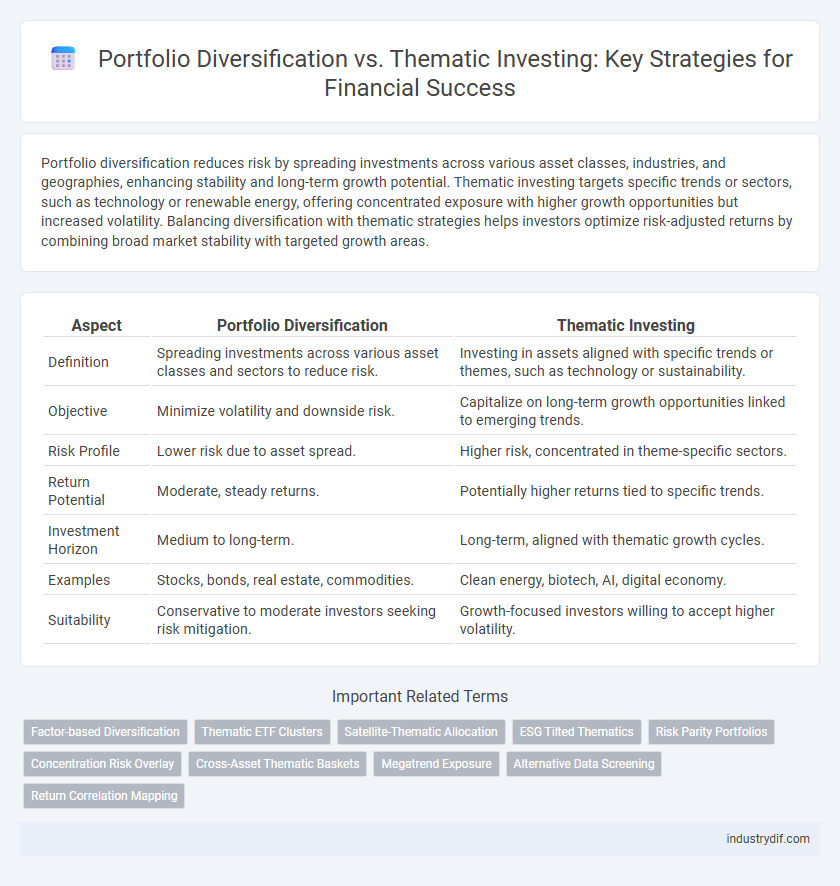

Portfolio diversification reduces risk by spreading investments across various asset classes, industries, and geographies, enhancing stability and long-term growth potential. Thematic investing targets specific trends or sectors, such as technology or renewable energy, offering concentrated exposure with higher growth opportunities but increased volatility. Balancing diversification with thematic strategies helps investors optimize risk-adjusted returns by combining broad market stability with targeted growth areas.

Table of Comparison

| Aspect | Portfolio Diversification | Thematic Investing |

|---|---|---|

| Definition | Spreading investments across various asset classes and sectors to reduce risk. | Investing in assets aligned with specific trends or themes, such as technology or sustainability. |

| Objective | Minimize volatility and downside risk. | Capitalize on long-term growth opportunities linked to emerging trends. |

| Risk Profile | Lower risk due to asset spread. | Higher risk, concentrated in theme-specific sectors. |

| Return Potential | Moderate, steady returns. | Potentially higher returns tied to specific trends. |

| Investment Horizon | Medium to long-term. | Long-term, aligned with thematic growth cycles. |

| Examples | Stocks, bonds, real estate, commodities. | Clean energy, biotech, AI, digital economy. |

| Suitability | Conservative to moderate investors seeking risk mitigation. | Growth-focused investors willing to accept higher volatility. |

Understanding Portfolio Diversification

Portfolio diversification involves spreading investments across different asset classes, sectors, and geographic regions to reduce risk and increase potential returns. It minimizes the impact of poor performance in any single investment by balancing the portfolio's overall exposure. Effective diversification enhances long-term financial stability and helps investors achieve consistent growth in volatile markets.

What is Thematic Investing?

Thematic investing involves selecting assets based on macro-level trends or specific themes such as technological innovation, clean energy, or demographic shifts. This strategy targets companies and sectors poised to benefit from long-term structural changes rather than traditional industry classifications. By focusing on emerging trends, thematic investing aims to capture growth opportunities linked to global economic, social, or environmental transformations.

Key Differences Between Diversification and Thematic Investing

Portfolio diversification reduces risk by spreading investments across various asset classes, sectors, and geographic regions to achieve balanced exposure and minimize the impact of market volatility. Thematic investing concentrates capital into specific trends or sectors, such as clean energy or technology innovation, aiming for higher returns by capitalizing on growth drivers. While diversification emphasizes risk management and stability, thematic investing focuses on targeted growth opportunities aligned with evolving economic or social themes.

Risk Management in Portfolio Strategies

Portfolio diversification spreads investments across various asset classes to minimize unsystematic risk, enhancing overall risk-adjusted returns. Thematic investing concentrates on specific trends or sectors, potentially increasing volatility but offering higher growth opportunities tied to emerging market dynamics. Effective risk management balances diversification's stability with thematic investing's targeted exposure to optimize portfolio resilience and capitalize on market innovation.

Performance Potential: Diversified vs Thematic Portfolios

Portfolio diversification spreads investments across various asset classes and sectors to reduce risk and stabilize returns, often resulting in moderate but consistent performance over time. Thematic investing concentrates on specific trends or sectors, offering higher performance potential due to targeted exposure but with increased volatility and risk. Studies show diversified portfolios typically deliver steady growth, while thematic portfolios may achieve superior gains during favorable market conditions tied to the chosen theme.

Asset Allocation Methods Compared

Portfolio diversification employs broad asset allocation across multiple asset classes such as equities, bonds, and real estate to minimize risk and enhance long-term returns, leveraging correlation dynamics between assets. Thematic investing concentrates capital on specific sectors or trends like technology, clean energy, or healthcare, aiming for targeted growth aligned with macroeconomic or societal shifts, which can increase volatility and sector-specific risk. Balancing these methods involves adjusting allocation weights to risk tolerance and investment horizon, optimizing exposure to diversified assets while capitalizing on high-conviction themes.

Aligning Investment Goals with Strategy Choice

Portfolio diversification spreads investments across various asset classes to reduce risk and achieve steady returns, making it ideal for conservative goals focused on capital preservation. Thematic investing targets specific sectors or trends, such as renewable energy or technology innovation, aligning with growth-oriented objectives and higher risk tolerance. Selecting the right strategy depends on financial goals, risk appetite, and investment horizon, ensuring a tailored approach to maximize portfolio performance.

Sector Exposure and Concentration Risks

Portfolio diversification minimizes sector exposure by spreading investments across multiple sectors, reducing concentration risks and enhancing risk-adjusted returns. Thematic investing targets specific trends or sectors, leading to higher concentration risks due to focused exposure in particular areas. Balancing thematic strategies with diversified assets helps mitigate the volatility associated with sector-specific economic shifts.

Long-Term Growth Considerations

Portfolio diversification reduces risk by spreading investments across various asset classes, enhancing stability over long-term horizons. Thematic investing focuses on sectors or trends with high growth potential, such as technology or renewable energy, aiming for substantial returns despite higher volatility. Long-term growth strategies benefit from balancing diversified exposure with targeted thematic bets to optimize risk-adjusted returns.

Which Approach Suits Your Investor Profile?

Portfolio diversification reduces risk by spreading investments across various asset classes, sectors, and geographies, suitable for conservative investors seeking steady returns and risk mitigation. Thematic investing targets specific trends or sectors like technology or sustainability, aligning with investors confident in particular industries and willing to accept higher volatility for growth potential. Understanding your risk tolerance, investment horizon, and market outlook is crucial in deciding between broad diversification and focused thematic exposure.

Related Important Terms

Factor-based Diversification

Factor-based diversification enhances portfolio resilience by spreading investments across multiple risk drivers such as value, momentum, and low volatility, reducing exposure to market-specific shocks. Unlike thematic investing, which concentrates on trends like technology or ESG, factor-based strategies systematically capture persistent sources of return, improving risk-adjusted performance over time.

Thematic ETF Clusters

Thematic ETF clusters concentrate investments in specialized sectors such as clean energy, artificial intelligence, or cybersecurity, offering targeted growth aligned with emerging market trends. Portfolio diversification balances risk by spreading assets across various industries and geographies, whereas thematic investing leverages concentrated exposure to capitalize on specific innovations and societal shifts.

Satellite-Thematic Allocation

Satellite-thematic allocation enhances portfolio diversification by targeting high-growth sectors like technology, clean energy, and healthcare, which may offer higher returns and unique risk exposures compared to core holdings. This approach balances risk and reward by complementing a stable core portfolio with thematic investments that capture emerging market trends and innovation-driven opportunities.

ESG Tilted Thematics

Portfolio diversification aims to reduce risk by spreading investments across various assets, while thematic investing targets specific trends or sectors, often leading to concentrated exposure. ESG tilted thematic portfolios combine sustainability criteria with focused themes, enhancing potential for long-term growth while aligning investments with environmental, social, and governance principles.

Risk Parity Portfolios

Risk parity portfolios balance asset allocation by risk contribution rather than capital allocation, reducing volatility through diversified exposure to equities, bonds, and alternative assets. Unlike thematic investing, which concentrates investments in specific sectors or trends, risk parity aims to optimize risk-adjusted returns by equalizing risk weights across multiple asset classes to enhance portfolio stability.

Concentration Risk Overlay

Portfolio diversification reduces concentration risk by spreading investments across various asset classes, sectors, and geographies, thereby minimizing the impact of any single asset's poor performance. Thematic investing, while offering targeted exposure to specific trends or sectors, inherently increases concentration risk due to its narrower focus and fewer holdings.

Cross-Asset Thematic Baskets

Cross-asset thematic baskets combine diverse asset classes such as equities, bonds, and commodities to capture specific long-term trends while mitigating risk through broad exposure. This strategy enhances portfolio diversification by aligning thematic investment principles with cross-asset allocation, optimizing risk-adjusted returns amid market volatility.

Megatrend Exposure

Portfolio diversification reduces risk by spreading investments across various asset classes and sectors, while thematic investing targets high-growth megatrends such as clean energy, artificial intelligence, and biotechnology to capitalize on long-term structural shifts. Focusing on megatrend exposure enables investors to align with transformative global changes but requires careful risk management to avoid concentration in volatile niches.

Alternative Data Screening

Portfolio diversification leverages alternative data screening to reduce risk by analyzing varied asset classes, while thematic investing uses such data to identify and capitalize on emerging trends and sector-specific opportunities. Employing advanced algorithms on alternative datasets enhances decision-making accuracy for both strategies, optimizing returns in dynamic financial markets.

Return Correlation Mapping

Return correlation mapping reveals that portfolio diversification reduces risk by combining assets with low or negative correlations, enhancing overall stability. In contrast, thematic investing often clusters assets with higher correlation due to shared sector or trend exposure, which can amplify volatility despite targeted growth opportunities.

Portfolio Diversification vs Thematic Investing Infographic

industrydif.com

industrydif.com