Asset management involves professional management of investment portfolios tailored to individual or institutional financial goals, often incorporating personalized strategies and active decision-making. Robo-advisory uses algorithm-driven platforms to automate investment management, offering cost-effective, scalable solutions with minimal human intervention. Comparing asset management with robo-advisory highlights differences in customization, fee structures, and accessibility for diverse investor profiles.

Table of Comparison

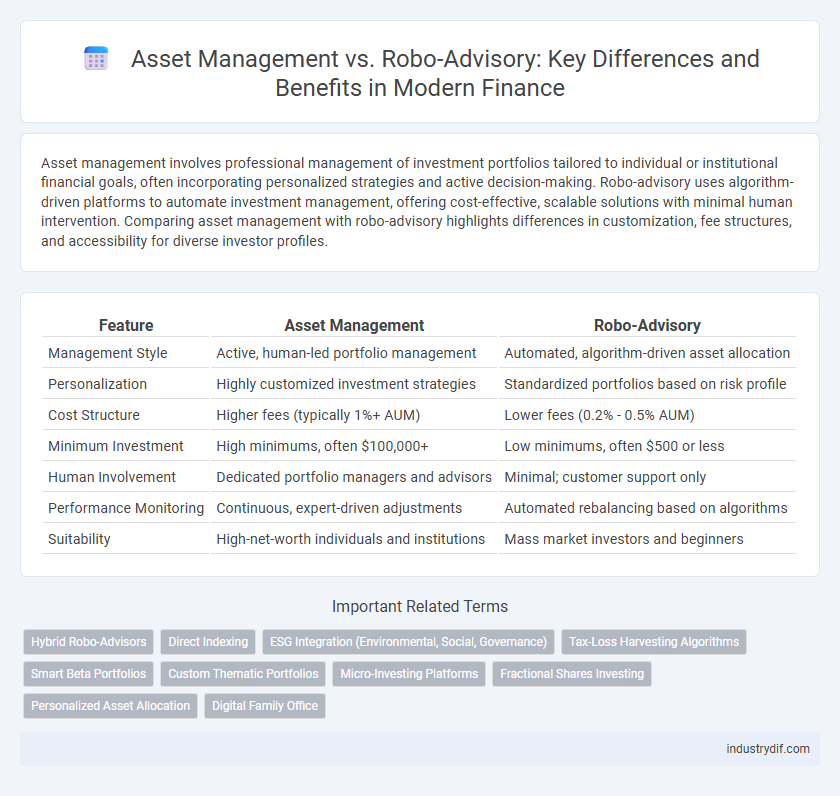

| Feature | Asset Management | Robo-Advisory |

|---|---|---|

| Management Style | Active, human-led portfolio management | Automated, algorithm-driven asset allocation |

| Personalization | Highly customized investment strategies | Standardized portfolios based on risk profile |

| Cost Structure | Higher fees (typically 1%+ AUM) | Lower fees (0.2% - 0.5% AUM) |

| Minimum Investment | High minimums, often $100,000+ | Low minimums, often $500 or less |

| Human Involvement | Dedicated portfolio managers and advisors | Minimal; customer support only |

| Performance Monitoring | Continuous, expert-driven adjustments | Automated rebalancing based on algorithms |

| Suitability | High-net-worth individuals and institutions | Mass market investors and beginners |

Asset Management vs Robo-Advisory: Key Differences

Asset management involves professional portfolio management with personalized strategies tailored by human experts, while robo-advisory uses automated algorithms to provide low-cost, scalable investment solutions. Asset management typically offers more comprehensive services, including financial planning and tax optimization, whereas robo-advisors focus on efficient, algorithm-driven asset allocation and rebalancing. Costs in robo-advisory are generally lower due to automation, but asset management often delivers higher customization and active decision-making.

Traditional Asset Management: Overview and Features

Traditional asset management involves personalized portfolio management by experienced financial professionals who actively allocate assets based on market analysis and client goals. This approach emphasizes in-depth research, risk assessment, and tailored investment strategies, often incorporating a wide range of asset classes such as equities, bonds, and alternative investments. Clients benefit from human expertise, discretionary decision-making, and ongoing portfolio monitoring to optimize returns and manage risks in dynamic market conditions.

Robo-Advisory: Technology-Driven Investing

Robo-advisory leverages advanced algorithms and artificial intelligence to provide automated, cost-effective investment management services, minimizing human bias and enhancing portfolio optimization. These platforms use real-time data analytics and machine learning to continuously adjust asset allocations according to market conditions and individual risk profiles. The technology-driven approach enables scalable, personalized financial advice, making investing accessible to a broader range of clients with lower fees compared to traditional asset management.

Cost Comparison: Fees in Asset Management vs Robo-Advisory

Asset management fees typically range from 0.5% to 2% of assets under management (AUM), reflecting personalized service and active portfolio management. Robo-advisory platforms charge lower fees, often between 0.25% and 0.5% of AUM, due to automated algorithms and reduced human intervention. Cost efficiency makes robo-advisors attractive for smaller investment portfolios, while asset management suits investors seeking tailored strategies.

Customization and Personalization: Human vs Algorithmic Approach

Asset management offers highly personalized financial strategies tailored by experienced professionals who consider nuanced client preferences and complex financial goals. Robo-advisory platforms utilize algorithmic models and data-driven insights to deliver scalable, cost-effective portfolio customization based on risk tolerance and investment horizon. The human approach excels in adaptive judgment and emotional understanding, while robo-advisors provide consistent, algorithmically optimized asset allocation with real-time adjustments.

Performance Metrics: Evaluating Asset Managers and Robo-Advisors

Performance metrics for evaluating asset managers and robo-advisors primarily include risk-adjusted returns, alpha generation, and portfolio diversification effectiveness. Traditional asset managers often emphasize qualitative assessments and discretionary decision-making, while robo-advisors leverage algorithmic trading and real-time data analysis to optimize returns and minimize costs. Comparing Sharpe ratio, Sortino ratio, and tracking error provides insight into each method's efficiency and ability to meet investor objectives.

Risk Management Strategies: Manual vs Automated Solutions

Asset management employs manual risk management strategies through human expertise, enabling tailored assessments of portfolio volatility and market fluctuations, while robo-advisory relies on automated algorithms to continuously monitor and rebalance assets based on predefined risk parameters. Manual solutions provide nuanced decision-making in complex scenarios, incorporating qualitative factors and investor behavior, whereas automated systems excel in real-time data analysis and consistent application of risk models to mitigate losses. Integration of both approaches offers a hybrid strategy that enhances risk diversification and adaptive portfolio management.

Accessibility: Minimum Investment and Client Onboarding

Traditional asset management typically requires higher minimum investments, often starting around $50,000, which limits accessibility for many investors. Robo-advisory platforms lower entry barriers with minimum investments as low as $500 and utilize automated digital onboarding processes, enabling faster and more efficient client enrollment. This accessibility makes robo-advisors ideal for beginners or those with smaller portfolios seeking personalized investment strategies.

Regulatory Considerations: Compliance in Asset Management and Robo-Advisory

Regulatory considerations in asset management emphasize stringent compliance with fiduciary duties, anti-money laundering (AML) laws, and rigorous reporting standards mandated by authorities such as the SEC and FCA. Robo-advisory platforms face regulatory scrutiny focusing on algorithm transparency, cybersecurity protections, and suitability assessments under frameworks like MiFID II and Dodd-Frank Act. Both sectors must continuously adapt to evolving guidelines from regulatory bodies to mitigate operational risks and ensure client protection.

Future Trends: The Evolution of Investment Advisory Services

Asset management is evolving with the integration of AI-driven robo-advisory platforms that offer personalized, cost-efficient portfolio management by leveraging big data analytics and machine learning algorithms. Future trends indicate a hybrid model where human advisors collaborate with robo-advisors to enhance decision-making, improve risk assessment, and provide tailored investment strategies. The ongoing digital transformation in asset management emphasizes scalability, transparency, and client-centric solutions powered by advances in fintech and blockchain technology.

Related Important Terms

Hybrid Robo-Advisors

Hybrid robo-advisors combine algorithm-driven investment strategies with human financial advisor expertise, offering personalized asset management solutions that enhance portfolio optimization and risk mitigation. This integration leverages advanced AI technologies and real-time data analytics to tailor investment portfolios while maintaining the scalability and cost-efficiency of automated platforms.

Direct Indexing

Direct indexing in asset management allows investors to own individual securities tailored to their specific goals, offering greater tax efficiency and customization compared to robo-advisory platforms that primarily use algorithm-driven ETF portfolios. This personalized approach in direct indexing enhances portfolio transparency and control, making it a preferred choice for high-net-worth clients seeking optimized tax-loss harvesting and sector-specific exposure.

ESG Integration (Environmental, Social, Governance)

Asset management firms traditionally integrate ESG factors through comprehensive analysis and active engagement strategies, leveraging expert insights to tailor sustainable investment portfolios. Robo-advisory platforms utilize algorithm-driven ESG scoring and automated portfolio rebalancing, offering scalable and cost-effective access to responsible investing aligned with individual values.

Tax-Loss Harvesting Algorithms

Asset management leverages sophisticated tax-loss harvesting algorithms to strategically offset capital gains and optimize after-tax returns by systematically identifying and selling depreciated assets. Robo-advisory platforms automate this process using data-driven algorithms, offering scalable and cost-efficient tax-loss harvesting solutions that enhance portfolio tax efficiency for individual investors.

Smart Beta Portfolios

Smart Beta portfolios combine the systematic approach of robo-advisory platforms with asset management expertise by leveraging factor-based investment strategies to enhance risk-adjusted returns. These portfolios invest in indexes weighted by factors such as value, momentum, and low volatility, offering a cost-effective alternative that bridges traditional active management and passive investing.

Custom Thematic Portfolios

Custom thematic portfolios in asset management offer personalized investment strategies aligned with specific market trends, providing flexibility and expert oversight. Robo-advisory platforms automate the creation of thematic portfolios using algorithms, enabling cost-efficient, scalable, and data-driven investment approaches tailored to individual risk profiles.

Micro-Investing Platforms

Micro-investing platforms leverage robo-advisory technology to offer low-cost, automated portfolio management tailored for small-scale investors, enabling easy access to diversified asset management. These platforms optimize investment strategies using algorithm-driven asset allocation, minimizing fees and enhancing financial inclusion compared to traditional asset management services.

Fractional Shares Investing

Fractional shares investing enables both traditional asset management firms and robo-advisory platforms to offer diversified portfolios with lower capital requirements, increasing accessibility for retail investors. Robo-advisors leverage algorithm-driven models and fractional shares to provide automated, low-cost investment strategies, while asset managers combine professional expertise with fractional investing to tailor customized solutions for high-net-worth clients.

Personalized Asset Allocation

Personalized asset allocation in traditional asset management leverages human expertise to tailor investment strategies based on individual risk tolerance, financial goals, and market conditions, ensuring nuanced adjustments. Robo-advisory employs algorithms and automation to rapidly adjust portfolios using real-time data, providing scalable and cost-effective personalized investment solutions with consistent risk management.

Digital Family Office

Digital Family Offices leverage asset management by integrating personalized financial strategies with robo-advisory technology, enabling automated portfolio optimization and real-time data analytics. This hybrid approach combines human expertise and AI-driven algorithms to enhance wealth preservation, tax efficiency, and multi-generational investment planning.

Asset management vs Robo-advisory Infographic

industrydif.com

industrydif.com