Stock exchanges operate as centralized platforms where securities are traded under regulatory oversight, ensuring transparency and investor protection. Decentralized exchanges (DEXs) facilitate peer-to-peer trading directly on blockchain networks, offering greater privacy and reduced reliance on intermediaries. While stock exchanges provide liquidity and legal safeguards, DEXs enable faster, borderless transactions without centralized control.

Table of Comparison

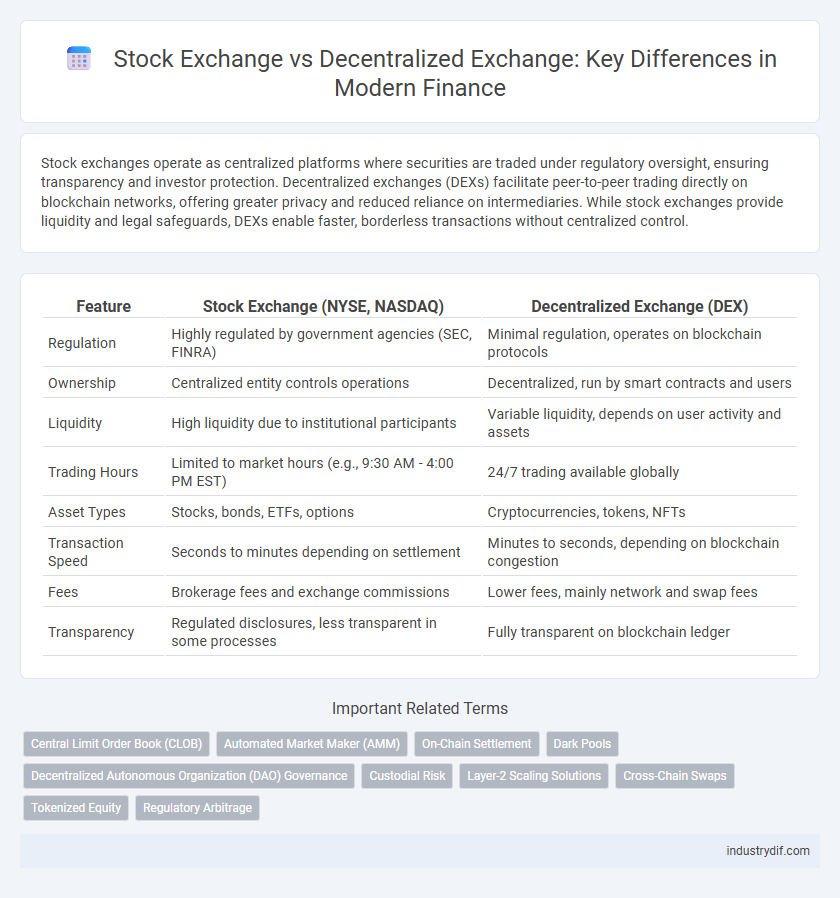

| Feature | Stock Exchange (NYSE, NASDAQ) | Decentralized Exchange (DEX) |

|---|---|---|

| Regulation | Highly regulated by government agencies (SEC, FINRA) | Minimal regulation, operates on blockchain protocols |

| Ownership | Centralized entity controls operations | Decentralized, run by smart contracts and users |

| Liquidity | High liquidity due to institutional participants | Variable liquidity, depends on user activity and assets |

| Trading Hours | Limited to market hours (e.g., 9:30 AM - 4:00 PM EST) | 24/7 trading available globally |

| Asset Types | Stocks, bonds, ETFs, options | Cryptocurrencies, tokens, NFTs |

| Transaction Speed | Seconds to minutes depending on settlement | Minutes to seconds, depending on blockchain congestion |

| Fees | Brokerage fees and exchange commissions | Lower fees, mainly network and swap fees |

| Transparency | Regulated disclosures, less transparent in some processes | Fully transparent on blockchain ledger |

Overview of Stock Exchanges

Stock exchanges serve as centralized platforms where securities, commodities, and other financial instruments are traded under stringent regulatory oversight, ensuring transparency and investor protection. Major global stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ facilitate high liquidity and standardized trading processes for stocks and bonds. These exchanges operate with intermediaries such as brokers and market makers, providing price discovery and reducing counterparty risk compared to decentralized alternatives.

Introduction to Decentralized Exchanges

Decentralized exchanges (DEXs) operate on blockchain technology, enabling peer-to-peer trading without intermediaries, contrasting traditional stock exchanges that rely on centralized authority and brokers. By utilizing smart contracts, DEXs provide increased transparency, security, and direct control over assets, reducing risks associated with centralized custody. The growing adoption of DEXs reflects a shift toward more democratized, permissionless trading environments within the finance sector.

Key Structural Differences

Stock exchanges operate as centralized platforms with regulatory oversight, providing a structured environment for buying and selling securities, while decentralized exchanges (DEXs) function on blockchain networks, enabling peer-to-peer trading without intermediaries. Key structural differences include custody of assets, where stock exchanges hold securities on behalf of investors versus DEXs allowing users to retain control of their private keys and funds. Furthermore, stock exchanges enforce stringent compliance and settlement processes, whereas DEXs utilize smart contracts for automated and immediate trade execution.

Trading Mechanisms Compared

Stock exchanges operate through centralized order books and designated market makers to ensure liquidity and price discovery, facilitating regulated and transparent trading environments. Decentralized exchanges utilize automated market makers (AMMs) and smart contracts on blockchain networks, enabling peer-to-peer trading without intermediaries and providing users with greater control over funds. The key differences in trading mechanisms affect transaction speed, costs, and security, with centralized exchanges typically offering faster execution and decentralized exchanges enhancing privacy and resistance to censorship.

Regulatory Frameworks

Stock exchanges operate under stringent regulatory frameworks enforced by government agencies such as the SEC in the United States, ensuring transparency, investor protection, and market integrity. Decentralized exchanges (DEXs) typically function without centralized authorities, presenting challenges for regulators due to their borderless and anonymous nature, leading to evolving and sometimes uncertain compliance requirements. Regulatory developments for DEXs are focusing on anti-money laundering (AML) and know-your-customer (KYC) policies to address risks while trying to preserve decentralization benefits.

Security and Transparency

Stock exchanges are centrally regulated platforms offering high security through stringent compliance and oversight, reducing fraud risks. Decentralized exchanges enhance transparency by leveraging blockchain technology, enabling direct peer-to-peer transactions without intermediaries. However, decentralized platforms may face security vulnerabilities due to smart contract exploits and lack of regulatory protection.

Liquidity and Volume Analysis

Traditional stock exchanges typically exhibit higher liquidity and trading volume due to centralized order books and established regulatory frameworks fostering investor confidence. Decentralized exchanges (DEXs) operate without intermediaries, resulting in variable liquidity pools dependent on user participation and automated market maker protocols, often leading to fragmented volume. Volume analysis of DEXs highlights rapid growth yet fluctuating liquidity compared to stock exchanges, influenced by factors like token diversity and network congestion.

Costs and Fees Structure

Stock exchanges typically involve higher costs and fees, including listing fees, trading commissions, and regulatory compliance charges, which can significantly impact investor returns. Decentralized exchanges (DEXs) often feature lower transaction fees and eliminate intermediaries, thereby reducing overall costs; however, users may incur network gas fees depending on the blockchain used. Understanding the fee structure differences is essential for traders optimizing cost-efficiency and liquidity access in financial markets.

Accessibility and User Experience

Stock exchanges offer centralized platforms with regulated environments that provide high liquidity and extensive asset listings, ensuring a streamlined user experience for traders. Decentralized exchanges (DEXs) enhance accessibility by allowing direct peer-to-peer transactions without intermediaries, fostering greater privacy and reduced entry barriers. The user experience on DEXs may involve steeper learning curves and slower transaction speeds due to blockchain confirmations, contrasting with the intuitive interfaces and faster trades typical of traditional stock exchanges.

Future Trends in Exchange Platforms

Future trends in exchange platforms reveal a shift toward decentralized exchanges (DEXs) due to their enhanced security, transparency, and reduced reliance on intermediaries. Stock exchanges continue to evolve by integrating advanced technologies such as AI-driven analytics and blockchain solutions to improve liquidity and regulatory compliance. The convergence of traditional finance and decentralized finance (DeFi) mechanisms is expected to reshape market dynamics, creating hybrid models that blend centralized oversight with decentralized access.

Related Important Terms

Central Limit Order Book (CLOB)

Stock exchanges rely on a Central Limit Order Book (CLOB) to match buy and sell orders transparently, providing liquidity and price discovery within a centralized system. Decentralized exchanges often forego a traditional CLOB in favor of automated market makers (AMMs), which offer liquidity through smart contracts but may lack the depth and price precision of CLOB-based trading.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) revolutionize decentralized exchanges (DEXs) by using algorithmic pricing models to provide continuous liquidity without order books, unlike traditional stock exchanges that rely on centralized intermediaries and matching buyers with sellers. This decentralized liquidity protocol enhances trading efficiency and accessibility, reducing fees and slippage commonly encountered in centralized stock exchange environments.

On-Chain Settlement

On-chain settlement in decentralized exchanges (DEXs) enables direct trade execution and asset transfer on the blockchain, reducing counterparty risk and enhancing transparency compared to traditional stock exchanges that rely on intermediaries and off-chain clearing processes. This blockchain-native settlement method ensures real-time finality and immutable transaction records, offering higher security and efficiency for traders in decentralized finance ecosystems.

Dark Pools

Dark pools are private trading venues allowing institutional investors to execute large stock orders away from public stock exchanges, minimizing market impact and price slippage. Unlike decentralized exchanges (DEXs) that operate on blockchain technology with transparent, peer-to-peer trade execution, dark pools provide anonymity and limited pre-trade information, raising regulatory concerns about market fairness.

Decentralized Autonomous Organization (DAO) Governance

Decentralized exchanges (DEXs) leverage Decentralized Autonomous Organization (DAO) governance to enable collective decision-making, enhancing transparency and security compared to traditional stock exchanges. DAO governance allows token holders to propose and vote on protocol upgrades and operational changes, reducing central authority and aligning platform development with the community's interests.

Custodial Risk

Centralized stock exchanges hold assets in custodial accounts, exposing investors to custodial risk such as fraud, hacking, or insolvency of the intermediary. Decentralized exchanges (DEXs) minimize custodial risk by enabling peer-to-peer trading directly on blockchain networks, allowing users to maintain control of their private keys and assets throughout the transaction.

Layer-2 Scaling Solutions

Layer-2 scaling solutions enhance decentralized exchanges (DEXs) by increasing transaction throughput and reducing gas fees on blockchain networks, addressing the scalability limitations of Layer-1 protocols. Traditional stock exchanges rely on centralized infrastructure with established regulatory frameworks, whereas Layer-2 platforms enable faster, cost-efficient, and trustless trading environments crucial for DeFi adoption.

Cross-Chain Swaps

Cross-chain swaps enable seamless asset exchanges across different blockchain networks, providing decentralized exchanges (DEXs) with enhanced liquidity and interoperability compared to traditional stock exchanges that rely on centralized intermediaries. This innovation in decentralized finance (DeFi) allows users to execute trustless trades without third-party custody, reducing counterparty risk and increasing transaction efficiency.

Tokenized Equity

Stock exchanges offer regulated environments for trading traditional equity securities with established legal frameworks, whereas decentralized exchanges enable peer-to-peer trading of tokenized equity using blockchain technology, providing greater transparency and reduced intermediaries. Tokenized equity on decentralized exchanges facilitates fractional ownership and 24/7 market access, enhancing liquidity and democratizing investment opportunities.

Regulatory Arbitrage

Stock exchanges operate under strict regulatory frameworks enforced by governments, providing investor protection but limiting trading flexibility compared to decentralized exchanges (DEXs), which leverage blockchain technology to facilitate peer-to-peer trading without intermediaries. Regulatory arbitrage arises as traders exploit the less regulated environment of DEXs to bypass traditional compliance requirements, creating challenges for authorities aiming to enforce securities laws globally.

Stock Exchange vs Decentralized Exchange Infographic

industrydif.com

industrydif.com