Fundamental analysis provides a detailed evaluation of a company's financial health by examining earnings, revenue, assets, and liabilities, offering long-term investment insights grounded in intrinsic value. Sentiment analysis captures market mood and investor psychology through social media trends, news sentiment, and trading volumes, enabling short-term market movement predictions. Combining both approaches enhances portfolio strategies by balancing objective financial metrics with real-time behavioral signals.

Practical Applications in Financial Markets

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, economic indicators, and industry conditions, providing investors with data-driven insights for long-term investment decisions. Sentiment analysis measures market mood and investor psychology through news, social media, and market trends, enabling traders to capitalize on short-term price movements and market volatility. Combining these approaches enhances portfolio management by balancing quantitative valuation with real-time market sentiment signals.

Integration of Both Analyses in Investment Strategies

Integrating fundamental analysis and sentiment analysis enhances investment strategies by combining quantitative financial data with market psychology insights, improving decision accuracy. Fundamental analysis evaluates a company's intrinsic value through metrics like earnings, cash flow, and growth potential, while sentiment analysis gauges investor emotions and market trends from news, social media, and trading volumes. This fusion enables investors to identify undervalued assets with positive sentiment momentum, optimizing portfolio performance and risk management.

Limitations and Risks of Each Approach

Fundamental analysis faces limitations due to its reliance on historical financial data and assumptions about future performance, which may not reflect sudden market changes or external shocks. Sentiment analysis carries risks related to the accuracy of sentiment indicators and the potential for market noise to skew signals, leading to false positives or misleading conclusions. Both approaches require careful integration with risk management strategies to mitigate potential errors and improve investment decision-making.

Future Trends in Financial Analysis Techniques

Future trends in financial analysis techniques emphasize the integration of fundamental analysis and sentiment analysis through advanced machine learning algorithms. These hybrid models leverage quantitative data from financial statements alongside real-time sentiment data from news and social media to improve predictive accuracy. Enhanced natural language processing (NLP) tools enable deeper insights into market psychology, driving more informed investment decisions and risk management strategies.

Related Important Terms

Alternative Data Signals

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, earnings reports, and economic indicators, while sentiment analysis leverages alternative data signals such as social media trends, news sentiment, and consumer behavior patterns to gauge market mood and investor confidence. Integrating alternative data signals enhances predictive accuracy by capturing real-time market sentiment beyond traditional financial metrics.

Earnings Sentiment Scoring

Earnings sentiment scoring quantifies investor emotions by analyzing textual data from earnings reports, offering predictive insights that complement traditional fundamental analysis focused on financial ratios and valuation metrics. This hybrid approach enhances market forecasting accuracy by integrating objective financial performance with subjective market sentiment signals.

News Flow Analytics

Fundamental analysis evaluates financial statements, economic indicators, and company performance to determine intrinsic asset value, while sentiment analysis interprets market emotions through news flow analytics, social media, and investor sentiment metrics. News flow analytics leverages real-time data extraction and natural language processing to quantify market sentiment, providing a complementary perspective for forecasting asset price movements alongside traditional fundamental indicators.

Social Media Alpha

Fundamental analysis evaluates a company's intrinsic value using financial statements, earnings reports, and economic indicators, while sentiment analysis leverages social media alpha to gauge investor mood and market trends from platforms like Twitter and Reddit. Social media alpha captures real-time crowd sentiment, often predicting short-term stock movements missed by traditional fundamental metrics.

Quantamental Models

Quantamental models combine fundamental analysis, which evaluates financial statements and intrinsic company value, with sentiment analysis that interprets market sentiment and investor behavior from news and social media data. This hybrid approach enhances predictive accuracy by integrating quantitative financial metrics with real-time sentiment indicators, optimizing investment decision-making processes.

Natural Language Processing (NLP) Parsing

Fundamental analysis leverages Natural Language Processing (NLP) parsing to extract financial metrics and key performance indicators from earnings reports and financial statements, enabling precise valuation models. Sentiment analysis employs NLP parsing techniques to gauge market sentiment and investor emotions from news articles, social media, and analyst opinions, influencing short-term trading decisions.

Buy-side Sentiment Index

Buy-side Sentiment Index measures investor confidence by aggregating buying patterns and transaction data, providing actionable insights for fundamental analysis to evaluate asset value more accurately. This index complements fundamental indicators by capturing market psychology, enhancing predictive power for investment decisions in equity and bond markets.

Event-driven Fundamental Shifts

Event-driven fundamental shifts capture sharp changes in a company's intrinsic value triggered by specific occurrences such as earnings reports, mergers, or regulatory decisions, providing a robust basis for investment decisions through fundamental analysis. In contrast, sentiment analysis gauges market psychology and investor reactions to these events, offering real-time insights into short-term price movements and momentum shifts driven by collective emotion and perception.

Behavioral Alpha Factors

Fundamental analysis evaluates a company's intrinsic value using financial statements, economic indicators, and industry trends, while sentiment analysis gauges market emotions and investor psychology to predict price movements. Behavioral alpha factors arise from exploiting investor biases and sentiment-driven mispricings identified through sentiment analysis, complementing traditional fundamental valuation metrics.

Automated Textual Data Mining

Automated textual data mining leverages natural language processing and machine learning algorithms to extract quantitative insights from financial news, earnings reports, and social media, enhancing both fundamental analysis by revealing underlying financial conditions and sentiment analysis by capturing market mood and investor behavior. This integration enables more precise stock valuation models and real-time risk assessments, improving decision-making efficiency in volatile markets.

Fundamental Analysis vs Sentiment Analysis Infographic

industrydif.com

industrydif.com