Stock exchanges offer transparent trading environments regulated by official authorities, enabling investors to buy and sell shares with visible order books and price quotations. Dark pools operate as private, less transparent venues where large institutional investors can execute sizable trades anonymously to minimize market impact. While stock exchanges promote liquidity and price discovery, dark pools cater to confidentiality and reduced transaction costs for large orders.

Table of Comparison

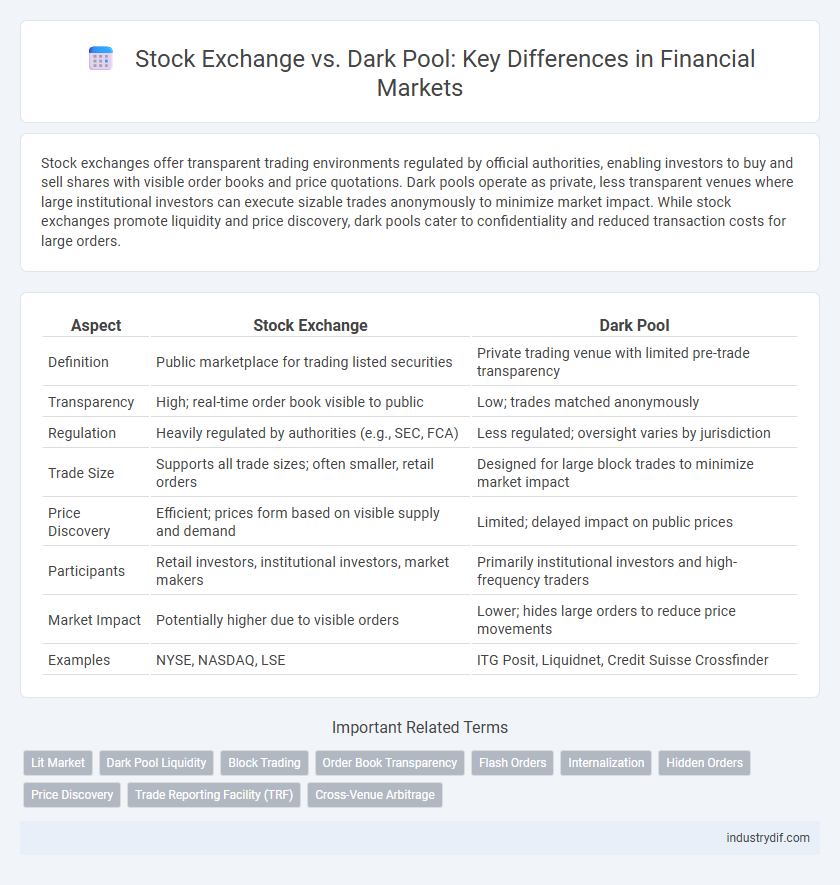

| Aspect | Stock Exchange | Dark Pool |

|---|---|---|

| Definition | Public marketplace for trading listed securities | Private trading venue with limited pre-trade transparency |

| Transparency | High; real-time order book visible to public | Low; trades matched anonymously |

| Regulation | Heavily regulated by authorities (e.g., SEC, FCA) | Less regulated; oversight varies by jurisdiction |

| Trade Size | Supports all trade sizes; often smaller, retail orders | Designed for large block trades to minimize market impact |

| Price Discovery | Efficient; prices form based on visible supply and demand | Limited; delayed impact on public prices |

| Participants | Retail investors, institutional investors, market makers | Primarily institutional investors and high-frequency traders |

| Market Impact | Potentially higher due to visible orders | Lower; hides large orders to reduce price movements |

| Examples | NYSE, NASDAQ, LSE | ITG Posit, Liquidnet, Credit Suisse Crossfinder |

Introduction to Stock Exchanges and Dark Pools

Stock exchanges are regulated marketplaces where securities such as stocks and bonds are bought and sold, ensuring transparency and price discovery through public order books. Dark pools are private trading venues that allow institutional investors to execute large orders anonymously, minimizing market impact and price fluctuations. Both platforms play crucial roles in the financial ecosystem by facilitating liquidity and efficient capital allocation.

Key Differences Between Stock Exchanges and Dark Pools

Stock exchanges operate as regulated public markets where securities are listed, ensuring transparency and real-time price discovery through continuous order matching visible to all participants. Dark pools function as private trading venues that facilitate large block trades anonymously, minimizing market impact but lacking the price transparency found in stock exchanges. The key differences lie in regulatory oversight, transparency levels, and trade visibility, with stock exchanges promoting public access and dark pools catering to institutional investors seeking discretion.

How Stock Exchanges Operate

Stock exchanges operate as regulated marketplaces where buyers and sellers trade publicly listed securities through a transparent order book system, ensuring price discovery and liquidity. They employ centralized order matching engines that execute trades based on price-time priority, providing real-time quotes and market data to investors. Regulatory oversight enforces compliance with listing standards, disclosure requirements, and fair trading practices to protect market integrity and investor confidence.

Dark Pools: Function and Role in the Market

Dark pools serve as private financial forums where institutional investors execute large block trades away from public stock exchanges, minimizing market impact and preserving anonymity. These venues provide liquidity by matching buy and sell orders without exposing intentions to the broader market, reducing price volatility often caused by large orders. Dark pools play a critical role in enhancing market efficiency and facilitating discreet trading, although their lack of transparency has prompted regulatory scrutiny to ensure fair market practices.

Advantages of Trading on Stock Exchanges

Stock exchanges offer transparency through real-time price dissemination and regulatory oversight, ensuring investor protection and market integrity. Liquidity is higher on stock exchanges due to the large number of participants and standardized trading mechanisms. This environment facilitates price discovery and reduces the risk of price manipulation compared to dark pools.

Benefits and Risks of Dark Pool Trading

Dark pool trading offers benefits such as reduced market impact and enhanced anonymity for large institutional investors, allowing sizable orders to be executed without significantly influencing public market prices. However, risks include decreased transparency and potential price manipulation, raising concerns about fairness and regulatory oversight. Investors must weigh the advantages of discreet trading against the possibility of information asymmetry and limited market visibility inherent in dark pools.

Transparency and Regulation: Stock Exchange vs Dark Pool

Stock exchanges operate under strict regulatory frameworks mandating high transparency with real-time public reporting of trades and pricing, ensuring market integrity and investor protection. Dark pools, however, provide limited transparency by allowing large institutional investors to execute block trades anonymously, reducing market impact but increasing the risk of information asymmetry. Regulatory scrutiny of dark pools is growing to address these transparency concerns while maintaining their role in facilitating large trades outside traditional exchange environments.

Impact on Market Liquidity and Price Discovery

Stock exchanges enhance market liquidity and price discovery through transparent order books and regulated trading environments that attract a broad range of participants, facilitating efficient price formation. Dark pools, by contrast, enable large block trades with reduced market impact and anonymity but can obscure true supply and demand dynamics, potentially impairing price discovery. The coexistence of both venues creates a complex liquidity landscape, where dark pools mitigate price volatility for large trades, while stock exchanges provide critical transparency for overall market efficiency.

Institutional Investors: Preferences and Strategies

Institutional investors leverage stock exchanges for transparency, liquidity, and price discovery, enabling efficient execution of large orders with market visibility. Dark pools offer these investors anonymity and reduced market impact, allowing discreet trading of substantial blocks without signaling intentions to competitors. Strategic use of both venues optimizes trade execution by balancing public market exposure and minimizing price slippage in high-volume transactions.

Future Trends in Stock Exchanges and Dark Pools

Future trends in stock exchanges highlight increased adoption of blockchain technology to enhance transparency, security, and settlement speed in equity trading. Dark pools are evolving with tighter regulatory scrutiny and advancements in algorithmic trading to minimize information asymmetry and improve liquidity management. Integration of artificial intelligence and machine learning is expected to optimize trade execution and risk assessment in both traditional exchanges and alternative trading systems.

Related Important Terms

Lit Market

The stock exchange operates as a lit market where buy and sell orders are transparently displayed, providing price discovery and liquidity. In contrast, dark pools conceal order sizes and prices, limiting transparency but reducing market impact for large trades.

Dark Pool Liquidity

Dark pool liquidity offers institutional investors the ability to execute large trades anonymously without significantly impacting stock prices, enhancing market efficiency by reducing volatility. Unlike traditional stock exchanges, dark pools match buy and sell orders privately, providing access to hidden liquidity pools that remain undisclosed to public markets.

Block Trading

Block trading refers to the buying or selling of large quantities of securities, typically executed on stock exchanges or dark pools to minimize market impact. Stock exchanges provide transparent pricing and public order books, while dark pools offer private venues that conceal trade intentions, reducing price volatility for significant block trades.

Order Book Transparency

Stock exchanges maintain transparent order books that display real-time bid and ask prices, enabling price discovery and market efficiency. Dark pools operate with non-transparent order books, allowing large institutional investors to execute substantial trades anonymously, reducing market impact but limiting price visibility for other participants.

Flash Orders

Flash orders exploit milliseconds of market data advantage in stock exchanges by briefly exposing buy or sell orders before they reach the broader public market, enabling high-frequency traders to capitalize on price movements. In contrast, dark pools execute large block trades away from public order books, minimizing market impact and reducing information leakage but typically lack the transparency and speed advantages associated with flash orders.

Internalization

Stock exchanges provide transparent trading venues with publicly visible order books, while dark pools enable internalization by allowing large institutional investors to execute large block trades anonymously, minimizing market impact. Internalization in dark pools aggregates liquidity off-exchange, ensuring price improvement but reducing public market transparency compared to traditional stock exchanges.

Hidden Orders

Stock exchanges provide transparent order books where buy and sell orders are publicly visible, whereas dark pools enable the execution of hidden orders to minimize market impact and maintain confidentiality. Hidden orders in dark pools offer institutional investors anonymity, allowing large trades to be executed without revealing trading intentions to the broader market.

Price Discovery

Stock exchanges facilitate transparent price discovery by aggregating public buy and sell orders, enabling market participants to gauge real-time asset values through visible order books and trade data. Dark pools, in contrast, obscure trade intentions to minimize market impact, limiting price discovery as transactions occur away from public view, often resulting in less informative pricing signals.

Trade Reporting Facility (TRF)

Trade Reporting Facilities (TRFs) serve as alternative venues for reporting off-exchange stock trades, complementing traditional stock exchanges by providing transparency for transactions executed in dark pools. TRFs facilitate regulatory compliance and market transparency by publishing trade data, enabling investors to access price and volume information from both lit markets and private trading platforms.

Cross-Venue Arbitrage

Cross-venue arbitrage exploits price discrepancies between stock exchanges and dark pools, leveraging real-time data to execute trades that capitalize on inefficiencies in liquidity and pricing. This strategy enhances market efficiency by narrowing spreads and increasing volume, benefiting institutional investors who seek to minimize market impact while maximizing returns.

Stock Exchange vs Dark Pool Infographic

industrydif.com

industrydif.com