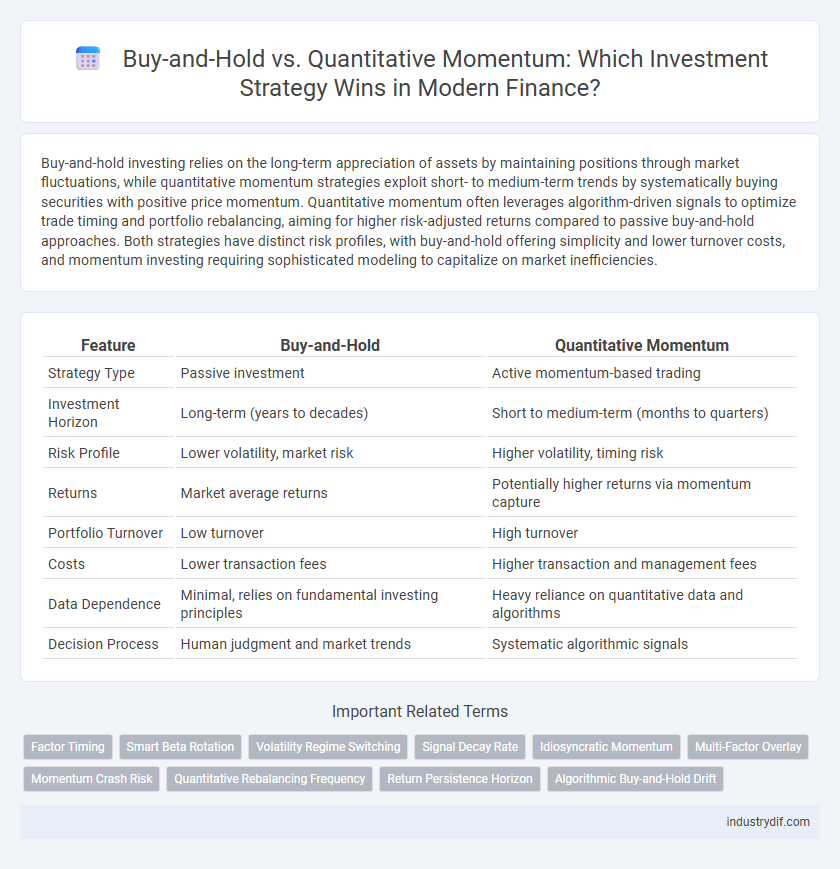

Buy-and-hold investing relies on the long-term appreciation of assets by maintaining positions through market fluctuations, while quantitative momentum strategies exploit short- to medium-term trends by systematically buying securities with positive price momentum. Quantitative momentum often leverages algorithm-driven signals to optimize trade timing and portfolio rebalancing, aiming for higher risk-adjusted returns compared to passive buy-and-hold approaches. Both strategies have distinct risk profiles, with buy-and-hold offering simplicity and lower turnover costs, and momentum investing requiring sophisticated modeling to capitalize on market inefficiencies.

Table of Comparison

| Feature | Buy-and-Hold | Quantitative Momentum |

|---|---|---|

| Strategy Type | Passive investment | Active momentum-based trading |

| Investment Horizon | Long-term (years to decades) | Short to medium-term (months to quarters) |

| Risk Profile | Lower volatility, market risk | Higher volatility, timing risk |

| Returns | Market average returns | Potentially higher returns via momentum capture |

| Portfolio Turnover | Low turnover | High turnover |

| Costs | Lower transaction fees | Higher transaction and management fees |

| Data Dependence | Minimal, relies on fundamental investing principles | Heavy reliance on quantitative data and algorithms |

| Decision Process | Human judgment and market trends | Systematic algorithmic signals |

Introduction to Buy-and-Hold and Quantitative Momentum

Buy-and-Hold is a long-term investment strategy that involves purchasing securities and holding them regardless of market fluctuations, emphasizing patience and minimizing transaction costs. Quantitative Momentum uses algorithm-driven models to identify and invest in assets exhibiting strong upward price trends, aiming to capitalize on market momentum systematically. Both strategies leverage distinct approaches to portfolio growth, with Buy-and-Hold focusing on fundamental value retention and Quantitative Momentum relying on data-driven trend analysis.

Defining Buy-and-Hold Investing

Buy-and-hold investing is a strategy where investors purchase securities and maintain ownership over an extended period, minimizing frequent trades to capitalize on long-term market growth. This approach emphasizes patience and discipline, reducing transaction costs and avoiding the pitfalls of market timing. Institutional data shows buy-and-hold portfolios often outperform active strategies during bull markets, reflecting the benefits of compounding and reduced volatility exposure.

What is Quantitative Momentum?

Quantitative Momentum is an investment strategy that uses mathematical models to identify stocks with strong price trends and upward momentum based on historical price and volume data. This systematic approach relies on algorithms to capture sustained price movements, aiming to outperform traditional buy-and-hold methods by capitalizing on market inefficiencies. By continuously analyzing factors such as relative strength and earnings momentum, quantitative momentum strategies seek to optimize portfolio returns through dynamic asset selection.

Core Principles and Strategies Compared

Buy-and-Hold investing centers on selecting quality assets and maintaining positions long-term, relying on market growth and compounding returns. Quantitative Momentum employs algorithms to identify securities exhibiting upward price trends, executing trades based on statistical momentum indicators. Core principles of Buy-and-Hold emphasize patience and fundamental analysis, while Quantitative Momentum prioritizes data-driven decision-making and dynamic portfolio adjustments.

Historical Performance Analysis

Historical performance analysis reveals that buy-and-hold strategies typically benefit from long-term market growth by minimizing transaction costs and capitalizing on compounding returns. Quantitative momentum strategies leverage price trends and risk-adjusted factors, often outperforming buy-and-hold during trending markets but facing periods of underperformance in volatile or mean-reverting environments. Empirical studies indicate that integrating momentum signals with buy-and-hold portfolios can enhance risk-adjusted returns while mitigating drawdowns historically experienced in pure momentum approaches.

Key Risk Factors for Each Approach

Buy-and-hold strategy faces key risks such as market downturns and prolonged economic recessions that can erode portfolio value over time, with limited flexibility to reallocate assets quickly. Quantitative momentum investing is vulnerable to sudden market reversals and high turnover costs, which can undermine returns during volatile or mean-reverting environments. Both approaches require thorough risk management to mitigate exposure to systemic shocks and behavioral biases affecting asset price trends.

Suitable Investor Profiles

Buy-and-hold strategies suit investors seeking long-term wealth accumulation with lower transaction frequency and tolerance for market volatility. Quantitative momentum appeals to traders prioritizing data-driven, short- to medium-term gains with higher risk tolerance and active portfolio management. Understanding individual risk appetite, investment horizon, and commitment level is crucial in selecting between these approaches.

Costs and Tax Implications

Buy-and-hold strategies generally incur lower transaction costs and minimize capital gains taxes due to infrequent trading, enhancing long-term after-tax returns. Quantitative momentum approaches, characterized by frequent rebalancing, often generate higher transaction fees and short-term capital gains taxes, reducing net profitability. Investors must carefully weigh trading costs and tax consequences when choosing between these strategies to optimize portfolio performance.

Behavioral Finance Considerations

Buy-and-hold investors often benefit from mitigating emotional biases such as panic selling during market downturns, promoting long-term wealth accumulation. Quantitative momentum strategies harness data-driven signals to systematically capitalize on trend persistence, reducing the impact of cognitive biases like overconfidence and herd behavior. Understanding these behavioral finance considerations aids investors in selecting approaches aligning with their psychological resilience and market outlook.

Choosing the Right Strategy for Your Portfolio

Selecting the appropriate investment strategy hinges on your risk tolerance, time horizon, and market knowledge; Buy-and-Hold offers stability through long-term growth by capitalizing on compound interest and market appreciation, while Quantitative Momentum leverages algorithmic analysis to capitalize on short-term price trends. Studies show Buy-and-Hold typically suits conservative investors aiming for steady wealth accumulation, whereas Quantitative Momentum appeals to those seeking higher returns through dynamic, data-driven trades. Integrating both strategies in a diversified portfolio may optimize risk-adjusted returns by balancing consistent growth with opportunistic gains.

Related Important Terms

Factor Timing

Buy-and-hold investors maintain positions regardless of market shifts, while quantitative momentum strategies rely on factor timing to exploit trends by dynamically adjusting exposure based on momentum indicators. Empirical studies reveal factor timing in momentum strategies can enhance risk-adjusted returns by systematically capitalizing on market inefficiencies and momentum persistence.

Smart Beta Rotation

Smart Beta Rotation strategies leverage quantitative momentum to systematically shift asset allocations toward securities exhibiting strong performance trends, outperforming traditional Buy-and-Hold approaches by capitalizing on market inefficiencies and reducing drawdowns. By blending factor-based investing with dynamic rebalancing, Smart Beta Rotation enhances risk-adjusted returns through disciplined exposure to momentum-driven assets, optimizing portfolio growth while maintaining controlled volatility.

Volatility Regime Switching

Buy-and-Hold strategies often underperform during high-volatility regimes as market fluctuations erode fixed positions, whereas Quantitative Momentum adapts by dynamically reallocating assets based on momentum signals, improving risk-adjusted returns. Volatility Regime Switching models enhance momentum strategies by identifying market state changes, enabling timely adjustments that capitalize on trending assets while mitigating drawdowns during turbulent periods.

Signal Decay Rate

Buy-and-Hold strategies exhibit minimal signal decay rate due to their reliance on long-term market trends, whereas Quantitative Momentum models face higher decay rates as their signals quickly lose predictive power amid market volatility. Understanding the contrasting signal decay rates helps investors optimize portfolio rebalancing frequency and enhance return consistency.

Idiosyncratic Momentum

Idiosyncratic momentum captures the tendency of individual stocks to exhibit persistent, firm-specific performance beyond market trends, making it a crucial factor in quantitative momentum strategies that outperform traditional buy-and-hold investing by capitalizing on short- to medium-term stock-specific return patterns. Empirical studies indicate that portfolios constructed on idiosyncratic momentum generate superior risk-adjusted returns through exploiting cross-sectional return predictability, unlike buy-and-hold approaches that primarily rely on long-term market appreciation and dividends.

Multi-Factor Overlay

Multi-factor overlay integrates Buy-and-Hold strategies with Quantitative Momentum by combining long-term asset allocation stability and momentum-driven trade signals to optimize risk-adjusted returns. This approach leverages diverse factors such as value, quality, and momentum, enhancing portfolio robustness and adaptability across different market cycles.

Momentum Crash Risk

Buy-and-hold strategies typically avoid frequent trading but are exposed to prolonged downturns, while quantitative momentum strategies can achieve higher returns by exploiting price trends yet face significant momentum crash risk during market reversals and sudden volatility spikes. Momentum crash risk is characterized by sharp losses when previously strong-performing assets underperform rapidly, necessitating robust risk management and adaptive models to mitigate drawdowns in quantitative momentum investing.

Quantitative Rebalancing Frequency

Quantitative momentum strategies often implement a rebalancing frequency ranging from monthly to quarterly to systematically capture momentum trends and reduce the impact of short-term volatility. This disciplined quantitative rebalancing contrasts with buy-and-hold approaches, which typically avoid frequent portfolio adjustments, potentially missing opportunities to optimize returns through timely momentum shifts.

Return Persistence Horizon

Buy-and-Hold strategies typically exhibit longer return persistence horizons due to sustained exposure to fundamental growth factors, while Quantitative Momentum approaches capture shorter-term return momentum driven by price trends and market sentiment. Empirical studies reveal that momentum-driven returns often reverse beyond a 6 to 12-month horizon, contrasting with the multi-year durability found in buy-and-hold portfolios.

Algorithmic Buy-and-Hold Drift

Algorithmic Buy-and-Hold Drift refers to the systematic deviation from a pure buy-and-hold strategy caused by algorithmic rebalancing or trading rules, often leading to unintentional momentum exposure. This drift can result in performance differences compared to traditional buy-and-hold portfolios and impacts risk-adjusted returns by introducing factors typical of quantitative momentum strategies.

Buy-and-Hold vs Quantitative Momentum Infographic

industrydif.com

industrydif.com